![]() , Sari M. Alamuddin, Charles C.

Jackson, Nina G. Stillman, Ronald E. Manthey, Ann Marie Painter,

Nancy L. Patterson, Anne Marie Estevez, Christopher A. Parlo,

Andrew J. Schaffran, Samuel S. Shaulson, Michael L. Banks, Dennis

J. Morikawa, Brian T. Ortelere, Michael J. Ossip, Thomas A.

Linthorst, Richard G. Rosenblatt, Rebecca Eisen, D. Ward Kallstrom,

Deena M. Smith, Gregory C. Braden, Corrie Fischel Conway, William

E. Doyle, James J. Kelley, Eleanor Pelta, Robert J. Smith and

Jonathan L. Snare

, Sari M. Alamuddin, Charles C.

Jackson, Nina G. Stillman, Ronald E. Manthey, Ann Marie Painter,

Nancy L. Patterson, Anne Marie Estevez, Christopher A. Parlo,

Andrew J. Schaffran, Samuel S. Shaulson, Michael L. Banks, Dennis

J. Morikawa, Brian T. Ortelere, Michael J. Ossip, Thomas A.

Linthorst, Richard G. Rosenblatt, Rebecca Eisen, D. Ward Kallstrom,

Deena M. Smith, Gregory C. Braden, Corrie Fischel Conway, William

E. Doyle, James J. Kelley, Eleanor Pelta, Robert J. Smith and

Jonathan L. Snare

On February 1, Secretary of Labor Hilda Solis released the Obama administration's proposed fiscal year 2011 budget for the U.S. Department of Labor (DOL or the Department). Adopting a theme of "good jobs for everyone," the DOL's FY2011 budget reshuffles the Department's discretionary funds to support new policy, program, and enforcement priorities for the DOL.

Employers should be mindful of the programmatic and policy themes underlying the more technical "dollars and cents" of the budget process. These themes give invaluable insights into the direction the Department intends to move labor and employment law in the coming months.

Summary of Budget Proposal

The DOL's budget proposal is only one step in a longer funding process that will carry through over the next few years. With that said, however, employers can expect the policies and priorities identified in the Department's budget to move forward—whether Congress approves the funding or not.

A number of themes emerge that should assist employers in this new regulatory environment:

- The DOL prefers corporatewide solutions, not site-specific fixes to a problem, be it an Occupational Safety and Health Administration (OSHA) violation or an Office of Federal Contracts Compliance Programs (OFCCP) audit. Employers should think broadly when problems emerge, and question whether the "band-aid" approach is always appropriate for any given situation.

- The DOL will continue to target repeat offenders, and will up the ante significantly when an employer is labeled as a "persistent" problem. Employers need to ensure that any "fixes" made in response to DOL complaints or audits completely fix the problem, and do so in a timely manner— companywide.

- The DOL (and the administration as a whole) values open access, making investigations less than confidential, and making press releases the norm of doing business. Employers need to be prepared for external pressure—from the press, from the community, and from the Department—to move in the directions the DOL has identified.

- The DOL's expanded enforcement will be accompanied by a substantial increase in regulatory activity, creating new obligations for employers.

As detailed more fully below, the budget highlights a number of new policy and enforcement trends:

- Employee Reclassification Initiative for Independent Contractors. The DOL's budget includes $25 million for a joint Labor-Treasury initiative to strengthen and coordinate federal and state efforts to enforce statutory prohibitions, and to identify and deter misclassification of employees as independent contractors.

- Reestablishment of Worker Protection Programs such as OSHA. The budget builds on the momentum begun in FY2010 to restore the capacity of the DOL's worker protection programs and to return them to FY2001 staffing levels, by strengthening their regulatory and enforcement activities.

The 2011 budget also attempts to fulfill several of President Obama's campaign promises, by allocating $50 million to help states launch paid leave programs, and by including a proposal to require employers to automatically enroll workers not already covered by retirement plans in direct deposit IRA accounts.

If there was any doubt leading up to the DOL's budget announcement, employers should have no question now that companies that utilize a large proportion of independent contractors in the course of business are now in the spotlight, and should take time to ensure that the independent contractor designation is appropriate. Contractors and service providers—especially those that work under a federal contract—need to pay particular care to the Davis-Bacon and Related Acts, the Service Contract Act, and other provisions that may apply to their workplaces. OSHA worksites should be prepared for a stepped-up enforcement environment, and second and third violations should be avoided.

These programs and other notable inclusions are covered in more detail below.

The DOL Budget: General Overview

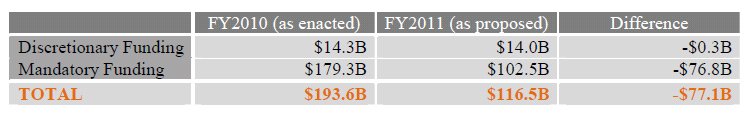

The DOL's proposed total budget actually is a reduction of $77 billion from last year—unexpected, given the Obama administration's promise of stepped-up DOL activity.

While the numbers suggest an aggressive and all-around cut, the bulk of the proposed reductions fall in mandatory spending, mirroring an expected decline in unemployment insurance benefit payments. The budget for discretionary programs is almost equal to the prior year's. In fact, the Department assumes under these projections that they will hire more than 350 new employees, including 177 investigators and enforcement personnel. The administration's new budget also includes an 11% increase in funding to the Department of Justice Civil Rights Division and a 5% increase in funding for the Equal Employment Opportunity Commission (EEOC).

Wage and Hour Division Budget

The DOL's Wage and Hour Division (WHD), which is responsible for enforcing the nation's minimum wage, overtime, and family medical leave laws, is requesting a nearly $17 million funding increase over last year's enacted budget. This funding increase is principally for spending on the new Employee Misclassification Initiative.

The Misclassification Initiative: Protecting Vulnerable Workers

In likely response to increasing criticism from Congress and the General Accounting Office, the hallmark of the WHD's 2011 budget request is the Employee Misclassification Initiative, a joint Treasury-Labor initiative to detect and deter the inappropriate misclassification of employees as independent contractors, and to strengthen and coordinate Federal and State efforts to enforce labor violations arising from misclassification. This initiative includes $12 million for the WHD to hire 90 new investigators who will specifically target "industries with misclassification characteristics, such as construction, child care, home health care, grocery stores, janitorial, business services, poultry and meat processing, and landscaping." In addition, the budget request separately includes a request for $1.6 million and 10 additional attorneys for the Solicitor's Office "to pursue misclassification litigation, including multi-State litigation to coordinate enforcement with States."

This initiative also provides funds for the DOL's Employment and Training Administration, to award competitive grants to states to increase enforcement of misclassification, and to reward states that are most successful at detecting and prosecuting employers that fail to pay the proper taxes due to misclassification. Finally, as an indication of the closer working relationship DOL is trying to foster among its constituent agencies, the Employee Misclassification Initiative also includes funding for OSHA, to modify its inspector training and investigative guidelines "to allow inspectors to identify potential employee misclassification and to share information with WHD."

The budget proposes legislation, similar to the Taxpayer Responsibility, Accountability, and Consistency Act of 2009 (S. 2882) introduced in the Senate in December 2009, to ensure the proper classification of employees by (1) shifting the burden of proof to employers to demonstrate that their employees are classified correctly, (2) closing the loophole created by Section 530 of the Revenue Act of 1978, and (3) making misclassification a violation of the Fair Labor Standards Act.

This initiative comes on the heels of one of the most significant IRS audit initiatives in decades—audits intended to "study" compliance in the areas of payroll taxes, independent contractor status, fringe benefits, and executive compensation.1 A number of states—recently Maryland and Delaware, among others—have also recognized the potential tax revenue at stake in misclassification and have moved quickly to enact laws to close existing gaps.

In addition to the Employee Misclassification Initiative, the WHD also intends to:

- Assume labor standards enforcement responsibility under the H-2B temporary guest worker program, and increase regulatory efforts related to the Immigration and Nationality Act's H-2A program, with specific emphasis in the agricultural industry.

- Increase Davis-Bacon "prevailing wage" enforcement on federally funded or assisted construction projects. The WHD plans to establish a compliance baseline in the construction industry in FY2011 from which it can measure improvements in compliance going forward.

- Implement revised Davis-Bacon wage survey processes to improve the quality and timeliness of published wage determinations, with the goal of publishing up-to-date and accurate wage rates for both the Service Contract Act and Davis-Bacon Act programs.

Identifying and Penalizing Persistent Violators

The FY2011 budget for the WHD also invests resources to deter recidivist behavior among employers and to target the worst violators in all program areas. The WHD has established compliance goals for persistent violators, and will focus on recidivism in the janitorial industry in 2011.

The WHD intends to pursue corporate-wide compliance initiatives, using penalties, sanctions, the Fair Labor Standards Act (FLSA) "hot goods" provision, and similar strategies to ensure future compliance among violators and to deter violations among other employers.

Worker and Community Outreach

The WHD budget proposal includes funds to increase the involvement of workers and community organizations in identifying, exposing, and reporting alleged workplace violations. Specifically, the WHD plans to partner with worker and community organizations to mitigate the fear of retaliation among workers who seek assistance in remedying violations. These partnership arrangements may have significant impact on employers, especially those companies who are regularly targeted by special interest groups and other organizations active in labor and employment issues.

Occupational Safety and Health Administration Budget

OSHA, which is charged with enforcing federal workplace safety and health regulations, is requesting a funding increase of more than $14 million in FY2011, with a total proposed budget of $573 million. This increase in resources (although smaller than last year's increase), combined with a shift in resources away from cooperative and compliance assistance programs, demonstrates that OSHA is continuing its change to a more robust regulatory agenda and expanding its enforcement efforts. The significant budget increase for OSHA over the past two years will allow the agency to develop a wide range of new initiatives and programs, and employers should be prepared for this increased oversight.

The FY2011 budget proposal also represents a clear signal that OSHA is shifting priorities to stronger enforcement and increased regulations, and away from cooperative and voluntary programs such as the Voluntary Protection Program (VPP). This shift is most prominently seen in the agency's decision to bolster its internal enforcement capabilities by transferring 35 employees from compliance assistance to enforcement, as well as hiring 25 new compliance safety and health officers (CSHOs). OSHA Assistant Secretary David Michaels stated that these new resources will allow the agency to conduct more inspections under national and local emphasis programs as well as other targeted inspections. These additional resources will also enable the agency to continue with its current enforcement priorities and new initiatives, including the expanded use of the general duty clause in areas such as ergonomics, the soon-to-be-announced Severe Violators Enforcement Program (SVEP), and the new National Emphasis Program (NEP) on Recordkeeping.

The number of inspections is expected to increase; OSHA is projecting that it will conduct 42,250 inspections, the most significant increase in the level of inspections per year, since the 1990s. At the same time, the agency should have sufficient resources to continue complex inspections under the NEP for Petroleum Refinery Process Safety Management (PSM) and the NEP for PSM-covered chemical plants. The agency has also announced that the additional CSHOs will also allow the agency to address the challenges from "changes in worker demographics" and the increase in immigrant workers. Funding for OSHA state programs, which cover 27 states and territories, will increase 1.9%. This will allow states to hire more CSHOs and expand enforcement efforts under their jurisdiction.

In addition to this expanded enforcement, OSHA is shifting more resources into drafting new standards and regulations. OSHA's directorate in charge of standard setting will receive the highest increase in funding (20% or $4 million) of any of the agency's directorates. It will allow the hiring of 20 new employees to assist in an expanded rulemaking effort. Assistant Secretary Michaels is expected to make standard-setting a particular priority, and will devote significant resources to this program. OSHA has already initiated several new rulemaking projects, including new regulations for combustible dust and requiring employers to add ergonomic injuries to OSHA Form 300 Recordkeeping Logs. The agency has also taken action to accelerate ongoing rulemakings regarding toxins such as silica and beryllium. We believe that OSHA will undertake efforts in the near future to expand the rulemaking agenda, including rulemaking to require each employer to implement a safety and health management system.

Employee Benefits Security Administration Budget

In response to the recent financial crisis and the public's concerns about rising healthcare costs, the Employee Benefits Security Administration (EBSA) has proposed a 4% budget increase aimed at increasing the agency's regulation and oversight of the nation's retirement and welfare benefit plans. The hiring of 30 new employees will support the agency's work to protect beneficiaries' interests through aggressive regulation and enforcement. This budget increase will be divided among numerous priority projects including, inter alia, EBSA's "aggressive" regulatory agenda and employer outreach initiatives.

More specifically, EBSA seeks to broaden the Employee Retirement Income Security Act's (ERISA's) definition of a fiduciary to include financial advisors and appraisers that currently operate outside of ERISA's strict fiduciary standards. Separately, EBSA is pursuing other regulations that will enhance the disclosure of fee and conflict-of-interest information by plan service providers to plan officials. Such changes will have an important impact on ERISA litigation, and may bloat already crowded ERISA dockets.

EBSA also plans to introduce a number of initiatives designed to reduce barriers to annuitization of 401(k) plan assets, and increase transparency with regard to plan service provider fees.

EBSA predicted an increased need for the agency to provide regulatory guidance to employers struggling to comply with recently passed legislation, including the Genetic Information Nondiscrimination Act of 2008 (GINA), the Mental Health Parity and Addiction Equity Act of 2008, and the Consolidated Omnibus Budget Reconciliation Act (COBRA) premium assistance provisions which were passed early last year and which were recently extended.

Finally, the 2011 budget reintroduces a proposal, first articulated by President Obama during his presidential campaign, to expand employee participation in 401(k) and other retirement savings plans through mandatory automatic enrollment. Building on the Pension Protection Act of 2006, which encouraged automatic enrollment in 401(k) plans, the current budget proposes to require employers who do not already offer employees some form of retirement savings to automatically enroll their workers in direct-deposit IRA accounts. Only employers with 10 or fewer employees would be exempt from this requirement.

Office of Federal Contractor Compliance Programs Budget

In his State of the Union address last month, President Obama announced, "We are going to crack down on violations of equal pay laws—so that women get equal pay for an equal day's work." The FY2011 budget proposal for the Department of Labor implements this part of the president's agenda. Secretary Solis described this initiative in her budget presentation as "narrow[ing] the wage gap" and requiring employers to "offer fair compensation."

The OFCCP currently investigates whether federal contractors' pay and employment practices are discriminatory, and it will play a key role in the Administration's expanded enforcement agenda. The OFCCP received a 33% budget increase in FY2010 to $105 million, and "has embarked on an unprecedented initiative" to hire 213 new compliance officers. The FY2011 budget proposal maintains these high funding levels: the OFCCP would therefore receive an increase to $113 million (788 full-time equivalents) for FY2011.

With this continued increased funding, the OFCCP "will dedicate additional resources to increase the monitoring" of contractors' self-audit obligations. In addition, the OFCCP will target two industries for random audits and will then re-audit the same facilities in FY2013 to evaluate recidivism rates. The OFCCP will also conduct extensive, corporate-wide audits of the headquarters and multiple facilities of the six corporate contractors that top the OFCCP's corporate management review lists for FY2010.

The OFCCP plans to conduct more frequent on-site compliance reviews, will monitor affirmative action compliance more closely, and will ensure that contractors are providing employment opportunities for covered veterans and individuals with disabilities. In particular, the OFCCP is expected to spend more time on the affirmative action obligations of government contractors, and will also spend more resources on identifying individual cases of discrimination. The OFCCP intends to update its regulations to strengthen affirmative action requirements for covered veterans, for individuals with disabilities, and for construction workers.

Conclusion

The DOL's FY2011 budget proposal further demonstrates the commitment of the Department to expand its enforcement and regulatory efforts. In addition, it provides employers with a roadmap of the major policies the DOL expects to implement in the coming years, and what changes employers need to be prepared for.

Footnote

1 For more information on this issue, see Morgan Lewis's October 26, 2009 LawFlash, "IRS Mounts Major Payroll Tax Audit Initiative of 6,000 Companies," available at http://www.morganlewis.com/pubs/EB_PayrollTaxAuditInitiative_LF_26oct09.pdf (www.morganlewis.com/pubs/EB_PayrollTaxAuditInitiative_LF_26oct09.pdf).

Copyright 2010. Morgan, Lewis & Bockius LLP. All Rights Reserved.

This article is provided as a general informational service and it should not be construed as imparting legal advice on any specific matter.