The U.S. Department of Labor (the "DOL") recently amended the qualified professional asset manager ("QPAM") exemption. The QPAM exemption is commonly relied on by fund managers that manage "plan assets" either through separately managed accounts or funds that exceed the 25% benefit plan investor test. If a manager is a QPAM, then certain transactions that would otherwise be considered prohibited transactions are not prohibited transactions. The amendment to the QPAM exemption (the "Amendment") is highly detailed and this client alert provides a summary of the changes to the QPAM exemption. While the Amendment made significant changes to the QPAM exemption, the changes were less significant than what was originally proposed in 2022. We expect that most managers that rely on the QPAM exemption will continue to rely on the QPAM exemption, but others may no longer qualify for the exemption. Those other managers may rely on other exemptions, such as the service provider exemption. Finally, some managers may decide not to manage plan assets.

Effective Date

The Amendment became effective on June 17, 2024.

Notification Deadline

A manager currently relying on the QPAM exemption must provide notice to the DOL by September 15, 2024. Notification is provided by emailing the DOL. A new manager that relies on the QPAM exemption or an existing manager that starts to rely on the QPAM exemption must provide notice to the DOL within 90 calendar days of its reliance on the QPAM exemption. The DOL will publish and maintain a public list of QPAMs. If a manager fails to report its reliance on the QPAM exemption within the specified period, a 90 calendar day cure period is available, provided the notification includes an explanation for the manager's inadvertent failure. A fund manager that relies on the QPAM exception is also required to notify the DOL within 90 calendar days if an entity that is relying on the QPAM exception changes its operating or legal name, or if it ceases to rely on the QPAM exemption. Prior to the Amendment, there was no notification requirement.

Dollar-Based Thresholds Increase

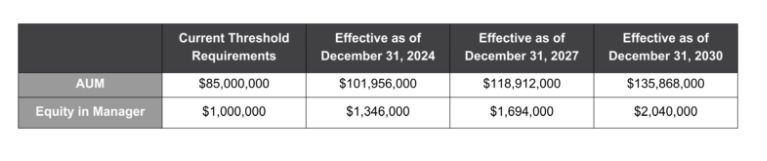

The Amendment incrementally increases the dollar-based thresholds to qualify as a QPAM. These increases may affect some managers that currently rely (or were planning to rely on) the exemption; there is no grandfathering of managers that currently qualify.

A manager that wants to rely on the QPAM exemption in 2025 must have at least $101,956,000 assets under management as of December 31, 2024. The dollar-based thresholds will be adjusted for inflation after 2030.

Other Changes

1. Expansion of QPAM Ineligibility

The Amendment broadens the type of activities that preclude QPAM eligibility. For example, foreign crimes and entering into certain non-prosecution agreements (a "NPA") or deferred prosecution agreements (a "DPA") may now affect eligibility. A manager may not rely on the QPAM exemption for 10 years if:

- The manager, its affiliates or any direct or indirect owner of 5% or more of the manager is convicted of certain enumerated crimes1 ("Criminal Convictions"); or

- The manager, its affiliates or any direct or indirect owner of 5% or more of the manager participates in prohibited misconduct2 ("Prohibited Misconduct").

A manager that relies on the QPAM exemption should implement procedures to verify and document that none of the applicable parties are the subject of a Criminal Conviction, participate in Prohibited Misconduct or enter into an NPA or a DPA, or the foreign substantial equivalent thereof.

The manager must provide notice to the DOL within 30 calendar days of any ineligibility date. The notice must include the QPAM's name and contact information, and a description of the Prohibited Misconduct or the agreement entered into with a foreign government that is substantially equivalent to an NPA or DPA. Additionally, within 30 calendar days of any ineligibility date that occurs as a result of the QPAM's Criminal Conviction or its participation in Prohibited Misconduct, the QPAM must notify the DOL and any current plan investors, of its Criminal Conviction or Prohibited Misconduct. Such notice must provide certain information including a description of the investor protections discussed directly below.

2. One Year Transition Period

If a manager relying on the QPAM exemption becomes ineligible, the manager has a one-year transition period in which it may rely on the QPAM exemption for any pre-existing plan investors. During this transition period, the manager may engage in new transactions for existing plan clients but may not rely on the QPAM exemption for any new plan investors. Additionally, the manager must provide certain protections to the current plan investors (including, but not limited to, eliminating any restrictions on the current plan investors' ability to terminate or withdraw, not imposing certain fees, penalties, or charges and indemnifying the current plan investors from certain losses directly resulting from such behavior). The manager cannot knowingly employ or engage any individual that participated in the Criminal Conduct or Prohibited Misconduct. A manager may request an exemption from the DOL to continue to rely on the QPAM exception for a period beyond the one-year transition period.

3. QPAM Independence

The Amendment expressly requires that any transaction decisions, commitments, investments by the fund, and any associated negotiations be determined by the QPAM that represents the interest of the investment fund engaged in the transaction. The QPAM may delegate certain investment related activities to a sub-adviser provided the QPAM retains sole authority with respect to planning, negotiating, and initiating any transactions covered the QPAM exemption.

4. Six-Year Record Retention Requirement

A QPAM is required to maintain records evidencing its compliance with the QPAM exemption requirements for six years from the date of each transaction. These records must be made available upon request to regulators and plan fiduciaries, plan contributing employers and plan participants and beneficiaries of plans investing in a fund. If a QPAM decides not to disclose certain information to regulators or requesters that are investors in the QPAM, it must provide the requestor with written notice explaining its rationale and that the DOL may request such information from the fund within 30 calendar days. Also, there is a narrow exception for disclosure if the requested information includes privileged trade secrets, privileged commercial or financial information, or personally identifying information. Managers should implement a process to ensure that it documents the QPAM's compliance with the QPAM exemption.

Footnotes

1. The enumerated crimes are: (A) "any felony involving abuse or misuse of such person's plan position or employment, or position or employment with a labor organization; any felony arising out of the conduct of the business of a broker, dealer, investment adviser, bank, insurance company or fiduciary; income tax evasion; any felony involving the larceny, theft, robbery, extortion, forgery, counterfeiting, fraudulent concealment, embezzlement, fraudulent conversion, or misappropriation of funds or securities; conspiracy or attempt to commit any such crimes or a crime in which any of the foregoing crimes is an element; or any crime that is identified or described in ERISA section 411" or (B) any substantially-equivalent foreign crime.

2. Prohibited Misconduct is found when (a) a QPAM "(1) Enters into a non-prosecution agreement ("NPA") or deferred prosecution agreement ("DPA") with a U.S. federal or state prosecutor's office or regulatory agency, where the factual allegations that form the basis for the NPA or DPA would have constituted a crime [enumerated in (A) of FN 1] if they were successfully prosecuted; or (2) Is found or determined in a final judgement, or court-approved settlement" that finds or determines that the QPAM participated in, or had/has knowledge (without reporting) of: (i) intentional violations or systematic patterns of violations of the QPAM exemption's conditions; or (ii) providing materially misleading information to certain governmental agencies.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]