On April 2, 2024, the US Department of Labor (DOL) issued an amendment establishing new rules (New QPAM Rules) for what is commonly referred to as the "QPAM Exemption." The QPAM Exemption is the main exemption relied upon by investment advisers and managers who provide services to employee benefit plans and individual retirement accounts that are subject to certain "prohibited transaction" rules under ERISA and/or the Internal Revenue Code.

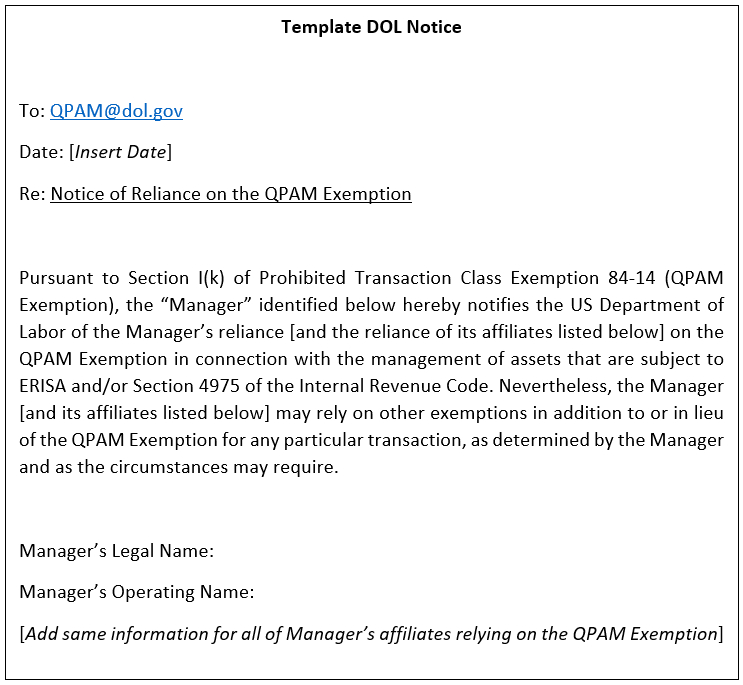

Among other changes, the New QPAM Rules require investment advisers and asset managers who rely on the QPAM Exemption (QPAM) to send a notice to the DOL via email. The notice must be provided within 90 calendar days of first reliance on the QPAM Exemption and should identify the legal name (and d/b/a name) of each business entity relying on the QPAM Exemption.

A QPAM relying on the QPAM Exemption as of June 17, 2024, must notify the DOL by no later than September 15, 2024.

The New QPAM Rules also provide a 90-day grace period for inadvertent notice failures if an explanation is provided to the DOL for such failure. Following the grace period, a QPAM that has not provided notice to the DOL risks ineligibility to rely on the QPAM Exemption.

A template notice to the DOL is included below for your convenience, although the DOL has not mandated any particular form of notice.

The New QPAM Rules provide other significant changes to the QPAM Exemption, including:

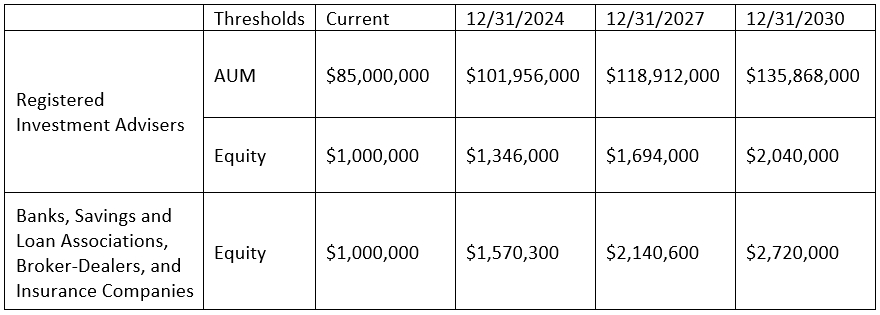

- Increasing Financial Thresholds. Increasing the shareholders' and partners' equity (Equity) and assets under management (AUM) thresholds to qualify as a QPAM, effective as of the last day of the QPAM's fiscal year:

- QPAM Ineligibility: Clarifying and expanding the types of criminal convictions and other prohibited misconduct that disqualify a QPAM from relying on the QPAM Exemption, which now includes foreign criminal convictions.

- Transition Period: Providing for a one-year transition period following a QPAM's ineligibility due to a criminal conviction or prohibited misconduct.

- QPAM Independence. Clarifying the requirement that the QPAM must act independently and retain sole responsibility for initiating and negotiating transactions covered by the QPAM Exemption.

- Recordkeeping. Implementing a new recordkeeping requirement to maintain records necessary for determining whether the conditions of the QPAM Exemption have been met with respect to a transaction for a period of six years from the date of the transaction.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.