Since 2021, Ropes & Gray has been actively tracking actions that states have taken on how or whether environmental, social and governance ("ESG") factors should be applied to the investment decisions for public sector retirement systems. Against a background of increasing political tensions, states have used legislative, administrative and enforcement mechanisms to address this area.

In this alert, we provide a broad overview of ESG lawmaking at the state level in 2024, now that most states' legislative sessions have adjourned. In the first part of this alert, we compare this year's activity to the level of activity over the last two years. In the second part, we provide a summary of the measures that states have adopted in recent months.

I. By the Numbers

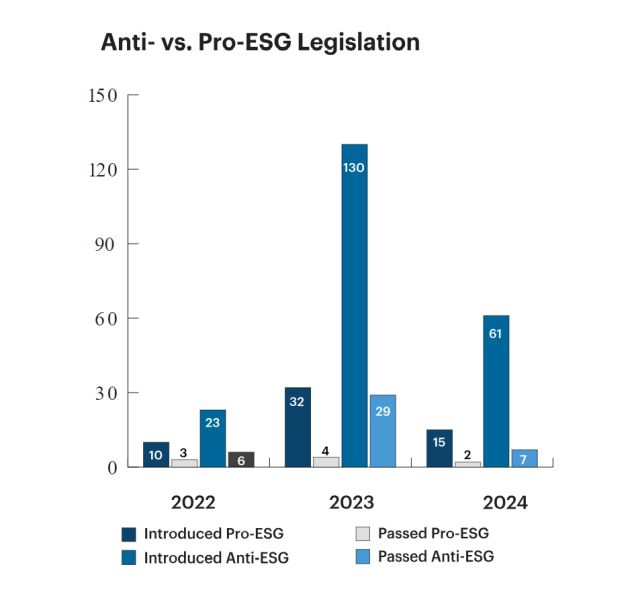

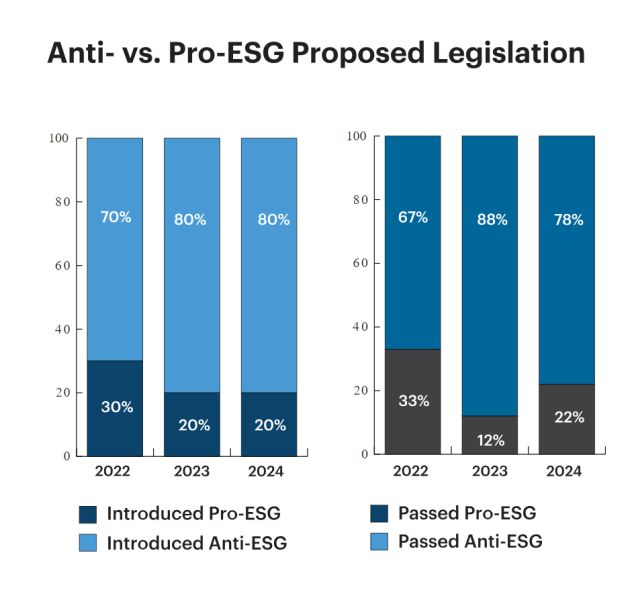

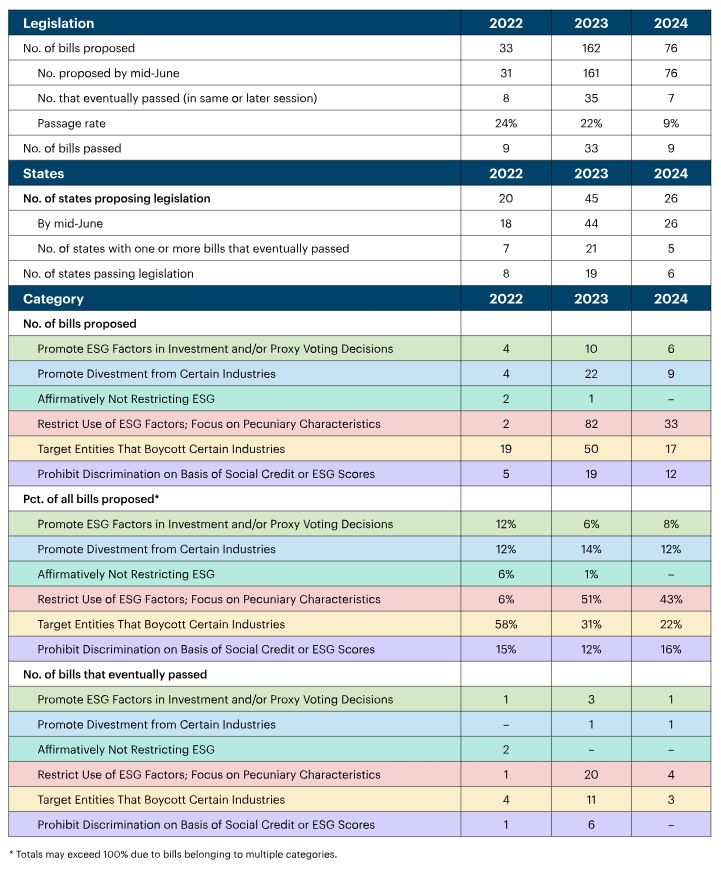

As we discussed in our 2023 white paper "ESG and Public Pension Investing in 2023: A Year-to-Date Recap and Analysis" (available here), we saw a surge in activity in 2023 among red states addressing and limiting the use of ESG by public retirement plans in investing. The year-over-year increase in anti-ESG legislation (from six bills enacted in 2022 to 29 enacted in 2023) was driven in part by the U.S. Department of Labor's 2022 adoption of its current investment and ESG rule, which expressly permits fiduciaries of private retirement plans to use climate change and other ESG factors in their investment decisions, and in part by the adoption of legislation in blue states to divest their retirement plans from the fossil fuel and firearms industries.

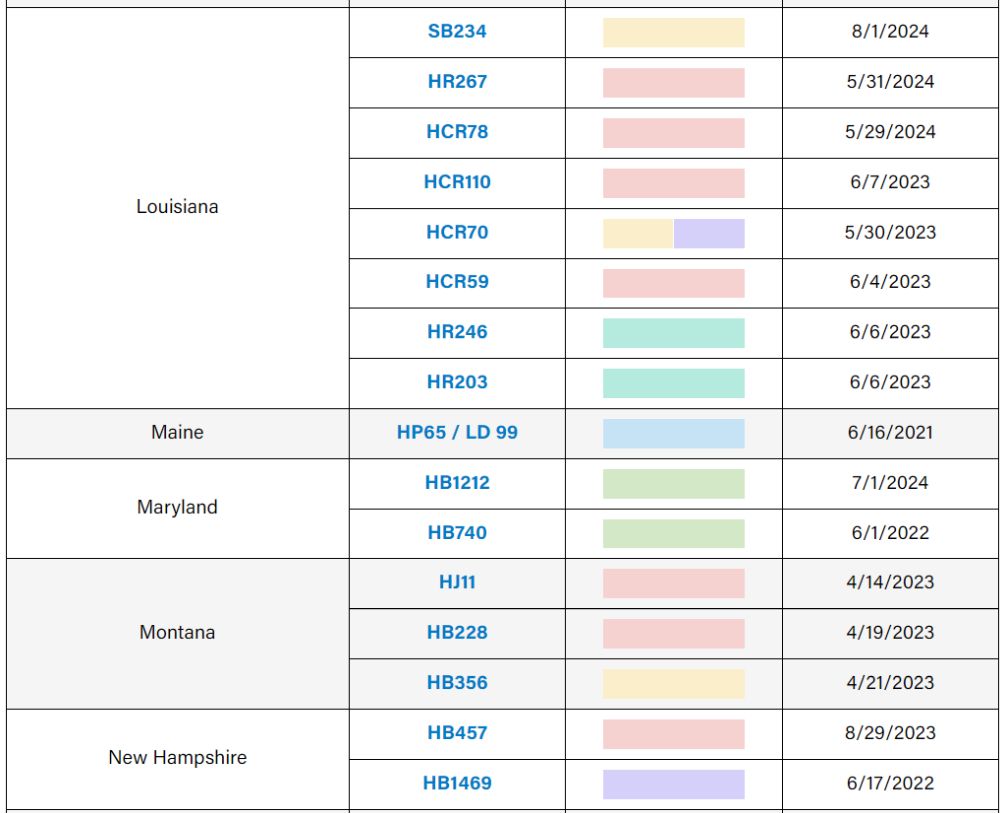

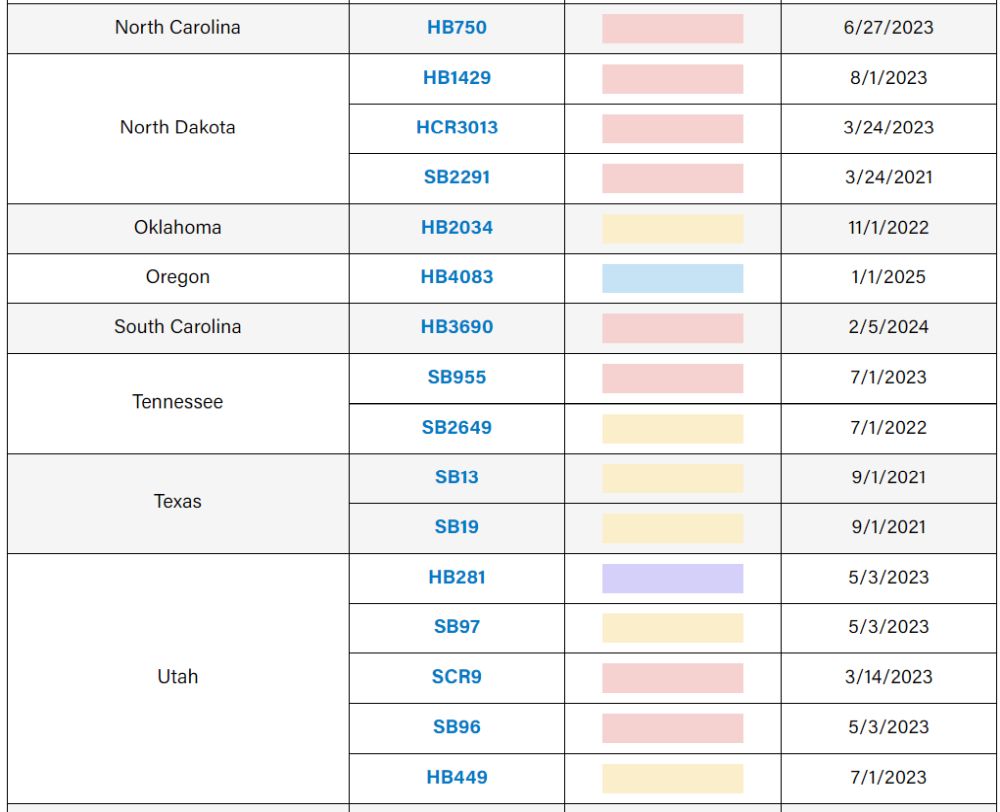

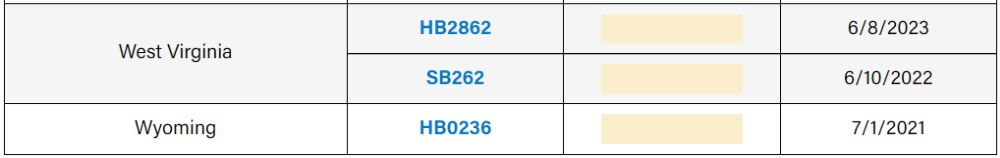

As of mid-June 2024, we have seen a precipitous drop-off from last year in state ESG-related legislation, with half the number of bills proposed and a quarter of the number of bills enacted (See Appendix A at the end for a table that summarizes our analysis). This decline might come as a surprise, given that the initiatives motivating last year's wave of anti-ESG legislation have not abated. In fact, we have already seen two major developments in the push to make ESG criteria more available to investors and their advisors: (i) the SEC's adoption in March of its final climate change reporting regime, which will require publicly traded companies to report certain direct and indirect emissions generated by their operations, and (ii) the European Union's adoption in May of its Corporate Sustainability Due Diligence Directive, which requires all large EU companies to report not only the extent to which their activities affect the environment but also the extent to which climate change affects their operations and performance. Despite these pressures, there has been widespread reporting of the decline in global ESG fund flows beginning in 2022 and continuing through 2023. Consequently, though the political rhetoric surrounding ESG investing continues, the perceived need for red states to act to slow the tide of ESG investing may have been less of a driving factor while state legislators were drafting bills for the 2024 session. We do not believe that this drop in overall legislative activity reflects a drop in concern over ESG in red states. Instead, we have observed multiple red states focused on the implementation of their existing anti-ESG laws, including through side letter and certification requests for managers of state assets.

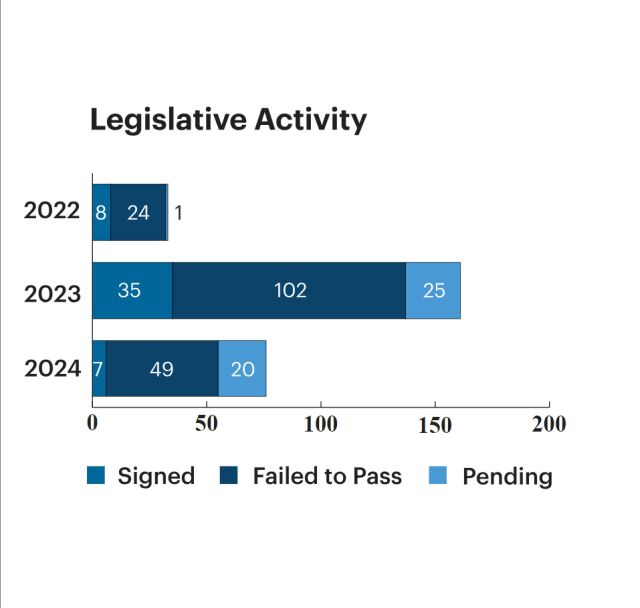

Even though the debate regarding the appropriate level at which public Treasuries and pension fiduciaries should engage in ESG efforts remains intense, nearly half of the states that introduced such legislation last year did not do so in 2024. According to our data, as of this time in 2023, 44 states had introduced bills or resolutions pertaining to the use of ESG criteria in investment decision-making for state funds or for selecting government contractors. By contrast, as of mid-June 2024, only 26 states had introduced such legislation. The number of actions likewise dropped off dramatically this year, from 161 bills having been proposed by June 2023 to only 76 by June 2024.

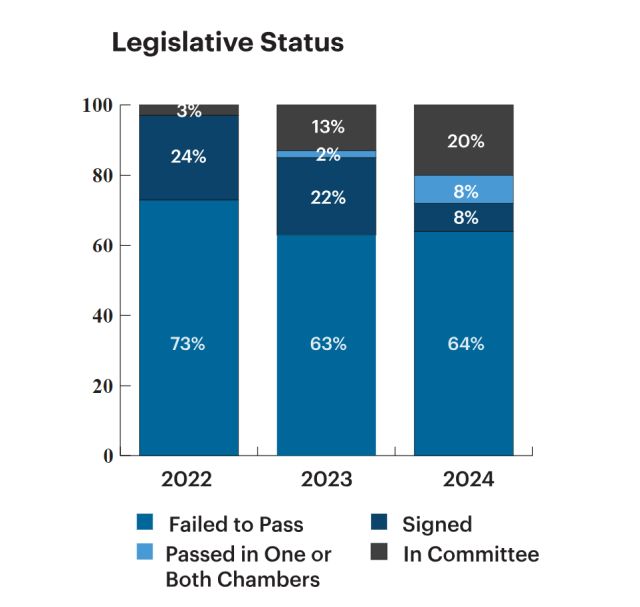

Even in statehouses where bills have been introduced in 2024, it appears that lawmakers have been more reluctant to actually enact the legislation. By the time most legislative sessions had adjourned last year, they had passed 30 bills introduced that year, and they would go on to pass five more, bringing the total passage rate of legislation proposed in 2023 to 22%. By contrast, as of mid-June 2024, only seven out of 76 bills introduced this year have passed (9%), while another 20 bills remain pending in states with ongoing legislative sessions.

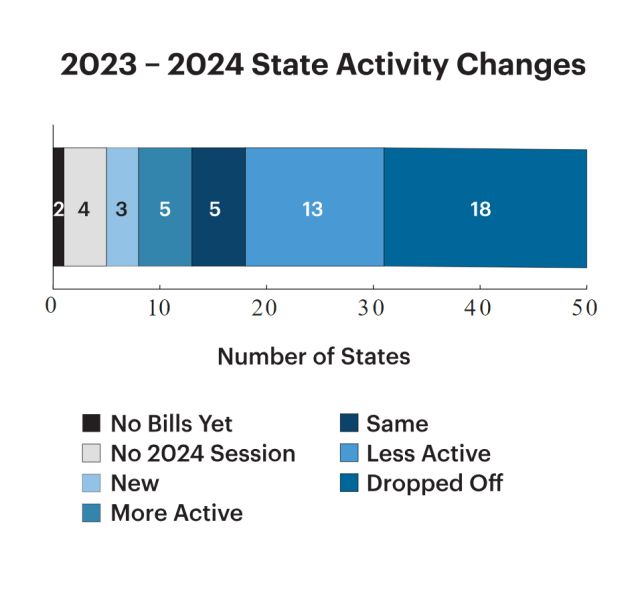

This decline in the level of ESG-related activity from 2023 to 2024 has not been reflected equally across the country. More than half of the year-over-year decrease can be accounted for by a decline in activity in the 10 most active states from last year.

- Notably, only one of these formerly active states—Massachusetts, which dropped from 10 proposed bills last year to none this year—is generally considered a pro- or neutral-ESG state, whereas the other major states that dropped off this year—including Oklahoma (from 15 to six), South Carolina (from nine to three), and Utah (from five to none)—are anti-ESG states. We explore this discrepancy between the declines in pro-ESG and anti-ESG legislation in the following section.

- Of the 10 most active states last year, only Missouri has kept up the pace, with lawmakers in the state introducing 15 bills in 2024—approximately 50% more than in 2023. Another active state last year, Illinois, has been nearly as active this year (proposing four bills vs. five last year).

- Other states that have been more active this year include West Virginia (seven bills in 2024 vs. three in 2023), New Jersey (four in 2024 vs. none in 2023), Louisiana (six in 2024 vs. three in 2023), New York (four in 2024 vs. one in 2023), New Hampshire (two in 2024 vs. one in 2023), and Maryland (one in 2024 vs. none in 2023). This year also saw Washington (two bills) introduce its first ESG-related bills.

Scope of Activity

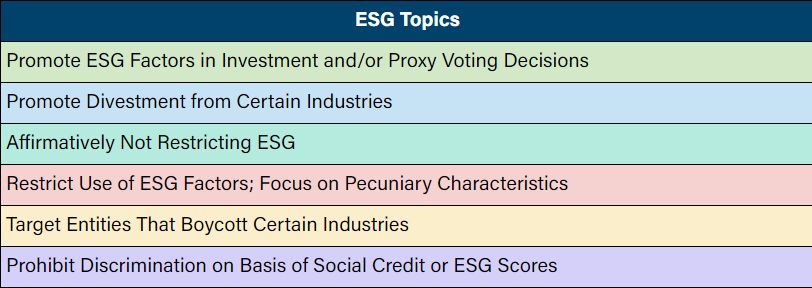

As the overall level of ESG-related legislative activity has diminished among the states in 2024, the focus of these actions has continued to shift away from targeting particular industries to the use of ESG factors more generally.

- In 2022, more than two-thirds (70%) of proposed legislation either promoted divestment from certain industries or targeted entities that boycotted certain industries. By contrast, only 18% of proposed legislation either promoted or restricted the use of ESG factors in investment or proxy voting decisions.

- However, by 2023, that balance had shifted sharply, with 57% of proposed legislation focusing on the use of ESG factors (either restricting or promoting them) and only 44% focusing on specific industries (whether targeting boycotters or promoting divestment). The most notable shift during this time was in the category of legislation restricting the use of ESG factors and focusing on pecuniary characteristics in decisions related to the investment of public funds, which represented only 6% of proposed legislation in 2022 but 51% of proposed legislation in 2023.

- In 2024, the balance largely reflects the trends established in 2023, with 51% of proposed legislation aimed at the use of ESG factors in more general terms (either restricting them, 43%, or promoting them, 8%) and 34% of proposed legislation relating to certain industries (whether targeting boycotters, 22%, or promoting divestment, 12%).

Looking at the legislation at a macro-level from the perspective of overall state sentiment over the last three years, the extent to which state anti-ESG efforts continue to outpace pro-ESG efforts becomes clear. Our data shows that in 2022, the number of anti-ESG measures was more than double that of pro-ESG measures (23 vs. 10 bills) that year, and in 2023, the number of anti-ESG measures introduced outnumbered pro-ESG bills by four to one (130 vs. 32 bills). The difference in enactment was even greater, with seven times as many anti-ESG bills passed in 2023 as pro-ESG bills. The trend has weakened only slightly in 2024 (61 anti-ESG vs. 15 pro-ESG bills proposed, with seven vs. two enacted, respectively).

Though the number of pro-ESG bills is relatively small, it is worth noting that passage rates for pro-ESG bills appear to be improving in relation to anti-ESG bills. In 2023, bills promoting ESG factors in investment and proxy decisions were 25% more likely to pass than bills restricting such factors. The gap widened in 2024, when bills promoting ESG factors in investment and proxy voting decisions were 42% more likely to pass than those restricting such factors. Further, while divestment bills are slightly less likely to be passed than anti-boycott bills, the passage rate for the former doubled over 2023 (from 5% to 11%), while the passage rate of the latter fell (from 22% to 18%). It is not clear whether these rates indicate a trend driven by stronger pro-ESG efforts or whether they simply reveal a steady current of pro-ESG sentiment that was eclipsed momentarily by the recent anti-ESG surge.

It is difficult to draw any conclusions from the available data, but we think it is clear that both blue and red states continue to be focused on ESG investing in various forms. The combination of new and potential legislation and increasing implementation actions under the many laws enacted in 2023 suggest that asset managers should continue to follow developments in this space and to consider the pro- or anti-ESG climate in each state when responding to RFPs for or engaging with state retirement plans.

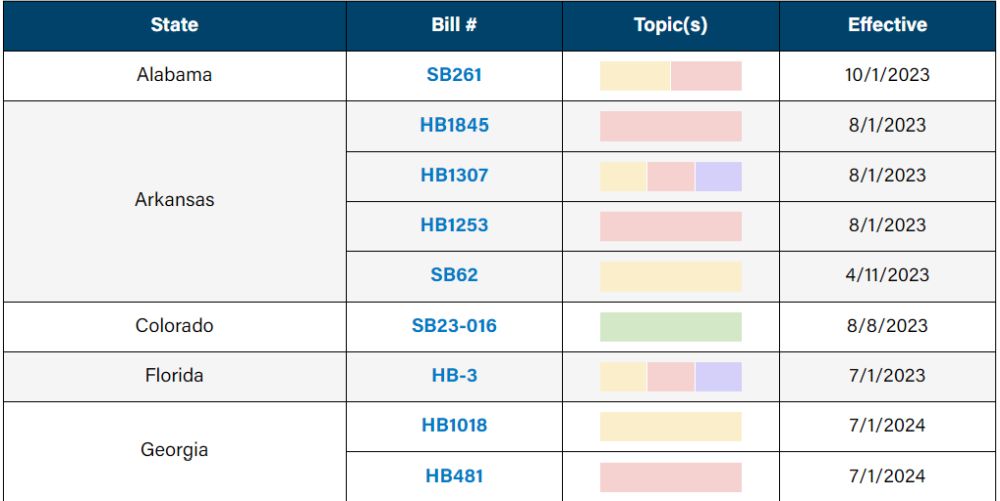

II. ESG Laws in Effect or Set to Take Effect in the Near Future; Enacted Legislation in 2024

In Part II of this alert, we provide a high-level summary of the laws that are currently in effect, or are scheduled to take effect in the near future. We separately provide a summary of measures that have been adopted in 2024.

ESG Laws in Effect or Set to Take Effect in the Near Future

Pro-ESG and Anti-ESG State Legislation Adopted in 2024

|

State |

Legislative Action |

Dates |

Topic(s) |

|

Georgia |

Introduced: 1/24/2024 Signed: 4/22/2024 Effective: 7/1/2024 |

Target Entities That Boycott Certain Industries |

- Prohibits financial institutions from requiring the use of a firearms code in a way that distinguishes a firearms retailer that is physically located in Georgia from general merchandise retailers or sporting goods retailers, unless a financial institution concludes in good faith that such action is required by applicable law or regulation.

- Prohibits financial institutions from discriminating against a firearms retailer by declining a lawful payment card transaction based solely on the assignment or nonassignment of a firearms code, except in response to customer requests, fraud prevention procedures or expenditure or corporate payment card control.

- Requires the Attorney General to bring an action against any person the Attorney General has reason to believe is engaging, has engaged, or is about to engage in any act or practice declared unlawful by the law. The action must be to (1) obtain a declaratory judgment that the act or practice violates the act, (2) enjoin any act or practice that violates the act, and (3) recover civil penalties of up to $10,000 per violation or injunction, judgment, or consent order and reasonable expenses, investigative costs, and attorney's fees.

|

State |

Legislative Action |

Dates |

Topic(s) |

|

Georgia |

HB481: Public Retirement Systems Investment Authority Law; provide for a fiduciary duty |

Introduced: 2/16/2023 Signed: 5/6/2024 Effective: 7/1/2024 |

Restrict Use of ESG Factors; Focus on Pecuniary Characteristics |

- Amends the Georgia Public Retirement Systems Investment Authority Law to require a fiduciary duty to invest retirement assets solely in the financial interest of participants and their beneficiaries. Prohibits any nonpecuniary interests, including the furtherance of any social, political, or ideological interests. Holds fiduciaries accountable even if such responsibility is breached after delegation.

- Requires fiduciaries to vote and execute all voting proxies solely and exclusively in the best economic interests or rights of the retirement system.

|

State |

Legislative Action |

Dates |

Topic(s) |

|

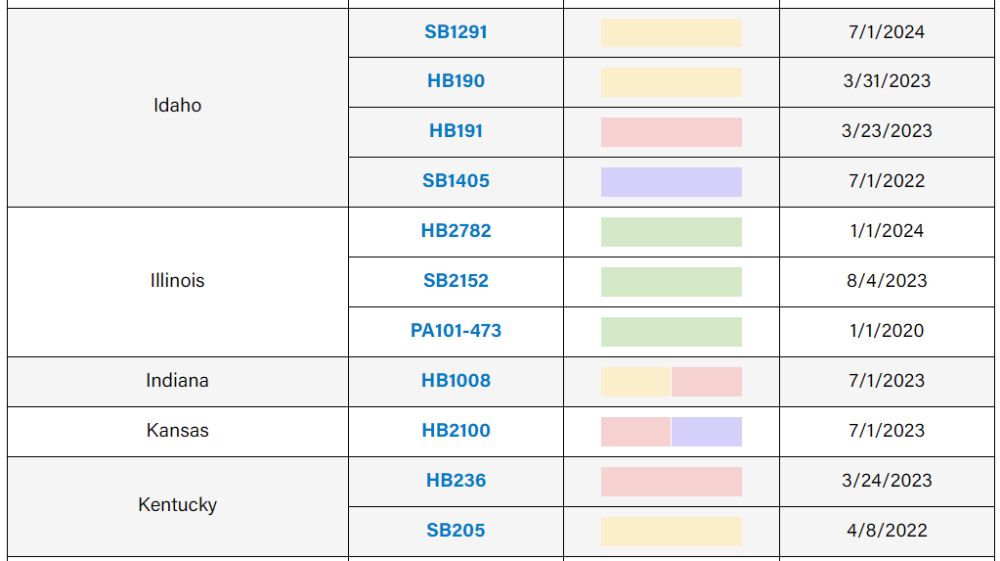

Idaho |

SB1291: Prohibition on Contracts with Companies Boycotting Certain Sectors |

Introduced: 2/7/2024 Signed: 3/25/2024 Effective: 7/1/2024 |

Target Entities That Boycott Certain Industries |

- Prohibits public entities from entering into certain purchase contracts unless the provider certifies in writing that it does not, and will not for the contract duration, boycott any individual or company because it (1) engages in or supports the exploration, production, utilization, transportation, sale, or manufacture of fossil fuel-based energy, timber, minerals, hydroelectric power, nuclear energy, or agriculture or (2) engages in or supports the manufacture, distribution, sale, or use of firearms.

- Applies to contracts worth at least $100,000, to be paid in part from public funds, with providers that have at least 10 full-time employees.

|

State |

Legislative Action |

Dates |

Topic(s) |

|

Louisiana |

Introduced: 3/1/2024 Passed: 6/11/2024 Effective: 8/1/2024 |

Target Entities That Boycott Certain Industries |

- Prohibits public entities from entering into certain purchase contracts unless the provider verifies in writing that (1) it does not have a practice, policy, guidance, or directive that discriminates against a firearm entity or firearm trade association and (2) it will not do so during the contract term.

- Applies to contracts worth at least $100,000, to be paid primarily from public funds, between a public entity and a company that has at least 50 full-time employees and is not a sole-source provider.

- Grants the Louisiana Attorney General the enforcement authority to recover all reasonable costs and reasonable attorney fees incurred in a prevailing lawsuit.

|

State |

Legislative Action |

Dates |

Topic(s) |

|

Louisiana |

HR267: Requests State Retirement Systems to Submit Reports Regarding Procedures for Proxy Voting |

Introduced: 5/22/2024 Passed: 5/29/2024 Effective: Immediately |

Restrict Use of ESG Factors; Focus on Pecuniary Characteristics |

- Alleges that "politically based shareholder proposals, especially those involving environmental and social issues, have dramatically increased" and "many of the environmental and social shareholder proposals are the work of activist investors that have no interest in the economic performance of the state, its residents, or pension investments; and environmental and social shareholder proposals are often in direct conflict with the guidance and direction of the boards of directors of public companies who, under law, are fiduciaries of such public companies and their shareholders."

- Requests that each state retirement system submit reports at least 60 days before the 2025 and 2026 regular sessions that (1) indicate voting recommendations for the prior year from the retirement system's proxy advisors and (2) specify all votes where the retirement system voted consistent with its proxy advisors and contrary to the vote recommendation of a public company's board of directors on shareholder proposals included in the company's annual proxy statement.

|

State |

Legislative Action |

Dates |

Topic(s) |

|

Louisiana |

Introduced: 4/23/2024 Passed: 5/31/2024 Effective: Immediately |

Restrict Use of ESG Factors; Focus on Pecuniary Characteristics |

- Requests that the Board of Regents and each public postsecondary education management board submit reports to the House Committee on Education, the Senate Committee on Education and the Joint Legislative Committee on the Budget no later than December 31, 2024, regarding actions related to ESG criteria that (1) defend the use of ESG criteria in the context of fiduciary responsibilities and (2) explain the nature of ESG reporting and the validity and financial efficacy of items scored and reported.

|

State |

Legislative Action |

Dates |

Topic(s) |

|

Maryland |

Introduced: 2/8/2024 Signed: 5/9/2024 Effective: 7/1/2024 |

Promote ESG Factors in Investment and/or Proxy Voting Decisions |

- Requires the Executive Director of the State Retirement Agency to employ a Director of Diversity, Equity, and Inclusion of the State Retirement Agency ("DEI Director"). Requires the DEI Director to, among other duties, (1) ensure the State Retirement Agency provides access and opportunities to underrepresented groups, (2) engage with the Board of Trustees to promote and support diversity of participation and leadership, (3) provide assistance as necessary to the Investment Division, and (4) provide advice and reports to the Board of Trustees on topics including diversity, equity and inclusion.

- Establishes a new governance program within the Investment Decision. Requires the person appointed by the Chief Investment Officer ("CIO") to implement the governance program to, among other duties, (1) monitor, evaluate, and quantify the risks and effects of material ESG factors on the investment of the assets of the Several Systems, (2) work across asset classes to integrate consideration of material ESG factors into investment due diligence and recommendations, (3) provide recommendations to the CIO based on research and analysis of material ESG factors, including diversity, equity, and inclusion, and (4) assist the Investment Division in identifying and recommending investment opportunities to the CIO.

|

State |

Legislative Action |

Dates |

Topic(s) |

|

Oregon |

HB4083: Relating to the Removal of Thermal Coal from the State Treasury Investment Portfolio |

Introduced: 2/5/2024 Signed: 4/10/2024 Effective: 1/1/2025 |

Promote Divestment from Certain Industries |

- Requires the Oregon Investment Council and the State Treasurer to make reasonable efforts to investigate all companies in which the Oregon Public Employees Retirement Fund ("OPERF") has invested or may invest, either directly or through a fund, to determine whether any of those companies are thermal coal companies.

- Requires the State Treasurer to give notice to thermal coal companies that the State Treasury will withdraw OPERF investments in the company for as long as the company is a thermal coal company, unless the company demonstrates that it is transitioning to clean energy on a reasonable timeline.

- Requires the State Treasurer to report annually to the Legislative Assembly on actions taken by the State Treasurer and the Oregon Investment Council pursuant to the provisions of this legislation, until OPERF has no moneys invested in thermal coal companies. Requires the State Treasurer to make reports under this section publicly available via the internet.

|

State |

Legislative Action |

Dates |

Topic(s) |

|

South Carolina |

Introduced: 1/19/2023 Signed: 1/17/2024 Effective: 2/5/2024 |

Restrict Use of ESG Factors; Focus on Pecuniary Characteristics |

- Requires the Retirement System Investment Commission ("RSIC") to consider only pecuniary factors when making investment decisions for the South Carolina Retirement System. Defines a "pecuniary factor" as a factor that a prudent person in a like capacity would reasonably believe has a material effect or impact on the financial risk or return on an investment based on an appropriate investment horizon consistent with a retirement system's investment objectives and funding policy. Excludes from this definition any factor or consideration that is collateral to or not reasonably likely to affect or impact the financial risk and return of the investment, including, but not limited to, the promotion, furtherance, or achievement of environmental, social, or political goals, objectives, or outcomes.

- Requires RSIC's statement of investment objectives and policies to include an explicit statement that all investment decisions must be based only on the consideration of pecuniary factors.

- Requires RSIC to cast shareholder proxy votes that are in keeping with its fiduciary duties based on pecuniary factors. Requires any RSIC engagement with a company regarding the exercise of shareholder proxy votes or the proposal of a proxy question to be based solely on pecuniary factors and for the sole purpose of maximizing shareholder value unless the proxy question does not have a pecuniary impact.

- Requires the closing documentation of any investment to include the CEO's certification that the decision to make the investment was based on pecuniary factors and not to promote, further, or achieve any nonpecuniary goal, objective, or outcome.

Further Information on State ESG Regulation

Be sure to check out our award-winning interactive website, Navigating State Regulation of ESG Investments, which tracks the latest ESG-related legislation, executive actions and initiatives, and coalition activities, as well as changes to state retirement plan investment policies across the United States. In addition, the website offers a variety of podcasts and memos to provide users with easy access to our team's key insights in understanding this dynamic area.

Appendix A

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.