- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- with readers working within the Technology industries

On January 1, 2024, the new beneficial ownership reporting requirements under the Corporate Transparency Act (the "CTA") took effect in the United States. These requirements have a sweeping effect, as many companies created in the United States or registered to do business in the United States are now required, regardless of business activities, to report certain information regarding their beneficial owners to the United States Treasury's Financial Crimes Enforcement Network ("FinCEN"). Notably, reporting companies created before January 1, 2024 have until January 1, 2025 to file an initial report. Given that extended timeline, some companies have taken a wait-and-see approach considering the potential for additional guidance, regulatory developments and legal challenges. While additional time may provide more clarity, companies should be preparing now for the looming January 1, 2025 deadline, given the complexities of the CTA, by analyzing their reporting obligations, considering potential exemptions and implementing new policies and procedures.

In relation to that, below we provide an overview of the CTA requirements followed by a selection of FAQs issued by FinCEN that we and our clients have found helpful.

Overview of CTA Requirements

Domestic and foreign companies subject to the CTA's requirements are referred to as "reporting companies." Domestic reporting companies include any corporation, limited liability company or other entity created by filing a document with a secretary of state or any similar office of a U.S. state, territory or Indian tribe, unless the entity fits within one of the exemptions laid out in the CTA. Foreign reporting companies include any corporation, limited liability company or other entity formed under the laws of a foreign country and registered to do business in any U.S. state, territory or tribal jurisdiction by the filing of a document with a secretary of state or any similar office, unless the entity fits within an exemption.

There are 23 exemptions from being deemed a reporting company, which predominantly apply to large U.S. companies and their wholly owned subsidiaries, meaning that most smaller entities will be required to report beneficial ownership information. The exemptions cover, among others, large operating companies that meet specified requirements as well as certain entities registered with the Securities and Exchange Commission, banking institutions and non-bank financial institutions. In addition, there is an exemption for entities whose "ownership interests" (as defined in the CTA) are wholly owned by one or more of most types of exempt companies.

Reporting companies created or first registered before January 1, 2024 have until January 1, 2025 to file an initial report. Reporting companies created or first registered in 2024 have 90 days to file an initial report. Reporting companies formed or first registered on or after January 1, 2025 will have 30 days to file an initial report. After an initial report is filed, there are no annual or quarterly filing requirements. However, reporting companies must report changes to any previously reported information within 30 days after a change occurs.

Beneficial ownership reports must identify all of a reporting company's "beneficial owners" and provide sensitive information about those individuals. Beneficial owners are natural persons that exercise substantial control over a reporting company or own or control at least 25 percent of the ownership interests of a reporting company.

Reporting companies created or registered on or after January 1, 2024, must also report their company applicants, which are up to two individuals: (1) the individual who directly files the document that creates or registers the company; and (2) if more than one person is involved in the filing, the individual who is primarily responsible for directing or controlling the filing.

Companies should analyze their reporting obligations under the CTA and establish policies, procedures and systems for this new reporting regime. In addition, companies should have a regular internal process for monitoring changes to beneficial ownership information for reporting companies and whether exempt entities continue to qualify for an exemption.

Selection of FAQs issued by FinCEN

FinCEN has issued a series of FAQs about the CTA on its website. Those FAQs are an important source of guidance in interpreting the CTA requirements. Below is a selection of FAQs that we and our clients have found helpful:

Reporting Company Status

Q: Does the activity or revenue of a company determine whether it is a reporting company?

A: Sometimes. A reporting company is (1) any corporation, limited liability company, or other similar entity that was created in the United States by the filing of a document with a secretary of state or similar office (in which case it is a domestic reporting company), or any legal entity that has been registered to do business in the United States by the filing of a document with a secretary of state or similar office (in which case it is a foreign reporting company), that (2) does not qualify for any of the exemptions provided under the Corporate Transparency Act. An entity's activities and revenue, along with other factors in some cases, can qualify it for one of those exemptions. For example, there is an exemption for certain inactive entities, and another for any company that reported more than $5 million in gross receipts or sales in the previous year and satisfies other exemption criteria. Neither engaging solely in passive activities like holding rental properties, for example, nor being unprofitable necessarily exempts an entity from the beneficial ownership information ("BOI") reporting requirements.

Reporting Company Exemptions

Q: If the size of a reporting company fluctuates above and below one of the thresholds for the large operating company exemption, does the reporting company need to file a BOI report?

A: Yes. The company will need to file a BOI report if it otherwise meets the definition of a reporting company and does not meet the criteria for the large operating company exemption (or any other exemption). If the company files a BOI report and then becomes exempt as a large operating company, the company should file a "newly exempt entity" BOI report with FinCEN noting that the company is now exempt. If at a later date the company no longer meets the criteria for the large operating company exemption or any other exemption, the reporting company should file an updated BOI report with FinCEN. Updated reports should be submitted to FinCEN within 30 calendar days of the occurrence of the change.

To qualify for the large operating company exemption, an entity must have more than 20 full-time employees in the United States, must have filed a Federal income tax or information return in the United States in the previous year demonstrating more than $5,000,000 in gross receipts or sales, and must have an operating presence at a physical office in the United States.

Q: If I own a group of related companies, can I consolidate employees across those companies to meet the criteria of a large operating company exemption from the reporting company definition?

A: No. The large operating company exemption requires that the entity itself employ more than 20 full-time employees in the United States and does not permit consolidation of this employee count across multiple entities.

Q: Does a subsidiary whose ownership interests are partially controlled by an exempt entity qualify for the subsidiary exemption?

A: No. If an exempt entity controls some but not all of the ownership interests of the subsidiary, the subsidiary does not qualify. To qualify, a subsidiary's ownership interests must be fully, 100 percent owned or controlled by an exempt entity.

A subsidiary whose ownership interests are controlled or wholly owned, directly or indirectly, by certain exempt entities is exempt from the BOI reporting requirements. In this context, control of ownership interests means that the exempt entity entirely controls all of the ownership interests in the reporting company, in the same way that an exempt entity must wholly own all of a subsidiary's ownership interests for the exemption to apply.

Beneficial Owners

Q: Who is a beneficial owner of a reporting company?

A: A beneficial owner is an individual who either directly or indirectly: (1) exercises substantial control over a reporting company or (2) owns or controls at least 25 percent of a reporting company's ownership interests. Because beneficial owners must be individuals (i.e., natural persons), trusts, corporations, or other legal entities are not considered to be beneficial owners.

Q: What is substantial control?

A: An individual can exercise substantial control over a reporting company in four different ways. If the individual falls into any of the categories below, the individual is exercising substantial control:

- The individual is a senior officer (the company's president, chief financial officer, general counsel, chief executive office, chief operating officer, or any other officer who performs a similar function).

- The individual has authority to appoint or remove certain officers or a majority of directors (or similar body) of the reporting company.

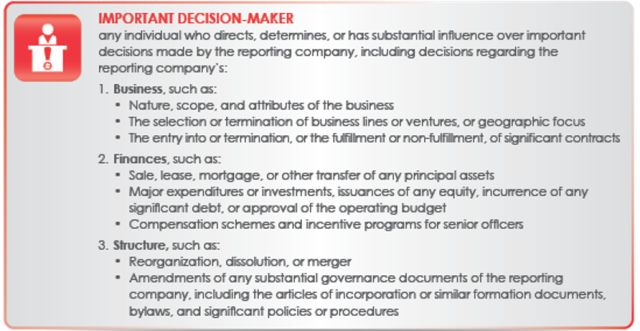

- The individual is an important decision-maker for the reporting company.

- The individual has any other form of substantial control over the reporting company.

Q: One of the indicators of substantial control is that the individual is an important decision-maker. What are important decisions?

A: Important decisions include decisions about a reporting company's business, finances, and structure. An individual that directs, determines, or has substantial influence over these important decisions exercises substantial control over a reporting company.

Q: What is an ownership interest?

A: An ownership interest is generally an arrangement that establishes ownership rights in the reporting company. Examples of ownership interests include shares of equity, stock, voting rights, or any other mechanism used to establish ownership.

Q: Is an unaffiliated company that provides a service to the reporting company by managing its day-to-day operations, but does not make decisions on important matters, a beneficial owner of the reporting company?

A: The unaffiliated company itself cannot be a beneficial owner of the reporting company because a beneficial owner must be an individual. Any individuals that exercise substantial control over the reporting company through the unaffiliated company must be reported as beneficial owners of the reporting company. However, individuals who do not direct, determine, or have substantial influence over important decisions made by the reporting company, and do not otherwise exercise substantial control, may not be beneficial owners of the reporting company.

Q: Is a member of a reporting company's board of directors always a beneficial owner of the reporting company?

A: No. A beneficial owner of a company is any individual who, directly or indirectly, exercises substantial control over a reporting company, or who owns or controls at least 25 percent of the ownership interests of a reporting company.

Whether a particular director meets any of these criteria is a question that the reporting company must consider on a director-by-director basis.

Q: Who does a reporting company report as a beneficial owner if a corporate entity owns or controls 25 percent or more of the ownership interests of the reporting company?

A: Ordinarily, such a reporting company reports the individuals who indirectly either (1) exercise substantial control over the reporting company or (2) own or control at least 25 percent of the ownership interests in the reporting company through the corporate entity. It should not report the corporate entity that acts as an intermediate for the individuals.

Two special rules create exceptions to this general rule in very specific circumstances:

- A reporting company may report the name(s) of an exempt entity or entities in lieu of an individual beneficial owner who owns or controls ownership interests in the reporting company entirely through ownership interests in the exempt entity or entities; or

- If the beneficial owners of the reporting company and the intermediate company are the same individuals, a reporting company may report the FinCEN identifier and full legal name of an intermediate company through which an individual is a beneficial owner of the reporting company.

Q: Who are a reporting company's beneficial owners when individuals own or control the company through a trust?

A: A beneficial owner is any individual who either: (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of a reporting company's ownership interests. Exercising substantial control or owning or controlling ownership interests may be direct or indirect, including through any contract, arrangement, understanding, relationship, or otherwise.

Trust arrangements vary. Particular facts and circumstances determine whether specific trustees, beneficiaries, grantors, settlors, and other individuals with roles in a particular trust are beneficial owners of a reporting company whose ownership interests are held through that trust.

For instance, the trustee of a trust may be a beneficial owner of a reporting company either by exercising substantial control over the reporting company, or by owning or controlling at least 25 percent of the ownership interests in that company through a trust or similar arrangement. Certain beneficiaries and grantors or settlors may also own or control ownership interests in a reporting company through a trust. The following conditions indicate that an individual owns or controls ownership interests in a reporting company through a trust:

- a trustee (or any other individual) has the authority to dispose of trust assets;

- a beneficiary is the sole permissible recipient of income and principal from the trust, or has the right to demand a distribution of or withdraw substantially all of the assets from the trust; or

- a grantor or settlor has the right to revoke the trust or otherwise withdraw the assets of the trust.

This may not be an exhaustive list of the conditions under which an individual owns or controls ownership interests in a reporting company through a trust. Because facts and circumstances vary, there may be other arrangements under which individuals associated with a trust may be beneficial owners of any reporting company in which that trust holds interests.

General Reporting Requirements

Q: Is there a requirement to annually report beneficial ownership information?

A: No. There is no annual reporting requirement. Reporting companies must file an initial BOI report and updated or corrected BOI reports as needed.

Q: Can a parent company file a single BOI report on behalf of its group of companies?

A: No. Any company that meets the definition of a reporting company and is not exempt is required to file its own BOI report.

Q: Should an initial BOI report include historical beneficial owners of a reporting company, or only beneficial owners as of the time of filing?

A: An initial BOI report should only include the beneficial owners as of the time of the filing. Reporting companies should notify FinCEN of changes to beneficial owners and related BOI through updated reports.

Q: How does a company report to FinCEN that the company is exempt?

A: A company does not need to report to FinCEN that it is exempt from the BOI reporting requirements if it has always been exempt.

If a company filed a BOI report and later qualifies for an exemption, that company should file an updated BOI report to indicate that it is newly exempt from the reporting requirements. Updated BOI reports are filed electronically though the secure filing system. An updated BOI report for a newly exempt entity will only require that the entity: (1) identify itself; and (2) check a box noting its newly exempt status.

Updated Reports

Q: What are some likely triggers for needing to update a beneficial ownership information report?

A: The following are some examples of the changes that would require an updated beneficial ownership information report:

- Any change to the information reported for the reporting company, such as registering a new business name.

- A change in beneficial owners, such as a new CEO, or a sale that changes who meets the ownership interest threshold of 25 percent.

- Any change to a beneficial owner's name, address, or unique identifying number previously provided to FinCEN. If a beneficial owner obtained a new driver's license or other identifying document that includes a changed name, address, or identifying number, the reporting company also would have to file an updated beneficial ownership information report with FinCEN, including an image of the new identifying document.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.