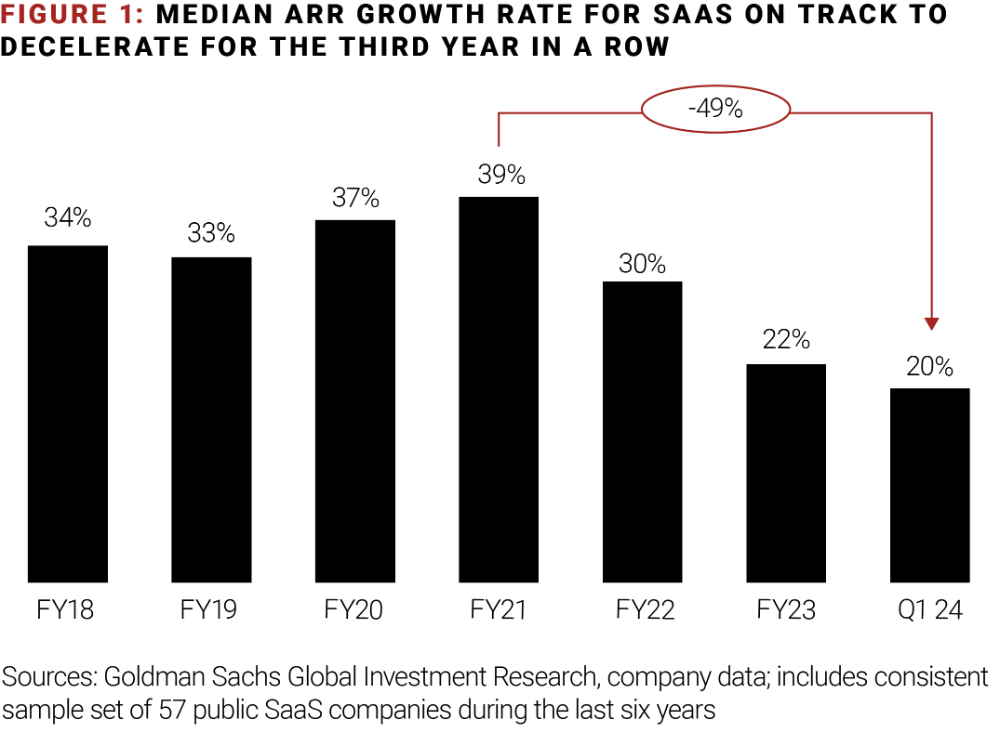

Investors can no longer count on fast growth in the software-as-a-service (SaaS) industry, where the rate of growth in annual recurring revenues (ARR) has plummeted nearly 50% in less than three years. As a result, many PE firms are shifting their focus to driving both profitability and growth, often in that order, which means they must make significant changes to how targets are identified and assessed in the pre-investment period.

SaaS companies must adjust to a new normal. As market penetration and market maturity increase and as customer priorities and buyer behaviors shift, the broad and rapid top-line growth that has until now characterized the entire industry has dissipated and is now relegated to smaller niches. A proliferation of players has given increasingly cost-conscious customers more options, contributing to disruptive industry trends—such as lengthening sales cycles, tougher pricing negotiations, and vendor consolidation among enterprise customers.

Collectively, those dynamics have created strong headwinds when it comes to ARR growth for companies in the industry (figure 1).

Figure 1:

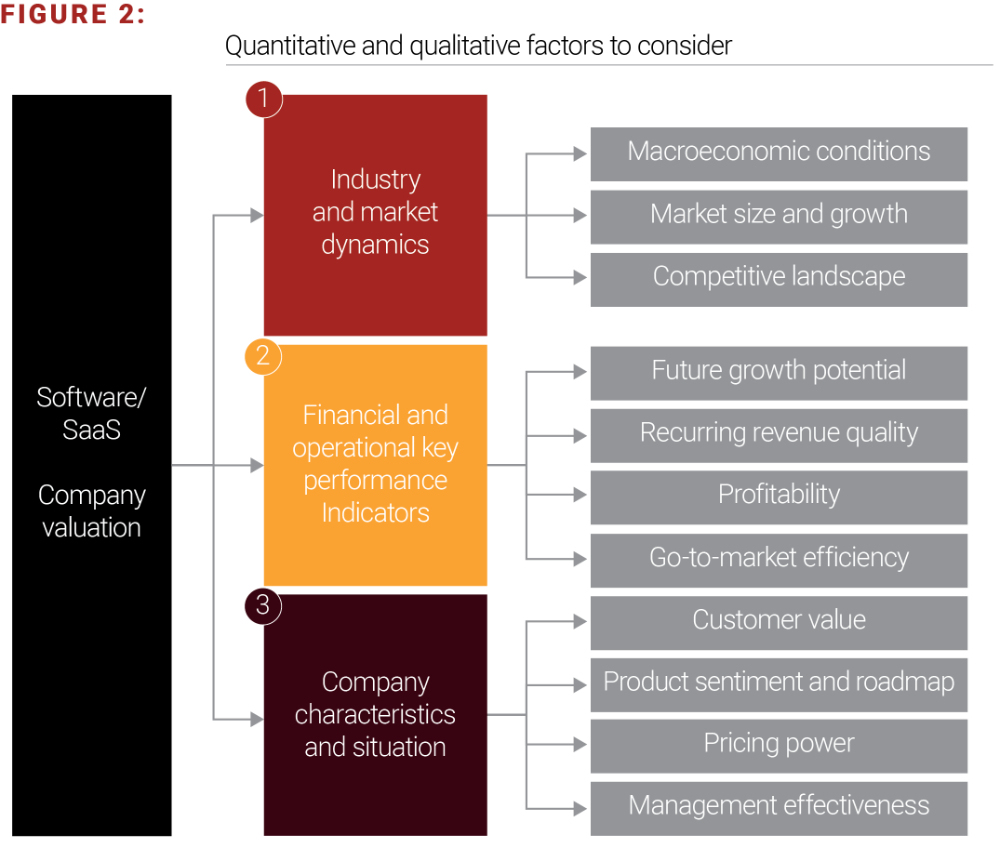

To increase confidence in profitable growth opportunities, PE firms must factor quantitative and qualitative analytics into a more comprehensive approach

When evaluating a SaaS company's profitability, start by assessing industry and market dynamics to contextualize the company's current situation. Then analyze historical performance and characteristics to determine the runway for profitable growth and then develop a compelling deal thesis.

It's still also necessary to assess and improve operational efficiency in the traditional manner—often through a combination of general-and-administrative-expenses (G&A) optimization, location strategy, offshoring, outsourcing, process efficiency and automation, research-and-development (R&D) effectiveness, and more. But a truly effective profitability boost requires additional quantitative and qualitative factors (figure 2).

Figure 2:

Industry and market dynamics

With regard to industry and market dynamics, macroconditions have shifted significantly in recent years. As disruption proliferates across industries and segments, an understanding of the current environment—for contextualizing market size, growth potential, and the competitive landscape—has become critical.

To achieve that understanding, firms can analyze what's driving ARR declines by industry segment. For example, companies cut budgets and close projects when facing a downturn, which results in reduced ARRs for SaaS providers. As the market stabilizes, SaaS providers may, cautiously, start smaller projects so that ARRs may increase, but the pace of growth will likely be dampened.

Although it's still important to conduct market size and competitive analyses, firms must weigh segment trends heavily. High-growth industries will naturally demand more SaaS solutions than slow-growth industries do, and therefore, gathering additional insights based on use cases within each industry segment offers a further level of detail on where the best value lies.

Financial and operational performance key performance indicators (KPIs)

Given the foregoing context, assessment of future growth potential based on KPIs requires a more detailed understanding of operational drivers and growth assumptions. As volatility continues, firms must adopt more-nuanced scaling methodologies—and with additional parameters.

Firms can start by assessing the quality of a SaaS company's recurring revenue and renewal rates based on customer segmentation and then align their sales coverage models based on their findings. Further analysis of win–loss data can recalibrate the segmentation and coverage model as needed, and analysis of upsell and downsell reasons will help calibrate the selling approach. The resulting data will also help R&D teams adjust product features to minimize downsell and provide customers with what they most value.

By monitoring a company's monthly and yearly subscriptions mix as well as longer-term licensing agreements such as perpetual models instead of subscription models, a firm can identify potential changes in purchasing behavior by industry segment. The firm can also examine a company's sales pipeline through demand generation analysis and pipeline conversion rate to determine the need for marketing investment by segment as macroconditions continue shifting.

To efficiently go to market, a company needs a streamlined delivery model. Customers should enjoy a seamless experience across all communication touch points—from product delivery to customer success interactions. Use of the latest technology to modernize R&D and G&A through process and automation improvement will further boost company efficiency. Technology advancements also can help optimize outsourcing and offshoring models.

Company characteristics and situations

It's also crucial for SaaS companies to monitor customer and product sentiment to ensure pricing and features align with customer values. Measuring product sentiment across scalability, workflow and automation, platform and operations support, customization, ease of deployment, and more enables companies to find where products match customer expectations and where adjustments are needed to retain, regain, or grow customer adoption.

The same process works to measure and adjust pricing and packaging as needed. Using technology helps drive net-positive margin improvements and simplify the measurement process.

Artificial intelligence (AI) can help make this comprehensive approach a reality

Traditional approaches to screening for leads rely heavily on networking and on generating contacts through established relationships. The monitoring of market trends depends on the meticulous, manual, and time-consuming activities of gathering and sifting through research, analyzing company performance and market data, and synthesizing news and industry reports. But that round-up-the-usual-suspects approach is limiting. Today it's table stakes for companies to take advantage of AI's ability to ingest and analyze vast amounts of data—especially as investors begin focusing more on profitability.

AI and machine-learning (ML) models can significantly enhance the efficiency and effectiveness of the dealmaking process. And even though those tools cannot alone either make critical decisions or replace investor expertise, they can empower deal teams to broaden their search and take quicker action. Large language models (LLMs) are changing competitor and market trend analyses by enabling buyers to evaluate vast quantities of data and review and synthesize thousands of research and company earnings documents in days rather than weeks. Those advances also enable PE investors to develop more-personalized investment strategies. When LLMs incorporate expert knowledge and operator experience during the building and training phases, AI models are more robust and get fed higher-quality data, which in turn delivers higher-impact recommendations.

By weaving in proprietary data from portfolio companies and past transactions, PE firms can zero in on prospects uniquely suited to their skills or strategies, can find niche acquisitions, or can devise and execute a roll-up strategy faster than before. Proprietary data also strengthens PE firms' competitive advantage when implementing predictive AI and ML models, thereby providing investors with an early warning on market fluctuations and potential investment risks.

Even as market conditions continue to fluctuate, savvy investors can identify the ideal SaaS companies to target through this comprehensive approach. Baking in our quantitative and qualitative metrics into profitability analyses, combined with thoughtful AI and ML applications to expedite the process and expand breadth and depth, will give PE firms a leg up on the competition—and the ability to adjust depending on where the headwinds blow next.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.