What Is It?

The Corporate Transparency Act (the CTA or the Act) was enacted by Congress in 2021 to enhance transparency in entity structures and ownership to combat money laundering, tax fraud, and other illicit activities. The CTA tasked the U.S. Department of Treasury's Financial Crimes Enforcement Network (FinCEN) with implementing the requirements of the CTA, including creating a centralized, non-public database of the individuals who own or control certain businesses in the U.S. Effective Jan. 1, 2024, with limited exceptions, any entity formed in the U.S. or any foreign entity qualified to do business in the U.S. is responsible for compliance with the CTA.

Who Needs to Comply

With limited exceptions, all corporations, limited liability companies, and similar entities created or registered to do business in the U.S. must file a beneficial ownership report (BOI Report) with FinCEN, disclosing certain information concerning the entity, its beneficial owners and, for entities formed after Jan. 1, 2024, the individual(s) involved in the entity's formation (each such individual is referred to as a "Company Applicant" under the CTA).

There are 23 exemptions to the CTA's reporting requirements. Generally, the CTA exempts entities that are regulated by agencies such as the SEC, FinCEN, bank regulators, insurance regulators, or other similar agencies. The exemptions also include certain tax-exempt entities, truly dormant companies, and large operating companies (i.e., companies with 20 or more full-time employees in the U.S., with a physical address in the U.S., and that have filed U.S. income tax returns reporting more than $5 million in gross receipts or sales for the prior year). The rules defining each exemption are extremely specific and require careful consideration of the unique facts and circumstances surrounding the entity. To determine whether your company may qualify for an exemption, reach out to Taft and/or see FinCEN's Small Entity Compliance Guide, found here.

How and When to Comply

How to Comply

Each reporting entity must file a BOI Report, which requires reporting the entity's legal name, any DBAs, address, jurisdiction of formation, and tax identification number. Additionally, for each beneficial owner and Company Applicant of a reporting entity, a reporting entity must report such individual's: (1) full legal name; (2) date of birth; (3) current address; (4) a unique identifying number from a non-expired U.S. passport, state ID or driver's license; and (5) a copy of the identification document.

For beneficial owners or Company Applicants who do not want to provide the above-listed personal information to the reporting entity, such individuals may, instead, report such information directly to FinCEN to obtain a FinCEN identifier and provide the FinCEN identifier to the reporting entity. A FinCEN identifier may be obtained here. Taft recommends all beneficial owners and Company Applicants obtain a FinCEN Identifier.

When to Comply

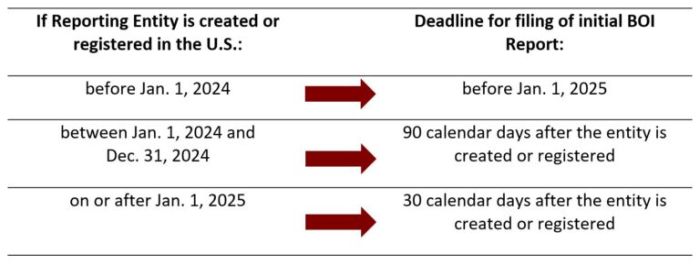

Depending on the date the reporting entity is created or registered in the U.S., the company and its beneficial owners or Company Applicants will have a specific deadline for filing its initial BOI Report. Please refer to the chart below for more information on such deadlines.

If, after filing its initial BOI Report, any information previously reported by the reporting entity should change, the reporting entity has 30 days to report any change by filing an amended BOI Report with FinCEN.

CTA in the News

While the CTA was passed with good intentions, it has already made its way to various courts. The National Small Business Association (NSBA) recently filed a brief with the Eleventh Circuit requesting it to uphold a lower court's finding that the CTA is unconstitutional. Cases challenging the constitutionality of the Act have also been filed in Maine and Michigan federal district courts.

While there are pending cases challenging the validity of the Act, the CTA remains in place unless a more global decision ruling the Act unconstitutional is delivered. It is important for business owners to comply with the CTA, as willful failure to comply may result in civil and criminal penalties, including civil penalties of up to $500 for each day that the violation continues and/or criminal penalties, including imprisonment for up to two years and/or a fine up to $10,000.

How Taft Can Help

Taft has assembled a multi-disciplinary committee to address the specific impact of the CTA and assist clients with complying with it.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.