Goulston & Storrs M&A attorney Dan Avery is a nationally recognized expert on M&A deal point trends. In partnership with Bloomberg Law, Dan has developed a series of 25 articles looking at these trends, on a topic-by-topic basis, providing practical insight into where these trends are heading, and the relevant implications for M&A deal professionals.

Market Trends: What You Need to Know

As shown in the American Bar Association's Private Target Mergers and Acquisitions Deal Points Studies:

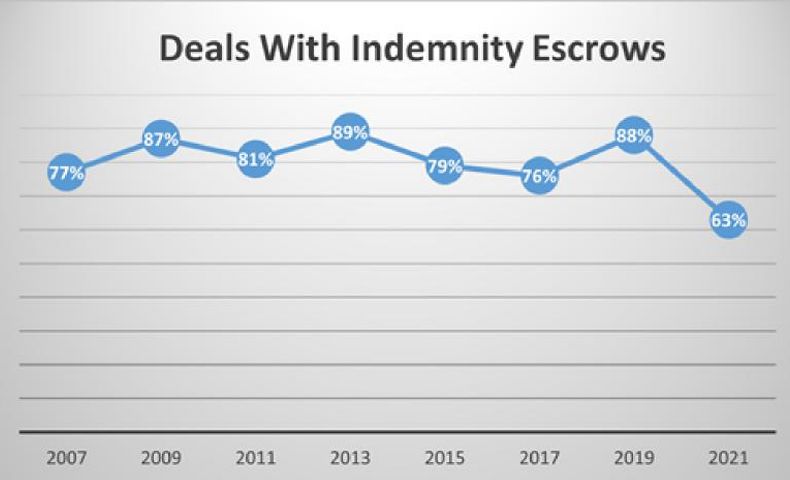

- Indemnity escrows are consistently seen in about two-thirds or more of reported transactions.

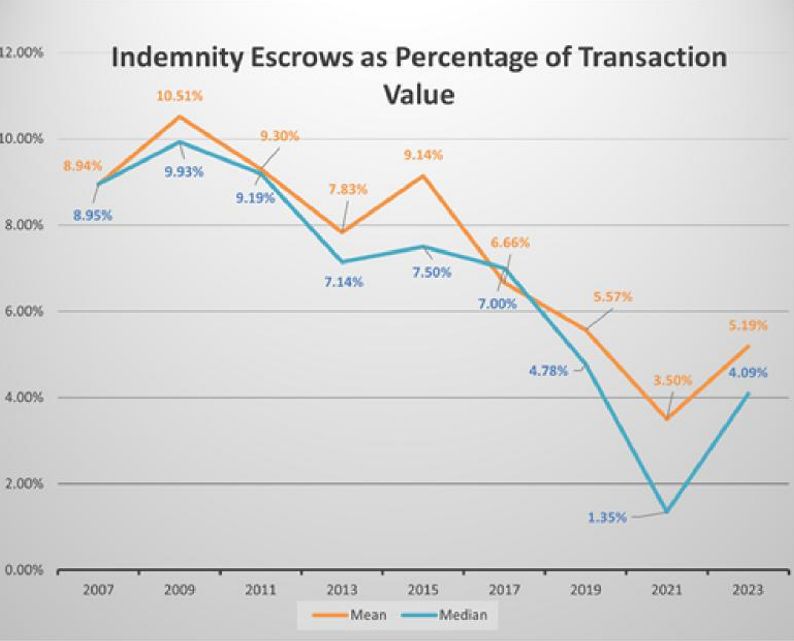

- As shown by the ABA studies, the level of indemnity baskets as a percentage of transaction value, whether as mean or median, has seen a moderate downward trend since 2009, though this has rebounded somewhat within the most recent (2023) study. This downward trend was likely impacted by the increase in representations and warranty insurance (RWI) procurement during that period, and deals with RWI tend to have lower indemnity escrows than deals without RWI.

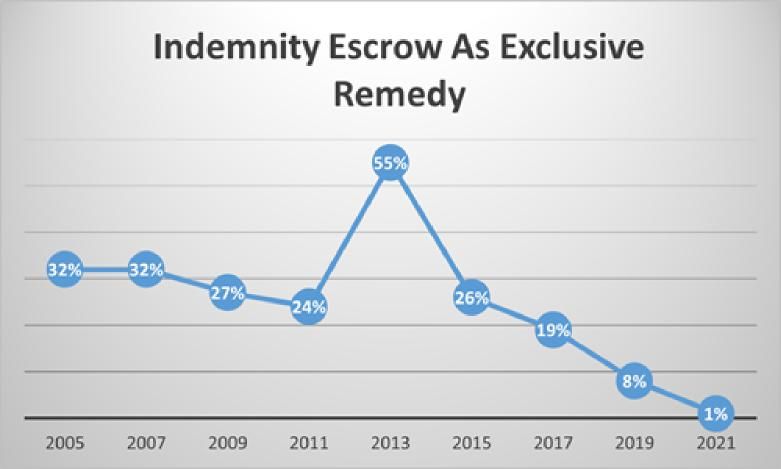

- With the exception of a dramatic (and unexpected if not inexplicable) bump in 2013, provisions making indemnity escrows the exclusive remedy for relevant indemnity claims have been on a steep decline in recent years, falling from 32% to 1% over the time periods covered by the ABA studies.

Introduction

Merger and acquisition (M&A) purchase agreements generally include indemnification provisions, pursuant to which any given party (indemnitor) agrees to defend, hold harmless, and indemnify the other party or parties (indemnitees) from specified claims or damages. These typically include claims arising from a breach of the indemnitor's representations and warranties or covenants set forth in the purchase agreement, or with respect to other specific matters.

In most M&A transactions, a portion of the purchase price otherwise payable to the seller is placed into escrow, for a defined period of time, to secure one or more indemnity obligations of the seller to the buyer following closing. This article examines trends relating to the use of indemnity escrows in private company M&A transactions.

M&A Indemnity Escrows

Indemnity escrows are typically set up as security for the seller's general indemnity obligations regarding its representations and warranties, but they need not be limited to those obligations. Typically, these escrows are held by a third party independent of the buyer and seller, such as a bank. Occasionally, the buyer may retain the escrow as a holdback, but this is less common. In this article the term escrow is intended to include buyer holdbacks as well as true third-party escrows, since the difference between the two relates primarily to whether the funds are held by an independent party or not.

The parties may agree to establish a single escrow to secure all potential claims, or establish multiple, separate escrows with each providing recourse for different seller obligations. For example, if the buyer discovers something in diligence that warrants negotiation of enhanced rights and remedies, it may also negotiate for a separate escrow, apart from the standard general indemnity escrow, to ensure funds are available if any of the enhanced remedies are triggered. In addition, buyers and sellers are increasingly establishing separate escrows to secure buyer obligations arising as part of the purchase agreement's post-closing purchase price adjustment.

A general indemnity escrow may, but does not necessarily need to, tie to different dollar-based and timing aspects of the underlying indemnity to which it relates. For example, it may make sense to set the term of the escrow to the normal survival period of the seller's representations and warranties. Although, because there are often exceptions to that survival period, including for specified fundamental representations, there is not necessarily a perfect alignment between the two time periods. The parties might agree that the escrow should be the sole recourse for indemnity claims, and as such operate as an indemnity cap. But, as in the case of survival periods, likely exceptions to a normal cap, whether for claims arising from breaches of fundamental reps, covenants or the like, may weaken the case for perfect symmetry between escrow amount and cap.

Trends in Indemnity Escrows

Every other year since 2005 the ABA has released its Private Target Mergers and Acquisitions Deal Points Studies (the ABA studies). The ABA studies examine purchase agreements of publicly available transactions involving private companies. The ABA studies examine purchase

agreements of publicly available transactions involving private companies. These transactions range in size but are generally considered as within the "middle market" for M&A transactions; the transaction values of the 108 deals within the 2023 study ranged from $30 to $750 million.

The ABA studies show that:

- Indemnity escrows are consistently seen in about two-thirds or more of reported transactions.

- The level of indemnity baskets as a percentage of transaction value, whether as mean or median, has seen a moderate downward trend since 2009, though this has rebounded somewhat within the most recent (2023) study.

- With the exception of a dramatic (and unexpected if not inexplicable) bump in 2013, provisions making indemnity escrows the exclusive remedy for relevant indemnity claims have been on a steep decline in recent years, falling from 32% to 1% over the time periods covered by the ABA studies.

For reference, the mean represents the average of all of the covered data, and the median represents the data point separating the lower and higher halves of the overall data, i.e., one-half of all data points are above and one-half are below the median. Median is often considered a more reliable indicator of what is normal or typical where data distribution is skewed.

The following three charts show how the trends described above, in more detail.

Indemnity Escrows and Representations and Warranty Insurance

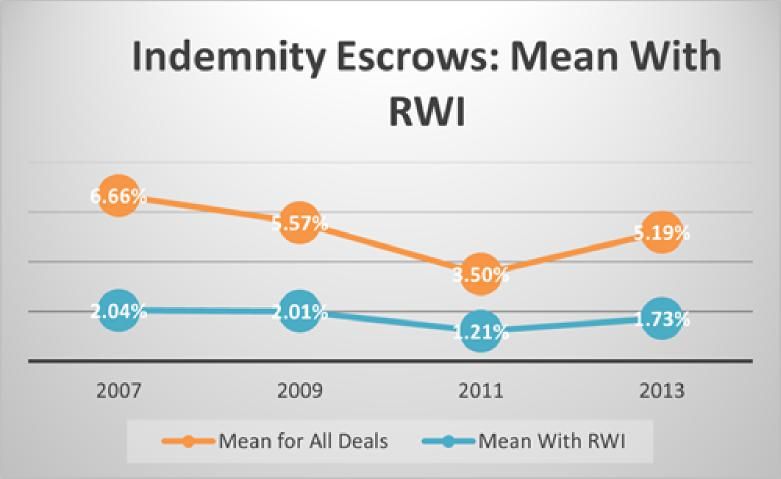

The past four ABA studies have looked at the relationship of RWI to indemnity concepts. The recent studies show that indemnity caps and indemnity baskets are lower in reported deals where RWI is referenced in the deal documents, as compared with transactions without any such reference.

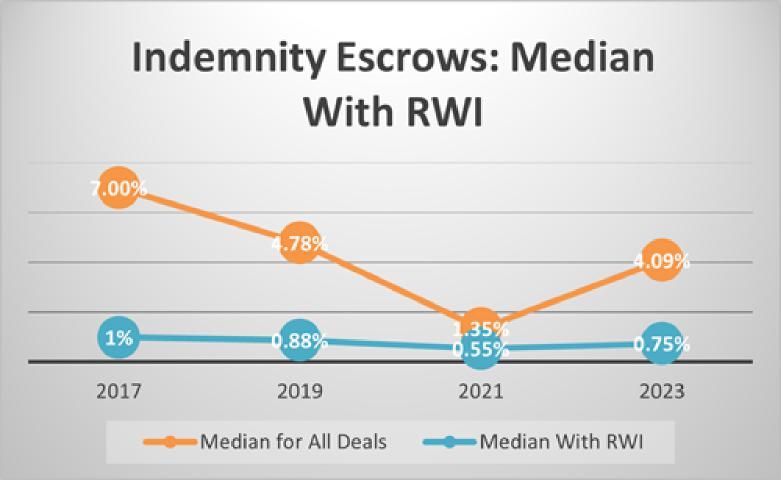

Similarly—and not surprisingly—indemnity escrows were also lower in deals within these four studies where RWI was referenced. The two charts below show this relationship, as to indemnity escrow means and medians, respectively.

Conclusion

Indemnity escrows provide an important source of recourse for indemnity claims. As shown by the ABA studies, the level of indemnity baskets as a percentage of transaction value, whether as mean or median, has seen a moderate downward trend since 2009, though this has rebounded somewhat within the most recent (2023) study. This downward trend was likely impacted by the increase in representations and warranty insurance (RWI) procurement during that period, and deals with RWI tend to have lower indemnity escrows than deals without RWI. The use of indemnity escrows as the sole recourse for relevant indemnity claims has decreased since 2005, and is now rarely if ever even seen anymore.

Click here for a pdf of the article.

Reproduced with permission from Bloomberg Law. Copyright ©️2024 by The Bureau of National Affairs, Inc. (800-372-1033) http://www.bloomberglaw.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.