Asset classes vary when it comes to setting and calculating hurdle rates, determining catch-up provisions, and starting successor funds.

In Goodwin's Fund Terms Intelligence series, we highlight those differences by pulling from our proprietary fund terms database. Our data span a wide array of asset classes, such as private equity, real estate, venture capital, infrastructure, and credit.

Below we've compiled four charts from the series.

Setting hurdle rates

Private investment funds distribute returns to investors and sponsors according to a predetermined plan, known as a "distribution waterfall." Sponsors and managers typically do not participate in returns until investors receive an amount that is equal to their original investment plus a minimum return, known as a "hurdle rate."

More than half of funds have a hurdle rate of 8%, according to Goodwin Terms Database for Private Investment Funds. However, the picture can be quite different for specific asset classes. For example, nearly 80% of private equity funds have a hurdle rate of 8%, but only 29% of real estate funds do.

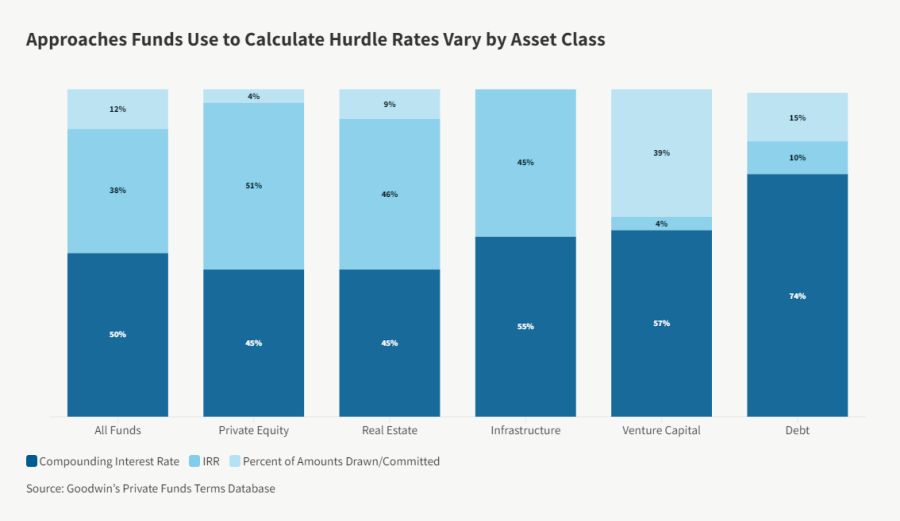

Calculating hurdle rates

Funds typically use one of three main approaches to calculate the hurdle rate: compounding interest rate, internal rate of return (IRR), or percent of amounts drawn or committed.

When all funds are considered together, the compounding interest rate approach is the most popular. About 50% of funds overall use this approach, while 38% use IRR, and 12% use percent of amounts drawn or committed.

The picture changes when funds are grouped by asset class. For private equity, real estate, and infrastructure funds, the split between those using the compounding interest rate and the IRR approaches is close to even.

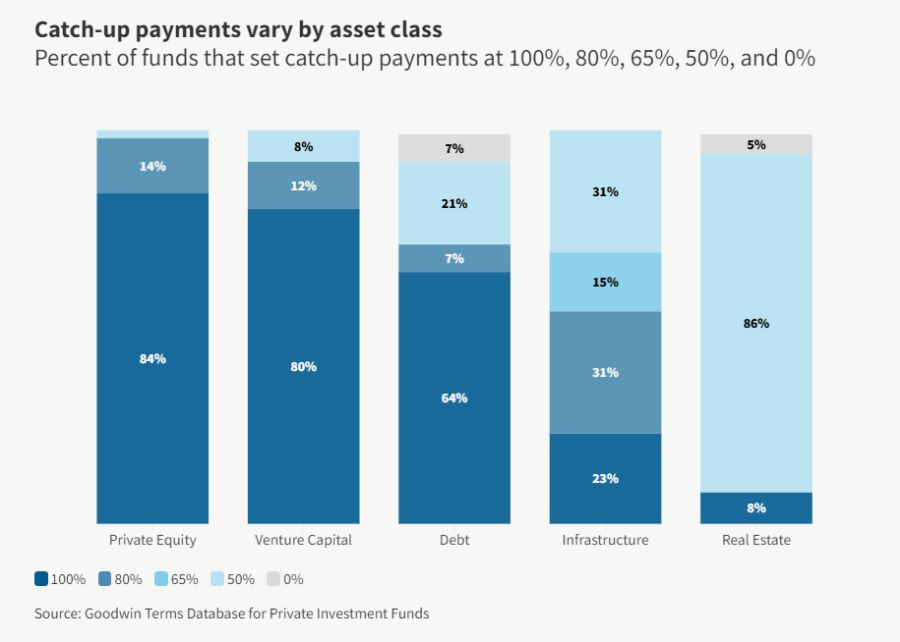

Approaches to catch-up payments

Catch-up payments kick in after investors recoup their original investment plus the hurdle rate. Only then do sponsors begin to participate in returns, typically starting with a catch-up phase that continues until the sponsor receives an amount based on the carried interest rate stipulated in the fund's governing document.

For most of the private equity, venture capital, and debt funds, catch-ups are 100%, but they are likely to be less than 100% for real estate and infrastructure funds.

Infrastructure funds show the greatest variability: about a quarter have 100% catch-ups, one-third have 80% catch-ups, and one-third have 50% catch-ups.

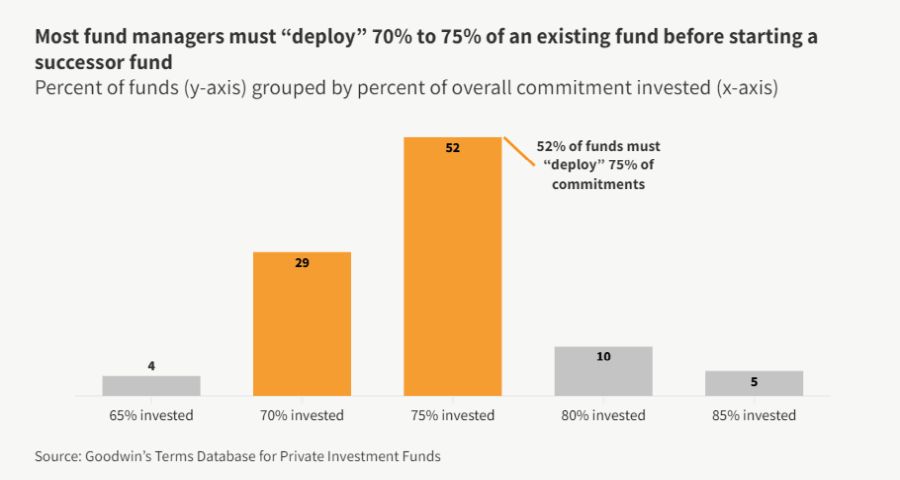

Starting a successor fund

Most fund managers must deploy 70% to 75% of an existing fund before starting a successor fund. The percentage varies, though, by asset class and other factors. Funds that expect to make significant follow-on investments, such as venture capital funds, typically push for lower requirements, often in the range of 65% to 70%. Only 15% of funds will have to deploy 80% or more.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.