Overview

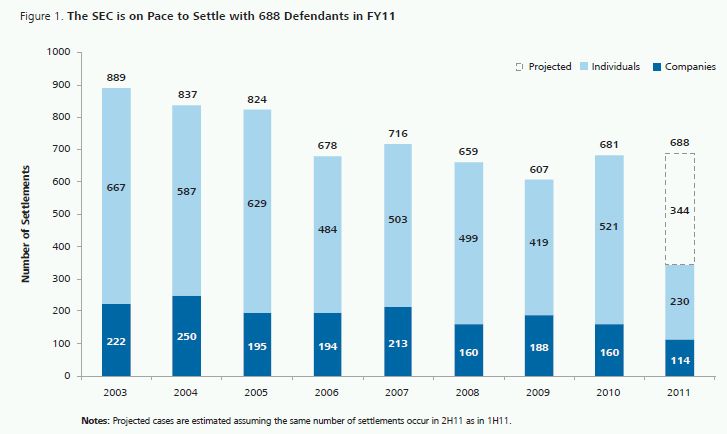

The SEC settled with 344 defendants in the first half of its 2011 fiscal year ("1H11"), putting the agency on pace to settle with 688 defendants for the full year, in line with the 681 settlements in FY10. This stability in overall settlements, however, contrasts with a substantial shift in their composition. The number of company settlements rose by 43% to 114, an annual pace of 228, compared with 160 for the entire 2010 fiscal year. As a result, company settlements made up 33% of 1H11 settlements. Individual settlements declined 12% to 230, an annual pace of 460, compared with 521 in FY10 (Exhibit 1).

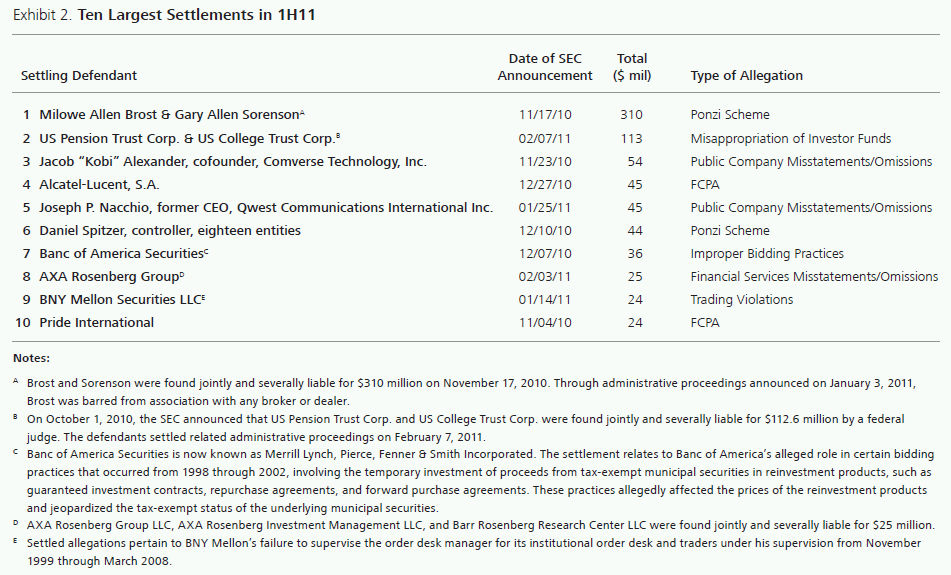

However, individual accountability remained an important theme in 1H11. Indeed, four of the 10 largest settlements in 1H11 were with individuals, including the $310 million default judgment1 entered against Milowe Allen Brost and Gary Allen Sorenson, which also rates as the ninth-largest SEC settlement since the passage of the Sarbanes-Oxley Act ("SOX").2 Other individual defendants settling with the SEC in 1H11 included Jacob "Kobi" Alexander, former CEO of Comverse Technology, and Joseph P. Nacchio, former CEO of Qwest Communications.

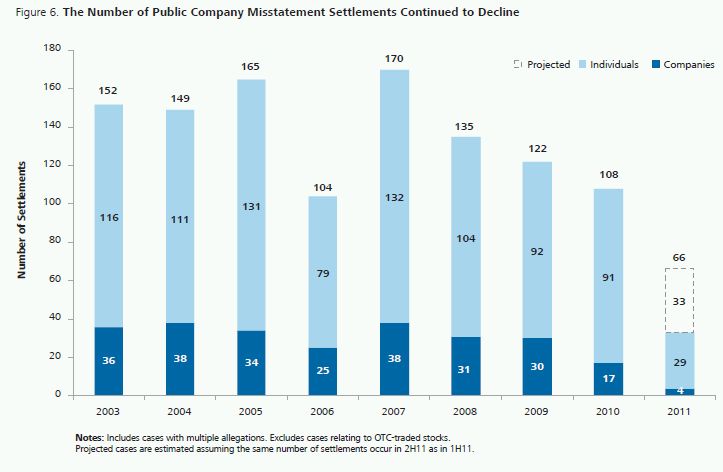

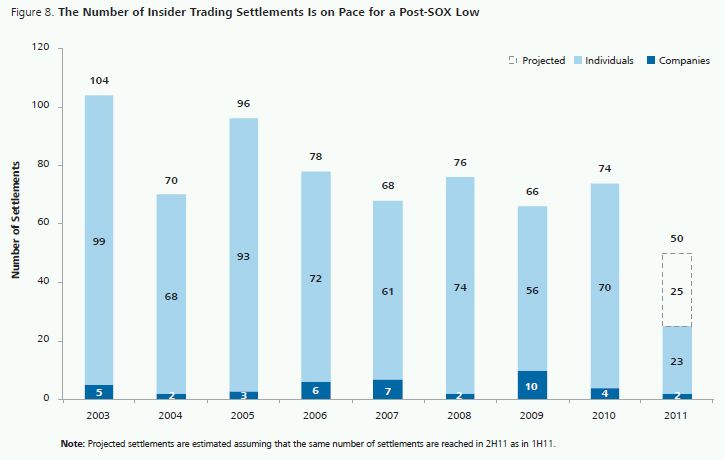

Settlements dropped sharply in the historically large categories of public company misstatement and insider trading. Public company misstatement settlements declined in 1H11 to 33, an annual pace of 66, down 39% from the 108 settlements in FY10 and more than 60% from the post-SOX high of 170 in 2007. Despite the recent prominence of insider trading enforcement including the Galleon case, the SEC reached only 25 insider trading settlements in 1H11. If this rate continues, the SEC will reach only 50 insider trading settlements this fiscal year, which would represent the lowest number of insider trading settlements in any year since SOX and a drop of nearly one-third from the 74 settlements reached in FY10.

Settlement Activity

The 10 largest settlements of the first half of the 1H11 are detailed in Exhibit 2, while the 10 largest settlements since the passage of SOX are detailed in Exhibit 3.

The highest-value settlement of 1H11 was the $310 million default judgment entered against Milowe Allen Brost and Gary Allen Sorenson. The SEC alleged that Brost and Sorenson operated their firm, Institute for Financial Learning Group of Companies, Inc., as a Ponzi scheme. According to the SEC, more than 3,000 investors in North America invested funds with the firm, lured by promises of 18 to 36 percent annual returns through investments in the gold mining industry. A trial is set to begin on June 4, 2012 to resolve remaining issues in the case.3

As a result of an SEC victory at trial, US Pension Trust Corp. and US College Trust Corp. were ordered by federal Judge Jose Martinez to pay a total of $112.6 million consisting of $62.6 million in disgorgement and a $50 million civil penalty.4 The firms were found guilty of misleading investors by charging undisclosed commissions and fees, which, according to the SEC, consumed up to 85% of the investors' initial contributions.

In the third-largest settlement of 1H11, Jacob "Kobi" Alexander, co-founder and former CEO of Comverse Technologies, Inc., agreed to pay $53.6 million to settle allegations involving options backdating. The settlement consists of $47.6 million in disgorgement and prejudgment interest and a $6 million civil penalty, which, according to the SEC, is "one of the largest penalties ever imposed in a stock options backdating case."5 The settlement came over four years after the August 2006 filing of the SEC's complaint alleging that Alexander participated in an options backdating scheme from 1991 through 2002. Alexander fled to Namibia in 2006, and is fighting extradition to the United States, where he faces criminal charges.6

Trends in Settlement Values

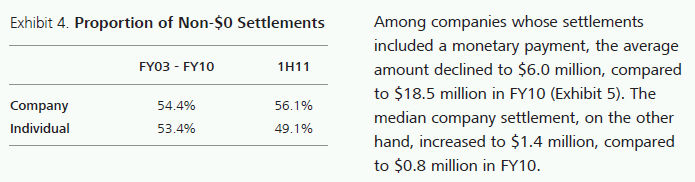

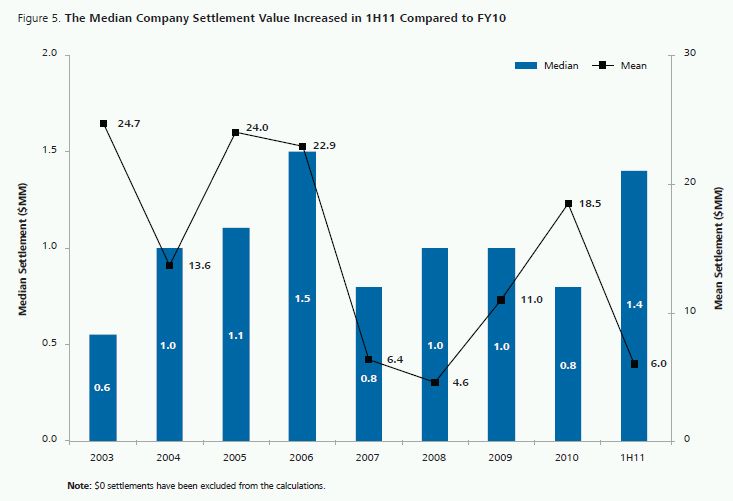

The proportion of 1H11 company settlements that included a monetary payment was 56.1%, somewhat higher than the 54.4% witnessed from FY03 through FY10. The proportion of individual settlements including a monetary penalty was 49.1%, somewhat lower than the 53.4% seen from FY03 through FY10 (Exhibit 4).

For individuals whose settlements included a monetary payment, the median amount was $310,000 while the average was $4.48 million. Both figures are greater than any full fiscal year since SOX.7 However, it should be noted that the average individual settlement amount is strongly influenced by the $310 million settlement with Brost and Sorenson.

Trends in Public Company Misstatement Cases

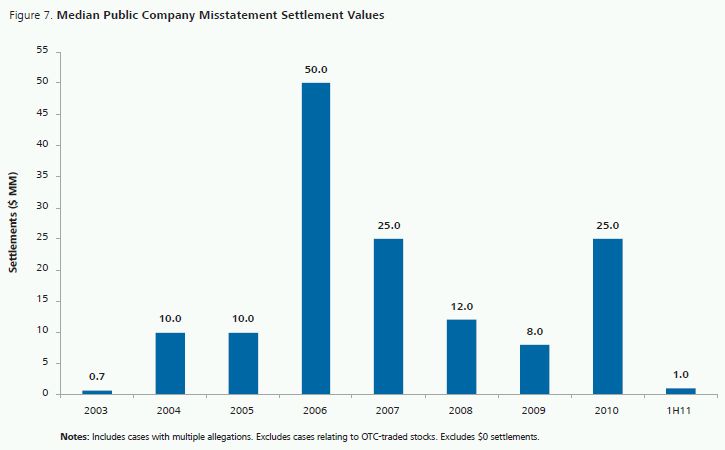

The number of settlements relating to public company misstatements continued its downward trend, dropping to 33 in 1H11 from 108 in FY10. (Exhibit 6) This annualized rate of 66 is only 39% of the high of 170 settlements in 2007. Of those 33 settlements, just four were with company defendants, the largest being in the amount of $1.3 million with Deerfield Capital Corp. The median company settlement of $1 million was lower than any fiscal year since FY03 (Exhibit 7), but this should be interpreted cautiously, as the 1H11 median is based on only four settlements.

The first half of FY11 did, however, bring significant settlements with individuals relating to public company misstatements, accounting for three of the 10 highest-value settlements in the period (Exhibit 2). The median individual settlement involving public company misstatements was $163,000. From FY03 through FY10, this figure ranged from $73,000 to $120,000.8

Trends in Insider Trading Cases

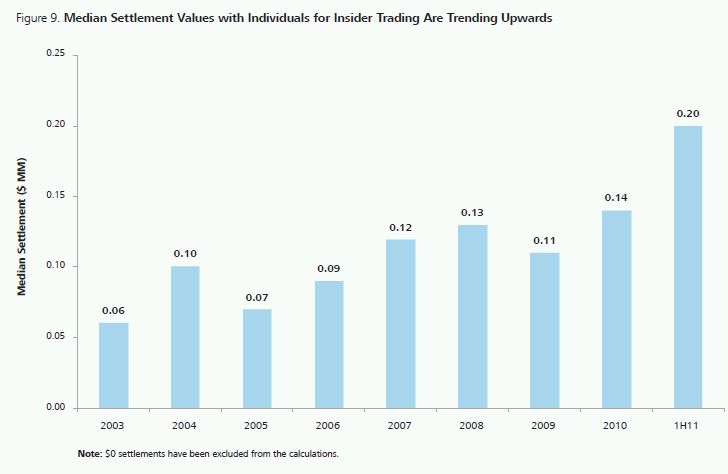

The SEC settled insider trading charges with 25 defendants in 1H11, putting it on pace to reach 50 such settlements for the year. Despite headline-making insider trading cases, this would be the smallest number of insider trading settlements in any year since SOX (Exhibit 8). Insider trading settlement values, on the other hand, continued to trend upwards. Among individuals whose settlements included a monetary payment, the median settlement value was $203,000. Should this figure hold up throughout the year, it would be the largest value since the passage of SOX (Exhibit 9).

Trends in FCPA Settlements

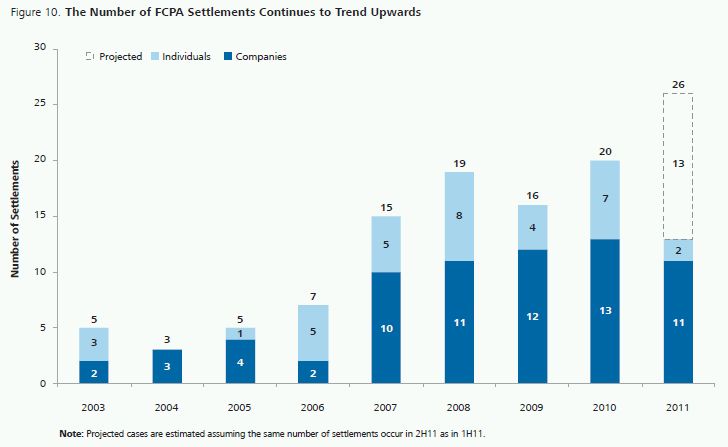

Increased levels of settlement activity in FCPA cases, a theme discussed in detail in our paper on SEC settlements in 2H10,9 continued in 1H11. In addition, settlement values were relatively large in 1H11, with median company settlements up 40% relative to the post-SOX average. The SEC settled FCPA charges with 13 defendants in 1H11, putting it on pace to reach 26 settlements for the full year. This would represent a post-SOX high (Exhibit 10).

Two of the 10 largest settlements in 1H11 concerned FCPA allegations (Exhibit 2). The largest FCPA settlement of the period was with Alcatel-Lucent, S.A., a French telecommunications company listed on Euronext as well as the New York Stock Exchange. Alcatel-Lucent agreed to a $45.4 million payment to settle SEC allegations that it supplied over $8 million in bribes to foreign officials in Costa Rica, Honduras, Taiwan, and Malaysia for the purpose of obtaining or retaining business.10 In a related action, the company paid an additional $92 million criminal fine to the US Department of Justice.11 In addition, Pride International settled FCPA allegations for $23.5 million. Pride International, an offshore drilling company, was accused of paying approximately $2 million in bribes to foreign officials in eight countries across the globe from 2001 through 2006. The $23.5 million payment consists of $19.3 million in disgorgement and $4.2 million in prejudgment interest. The company agreed to pay an additional $32.6 million to settle related criminal charges.12

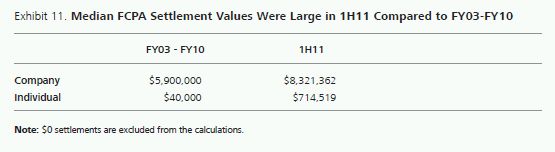

The median company settlement value for FCPA allegations in 1H11 was $8.3 million. By comparison, over the full period of FY03 through FY10, the median was $5.9 million (Exhibit 11). The two settlements with individuals related to FCPA charges in 1H11 had a median value of $715,000, compared to $40,000 for the period FY03 through FY10.

Conclusion

While the overall rate of SEC settlements in 1H11 is little changed, the composition of settlements shifted from individuals to companies, with the pace of company settlements rising 43 percent. Despite sharp drops in settlements involving public company misstatements and insider trading, typically two of the most common allegations in SEC settlements, the SEC is on pace to settle with 688 defendants in FY11, comparable to the 681 settlements reached in FY10.

The upward trend in the number of FCPA settlements continued in 1H11, and FCPA settlement values were high compared to the post-SOX era through FY10. The SEC is on pace to settle with 26 defendants in such cases for the full year, which would represent a post-SOX high.

We will continue to monitor these trends in this series of semiannual reports.

Footnotes

* Mr. Larsen is a Senior Consultant, Dr. Buckberg is a Senior Vice President, and Dr. Overdahl is a Vice President at NERA Economic Consulting; Dr. Overdahl previously served as Chief Economist and Director of the Office of Economic Analysis for the US Securities and Exchange Commission. The authors thank Svetlana Starykh for capable database and research management and Shaena McPadden and Carlos Soto for excellent research assistance.

1 Because the overwhelming majority of SEC matters are resolved via settlement, we refer to all resolutions, including judgments, as "settlements."

2 This analysis excludes the 2005 settlement with Adelphia and the Rigas family. The Adelphia settlement involved complex transfers of assets and is not easily valued.

3 "SEC Obtains Permanent Injunctions Against Sorenson and Brost in Merendon Mining Ponzi Scheme," SEC Litigation Release, November 17, 2010.

4 Although this was actually a court judgment rather than a settlement, we include it and other trial outcomes in our settlement data given that the overwhelming majority of cases are resolved via settlement. "SEC Wins Fraud Trial Against Miami Investment Company U.S. Pension Trust and Its Officers," SEC Litigation Release, October 1, 2010.

5 "SEC Settles Options Backdating Case Against Jacob "Kobi" Alexander, Former CEO of Comverse Technology, Inc.," SEC Litigation Release, November 23, 2010.

6 C. Kaira, "U.S. Fugitive 'Kobi' Alexander Wins Extradition Appeal, Namibian Reports," Bloomberg, April 12, 2010.

7 The highest median individual settlement value for a full fiscal year was $130,000, achieved in both 2008 and 2010. The highest average settlement value for individuals in a full fiscal year was $3,699,000, in 2005.

8 All individual settlement amounts are rounded to the nearest thousands.

9 J. Larsen, E. Buckberg and J. Overdahl, "SEC Settlement Trends: 2H10 Update," NERA Economic Consulting, December 7, 2010.

10 Complaint, Securities and Exchange Commission v. Alcatel-Lucent, S.A., Civil Action No. 1:10-CV-24620-GRAHAM (S.D. FL.), December 27, 2010.

11 "SEC Files Settled Foreign Corrupt Practices Act Charges Against Alcatel-Lucent, S.A. With Total Disgorgement and Criminal Fines of Over $137 Million," SEC Litigation Release, December 27, 2010.

12 "SEC Charges Pride International with Violating the Foreign Corrupt Practices Act," SEC Litigation Release, November 4, 2010.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.