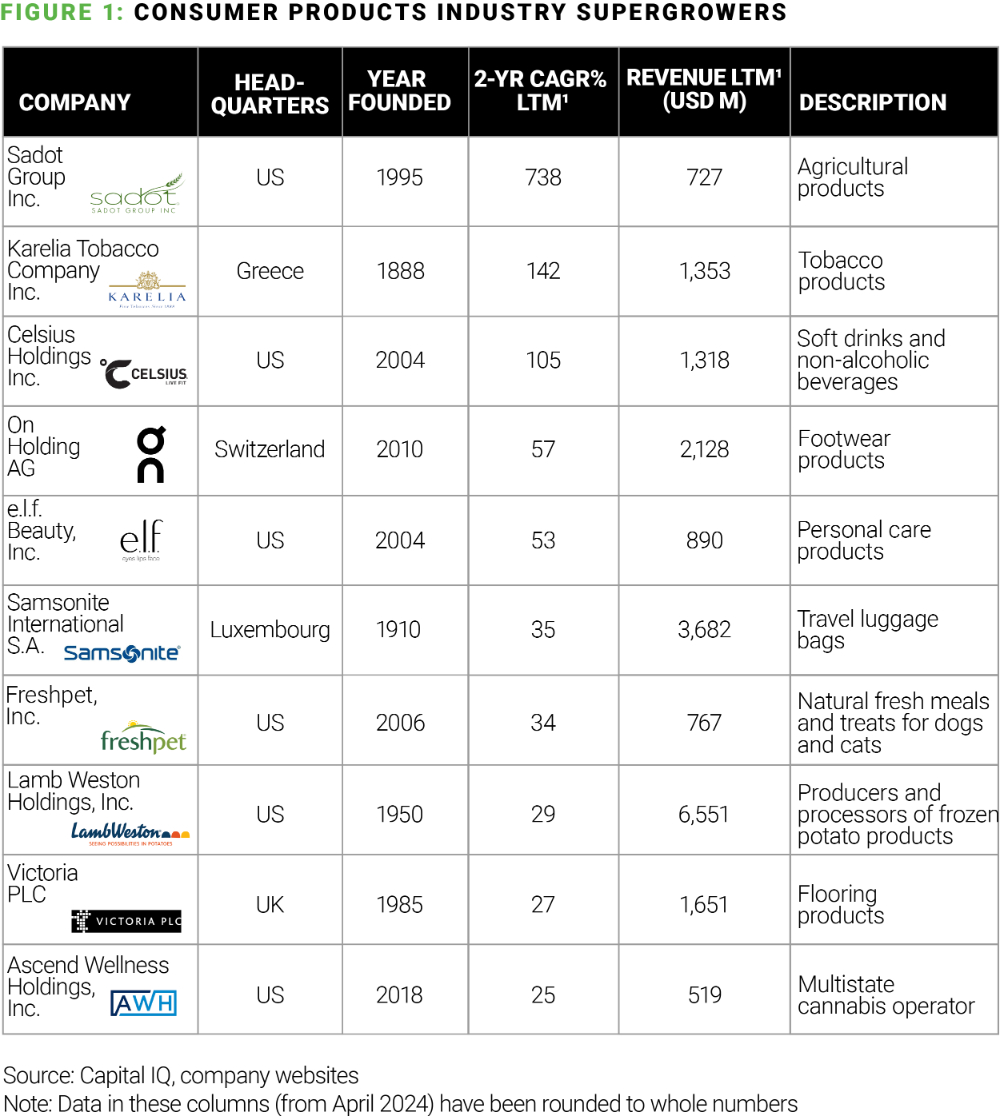

Analyzing growth-leaders in the consumer products sector

While consumer product companies struggle to contend with greater price sensitivity, changing wallet-share decisions, digital disruption, and limits to brand reach, a select group of growth leaders has found ways to set themselves apart. They've met a clear consumer need with enough differentiation to stand apart—take beverage company Celsius Holdings Inc., which has carved out a space in the energy drink market for health-conscious consumers looking for enhanced functionality and the never-kibble petfood company Freshpet, Inc., which has fast become the darling of pet lovers who want "human-grade food" for their furry friends. From ON Holding AG's athletic footwear to Ascend Holding's cannabis products, many of the category leaders have leaned into the wellness boom.

These companies have also maximized points of distribution across channels. Celsius solidified a distribution agreement with PepsiCo, while Lamb Weston Holdings, Inc. has slotted its frozen potato products into new food service offerings at Starbucks, Chipotle, and Domino's.

Top-performers have worked to help their brand stand out in the most relevant channels. Affordable, fair-trade company e.l.f. beauty attracted 2 million TikTok uploads—including unpaid participation from Reese Witherspoon and Ellen DeGeneres — with the #eyelipsface challenge, increasing its penetration of the Gen Alpha and Gen Z demographics.

These companies operate in disparate spaces, but all demonstrate agility and focus on the next target market. Sensitive pricing maneuvers and strategic partnerships have allowed these category leaders to move past competitors, as we can see from in-depth looks at Celsius Holdings, Inc., e.l.f. Beauty, Inc., Freshpet, Inc., and Lamb Weston Holdings, Inc. In this dive into the consumer products industry within our broader fastest-growers project, we discuss how these companies have grown and adapted, spotlighting their recent achievements and the tactics driving their success.

e.l.f. Beauty, Inc.

A pot of e.l.f. liquid metallic eye shadow (cruelty-free, vegan, and fair-trade) retails for just $6. But each sale of an affordable, trendy beauty product has built significant momentum for the company across the U.S. market and even some international markets such as Canada and the U.K. The company doubled its unaided brand awareness between 2020 and 2023, per its Fourth Quarter FY2024 earnings report, in part through clever audience-engagement initiatives and a sharp focus on younger consumers who crave new trends but have a lower price-point.

Marketing efforts have been focused on finding consumers where they play. The company launched the eyeslipsface challenge on TikTok with a custom music track, becoming the fastest TikTok campaign to reach 1 billion views. Marketing efforts have been focused on finding consumers where they play. The company's Beauty Squad loyalty program reported over 4 million members in its last earnings call, and has a top-rated mobile app, as well as a presence in stores where a wide swath of consumers can be reached—Target, Ulta, and Walmart—at a time when hanging out in stores has again become a teen pastime.

Lamb Weston Holdings, Inc.

There are many ways to slice a potato, as Lamb Weston's growth shows. The frozen food giant is one of the world's largest producers and processors of frozen French fries, waffle fries, and other frozen potato products, and has found ways to raise prices without tanking volume. It has been able to do this by taking advantage of the relatively low price elasticity for a few of its products as well as by indexing pricing to customer menu price increases.

The company has stayed focused on the coated fried category, which is growing twice as fast as overall U.S. fry demand according to a 2023 Investor Day presentation and has a higher return on investment over uncoated products. Customer taste for a good product has been satiated by Lamb Weston's expansion into quick-service restaurants like Dominoes, Chipotle, and Starbucks, where the company has reached nontraditional consumers. International expansion has further bolstered its position.

Celsius Holdings, Inc.

In the crowded beverage market, Celsius has metabolized the thirst for health-conscious offerings, billing itself as "your partner in an active lifestyle." In a repositioning of the traditional energy drink messaging, Celsius emphasizes the ingredients in its products, as well as those it doesn't contain—there is no aspartame, no colors or additives, and the drinks are low-sodium. At the same time, it has pushed the flavor profiles in new ways: there is a Cosmic Vibe, a Fantasy Vibe, and consumers list their dream flavors on the brand's channels.

The growth of Celsius in the sports and energy beverage market has been driven in large part by a long-term distribution agreement with PepsiCo—the largest beverage carrier in the U.S.—that was established in 2022. Having opened a crucial channel to consumers, the company has recorded strong financial growth, with significant increases in revenue and earnings.

Freshpet

Humans aren't the only ones consuming a healthy, varied diet. The marketing for Freshpet emphasizes its "minimally processed" products and winning recipes, arrayed like a chef box, and with "no meat powders, meals, or by-products." A concerted effort to cater to a wider palate has paid off for Freshpet, which saw a 30% increase year-over-year in the fourth quarter of 2023, thanks to a 25% increase in volume. The offerings speak to greater differentiation between pets, each with their own unique nutritional needs and preferences.

Despite facing rising costs—a common challenge in the industry—Freshpet has demonstrated effective cost-management strategies. The company has managed to improve its gross profit margin, reflecting its ability to maintain profitability amid financial pressures. It has also invested heavily in its operational infrastructure, expanding its production capabilities and enhancing its distribution network to efficiently meet growing demand.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.