NEW YORK (July 30, 2024) – Parents, preparing to send children back to school amid another year of inflationary pressure, are focusing more on the overall value of footwear than simply finding the best deal, according to the autumn footwear study published by AlixPartners, the global consulting firm. The study was produced in partnership with the Footwear Distributors and Retailers of America.

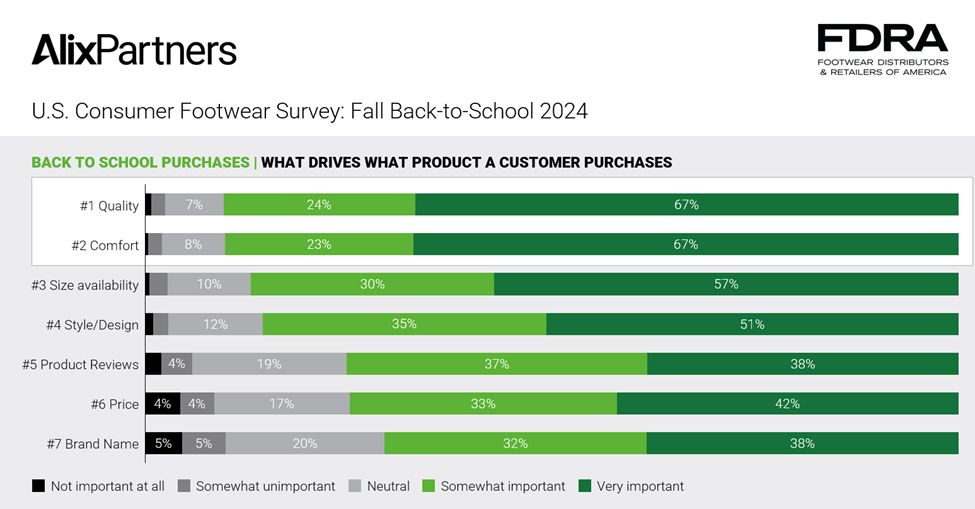

The 2024 Fall Back-to-School U.S. Consumer Footwear Study, utilizing responses from a July survey of more than 1,000 adults, found attributes including quality, comfort, fit, and design all rank above price as factors considered "somewhat important" or "very important" when shopping for back-to-school footwear. The survey also found product reviews and referrals hold more sway than how much a shoe costs. Brand, meanwhile, is the only attribute considered a lower priority than price when making a purchase.

"We're seeing a shift in how parents view footwear products and prices," said Bryan Eshelman, partner & managing director at AlixPartners and Americas Retail practice lead. "While inflation has been an obsession among shoppers around cost—recently raising the importance of discounts to drive traffic—the deal alone isn't what's converting sales of kids' shoes today. Consumers, in fact, are more focused on value for their spend."

Consumers are prepared to dish out more money on footwear as their kids return to class, according to the survey. Buyers—regardless of income threshold—expect to spend 16% more on shoes on a net basis this fall vs. the same period a year ago. Those making more than $100,000 annually expect to spend 38% more than year-ago, while those under that mark plan for a 14% spike. Of those polled, only 25% plan to pay less than a year ago.

Expectations for higher footwear spending reverses a trend seen in spring, when survey respondents told AlixPartners and FDRA they anticipated spending less money on footwear than the year prior for summer footwear. Consumers know higher prices don't necessarily equate to better prices. This lower-bang-for-the-buck equation will lead two-thirds of buyers to comparison shop, and likely translate into lower volumes of footwear sold overall, the study found.

Through midyear, consumer dollars spent on footwear is modestly higher, according to an FDRA analysis. The same is true for prices, however, with a 0.9% rise in the first half of 2024 compared to the same period in 2023.

Browse Online, Buy In-Store

Nearly two-thirds (63%) of survey respondents tend to purchase the bulk of footwear in the store, with 45% saying they buy a "majority" of footwear in-store and 18% saying "nearly all" such purchases are in store. Of the remaining 37%, just 10% say "nearly all" footwear purchases are made online—the balance (27%) say they purchase a "majority" online.

Window shopping, however, is increasingly an online activity, according to the survey. More than one-third (34%) of buyers start their search on Amazon.com, followed by 21% going to brand websites, and 16% utilizing search engines.

"While consumers remain relatively committed to finalizing their purchase in store, the internet increasingly influences spending decisions," Matt Priest, President and CEO of FDRA said. "This means critical steps in the process of finding the most shoe for the buck—from assessing brands to researching models or comparing prices—are taking place online. Retailers and brands cannot afford to rely on a single-channel approach to winning the battle for attention and dollars in a crowded footwear marketplace."

Other key findings of the survey include:

- While logos matter, brands have a varying level of interest based on income level. Of those earning above $100,000, 76% say brand of shoe is a key consideration; that number drops to 58% among those below $100,000.

- Children also have varying levels of influence. Some 61% of middle schoolers exert significant sway over parents' footwear-purchase decisions; that number dips slightly to 59% of high schoolers represented; 48% and 35% of elementary and kindergarten children respectively offer strong input.

- The biggest driver of external influence over purchase decisions is word-of-mouth endorsement, according to 42% of respondents. By contrast, marketing messages, including those disseminated through social media, were identified as the top external influence by 27% of respondents. "In this highly competitive environment, retailers must drive consumer interest with a broad selection in assortment, a personalized and targeted message, or highly competitive prices on visible and widely carried styles," Eshelman said.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.