Overview

The 2023 holiday shopping season has officially ended, and consumers are packing away their holiday décor to peacefully collect dust until they are summoned again in November.

Let us unpack the Holiday sales and traffic results and see how accurate (or not) Ankura's "2023 Holiday Consumer Sentiment Survey" and "Black Friday Shopping Pulse" observations were.

The Inflation-Weary Consumer

The 2023 holiday season arrived with echoes of inflation and murmurs of uncertainty about the U.S. macroeconomic outlook. The front-half of 2023 unfolded as a careful tango between consumers grappling with cost-consciousness and retailers adeptly maneuvering through a promotion-fueled marketplace. We expected this dynamic to continue through the holiday season with consumers ready to attack their shopping lists at malls or online, but with a keen eye for value and discounts.

We predicted a heavy emphasis on deal hunting and promotions to support holiday sales and thus recommended that retailers be loud and proud about their price-value offerings as the shopper will be responsive.

Deal-hunting and promotions became the siren call for consumers this holiday season. As we accurately predicted, inflation was the omnipresent guest at the shopping table, prompting an unprecedented focus on value by stretching every dollar to its fullest.

Our consumer survey indicated that shoppers' economic sentiments were cautious going into the holiday season, with 55% of respondents stating that they were either somewhat or very concerned about their and/or their family's economic situation, and 47% stating that they see the U.S. economy getting worse over the next 12- months. We predicted that shoppers would be in abundance online, and a relatively strong number would also be walking stores, but with tighter grips on their purse strings and eyes open for discounts.

A "Nothing Spectacular" Holiday Spend

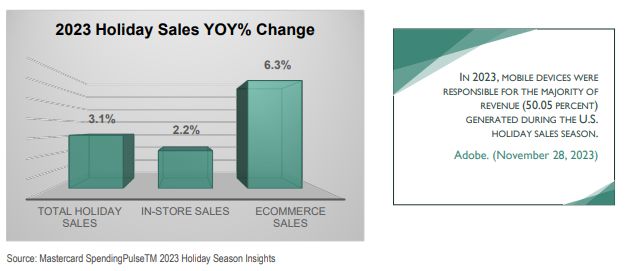

As preliminary reporting begins to trickle in, it appears that retailers achieved lowsingle-digit gains this past holiday season with sales increasing 3.1% YOY (over Nov 1-Dec 24, excluding autos and unadjusted for inflation).

Helped by Historic Credit Card Debt

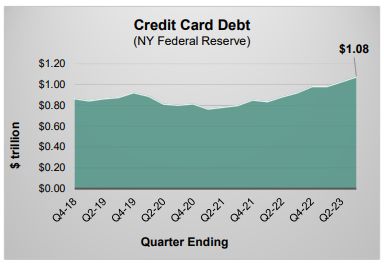

It wasn't just a keen eye for discounts, however, that helped consumers with their holiday shopping this year. The Federal Reserve Bank of New York reported that U.S. credit card debt reached $1.08 trillion in Q3 of 2023, representing a $154 billion year-over-year increase (the largest increase since 1999).

This historic jump in credit card usage going into the holiday season suggested that customers would be resolute in finding ways to tip toe through broader economic headwinds and get their shopping done, even if through credit extensions and shortterm financing.

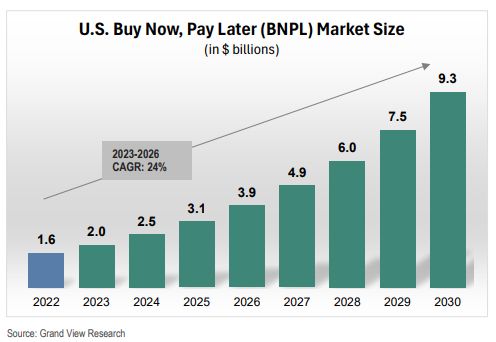

While from a low base, "Buy Now, Pay Later" (BNPL) purchases experienced significant growth, essentially extending customers' debt limits.

The Physical Store Still Matters

Direct-to-Consumer sales represented >15% of total retail sales in 2023, but that still leaves most sales supported through brick-and-mortar. Ankura's "2024 Holiday Consumer Sentiment Survey" highlighted that while an "online-only" customer exists, stores remain relevant.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.