Part IV of A NERA Insights Series

Previous topics in our options backdating series include:

Despite the widespread attention given to "options backdating" by investors, regulators, the legal profession, and the news media, the issue has not generated the spate of shareholder class action litigation that some observers anticipated. Of nearly 250 companies identified as potentially involved in backdating,1 only 38 have actually been the target of a related federal shareholder class action lawsuit.2

It now appears that backdating class actions may be falling short of expectations in another respect: in the cases that have settled to date, the amounts paid to plaintiffs have been substantially lower than in comparable non-backdating class actions. On average, class actions involving backdating allegations have settled for less than half the amounts forecast by NERA's settlement prediction model.

As only eight cases have fully settled thus far, the reasons for the low settlements are not yet clear.3 It may be that, generally, suits alleging backdating are viewed as weaker on the merits than other class actions. If true, this would indicate that still-pending backdating-related class actions may also be expected to yield relatively small settlements. Alternatively, it could be that the weakest cases have settled first. This would suggest that, in the future, settlements of backdating-related class actions will be more in line with those in other shareholder class actions.

Options backdating settlements to date

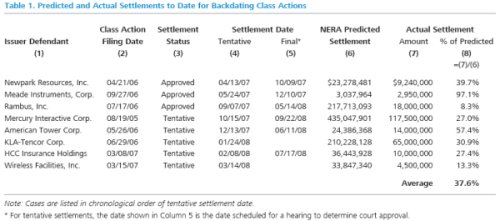

Eight federal shareholder class actions with options backdating allegations have fully settled, meaning settlements have been reached with all remaining defendants.4 For each of these cases, we can compare the size of the total settlement reached to the amount forecast by NERA's shareholder class action settlement prediction model. As described in more detail below, this model predicts the most likely settlement for a case, based on the level of "investor losses" and other lawsuit characteristics.

Table 1 shows that actual settlements to date in backdating class actions have averaged less than 38% of the amounts predicted by the model. While one case, Meade Instruments, Inc., settled for approximately 97% of the amount predicted, the other seven cases each settled for less than 60% of the predicted amount, and in one case (Rambus, Inc.), the actual settlement was only about 8% of the predicted amount.5

NERA's Predicted Settlement Model

The model used to predict the settlements in Table 1 was estimated using data on over 700 fully settled class actions filed in federal court since 1 January 1996, excluding backdating cases.6 It explains over 60% of the variation in settlement amounts across these cases.7 The single most powerful determinant of settlement value is "investor losses": a simple estimate of the total losses by purchasers of the company's shares during the class period relative to an investment in the S&P 500 index. Settlements also rise with the inclusion in the settlement of each class of security other than common stock (e.g., bonds or options).

The mere existence of accounting-related allegations, as in a backdating case, tends to increase settlement size, as does an inquiry or investigation relevant to the allegations by any official body (such as the SEC, the NASD, or a state Attorney General) and an admission by the defendant company of accounting "irregularities" related to the allegations.8

All eight of the companies in Table 1 were the subject of at least one official inquiry or investigation, and four—Rambus, Inc., Mercury Interactive Corp., KLA-Tencor Corp., and Wireless Facilities, Inc.—admitted to accounting irregularities in connection with options backdating.

Testing a backdating variable

We conducted a formal test to determine whether a backdating variable, added to NERA's existing predicted settlement model, was statistically significant. We added the eight settlements listed in Table 1 to our model estimation sample and introduced an "indicator" variable that takes a value of one if a settled case involved backdating allegations, and zero otherwise. The backdating indicator variable is estimated to be negative and statistically significant at the 1% level. The estimate implies that, controlling for all the other variables, the settlement in a backdating case is about 46% of the settlement in a non-backdating case with a similar level of investor losses and other characteristics captured by the model. This finding is broadly consistent with the results presented in Table 1.9

Implications

Why do shareholder class actions that allege options backdating appear to settle for less than comparable non-backdating cases? One possibility is that shareholder suits with backdating allegations are perceived as weaker on the merits than other class actions. This would suggest that ongoing class actions alleging backdating should also be expected to settle for relatively low amounts. Alternatively, it may be that the weakest cases have been the first to settle. If this is true, then, in the future, settlements in backdating-related class actions may be more in line with settlements in other types of shareholder class actions. NERA will continue to track these settlements, and as the cases make their way through the courts it should become more clear which hypothesis is correct.

Footnotes

* Mr. Patton and Dr. Jovanovic are Senior Consultants at NERA. Ms. Starykh is a Consultant at NERA. The authors would like to thank Jori Visokomogilska, Stefan Boettrich, and Sheena Siu for research assistance, and DavidTabak, Marcia Mayer, Stephanie Lee, Pat Conroy, Raymund Wong, Erik Stettler, Kevin LaCroix, and Adam Savettfor valuable comments and suggestions.

1. Source: database maintained by NERA. NERA's database includes companies identified by the Wall Street Journal's Options Scorecard, Reuters Factbox, and news searches. Companies in NERA's database were identified for one or more of the following reasons: (1) the company and/or one or more of its executives were the target of a shareholder class action and/or derivative lawsuit alleging backdating; (2) the company and/or one or more of its executives were the target of a US Securities and Exchange Commission (SEC) and/or US Department of Justice (DOJ) investigation alleging backdating; or (3) the company announced a restatement, charge, internal investigation, and/or executive departure relating to backdating.

2. In addition, there has been one shareholder class action in state court. Backdating-related derivative suits—litigation brought by a shareholder or shareholders on behalf of a company, usually against its officers and directors—have been considerably more common than class actions.

3. In an earlier version of the paper, our sample consisted of six full settlements, and we stated that 37 companies had been the target of federal shareholder class actions with options backdating allegations. We have updated the paper to reflect our determination that all defendants in the Mercury Interactive class action have settled, to include the settlement of the Wireless Facilities, Inc. class action, and to reflect a revised count of backdating class actions filed to date.

4. At the time this article went to press, three of the eight full settlements had been approved by a court and five were tentative. In one additional case, Vitesse Semiconductor Corp., some, but not all, defendants had settled.

5. In one of the cases shown in Table 1, Newpark Resources, Inc., the settlement encompassed allegations in addition to options backdating. However, excluding this case does not substantially change the average presented in Table 1: for the other seven cases, settlements were on average 37.3% of the predicted amount.

6. For more detail on the predicted settlement model, see Todd Foster, et al, "Recent Trends in Shareholder Class Action Litigation: Filings Stay Low and Average Settlements Stay High—But Are These Trends Reversing?" NERA study, September 2007.

7. Technically, the model explains over 60% of the variation in the logarithm of settlement.

8. In addition, settlements are found to increase with the potential depth of defendants' pockets: the higher the defendant company's post-class period market capitalization, for example, the higher the settlement tends to be. Also, settlements tend to be higher if an accounting firm is a co-defendant. Settlements are generally lower, however, if the issuing defendant has declared bankruptcy or has a stock price of less than $1.00 per share at the time of the settlement. Finally, cases tend to settle for more if the lead plaintiff is an institutional rather than a retail investor, as well as if an IPO is involved.

9 .As noted above, the Newpark Resources, Inc., settlement encompassed allegations in addition to backdating . Excluding Newpark Resources, however, the dummy variable is of similar magnitude and is statistically significant at the 1% level. The coefficient indicates that the settlement in a backdating class action is about 45% of the settlement in a comparable non-backdating class action.

* * * * * *

About NERA

NERA Economic Consulting is an international firm of economists who understand how markets work. We provide economic analysis and advice to corporations, governments, law firms, regulatory agencies, trade associations, and international agencies. Our global team of more than 600 professionals operates in over 20 offices across North America, Europe, and Asia Pacific.

NERA provides practical economic advice related to highly complex business and legal issues arising from competition, regulation, public policy, strategy, finance, and litigation. Our more than 45 years of experience creating strategies, studies, reports, expert testimony, and policy recommendations reflects our specialization in industrial and financial economics. Because of our commitment to deliver unbiased findings, we are widely recognized for our independence. Our clients come to us expecting integrity and the unvarnished truth.

NERA Economic Consulting (www.nera.com), founded in 1961 as National Economic Research Associates, is a unit of the Oliver Wyman Group, an MMC company.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.