Settlement Values Rise as SEC Begins Implementing Dodd-Frank1

NERA has developed a proprietary database of settlements and judgments in SEC enforcement actions since Sarbanes-Oxley ("SOX") by reviewing every litigation release and administrative proceeding document published since July 21, 2002. This paper provides an update on trends in the number of settlements and settlement values in fiscal year 2011 ("FY11").

FY11 Highlights

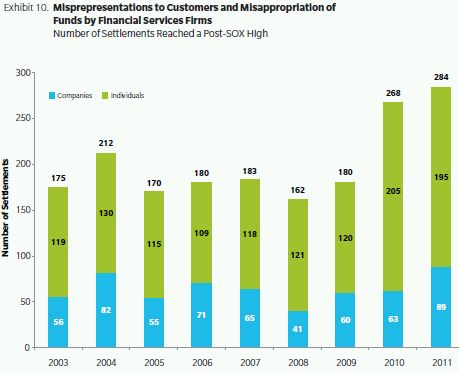

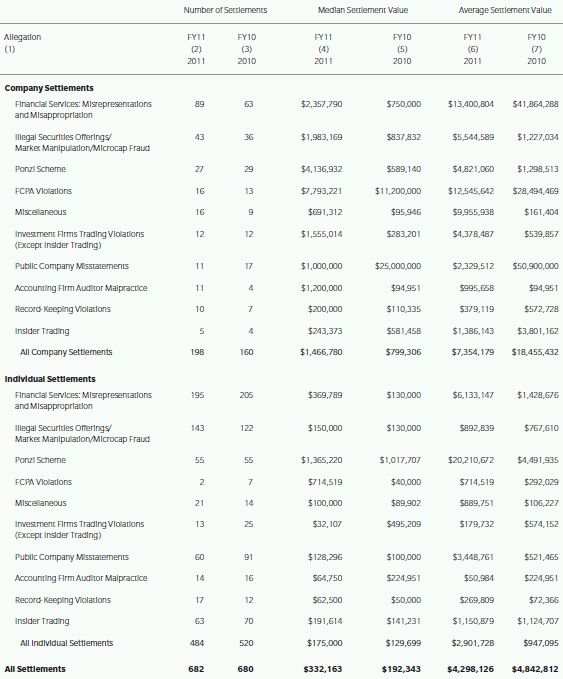

- The total number of settlements in FY11 (682) remained almost unchanged from FY10 (680). However, there has been an increase since FY09 in settlements with financial services firms for misrepresentations to customers or misappropriation of funds, and an offsetting decrease in settlements relating to public company misstatements.

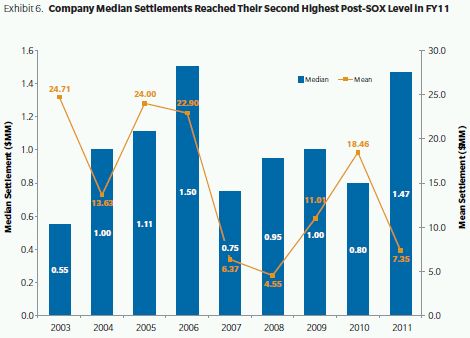

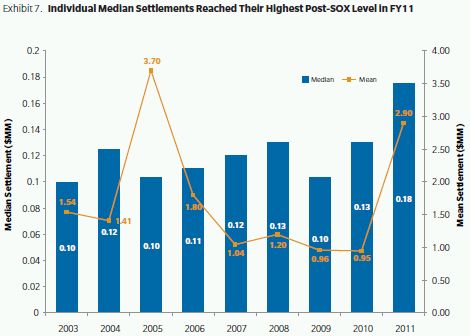

- Median settlement values increased for companies and individuals, as well as for virtually all categories of allegations. The median settlement value with companies nearly doubled from $800,000 in FY10 to $1.47 million in FY11, near its post-SOX high of $1.5 million in FY06. For individuals, the FY11 median value was $175,000, a 35% increase from the previous post-SOX high of $130,000 in FY08.

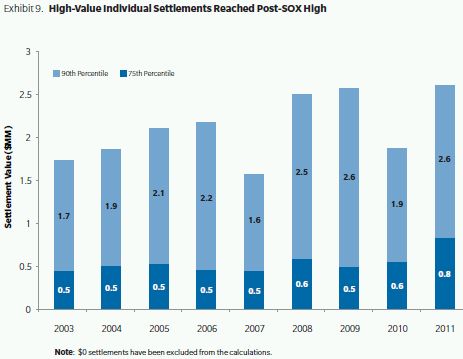

- High-value settlements with individuals reached post-SOX highs, when measured at the 75th and 90th percentiles. This result is consistent with recent statements by SEC officials emphasizing individual accountability for actions taken by individuals responsible for corporate decisions.

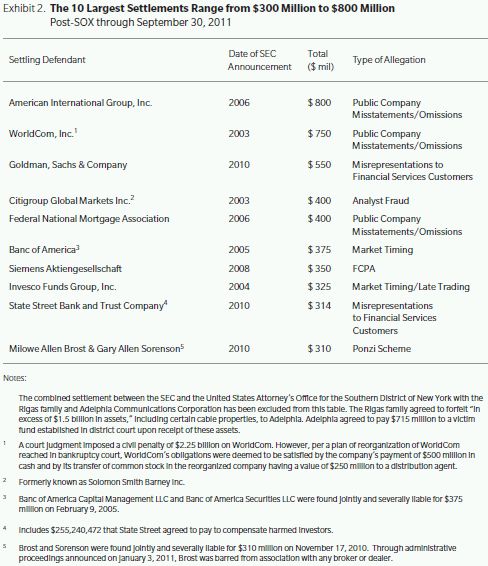

- The largest settlement in FY11 ($310 million) was a default judgment with alleged Ponzi scheme operators Milowe Allen Brost and Gary Allen Sorenson. This was the largest ever settlement or judgment with individuals, and the tenth-largest settlement or judgment with a company or individual since SOX.

- High-value settlements with companies, measured at the 75th and 90th percentiles, declined from FY10 to FY11, but remained at approximately the levels observed in the four-year period from FY06 through FY09.

- Dodd-Frank has significantly expanded the authority of the SEC Enforcement Division, as well as the range of market participants subject to SEC enforcement. However, the effects of these changes are not yet fully known, because the SEC has been prevented from using these expanded powers for conduct pre-dating Dodd-Frank, and in some cases the rulemaking process is still underway.

- Judge Jed S. Rakoff's recent decision nullifying the SEC's settlement with Citigroup Global Markets called into question the common SEC practice of agreeing to settle without requiring any admission of facts or wrongdoing. The SEC is appealing this decision, and Congress has called for hearings on the issue. Should the practice not be allowed to continue, corporate defendants would almost certainly be less willing to settle, resulting in fewer settlements and more cases resolved at trial.

Top Settlements and Judgments

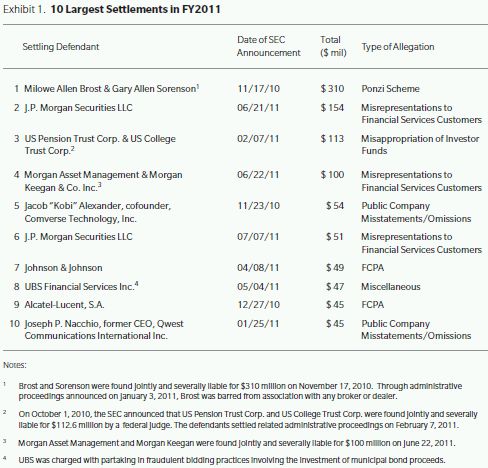

The 10 largest settlements and judgments of FY11 ranged from $310 million to $45 million, as detailed in Exhibit 1. They include two settlements with and one judgment against individuals, which carried the largest monetary payment of the year. Top company settlements include five settlements with SEC-regulated financial firms, and two with public companies that are subject to SEC enforcement as issuers of public securities. While our database includes both settlements and judgments in cases brought by the SEC, the vast majority of cases are settled, and we use the term "settlements" throughout this paper to describe the full set of cases resolved.

The highest-value settlement of FY11 was the $310 million default judgment2 entered against Milowe Allen Brost and Gary Allen Sorenson. The SEC alleged that Brost and Sorenson operated their firm, Institute for Financial Learning Group of Companies, Inc., as a Ponzi scheme. According to the SEC, more than 3,000 investors in North America invested funds with the firm, lured by promises of 18% to 36% annual returns through investments in the gold mining industry. A trial is set to begin on June 4, 2012 to resolve remaining issues in the case.3 This was the tenth-largest settlement since the passage of SOX. No other settlements from FY11 reached the post-SOX top 10.

The second-largest settlement of FY11 was with J.P. Morgan Securities LLC. J.P. Morgan was charged with creating and marketing a CDO, called Squared CDO 2007-1, without informing investors that hedge fund Magnetar Capital LLC helped select the assets in the CDO portfolio while having a short position in over half of the underlying assets. Under the settlement, harmed investors will recover all of their losses.4

The third-largest settlement of FY11 resulted from a verdict at trial against US Pension Trust Corp. and US College Trust Corp. The defendants were ordered by federal Judge Jose Martinez to pay a total of $112.6 million, consisting of $62.6 million in disgorgement and a $50 million civil penalty. The firms were found guilty of misleading investors by charging undisclosed commissions and fees, which, according to the SEC, amounted to as much as 85% of the investors' initial contributions.5

The SEC reached its fourth-largest settlement of FY11 jointly with Morgan Asset Management and Morgan Keegan & Co. for $100 million. Morgan Keegan, a broker-dealer, was the principal underwriter for several Helios Funds and was in charge of pricing the Funds' shares. It was alleged that Morgan Keegan failed to employ proper valuation procedures and overvalued the shares.6

Trends in the Number of Settlements

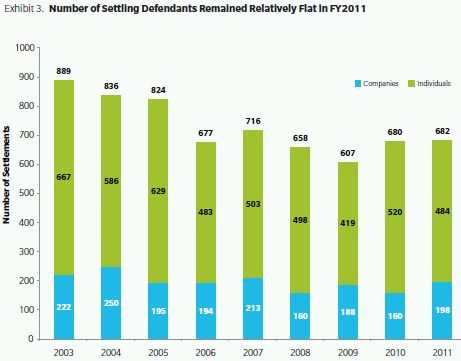

The number of settlements reached by the SEC has remained relatively constant over the past five years. As Exhibit 3 shows, the SEC settled with 682 defendants in FY11, almost identical to the 680 settlements reached in FY10. Relative to FY10, the SEC reached 24% more settlements with companies in FY11 and 7% fewer settlements with individuals. However, company and individual settlements have fluctuated by similar amounts in recent years, and the small shift toward companies in FY11 does not appear indicative of a multi-year trend.

The composition of settlements, in terms of allegations, has shifted since the financial crisis began in 2008, as shown in Exhibit 4. The three-year rise in the percentage of SEC settlements involving misrepresentations made to customers or misappropriation by financial services firms represents a shift in the SEC's enforcement activity, which coincided with the revelation of the Bernard Madoff fraud. These settlements, including settlements in Ponzi scheme cases, reached 41.6% of all SEC settlements in FY11, as compared to the FY03-08 average of 23.7%. Illegal offering and market manipulation settlements were the second most common in FY11, representing 27.3% of settlements, the highest level since 2005. Public company misstatement settlements continued to decline for the fourth consecutive year, falling to 10.4% of settlements, the lowest level since SOX and less than half of 2007 high of 23.7%.

Trends in Settlement Values

Compared with FY10, settlement values generally rose in FY11. The median settlement value with both companies and individuals and the average settlement value with individuals were all at or near post-SOX highs in FY11. The average settlement value with companies declined from FY10, as there were fewer settlements at the top of the value range in FY11.

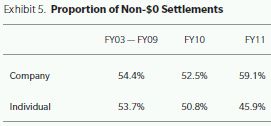

Just over half of SEC settlements since SOX have involved a monetary payment. In FY11, 59% of company settlements involved a monetary payment, a slight increase from historical levels. The proportion of individual settlements involving monetary payments decreased from historical levels to 46%, as shown in Exhibit 5. All of the statistics in this paper about settlement value relate to those settlements that do carry a monetary payment; settlements with no monetary payment are included in the number of settlements, but are excluded from settlement value statistics.

Settlement values increased in FY11, for all but the largest settlements against company defendants. This increase is observable across all types of settlements, and applies to both companies and individuals.

Exhibit 6 reports average and median settlement values with companies by year. The average settlement value for companies decreased from $18.5 million in FY10 to $7.4 million in FY11, although more than half of this decrease is due to the $550 million settlement with Goldman Sachs, which is the third-largest settlement since SOX. Excluding the Goldman settlement, the average company settlement in FY10 was $12.3 million

Exhibit 7 reports average and median settlement values with individuals by year. Median settlements with individuals reached post-SOX highs in FY11 of $175,000. The median company settlement nearly doubled to $1.5 million, just below the post-SOX high observed in FY06. These increases are remarkably consistent across types of allegations: the median settlement value increased in FY11 versus FY10 in 11 out of 12 categories of cases.7

High-value settlements with companies provide an exception to the overall trend of increasing settlement values. As shown in Exhibit 8, after more than doubling in FY10 to $39.3 million, the 90th percentile company settlement value fell to $16.4 million in FY11, a level more consistent with the period from FY06 – FY09. The 75th percentile settlement value rebounded slightly to $5.6 million in FY11, up from $3.5 million in FY10, but remained lower than the previous five years.

In contrast, high-value settlements with individuals reached post-SOX highs in FY11. High-value settlements with individuals are consistent with statements by SEC commissioners and senior staff about promoting individual accountability for actions undertaken within corporations.8 In a statement made to the SEC Historical Society, SEC Enforcement Director Robert Khuzami said "...at the end of the day, regardless of the consequences, pursuing individuals is the most important thing and if it means we are going to chew up more resources by having more trials, so be it."9 The emphasis on individual accountability is resulting in larger penalties in cases with individual defendants, not more settlements, as the SEC reached 7% fewer settlements with individuals in FY11, as compared to FY10. However, as Exhibit 9 shows, the 90th percentile individual settlement value was $2.6 million in FY11, up from a previous post-SOX high of $2.5 million in FY08. The 75th percentile individual settlement increased to $844,000 in FY11, a 41% increase from the previous high of $598,000 in FY08.

Misrepresentations to Customers and Misappropriation of Funds by Financial Services Firms

Already the single largest category of settlement since 2006, the number of settlements involving misrepresentations to customers or misappropriation of funds by the financial services firms has increased by 75% since the disclosure of the Madoff fraud, from a post-SOX low of 162 in FY08 to a high of 284 in FY11, as shown in Exhibit 10. While individual settlements in this category declined slightly in FY11, this was more than offset by an increase in company settlements.

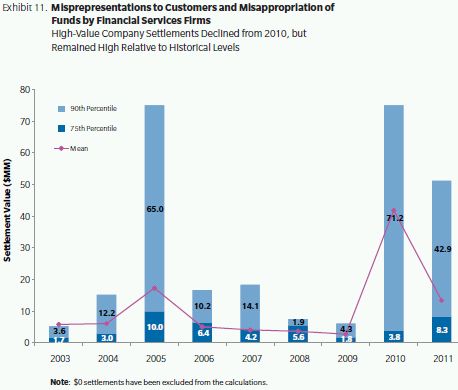

Settlement values in financial services cases involving misrepresentations to customers or misappropriation of funds have increased along with the number of settlements. Median settlement values with companies and individuals both almost tripled from FY10 to FY11: the median company settlement increased from $750,000 in FY10 to $2.4 million in FY11, while the median individual settlement increased from $130,000 to $370,000. As Exhibit 11 shows, high-value settlements with companies remained comparable to FY10 values, which were dramatically higher than all previous years, with the exception of FY05. For individuals, the 75th and 90th percentile settlements were $1.4 million and $3.5 million respectively. While these values increased from FY10, they remain below their levels from FY05 through FY09.

Illegal Securities Offerings, Market Manipulation, and Microcap Fraud

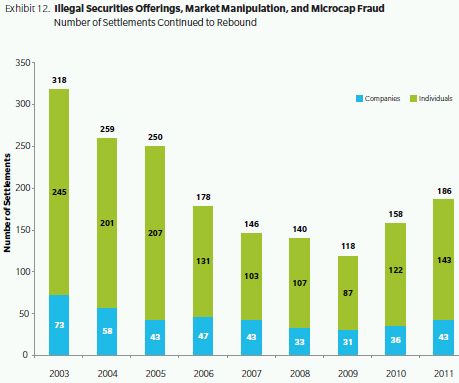

Immediately following SOX, cases involving illegal securities offerings, market manipulation, and microcap fraud were the most frequent types of case settled with the SEC. After declining in number every year, from a FY03 high of 318 to a FY09 low of 118, settlements in this category rose for the second consecutive year to 186 (see Exhibit 12), up 58% from the FY09 low.

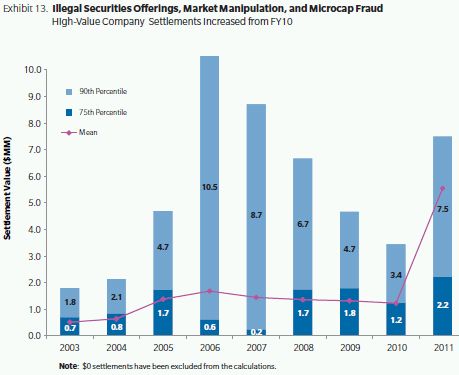

Consistent with the overall trend, median settlement values for these types of cases increased both for companies, from $838,000 in FY10 to $2.0 million in FY11, and for individuals, from $130,000 in FY10 to $150,000 in FY11. In addition, high-value settlements with companies increased from FY10 to FY11. As Exhibit 13 shows, the average, 75th percentile, and 90th percentile settlement values all increased, with the mean and 75th percentile values reaching post-SOX highs of $5.5 million and $2.2 million, respectively.

Public Company Misstatements

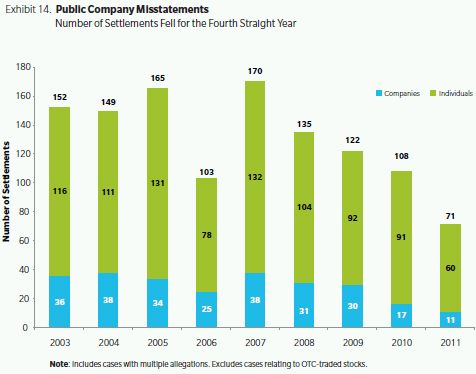

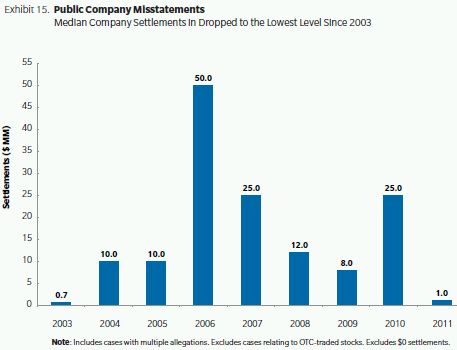

The annual number of public company misstatement settlements has declined for the last four years in a row. From a FY07 peak of 170 settlements, activity declined to a post-SOX low of 71 settlements in FY11, as shown in Exhibit 14. SEC Enforcement Division Director Robert Khuzami, in comments made to the SEC Historical Society, noted the downward trend and also noted that there were fewer restatements. He observed that there was speculation as to the causes including that "people are considering things better, or the economic shakeout has resulted in people being more candid, or maybe everybody's communal efforts from SOX on down, and more conscientiousness and more attention in board rooms and amongst auditors result in fewer [re]statements."10

Public company settlements relating to misstatements fell in value to pre-SOX levels for the first time in FY11. Prior to SOX, the largest penalty imposed in an SEC enforcement action against a public company was a $10 million penalty against Xerox in April 2002.11 Since SOX, there were 44 public company misstatement settlements of at least $10 million from FY03 through FY10, including 10 settlements of at least $100 million. But of the 11 settlements with companies in FY10, only six required a monetary payment, the largest of which was $10 million with Satyam Computer Services Ltd. Because four of these six settlements were for $1 million or less, the median settlement value dropped to $1.0 million in FY11, the lowest level since 2003, after tripling in value to $25.0 million the previous year.

Insider Trading

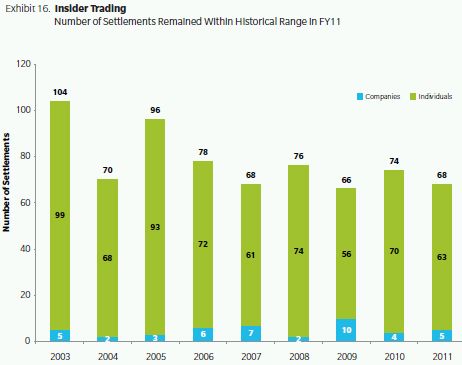

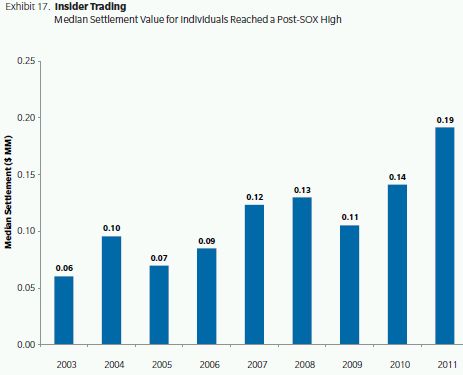

Although insider trading investigations and prosecutions continued to make headlines in the second half of FY11, the total of 68 insider trading settlements reached by the SEC in FY11 is not dissimilar to the annual number of cases settled in recent years, reported in Exhibit 16. As Exhibit 17 shows, the median settlement value with companies declined from $581,000 in FY10 to $243,000 in FY11, while the median individual settlement value rose to $192,000, a 36% increase over the previous post-SOX high of $141,000 in FY10.

SEC enforcement of insider trading rules is likely to maintain its high profile in the coming year, due to the record $92.8 million settlement with Galleon hedge fund manager Raj Rajaratnam announced on November 8, 2011.12 This is the largest insider trading settlement ever reached by the SEC.

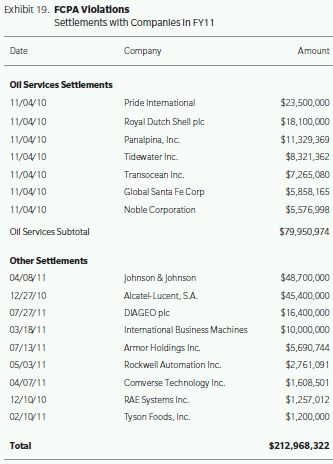

FCPA Violations

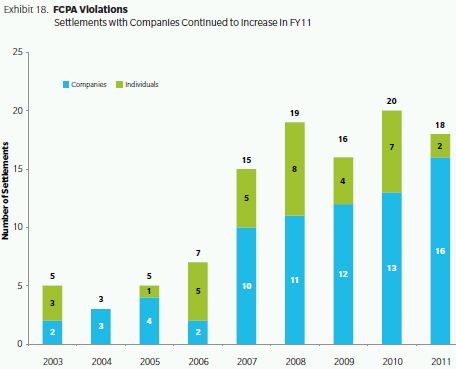

FCPA settlement activity remained high in FY11, accounting for two of the top 10 settlements of the year, a $49 million settlement with Johnson & Johnson and a $45 million settlement with Alcatel-Lucent, S.A. As shown in Exhibit 18, the SEC reached a new high number of FCPA settlements with companies in FY11, with a total of 16, up from the previous high of 13 in FY10.

The 16 FCPA settlements with companies includes seven settlements, all announced on November 4, 2010, with companies in the oil services industry, related to bribes paid to officials in Nigeria and other countries for preferential treatment and benefits from customs agents.13

Settlement activity related to FCPA violations slowed down in the second half of FY11: after settling with 11 companies in the first half of the fiscal year, the SEC reached only five more company settlements relating to the FCPA in the second half. These include the $49 million settlement with Johnson & Johnson relating to bribery of doctors in Greece, Poland, and Romania as well as kickbacks paid in Iraq in order to obtain contracts under the United Nations Oil for Food Program and a $16.4 million settlement with Diageo concerning multiple violations in India, Thailand, and South Korea.

Median and average FCPA settlements vary from year to year, in part due to the small number of cases settled. However, one consistent result in the post-SOX era is that FCPA cases settle for larger amounts than SEC settlements overall. In FY11, the median company settlement relating to FCPA violations was $7.8 million, compared to an overall company settlement median of $1.5 million. Furthermore, all 16 company settlements related to FCPA violations in FY11 involved monetary payments of at least $1 million. These settlements are summarized in Exhibit 19.

SEC Litigation after Dodd-Frank

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 ("Dodd-Frank") immediately changed the scope of the Commission's enforcement activities, by expanding the authority of the SEC's Enforcement Division, and by expanding the range of market participants subject to SEC registration, oversight, and enforcement. Sources of expanded authority include whistleblower protection and incentives, a mandate for the enforcement of aiding and abetting liability, expanded scope of administrative penalties, and the introduction of collateral bars to sanction individuals.14 In recent litigation, the SEC has been prevented from exercising these new powers in cases involving conduct that pre-dated Dodd-Frank. As a result, the effects of these changes are only just beginning to be realized.

The full scope of the impact of Dodd-Frank on the SEC's authority will not be fully known until the Commission completes its rulemaking process implementing the law. As of December 13, 2011, the SEC had proposed or finalized approximately three-quarters of the 90 implementing regulations that the law required, including definitions and exemptions concerning registration requirements. New categories of market participants (subject to registration and oversight inspection and examination) include advisors to hedge funds and other private funds, as well as advisors to issuers of municipal securities. In addition, Dodd-Frank creates new registration categories for security-based swap dealers, major security-based swap participants, and security-based swap execution facilities. As with other SEC-regulated entities, these inspections and examinations will produce referrals to the Division of Enforcement, which should lead to more enforcement proceedings and more settlements. Dodd-Frank also clarifies the SEC's authority to bring cases involving control person liability—a clarification that may increase the likelihood that senior managers and members of boards of directors can be found liable for securities violations committed by employees under their control. Of course, this is contingent on the capacity of the SEC's staff expanding with the number of entities it regulates; if its resources are little changed, Dodd-Frank would cause the SEC to diversify its efforts across a wider range of firms subject to its regulation without increasing the number of cases it pursues.

Whistleblower Incentives

Dodd-Frank authorized the SEC to set incentives in the form of financial awards related to the size of any financial sanction to eligible whistleblowers who voluntarily provide the Commission with original information about a violation of federal securities laws and that leads to successful enforcement proceedings. In November 2011 the SEC reported that it had received 334 whistleblower tips in the seven weeks between the date the rules became effective (August 12, 2011) and September 30, 2011, the end of the SEC's fiscal year. Of the 334 whistleblower tips, 54 involved allegations of manipulation, 52 involved offering fraud, 51 involved corporate disclosure and financials, and 25 involved insider trading, with the remaining tips involving a wide variety of other allegations, including FCPA violations.15 In an interview with International Financial Law Review on November 9, 2011, SEC Commissioner Elisse Walter said that the percentage of whistleblower filings resulting in investigations was higher than the SEC had expected when the Commission adopted its whistleblower rules.16 In an appearance with the SEC Historical Society in September 2011, SEC Enforcement Division Director Robert Khuzami noted the importance of whistleblower filings, particularly with respect to FCPA cases.17 In recent years these cases have involved large financial sanctions, and so the potential award to a whistleblower in these cases could be extremely large.

Expanded Administrative Powers

Dodd-Frank also broadened the SEC's authority to impose civil monetary penalties in administrative proceedings. Prior to Dodd-Frank, the SEC could only impose a financial penalty in an administrative proceeding against a regulated entity (e.g., a broker-dealer or investment advisor) itself or a member of management, board, or staff. For other alleged violators, available administrative remedies were limited to cease and desist orders and disgorgement of illegal profits. The SEC needed to file an action in federal district court to seek financial penalties. Following Dodd-Frank, the SEC can now use administrative proceedings or court proceedings against any party to impose a financial penalty.

There are tactical advantages to the SEC of bringing actions through administrative proceedings including limited discovery, absence of a right to a jury trial, and appeals considered by the Commission, which will likely mean the SEC will start to use administrative proceedings in actions against non-registered persons. The SEC reported that administrative proceedings increased during the second half of FY 2011 to 173 matters compared to 131 matters in the second half of 2010.18 However, it is not clear that this increase is a result of the SEC's new powers since the numbers do not reveal the registration status of the respondent, or whether financial penalties are being sought.19

Enforcement of Aiding and Abetting Liability

The expansion of the SEC's enforcement authority with respect to aiding and abetting liability will likely increase litigation activity in this area. Prior to Dodd-Frank, the SEC had aiding and abetting authority with respect to the Securities Exchange Act of 1934 and the Investment Advisers Act of 1940. Dodd-Frank expanded SEC aiding and abetting authority to include actions under Securities Act of 1933 and civil penalties under the Investment Advisors Act of 1940. Dodd Frank reduces the standard of proof for showing aiding and abetting to a "recklessness" standard. The prior standard required proof of assistance being "knowingly" provided to another person's violation. The SEC's expanded aiding and abetting enforcement authority will likely result in enforcement action against new classes of participants in securities transactions.20

Dodd-Frank also expands the SEC's enforcement authority by increasing the Commission's ability to access audit work papers and other documents of foreign auditors who perform services relied upon by a registered public accounting firm in conducting an audit.21 In addition, Dodd-Frank provides the SEC with extraterritorial jurisdiction for certain cases involving overseas conduct or foreign individuals.

Collateral Bars

Dodd-Frank gives the SEC authority to impose "collateral bars" as a sanction, barring (or suspending) a registrant who is found to have violated securities laws related to a segment of the securities industry from participating in other parts of the industry. For example, a stock broker found to have violated securities laws could be banned not only from working as a broker but also from working in other parts of the securities industry, such as being an investment adviser.22

Judge Rakoff's Rejection of the Citi Settlement and Implications for Future SEC Settlements

Two recent developments hold the potential for significantly affecting the SEC settlement process in the months ahead. The first development involves the refusal of US District Court Judge Rakoff to approve a proposed settlement between the SEC and Citigroup Global Markets.23 In that ruling, the judge criticized the SEC's policy of settling lawsuits without having defendants admit or deny wrongdoing. By avoiding an admission of wrongdoing, defendants reduce their vulnerability to findings of liability in related, private civil litigation and to the accompanying increased legal and settlement costs. The SEC recently appealed Judge Rakoff's decision on grounds that "the district court committed legal error by announcing a new and unprecedented standard...."24

The second development involves the role of Congress, which has responded to Judge Rakoff's decision by calling hearings of the House Financial Services Committee to discuss whether the SEC should be allowed to reach settlements without an admission or denial of wrongdoing.25 Congress has the potential to influence SEC enforcement activity by exerting pressure on the SEC through its control of annual budget appropriations.

The outcome of the SEC's appeal to the Second Circuit Court of Appeals will determine whether the SEC can continue to reach settlements without an admission of wrongdoing; Congress may also try to influence SEC settlement practices through its control over the SEC's budget. Should an admission of wrongdoing become required in SEC settlements, corporate defendants would almost certainly be less willing to settle, resulting in fewer settlements and more cases resolved at trial.

Appendix: Company and Individual Settlements by Allegation Type

Footnotes

1 Dr. Gulker is a Senior Consultant, Dr. Buckberg is a Senior Vice President, and Dr. Overdahl is a Vice President with NERA Economic Consulting. Dr. Overdahl previously served as Chief Economist and Director of the Office of Economic Analysis for the US Securities and Exchange Commission. The authors thank Svetlana Starykh for capable database and research management and Shaena McPadden and Carlos Soto for excellent research assistance. We also thank Paul Hinton for insightful comments.

2 A default judgment is a judgment entered against a defendant who fails to plead or defend against plaintiffs' claims, or fails to appear at trial. See Black's Law Dictionary, Bryan A. Garner, Editor, West Publishing Co., 1996, p. 174.

3 "SEC Obtains Permanent Injunctions Against Sorenson and Brost in Merendon Mining Ponzi Scheme," SEC Litigation Release, November 17, 2010.

4 "J.P. Morgan to Pay $153.6 Million to Settle SEC Charges of Misleading Investors in CDO Ties to U.S. Housing Market," SEC Press Release, June 21, 2011.

5 Although this was actually a court judgment rather than a settlement, we include it and other trial outcomes in our settlement data given that the overwhelming majority of cases are resolved via settlement. "SEC Wins Fraud Trial Against Miami Investment Company U.S. Pension Trust and Its Officers," SEC Litigation Release, October 1, 2010.

6 "In the Matter of Morgan Asset Management, Inc.; Morgan Keegan & Company, Inc.; James C. Kelsoe, Jr.; and Joseph Thompson Weller, CPA, Respondents," SEC Administrative Release, June 22, 2011.

7 The only category where the median settlement decreased in FY11 was mutual fund market timing; the SEC reached only three settlements in this category in FY11.

8 See Luis A. Aguilar, SEC Commissioner, Speech at Third Annual Fraud and Forensic Accounting Education Conference, Atlanta, Georgia, "Combating Securities Fraud at Home and Abroad" (May 28, 2009), available at www.sec.gov/news/speech/2009/spch052809laa.htm.

9 SEC Enforcement Director Robert Khuzami "Bingham Presents 2011: Enforcement After Dodd-Frank," SEC Historical Society, September 13, 2011. See: http://c0403731.cdn.cloudfiles.rackspacecloud.com/collection/programs/sechistorical-09132011-transcript.pdf.

10 "Bingham Presents 2011: Enforcement After Dodd-Frank," Audiocast, SEC Historical Society, September 13, 2011.

11 See US Securities and Exchange Commission Statement, "Xerox Settles SEC Enforcement Action Charging Company with Fraud, " http://www.sec.gov/news/headlines/xeroxsettles.htm.

12 See US Securities and Exchange Commission Statement, "SEC Obtains Record $92.8 Million Penalty Against Raj Rajaratnam," http://www.sec.gov/news/press/2011/2011-233.htm. Data presented in this paper does not include this settlement, as it took place in FY12.

13 Five of the seven settlements involved bribes paid to Nigerian officials. One settlement (Pride International, Inc.) involved payments to officials in Venezuela, and one settlement (Panalpina, Inc.) involved allegations of bribes to officials in Nigeria, Angola, Brazil, Russia, and Kazakhstan. See US Securities and Exchange Commission Statement "SEC Charges Seven Oil Services and Freight Forwarding Companies for Widespread Bribery of Customs Officials," http://www.sec.gov/news/press/2010/2010-214.htm.

14 Another enforcement-related provision of Dodd-Frank requires the SEC to file cases within 180 days of issuing a Wells Notice to an enforcement target. The purpose of this provision is to resolve investigations, one way or another, in a reasonable period of time. The law allows for this deadline to be extended for additional 180-day periods in cases that are determined by the Director of Enforcement (or the Director's designee), after notice to the Chairman, to be sufficiently complex.

15 US Securities and Exchange Commission, Annual Report on the Dodd-Frank Whistleblower Program, Fiscal Year 2011, November, 2011, http://www.sec.gov/about/offices/owb/whistleblower-annual-report-2011.pdf.

16 See: "SEC: Quality of whistleblower filings higher than expected," International Financial Law Review, November 11, 2011, http://www.iflr.com/Article/2933425/SEC-Quality-of-whistleblower-filings-higher-than-expected.html.

17 "Bingham Presents 2011: Enforcement After Dodd-Frank," SEC Historical Society, September 13, 2011. http://c0403731.cdn.cloudfiles.rackspacecloud.com/collection/programs/sechistorical-09132011-transcript.pdf.

18 Report on Administrative Proceedings For the Period April 1, 2011 through September 30, 2011, United States Securities and Exchange Commission, Release No. 34-65691/November 4, 2011, http://www.sec.gov/news/studies/2011/34-65691.pdf.

19 The SEC used its new authority to initiate an administrative proceeding alleging insider trading against Rajat Gupta, a former Goldman Sachs director alleged to have tipped Raj Rajaratnam of the Galleon Group, who has been convicted of insider trading (In re Gupta, Admin. No. 3-14279). Mr. Gupta's counsel challenged the choice of forum in federal court on the grounds that retroactive application of the Dodd-Frank authority unconstitutionally deprived the respondent of a jury trial. Less than six months after initiating administrative proceedings, the SEC dismissed the proceedings and agreed that any future action against the respondent based on the same allegations would be filed in the US District Court for the Southern District of New York. See In re Gupta, SEC, Admin. Proc. File No. 3-14279, 8/4/11; Gupta v. SEC, S.D.N.Y., 11-1900, 8/4/1.

20 The SEC's use of this new aiding and abetting authority has been challenged when applied to conduct occurring prior to the enactment of Dodd-Frank. For example, on June 6, 2011, the US District Court for the Northern District of California dismissed the SEC's claims for aiding and abetting violations of the Investment Company Act against two Charles Schwab executives responsible for its YieldPlus Fund, holding that the SEC's new authority under Dodd-Frank could not be applied retroactively. See SEC v. Daifotis, No. C 11-00137 (N.D. CA). The decision also addressed the issue of whether the authority contained in Dodd-Frank was indeed new, finding that Dodd-Frank "changed the liabilities, remedies, and scope of authority the Commission has to pursue such violations." (Page 19 of opinion.)

21 In one recent case, the SEC on September. 8, 2011 filed a subpoena enforcement action against Deloitte Touche Tohmatsu CPA Ltd. for failing to produce documents related to the SEC's investigation into possible fraud by the Shanghai-based public accounting firm's longtime client Longtop Financial Technologies Limited. In the filing with the court, the SEC stated that Deloitte Touche Tohmatsu had submitted a letter to SEC staff refusing to comply with the subpoena because, among other things, it believed it could not be compelled to produce documents predating the effective date of Dodd-Frank. See: http://www.sec.gov/litigation/complaints/2011/comp-pr2011-180.pdf.

22 In the recent Matter of John W. Lawton, the SEC sought a collateral bar for conduct that occurred prior to the enactment of Dodd-Frank. In an initial decision, Chief Administrative Law Judge Brenda Murray limited the scope of collateral bars by finding that some of the collateral bar provisions attached new legal consequences to Mr. Lawton's conduct and were therefore impermissibly retroactive. See Initial Decision Release No. 419 Administrative Proceeding File No. 3-14162, April 29, 2011.

23 SEC v. Citigroup Global Markets Inc.,F. Supp. 2d , 2011 WL 5903733 (S.D.N.Y. Nov. 28, 2011)

24 See: http://sec.gov/news/press/2011/2011-265.htm.

25 See: http://financialservices.house.gov/News/DocumentSingle.aspx?DocumentID=273033.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.