The Federal Trade Commission has released the annual jurisdictional adjustments for premerger notification filings made pursuant to the HSR Act,1 which take effect for transactions closing on or after February 24, 2011. But while the thresholds should be the first step in determining whether or not you have to file, there are other important considerations as well.

HSR Thresholds

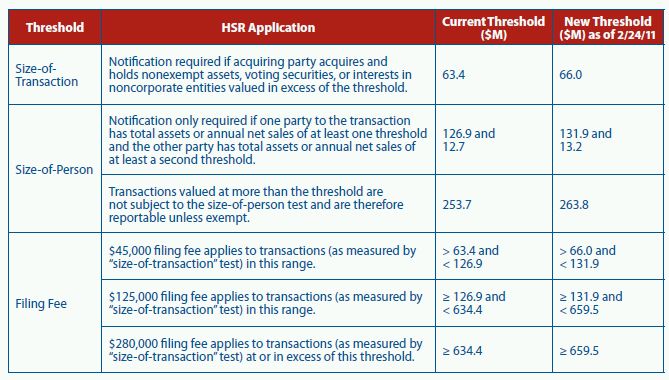

Under the HSR Act, certain acquisitions of assets, voting securities, or interests in noncorporate entities are subject to premerger notification filing and waiting period requirements if the applicable jurisdictional thresholds are satisfied and no exemption applies. These thresholds are adjusted annually based on changes to the U.S. gross national product in the preceding fiscal year. The amount of the three-tier HSR filing fee does not change, but the range of transaction size applicable to each tier does adjust. The most significant jurisdictional thresholds are as follows:

Other Important HSR Considerations

Unfortunately, determining whether or not a filing is required for any particular transaction is rarely as simple as applying the published thresholds. The reason is that the size-of-transaction for HSR purposes can differ significantly from what the parties consider to be the purchase price or the value of the deal. For example:

- Exemptions. Consideration paid for the exempt elements of transactions do not count toward the size-of-transaction for HSR purposes. Some notable exemptions (there are many others) include:

-

- Certain assets located outside of the United States

- Non-voting securities

- Many types of realty including office buildings and hotels

- Fossil fuel reserves

- Warehouses (broadly defined; e.g., natural gas and oil storage facilities meet the definition)

- Thresholds Are Cumulative. The size-of-transaction is measured by the value of the acquiring entity's cumulative holdings of the acquired entity, not by the amount acquired in any particular transaction. So, for example, if ABC bought 30 percent of the outstanding voting securities of XYZ, Inc. for $40 million in 2006, that transaction would not have been reported, but if ABC now seeks to buy an additional 30 percent of the voting securities of XYZ for an additional $40 million, this second transaction would be reportable because, post transaction, ABC will hold voting securities worth in excess of $66 million.

- The Impact of Debt Assumed or Paid-Off. Businesspeople and corporate lawyers generally add debts assumed or paid-off to the value of the deal. For HSR purposes, however, in a stock deal (i.e., an acquisition of voting securities, LLC membership interests, etc.), the assumed debts of the acquired entity do not count toward the size of transaction. In other circumstances, however, such as when the assets of the seller (as opposed to the acquired entity) are paid-off or debts are assumed in connection with an asset deal, the value of the debt may need to be added to the purchase price when calculating the size-of-transaction.

These are but a few of the many reasons that determining whether or not you are required to file under the HSR Act is not as simple as applying the thresholds. If at all in doubt, you should consult qualified counsel, particularly because the penalty for failing to file is up to $11,000 per day.

Footnote

1 The "HSR Act" refers to the Section 7A of the Clayton Act, 15 U.S.C. 18a, as added by the Hart-Scott-Rodino Antitrust Improvements Act of 1976, Pub. L. 94-435, 90 Stat. 1390.

www.cozen.comThe content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.