The Bottom Line

- The FTC continues its aggressive campaign against "dark patterns" and deceptive earnings claims – especially where impressionable consumer demographics are involved.

- Regulators aren't going to wait until the new Negative Option Rule is passed to bring actions against companies who make it too difficult for consumers to cancel their subscription.

- Companies should take the time to audit their marketing claims and user flows to avoid becoming the FTC's next target. Any consumer "save" attempts or upsells should be closely scrutinized.

The Federal Trade Commission (FTC) has taken action against Care.com (Care), an online caregiving platform for job posters and job seekers, alleging that the platform used inflated job numbers and unsubstantiated earnings claims to "lure" caregivers onto its platform and that it further "used deceptive design practices to trap consumers in subscriptions" they could not easily cancel.

The action comes as the FTC continues its focus on companies employing interfaces designed to systematically mislead online consumers. Care agreed to a settlement that requires it to turn over $8.5 million in consumer restitution, as well as to cease future deceptive earnings claims and to provide users with a simple cancellation method for any negative option subscriptions available on the site.

Deceptive Claims

According to the FTC, Care's deceptive advertising claims took two forms.

- First, the company vastly overstated the number of jobs available on the platform.

- Second, it made unsubstantiated claims about how much individuals could expect to earn from those jobs.

With respect to the first issue, the complaint alleges that Care advertises the availability of millions of jobs on its platform, but this number is deceptively inflated because it includes jobs for which there is little to no chance a job seeker could be hired. Care offers two types of memberships for job seekers – Basic (free, non-renewing) and Premium (paid, auto-renewing). To read a job application or hire a provider, Basic job seekers must upgrade to a Premium membership. The FTC emphasized that millions of job postings on the Care platform came from Basic seekers who never upgraded to a Premium seeker membership (which would have allowed them to hire providers). As such, Care entices care providers to pay for subscriptions to its platform by appearing to offer more jobs, and have a higher demand for providers, than truly exists. This ultimately creates a self-perpetuating cycle, as the increase in the supply of providers attracts more job seekers to the platform, even though Basic job seekers are unable to hire providers.

In addition to the inflated job claims, the complaint also alleges that Care deceived users about how much money consumers can earn when they get a job on the platform. According to the FTC, in its marketing and e-commerce materials, Care advertised hourly as well as weekly earnings totals that were also designed to entice consumers into paying for subscriptions. However, these earnings claims are not based on actual wages earned by providers. In fact, the complaint charges that Care does not know or even track the actual pay rates negotiated between job seekers and job posters after they make contact. The complaint further notes that, despite pay differences across different geographic regions, Care disseminates advertisements with uniform earnings claims nationally.

According to the complaint, Care continued these deceptive earnings claims even after receiving a Notice of Penalty Offenses related to earnings claims from the FTC in 2021.

Subscription Traps

The complaint alleges that Care intentionally employed several deceptive design tactics – colloquially known as "dark patterns" – to prevent consumers from being able to easily cancel their subscriptions. Some of the tactics challenged by the FTC include:

- Making it unreasonably difficult to find information about how to cancel – e.g. having to click through a number of unrelated links.

- Including multiple "roadblocks" to canceling, such

as:

- Multi-page questionnaires

- Confusing Language

- Warnings about the Effects of Cancellations

- Offers to buy other paid memberships.

According to the complaint, Care offered consumers at least four exits to the cancellation flow, required consumers to complete three pages of questions prior to cancellation, warned consumers twice of the consequences of canceling, and then offered the purchase of a different membership in lieu of canceling.

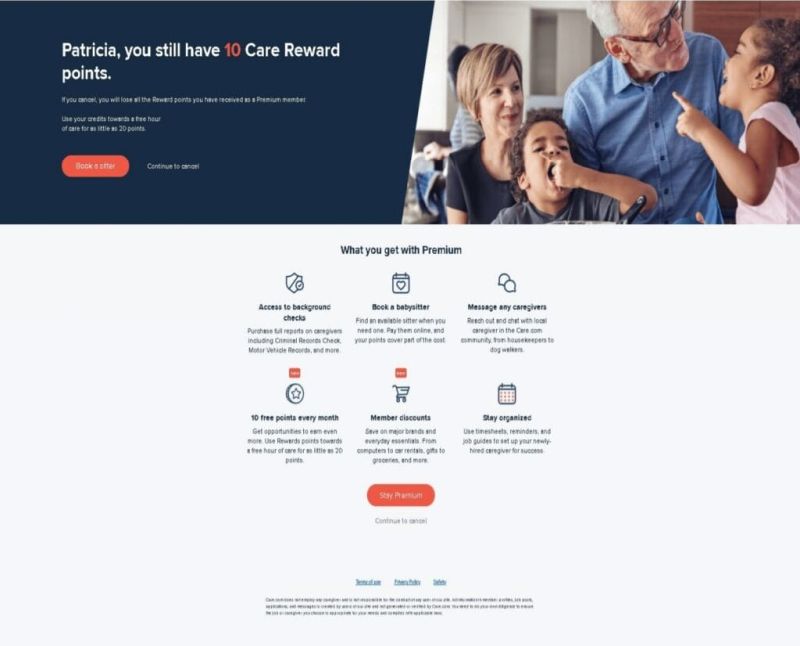

For example, below is an Exhibit from the complaint which depicts step 2 of a 6-page cancellation flow. As you can see, the screen attempts to "save" the consumer by explaining the loss of benefits and de-emphasizing the "continue to cancel" button.

Notably, the complaint alleges that several of these design

tactics were employed for the specific purpose of keeping consumers

locked into the subscription. For example, Care's internal

R&D testing revealed that more consumers select orange buttons

over deemphasized options when choosing membership options.

The FTC will doubtlessly continue its focus on companies who cross

the line from acceptable consumer retention efforts to deceptive

dark patterns, especially as it moves to finalize its federal

"click to cancel" requirement under the proposed updates

to the Negative Option

Rule.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.