Fraud remains an ever-evolving risk and we continue to see forged and fictitious documents being used to deceive financial institutions.

Against a backdrop of a number of high-profile cases in recent years1 we set out here to review our proprietary claims data and to examine the insurance cover available to financial institutions under the crime/bankers blanket bond and/or Professional Indemnity (PI) policies.

What are fictious and forged document claims?

Generally this type of claim encompasses forgery, counterfeiting or fraudulent alteration of specifically defined documents which have been relied upon by an Insured institution in the course of business. However, the policy wordings are precise, and it is necessary to test if the exact fact pattern falls for cover. Crime policies can also provide coverage for certain costs that an Insured may incur following discovery of a fraudulent act – we discuss this further below.

Crime policies can also provide coverage for certain costs that an Insured may incur following discovery of a fraudulent act.

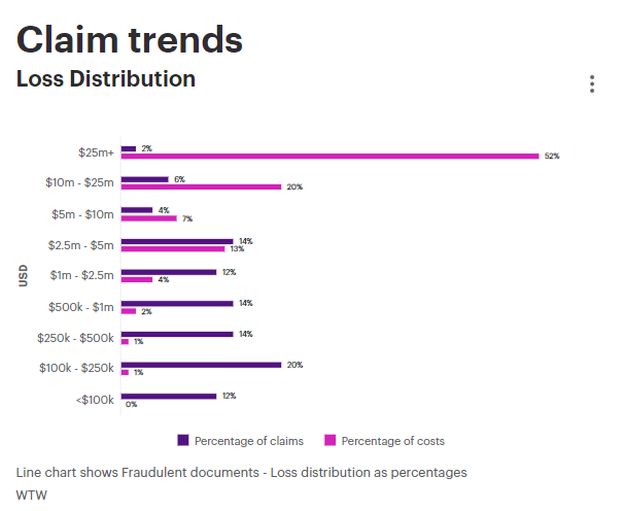

An analysis of crime claims that have been reported to WTW involving this type of fraud during the period of 2007 to November 2023 indicates an average loss of $4.3m, with the largest loss being $108m. But what type of frauds are being perpetrated?

Fictitious and forged documents – cost of claims

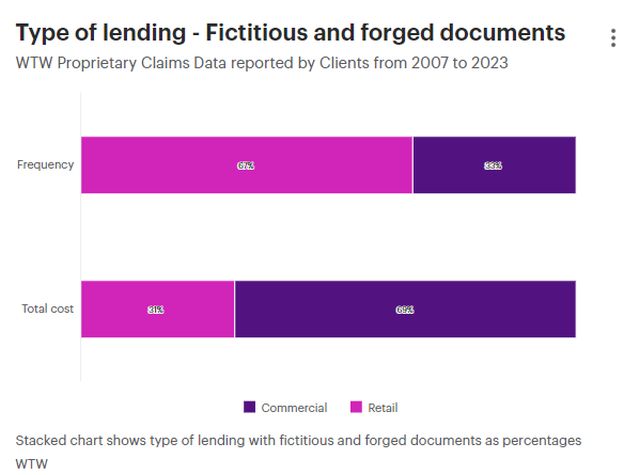

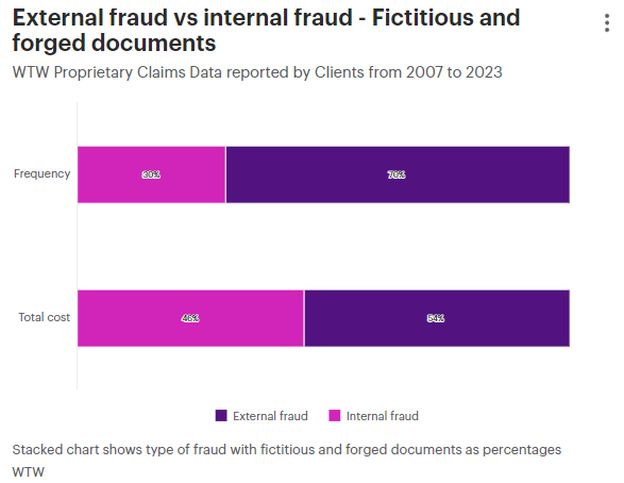

Our data is broken down between commercial and retail lending, as well as by type of fraudulent act - internal (employee) or external (third parties). Our analysis shows that:

- The total cost relating to external and internal fraud are fairly even, however this is based on a much higher frequency of external fraud claims which would suggest that internal fraud can be more costly proportionately.

- Approximately two thirds of lending based on forged or fictitious documents was in respect of retail clients, however higher costs were associated with commercial lending which is expected.

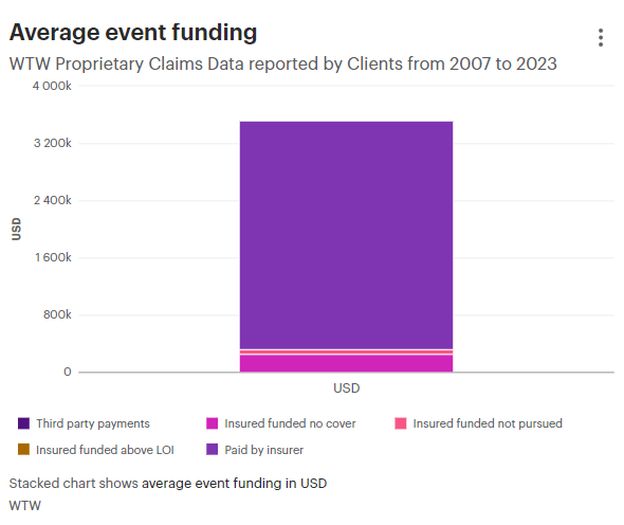

When looking at the funding of an event based on the average loss amount, our data also shows that 75% of the loss caused by this type of fraud was indemnified by Insurers.

What coverage is available? Crime or PI policies?

Insurance coverage for fictitious and forged document losses differs from policy to policy and can sometimes differ geography to geography. Generally, there is a requirement that cover under a crime policy involves a direct financial loss to an Insured, (but this can include circumstances where an Insured has a legal liability for third party funds). Often policies define 'forgery', 'counterfeiting' or 'fraudulent alteration', which can be useful to assess coverage under the policy.

Often policies define 'forgery', 'counterfeiting' or 'fraudulent alteration', which can be useful to assess coverage under the policy.

As ever the insurance policy may include exclusions or special conditions and so a careful review of the insurance policy is necessary.

Q: What about notification provisions?

Notification provisions can often vary between policies but generally they provide a timeframe in which to notify the insurer(s) of a crime incident - this usually commences from the date of discovery. Insureds are then expected to present a proof of loss within a specific time period. This too can commence from the date of discovery, however, often the clock can start ticking from the date of notification. It is important for insureds to check their policy wording or discuss the provision with their broker to ensure they understand what is required of them.

It may also be worth exploring potential coverage under a professional indemnity policy. Coverage may be applicable here if the insured receives a third-party complaint in connection with its provision of (or indeed failure to provide) professional services following the 'incident'. This may be from affected customers for example.

Q: What are the cost of these claims?

As discussed above, these types of claims can be costly. Some policy wordings will include cover for certain costs that an insured may incur following discovery of a crime incident. For example, legal costs, costs associated with preparing the claim and costs to reconstitute any data. Again, coverage may vary and costs may be sub-limited.

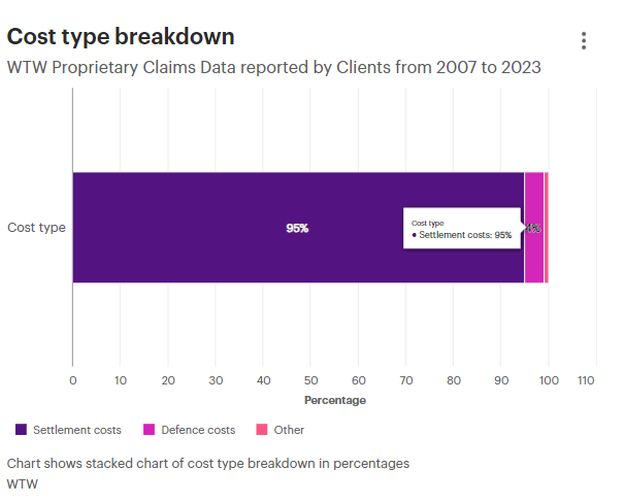

The majority of the costs associated with the claims that we have analysed relate to the settlement of the insured's direct financial loss, whereas a small amount relates to defence costs and other costs such as those mentioned above.

Conclusion

Given the potential costs involved in claims of this nature, insureds should understand the coverage available under their financial lines policies. In addition to this, Insureds may want to review their systems and controls and review what protocols are in place to minimise the risk of these type of losses. If you require any assistance in this area or would like to discuss your insurance cover, please contact your WTW broker.

Reference

*WTW Proprietary Claims Data reported by Clients from 2007 to 2023

Footnote

1. Fintech Global.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.