This briefing note discusses the current capital allowance environment and the practical issues in applying recent changes. Finance Act 2008 introduced significant changes to the Capital Allowance regime. Some points of note on the recent changes include the following:

Introduced in April 2008

- An annual investment allowance (AIA) of £50,000 for plant & machinery expenditure, available to all businesses, though restricted in the case of associated businesses (see below for change with effect from April 2010 and April 2012);

- Abolition of first year allowances (FYAs) for small & medium-sized enterprises (the 40% and 50% rates in existence prior to April 2008);

- A reduced WDA rate for the general plant & machinery pool (from 25% to 20%, though see below for further changes due in April 2012);

- The ability to write off the balance of expenditure on small pools (those with balances of £1,000 or less);

- A new special rate pool for integral features (a new category of allowance) and long life assets, with a 10% writing down allowance (though see below for further changes due in April 2012);

- Phased withdrawal of industrial buildings allowances (IBAs) and agricultural buildings allowances (ABAs);

- Payable Enhanced Capital Allowances (ECAs).

Introduced with effect from April 2009

- A temporary first year allowance of 40% for general plant or machinery expenditure for all businesses for 12 months from 1 April or 6 April 2009;

- Changes to capital allowance for cars, providing for greater pooling and allowances based on CO2 emissions.

The 2008 changes in capital allowance rates (other than for industrial buildings) do not affect North Sea oil and gas businesses, which retain 25% allowances for plant or machinery general pools and 6% rates for long life assets. However first year allowances in these businesses for long life asset expenditure was increased from 24% to 100%, and there has been an extension to the period for which relief can be claimed on abandonment or decommissioning expenditure. No further changes were included in Finance Act 2009 for capital allowances on North Sea Oil and Gas businesses, but there were changes in Finance Bill 2010 with respect to cushion gas and leasing arrangements. This note does not discuss capital expenditure in this sector further.

Introduced with effect from April 2010

- The Annual Investment Allowance was increased from £50,000 to £100,000 with effect for expenditure incurred on or after 1 April 2010 for companies and 6 April 2010 for unincorporated businesses. The change was accompanied by anti-avoidance provisions to prevent sideways loss relief being obtained where a property loss is generated and has a capital allowance connection. The anti-avoidance precludes sideways loss relief for the amount of the loss applicable to the AIA where the main purpose or one of the main purposes of arrangements entered into (on or after 24 March 2010) was to obtain sideways loss relief in respect of the property loss. In applying the restriction the AIA is considered first in a loss making property business' total capital allowance claim.

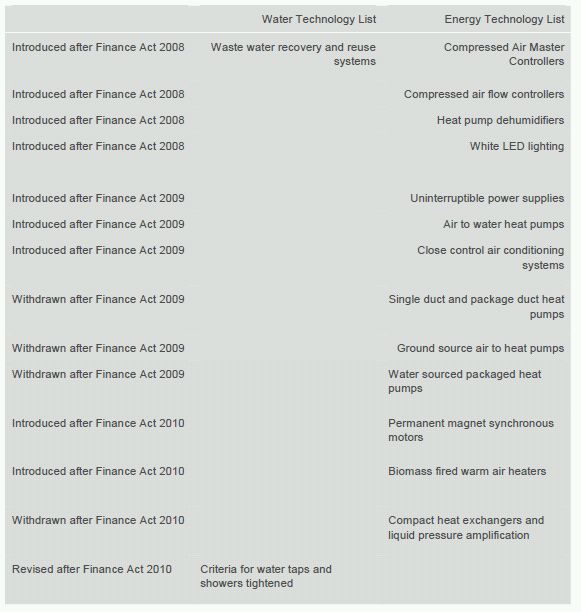

- Changes will be made to the ECA list of qualifying expenditure from a date to be appointed by Treasury order. The change will introduce two new energy efficient sub-technologies (permanent magnet synchronous motors and Biomass fired warm air heaters), while removing compact heat exchangers and liquid pressure amplification. In addition the criteria for water taps and showers to be included in the water technology list will be tightened.

Changes announced in Finance (No 2) Bill 2010

- The following changes will apply with effect from 1 April 2012 for companies and 6 April 2012 for unincorporated businesses.

- a reduction in the annual investment allowance from £100,000 to £25,000.

- Rates of writing down allowance on qualifying capital expenditure will fall from 20% to 18% for expenditure qualifying for the main pool, and from 10% to 8% for expenditure qualifying for the special rate pool.

As with previous capital allowance rate changes where a chargeable period crosses the date of change, a hybrid rate will need to be calculated and applied to the pool balance.

- 100% allowances for expenditure on new zero emission goods vehicles with effect for expenditure incurred between 1 April 2010 and 31 March 2015 for companies and between 6 April 2010 and 5 April 2015 for unincorporated businesses. To comply with EU state aid rules this allowance will not be available to businesses in financial difficulty, to those involved in fisheries, aquaculture or waste management, and will be limited to €85m of expenditure per undertaking over the five year period.

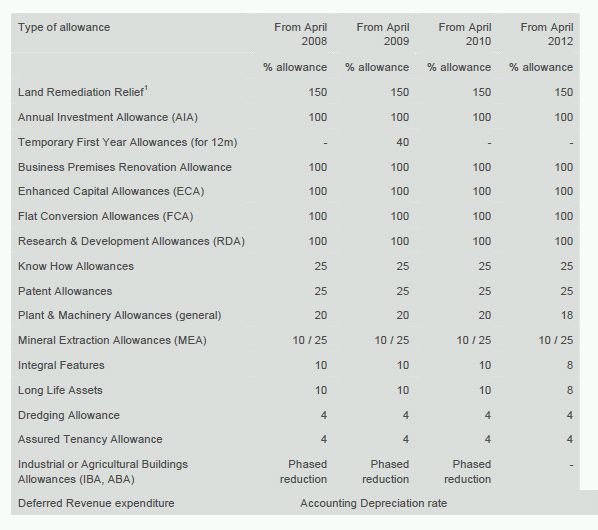

Rates summary: The table below summarises the recent changes in rates of relief for qualifying fixed asset expenditure (apart from North Sea ring fence activities):

Table Summarising Rates of Relief for Qualifying Fixed Asset Expenditure

Annual Investment Allowance (AIA)

The allowance is available to qualifying persons which include:

- individuals;

- partnerships consisting of individuals (note that a partnership with a member who is a company or trust does not qualify);

- companies.

There are restrictions to the availability of the AIA which are slightly different for companies and for unincorporated businesses. For companies the basic rule is that one AIA is available per company.

However, only one AIA is available:

i) between all companies that are part of a corporate group,

ii) between two or more groups controlled by the same person and where the groups are related (see below),

iii) between two or more companies that are under common control and that are related (see below).

"Group" in relation to companies means the parent company and subsidiaries in which it holds a greater than 50% interest. Control in this context is defined in s574 CAA2001 (by share capital, or voting power, or articles of association or similar document). Related companies or groups are defined as those which operate from the same premises or have 50% or more of the same category of turnover (using the EU NACE2 classification). The same premises test is met if at the end of the chargeable period the company or group operates from the same premises.

For unincorporated businesses the basic rule is that one AIA is available per business. However only one AIA is available to more than one business where:

i) a person other than a company carries on the businesses,

ii) the businesses are controlled by the same person, and,

iii) the businesses are related (see below).

For control purposes a business is treated as controlled by the person who carries it on, and control in relation to a partnership means the right to a share of more than half of either the assets or the income of the partnership. Unincorporated businesses are related if at the end of the chargeable period they operate from the same business premises or undertake the same EU NACE classification of activity (there is no turnover test).

Where a business owner operates a company and also operates a partnership (which has only individuals as partners), then both the partnership and the company would be entitled to an AIA.

The AIA is not available where disqualifying arrangements are entered in to. Disqualifying arrangements are those where the main reason for entering in to them is to obtain entitlement to the AIA for a business which would not otherwise be entitled to an AIA. Where there is entitlement to AIA, it is possible to choose how the allowance is allocated between the companies within a group, or the businesses within a related group of businesses.

As a result of the introduction of the AIA, First Year Allowances (FYA) for small and medium-sized enterprises (SME) were withdrawn from the relevant dates (1 April 2008 for corporation tax, and 6 April 2008 for businesses subject to income tax). The AIA will provide a 100% FYA for expenditure of up to £50,000 incurred on qualifying plant and machinery (£100,000 for expenditure incurred on or after the commencement dates in April 2010, but reducing to £25,000 on or after commencement dates in April 2012).

There are certain exclusions from plant & machinery qualifying for the AIA and these include:

- expenditure incurred in the chargeable period when qualifying activity ceases;

- expenditure on cars;

- expenditure incurred for the purpose of a ring fence trade;

- expenditure incurred in connection with a change in the nature or conduct of a trade where obtaining the allowance is the main (or one of the main) benefit(s) of making the change;

- expenditure arising from the expiry of a long funding lease, as a result of a gift, or which has been transferred into a qualifying activity from a non-qualifying activity.

Any capital expenditure on plant and machinery over the first £50,000 (£100,000 for expenditure incurred on or after 1 April (incorporated) or 6 April (unincorporated) 2010 and £25,000 for expenditure incurred on or after the same dates in 2012) will be dealt with through the standard regime for capital allowances. 100% FYA will continue to be available for plant or machinery with environmentally favourable credentials, business premises renovation allowances, flat conversion allowances and research & development allowances. It is possible to choose which plant or machinery expenditure qualifies for the AIA. Thus if there is £50,000 (or £100,000/£25,000 with effect from April 2010/April 2012) of expenditure qualifying for the special rate pool (currently attracting WDA at 10%, but reducing to 8% from April 2012) and AIA, the full AIA could be used. In this case the plant or machinery on which the AIA had been claimed would be allocated to the special rate pool, so that any proceeds on a subsequent sale would result in a clawback of allowances given from that pool. Unused AIA relief in any year cannot be carried forward to future years, so if possible the timing of expenditure qualifying for relief should be planned so that allowances are maximised.

In relation to losses generated by property businesses who have claimed an AIA, there is a restriction on sideways loss relief for the amount of any AIA claimed where arrangements are entered into on or after 24 March 2010 with the main purpose (or a main purpose) of securing sideways loss relief as a result of claiming AIA.

Small Pools

For chargeable periods beginning on or after the 'relevant date' (1 April 2008 or 6 April 2008) it will be possible to take an amount of allowance up to the remaining balance for "small" P&M general pools, or special rate pools (see below for special rate pool). A 'small pool' is a pool with a balance of £1,000 or less. It will therefore be possible to choose to write off the whole pool balance for tax purposes, or any amount up to that pool value. Taking the full write down will remove the need to account for small pool balances for tax purposes for extended periods of time.

Transitional Provisions for the changes in rate affecting the General Pool, Annual Investment Allowance and Long Life Assets

Where an accounting period straddles the effective date of change, allowances for the general plant or machinery pool (PMA) are apportioned, by applying a hybrid rate. This is calculated using the number of days before and after the relevant date, and rounding up the allowance to two decimal places. For instance, a company with a year end of 31 December 2008 had a hybrid rate for WDA for plant and machinery of 21.25% (91/366 x 25% = 6.2158% plus 275/366 x 20% = 15.027% = 21.2431% = 21.25% rounded). It is expected that similar transitional rules will be introduced when the main pool writing down allowance rate changes from 20% to 18% in April 2012.

The AIA is applied to expenditure from the 'relevant date' (see above), with time apportionment where the accounting period crosses the relevant date. On an ongoing basis the AIA will be reduced pro-rata for short accounting periods or where the accounting period straddles the relevant date. Taking the example of a company with a year end of 31 December 2008, it was entitled to an AIA of £37,671, being 275/365 x £50,000 (the £50,000 annual allowance ran from 1 April 2008, which was not a leap year). Similar calculations will be required with respect to the £100,000/£25,000 limits where accounting periods straddle the April 2010/April 2012 introduction dates.

The transitional rules for the change in long life asset (LLA) WDA rate (6% to 10%) work in a similar way to those for the general pool. It was possible, however, to obtain the full WDA rate of 10% for LLA expenditure incurred before the April 2008 'relevant date' but allocated to the special rate pool after the relevant date. Any balance left in the LLA pool will be transferred to the 'special rate pool' the day after the end of the transitional year. In view of the change in rates around the 'relevant date' it is important to remember the definition of when expenditure is incurred for capital allowances. Capital expenditure is treated as incurred on the date when there is an unconditional obligation to pay for it (CAA2001 s5). Where the unconditional obligation comes into being as a result of the issue of a certificate (for example a building certificate on a long term refurbishment contract), and the certificate is issued within one month of the end of a chargeable period, then provided the asset has become the property of the taxpayer before the end of the chargeable period, the expenditure is treated as incurred immediately before the end of that period. However, where there is agreement that payment for an asset is not required until more than four months after the date of obligation to pay, then the date of payment takes precedence. Where a debt is paid more than four months after it is due, this does not necessarily mean that the payment date will be treated as the date capital expenditure is incurred.

Temporary 40% First Year Allowance

Finance Act 2009 introduced a 40% temporary first year allowance for plant or machinery expenditure qualifying for the general pool of expenditure (otherwise qualifying for the 20% rate of allowance). The expenditure must have been incurred in the 12 months from 1 April 2009 (companies) or 6 April 2009 (unincorporated businesses), and there is no limit to the amount of qualifying expenditure for which relief can be claimed. Certain expenditure is excluded from this allowance, such as:

- Special rate expenditure (see next section);

- Cars;

- Assets for leasing.

Businesses will need to review which first year allowances to claim. Where possible it may be advantageous to claim at rates of 100% (e.g. AIA and ECA), before considering the temporary 40% FYA. For qualifying expenditure in excess of amounts claimable at rates of 100%, or which cannot otherwise be claimed at these favourable rates, the temporary FYA is a consideration. For example the allowance is available to each company in a group, to partnerships with companies or trusts as partners, and to businesses which are associated with other businesses.

Special Rate Pool and lntegral Features

The special rate pool is a new pool for the following categories of expenditure incurred on or after the relevant dates (1 April 2008 (Corporation Tax), or 6 April 2008 (Income Tax)):

- thermal insulation expenditure;

- integral features;

- long life assets (unless used in a ring fence trade);

- long life assets (unless used in a ring fence trade) which have not yet been allocated to the LLA pool.

Special rate pool expenditure incurred on or after the relevant date will attract a full 10% WDA for the chargeable period, provided there is a 12 month accounting period (even in the transitional period). The allowance will be apportioned where the accounting period is less than 12 months. The rate of allowance will fall from 10% to 8% with effect for expenditure incurred and pool balances on or after 1 April or 6 April 2012. It is expected that transitional rules will operate to determine the rate of allowance for accounting periods that straddle the date of change of rate, in a similar way to that described for the transitional rules above for the general pool.

lntegral Features

The new category of integral features (which may or may not be fixtures) includes some items previously qualifying for the old 25% PMA rate, and some new categories. The integral feature categories are:

- electrical systems (including lighting systems);

- cold water systems;

- space or water heating systems, powered systems of ventilation, air cooling or purification and any floor or ceiling comprised in such systems;

- lifts, escalators and moving walkways;

- external solar shading.

While this is a simple list, it does not remove the need for judgement in determining which category of allowance (general pool, integral feature, or none) the asset falls within. New section 33A para 1 CAA2001 applies integral feature plant or machinery classification to that used in a building or structure which is used for a qualifying activity. Thus the plant itself does not have to be specifically used in the trade. This permits capital allowances to be available for expenditure which previously did not attract such allowances (for example certain cold water systems and external solar shading). It also permits this type of expenditure to attract enhanced capital allowances (ECA for which the rate of allowance is 100%) where the equipment otherwise qualifies.

The majority of plant included in a lease of a building is excluded from the long funding lease rules (which transferred the availability of capital allowances from the lessor to lessee) by the 'background plant exemption'. This exemption permits the lessor to retain the right to capital allowances on certain plant or machinery included in a building leased under a lease which would otherwise come within the long funding lease rules introduced in April 2006. With the introduction of new categories of plant, however, there will be a requirement to check closely whether the plant included in a lease still comes within the background plant exemption so that capital allowances can be claimed.

The question of when renewal expenditure on assets falling into the integral features category is to be treated as capital or revenue was clarified in the 2008 Budget. Expenditure will be 'replacement expenditure' (i.e. capital) where more than 50% of the replacement cost of the asset is incurred within a 12 month period. The 'more than 50%' test is by reference to the replacement cost of the asset when expenditure is first incurred in that 12 month period. In the case of major repair work, it has always been necessary to determine whether the expenditure is of a revenue nature (i.e. a repair, or a replacement on a 'like for like' or 'nearest modern equivalent' basis), or whether it replaces an 'entirety' and is capital for tax purposes. In providing more precise boundaries, the room for dispute around differences in judgement on whether expenditure is revenue or capital for tax should be less than otherwise, but still remains.

Compliance in this area may, therefore, require a formal estimate of replacement cost of integral feature items when repairs are carried out. Treasury Secretary Angela Eagle has clarified that where a landlord owns a property with three floors and replaces the electrical system on one floor – that would be regarded as a repair under the new rules, not a capital replacement. She also clarified that disparate water and electrical system assets of the water processing and supply industry and electrical undertakings would be not be caught by the new integral features definition. The integral feature definition would apply to systems for the use and consumption of water and electricity, not their production and distribution.

HMRC's guidance on integral features is to be found at manual reference CA22300. While explaining the new rules, in relation to integral features, the guidance provides no definitive boundary between general plant and integral features, nor what is and what is not part of a system. HMRC also published a revenue brief in January 2009 which said that areas other than communal areas in University Halls of residence would be classified as dwelling houses (this is in contrast to the view expressed in their manuals at CA11520, as at July 2009). The view expressed in the revenue brief was never formally put into practice, with the interpretation as expressed in CA11520 continuing to apply. It is expected that further clarification of HMRC's view on the definition of a dwelling house for capital allowance purposes will be available in October 2010.

There has been some discussion as to whether the splitting of a business into an operating company and a property company could affect the ability to claim capital allowances. There is some question as to whether such a division in businesses such as nursing homes or hotels could result in the property company activity being classified as the provision of dwelling houses, which would then preclude a claim for capital allowances. Key to the ability to claim capital allowances in these instances will be the need to demonstrate how specific the property is to the trade, in contrast to how the property is designed to meet the long term needs of an occupant's dwelling requirements. Further clarification in this area is expected in due course.

A recent tax case clarified the determination of the amount qualifying for capital allowances in the context of capital expenditure on the fitting out and refurbishment of commercial premises (JD Wetherspoon plc v HMRC[2008] SPC 657 and JD Wetherspoon plc v HMRC TC00312 [18 December 2009]). It discussed the extent to which alterations of an existing building might be incidental to the installation of plant or machinery and therefore treated as expenditure on that plant or machinery, as well as the method of allocating overhead costs across the categories of expenditure (where a reasonable method of allocation is permissible).

Integral features will not qualify as short life assets, (no special rate pool expenditure does). Where refurbishment programmes are normal business practice it will be relevant to consider short life asset elections for plant or machinery expenditure (that would otherwise qualify as integral feature expenditure) incurred up to the relevant date. Short Life asset elections offer the opportunity to accelerate capital allowances where qualifying plant is sold or scrapped for less than tax written down value within a five year period. For companies there is a two year period in which to make such elections, being two years from the end of the accounting period in which the expenditure is incurred. For unincorporated businesses the time limit for elections is the normal time limit for amending the tax return for the tax year in which the accounting year ends (i.e. 12 months from 31 January following the end of the tax year).

Transfers of lntegral Features between connected persons

For expenditure transferred between connected persons it is not possible to generate an entitlement to integral features allowance where previously there was none because the expenditure was incurred before the relevant date. Connected persons are defined using s575 CAA2001. For individuals this includes relatives, spouses or partners, while companies are connected with other companies or persons through control as defined by s416, ICTA 1988 (more than 50% of assets, income, issued shares and voting rights).

Where what is now an integral feature is transferred between connected parties, but is not qualifying expenditure as it was incurred before the relevant date, the expenditure may previously have qualified for PMA. Where companies transfer such an asset, the buyer and seller may elect (s16 -17 Sch 26, FA2008) within two years of the date of sale for the expenditure to remain in the plant or machinery (P&M) pool on transfer at tax written down value (TWDV). The buyer will then need to keep records of the seller's original cost (which might be greater than TWDV on transfer) to ensure the correct value for future disposal proceeds allocated to a pool.

This will affect flexibility around the values for sl98 elections on transfers within a group. In the absence of an election the expenditure will need to be transferred from the buyer's P&M pool to an integral feature pool. For similar transfers involving individuals and trusts, however, reclassification will have to take place in any event. Where a sale takes place between unconnected parties with a s198 election, the buyer must undertake an apportionment exercise (which the seller may not have to do for its own tax compliance). Buyers should therefore ensure that s198 elections specify the value attributable to integral features, whether or not the seller claimed integral feature allowances. It is understood that HMRC will no longer apply the concession outlined in their Capital Allowance manual (CA26850 which accepts a degree of amalgamation of assets in certain s198 elections) so that s198 elections will need to identify the relevant assets more precisely now that integral feature legislation has been introduced.

Capital Allowances on Cars

Extensive consultation took place on the taxation of cars used for business purposes before the Finance Act 2009 changes were introduced. Prior to that, FA 2008 reduced the CO2 emissions levels of cars qualifying for 100% FYA on cars purchased on or after 1April 2008 from 120 g/km to 110 g/km, extending the availability of this particular allowance from 31 March 2008 to 31 March 2013.

The expensive car category of allowance in existence prior to April 2009 has been removed for new expenditure after the relevant date (1 April 2009 for companies and 6 April 2009 for unincorporated businesses), and replaced with a pooling system based on CO2 emissions. Transitional rules will operate for expensive car pools in existence on the date of change for a period of five years, where the single asset pools will continue to attract a 20% writing down allowance. Any balance in these pools remaining at the beginning of chargeable periods commencing on or after 1 April 2014 (companies) or 6 April 2014 (unincorporated businesses) will be transferred to the general pool. Anti-avoidance provisions preclude certain schemes from accelerating capital allowances on pools containing cars.

The following table sets out the capital allowance treatment for expenditure on cars in different categories incurred in each of the three years 2007/08 to 2009/10.

Note a consequence of the combined pooling for cars in 2009/10 is that there will be no balancing allowance on the disposal of cars allocated to the pools, in contrast to the situation for expensive cars currently allocated to a single expensive car pool. However cars with an element of private use (which could cover business cars in unincorporated businesses, but not companies) will continue to be allocated to single asset pools, and so will still be subject to a balancing charge or allowance on disposal.

On 24 March 2010 the government announced that new and unused goods vehicles would qualify for a 100% writing down allowance from 2010/11 to 2014/15 provided they could not produce CO2 emissions. This covers expenditure between 1 April 2010 and 31 March 2015 for companies and 6 April 2010 and 5 April 2015 for unincorporated businesses. The total expenditure permitted for each undertaking will be €85m over the five year period and there are other EU state aid conditions. The measure is to be legislated in Finance (No3) Bill 2010 to be introduced as soon as possible after the 2010 summer recess.

Enhanced Capital Allowances and the payable tax credit

With the reduction in rates of allowance for general plant or machinery and some categories of plant or machinery being reclassified from qualifying for main pool allowances to qualifying for the 10% special rate pool, it will be worth considering whether to specify equipment qualifying for 100% enhanced capital allowances (ECA's) in any refurbishment programme.

New categories of technology were added to and removed from the list as indicated in the following table:

The payable ECA credits introduced by Finance Act 2008 permit the part of a company loss generated by expenditure on ECA qualifying equipment to be surrendered in return for a repayment calculated at 19% of the loss surrendered.

Adjustments to the payment may occur in subsequent periods (e.g. where an ECA certificate is revoked, where an amended claim is submitted, or where ECA qualifying equipment is sold within four years of the end of the chargeable period in which the original claim is made). Where the adjustment reduces the amount of payable ECA the associated loss will be reinstated. However, where the company realises a loss on disposal of ECA qualifying equipment on which it has obtained an ECA payment, it will be able to retain the portion of the ECA payment relating to the realised loss.

The tax repayment cannot exceed the larger of:

- the company's PAYE and NIC liabilities for payment periods ending in the chargeable period;

- £250,000.

A loss can only be used once and a company may choose how much of the loss to surrender. In addition a loss can only be surrendered if other forms of loss relief are unavailable (such as relief against other or earlier profits, group or consortium relief). The rate of tax by which the repayment is calculated is 19% (this compares with 14% for R&D tax credit and 16% for Land Remediation (LRR) tax credit with effect from 1 April 2008). Thus the maximum loss that can be surrendered for a payment under the ECA loss facility is £1,315,789, regardless of the PAYE/NIC liabilities, or more if the PAYE/NIC liabilities are greater than £250,000. It will not be possible to use the same loss to claim for tax credit repayment under the ECA, R&D and LRR facilities.

Industrial and Agricultural Buildings Allowances (IBA and ABA)

Finance Act 2008 provided the detail on how IBA and ABA are to be phased out over the period from April 2008 to March/April 2011, and as a reminder no balancing adjustments on disposal of industrial or agricultural buildings have been available since 21 March 2007. The phasing out of allowances will work as follows:

- 2008/09 75% of previous full rate;

- 2009/10 50% of previous full rate;

- 2010/11 25% of previous full rate.

These rates will be time apportioned where the accounting period straddles 1 April (for corporation tax) or 5 April (for income tax) each year, although there is no rounding to two decimal places as for P&M transitional allowances. Where the full rate of allowance was previously 4% prior to 2008/09 or there is new expenditure, the rate of allowance for 2008/09 will be 3%. The reductions work in a similar way for the other years.

While IBA legislation is removed from April 2011, clawback of allowances via a balancing charge is retained for enterprise zone allowances (EZAs) where there would have been a balancing event within seven years of the first use of the building. Thus if claim to EZA was made in 2010, and the building was first used on 1 December 2007, there would be a risk of a balancing charge if the building was disposed at a time before 1 December 2017.

Anti-avoidance measures have also been introduced with effect from 12 March 2008 to prevent connected parties from obtaining multiple WDAs by transferring properties to connected entities with different year ends in order to claim extra IBAs. Any such transactions will now have a time apportionment feature to restrict the IBAs available.

In view of the phasing out of relief it will be worthwhile reviewing any open tax returns to ensure all balancing allowances have been claimed where qualifying expenditure has been disposed or replaced, and that all capitalised revenue expenditure has been properly identified.

Anti-Avoidance

Finance Act 2008 introduced various anti-avoidance measures that stop avoidance arrangements involving chains of leases, the interaction of the capital allowance and long funding lease rules on disposals and sale and finance leaseback arrangements. Further plant & machinery leasing anti-avoidance rules were introduced in Finance Act 2009 and Finance Act 2010. These arrangements are not dealt with in this briefing note.

Please Note

We have taken care to ensure the accuracy of this publication, which is based on material in the public domain at the time of issue. However, the publication is written in general terms for information purposes only and in no way constitutes specific advice.

You are strongly recommended to seek specific advice before taking any action in relation to the matters referred to in this publication. No responsibility can be taken for any errors contained in the publication or for any loss arising from action taken or refrained from on the basis of this publication or its contents.

Footnotes

1 Finance Act 2009 introduced refinements to Land Remediation Relief which are covered in a separate briefing note

2 NACE classification means the first level of economic activities classification published in European Union Regulation (EC) No 1893/2006

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.