Issues affecting all schemes

Pensions dashboards – updated code of connection

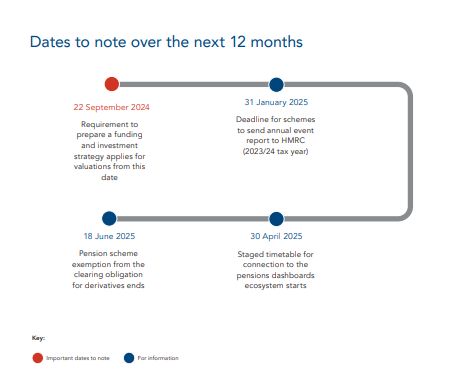

The Pensions Dashboards Programme (PDP) has published an updated version of the pensions dashboards code of connection. The code sets out how schemes and dashboard providers are to connect to the dashboards ecosystem and what they need to do to remain connected. It details the mandatory requirements that must be met, as well as the recommended ways in which they should be implemented. The code remains subject to ministerial approval. The PDP has also published FAQs on the updated code.

Action

Trustees and administrators of schemes that are subject to the dashboards requirements should review the updated code and factor its contents into their dashboards preparations.

Abolition of the lifetime allowance – further regulationsl

HMRC has consulted on draft regulations making further technical changes in connection with the abolition of the lifetime allowance and the introduction of the new lump sum regime. The consultation closed on 14 August 2024, and it is not clear when the regulations will come into force.

Action

Trustees and administrators should monitor publication of the finalised regulations.

Pensions review – terms of reference

The government has published terms of reference for phase one of its pensions review. These confirm that the review will focus on DC workplace pension schemes and the Local Government Pension Scheme (LGPS). Ongoing policy development with respect to DB schemes will remain separate from the review.

Phase one of the review will focus on investment and in particular on developing policy in four areas:

- Driving scale and consolidation of DC workplace pension schemes.

- Tackling fragmentation and inefficiency in the LGPS through consolidation and improved governance.

- The structure of the pensions ecosystem and achieving a greater focus on value to deliver better outcomes for future pensioners, rather than cost.

- Encouraging further pension investment into UK assets to boost growth across the country.

Phase one's initial findings will be reported later this year, ahead of the introduction of the Pension Schemes Bill. Phase two will start later this year and, alongside investment, will consider further steps to improve pension outcomes, including assessing retirement adequacy.

Action

Trustees and employers should monitor the progress of the review.

Normal minimum pension age – guidance on 2028 increase

The Pensions Administration Standards Association has published guidance on preparing for the 2028 increase to normal minimum pension age (NMPA). The guidance is designed to help trustees and administrators:

- Identify members with a protected pension age (PPA).

- Deal with transferred-in PPAs.

- Understand how the 2028 changes differ to the last NMPA increase in 2010.

The guidance includes a checklist of actions to be taken now in preparation for the increase.

Action

No action required, but trustees and administrators may find the guidance helpful.

To view the full article click here

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2024. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.