The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

The property sector is beginning to show signs of recovery. With inflation falling and interest rates peaking, the outlook for 2024 is a lot more positive.

THE HOUSING MARKET

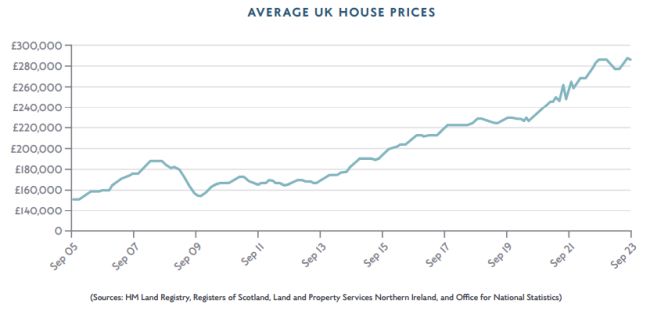

In September 2023, according to the Office for National Statistics (ONS) the UK experienced its first fall in average house prices since April 2012. However, to put this into perspective, the provisional estimate for the average UK house price was £291,000 in September 2023, which was little changed from 12 months ago.

Interestingly, Zoopla reported that discounts to asking price average 5.5% or £18,000 – the highest in five years – and are even larger in the South of England, suggesting that people selling their homes are becoming more realistic and agreeing to larger discounts.

Indeed, reports from the Nationwide Building Society and Halifax suggest that prices rose by around one per cent in October 2023, meaning that house prices (on the Nationwide measure) are now just 4.6% below their summer 2022 peak (5.4% previously).

THREE AREAS TO WATCH OUT FOR IN 2024

Mortgage rates stabilising

There is cautious optimism for homebuyers, with mortgage interest rates stabilising and lenders now reducing rates on fixed mortgage deals. It comes after the rate of inflation remained at 6.7% in September 2023, according to the ONS.

Shortage of houses

According to Benham and Reeves, prospective sellers are cautious, concerned they may not achieve the price they had expected. But because of low stock levels, accurately priced properties are generating interest, and many are getting good offers quite quickly.

Increasing demand from overseas investors

According to Benham and Reeves, demand from overseas clients increased during 2023, boosted by the continuing weakness of sterling.

THE COMMERCIAL SECTOR

£7.9 billion of UK property assets changed hands in Q3 2023 (data from Lambert Smith Hampton). This was 8% down on Q2 2023's already weak outturn. However, the actual number of transactions rebounded by 25%, suggesting signs of recovery. Retail volumes appeared the most resilient in Q3 2023, hitting a five year high of £1.9 billion, while offices remain under greatest pressure.

When considering different asset classes, the Royal Institute of Chartered Surveyors (RICS) survey revealed that it is the non-traditional areas of the market which are delivering the strongest returns, such as aged care facilities, student housing, life sciences and data centres.

RENTAL MARKET

Rental prices are increasing. A report from Rightmove reveals that average advertised rents in London have reached a record high of £2,627 per month. Rightmove notes that they receive an average of 25 inquiries per rental property, a increase from just eight in 2019. This overwhelming demand, coupled with a limited supply of rental properties, has driven up rental prices by 12.1% compared to last year.

Meanwhile, the October RICS data provides the first sign that rental demand may be slowing in the face of elevated rental costs. Alongside this, landlord instructions fell at a slower pace in the latest survey, suggesting a narrowing in the gap between fresh demand and supply. That said, the Rental Expectations indicator remains firmly in positive territory.

PROPERTY SERVICES

Construction output saw a decrease of 0.3% in the three months to October 2023; this came solely from a decrease in new work (2.0% fall), as repair and maintenance increased by 2.2% (RICS). This decrease is predicted to be because of increasing pressure on private residential development as housebuilders slow the pace of work. In contrast, infrastructure is proving to be resilient.

Challenges for the industry remain to be financial constraint with worsening credit conditions and the skills deficiency. The demographic challenge of an ageing workforce points to the skills issue becoming even more potent in the future.

Meanwhile, official data on building material costs shows the headline index to have fallen by almost 2% over the past twelve months. However, the level of material prices remains elevated, some 40% higher than in January 2020 (RICS).

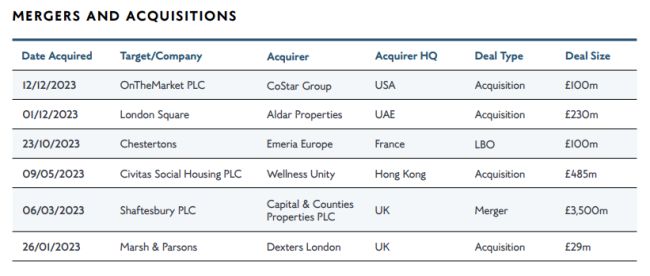

M&A activity within the UK real estate sector experienced a slowdown in 2023, primarily attributed to concerns surrounding asset valuation and borrowing costs. The commercial real estate segment, in particular, grappled with the ongoing impact of the post-pandemic landscape, marked by significant shifts in work and lifestyle patterns, thereby fostering an environment of uncertainty.

"Despite the challenging economic environment, the property sector is showing signs of recovery."

Looking ahead to 2024, we anticipate that current market conditions will give rise to new M&A opportunities. Investors aiming to capitalise on emerging trends, such as the experience-led paradigm, or seeking to establish and enhance their presence in the UK market, will likely find ample opportunities.

Additionally, we may witness companies strategically pursuing acquisitions to hedge against market volatility. A notable example is Foxtons, which, in 2023, expressed its intent to acquire rival letting agencies, in order to diversify away from the unpredictable sales market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.