In late October 2010, the Smith & Williamson property group conducted its eighth annual survey. 166 property executives responded.

While opinions are divided about the prospects for the sector as a whole, our survey revealed some consistent and strongly held views about the key issues facing the UK property industry.

- Public sector job cuts are expected to hit the property sector hard and are perceived to be a real threat.

- The lack of bank finance and anaemic UK economic performance are yet again seen as the key issues.

- The next twelve months will provide good opportunities to make residential and commercial investments.

- The nature of individual assets and management rather than market trends will be paramount for success.

The Spending Review

The Spending Review has not been welcomed with open arms by the UK property sector, but only 25% of respondents to our survey expressed the view that it would definitely have a negative impact on their business in the long term.

Those aspects of the Spending Review that our respondents expect to have the greatest impact on their businesses are the prospect of public sector job cuts and reform of the planning system. Also worthy of mention and of great relevance to the social housing sector are; welfare reform, reform of the council housing finance system and the New Homes Bonus.

The UK property industry

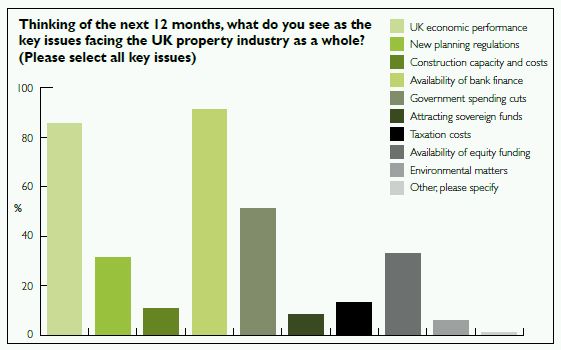

As indicated in the graph below, our respondents were of the view that the key issues facing the UK property industry as a whole are the availability of bank finance and UK economic performance.

Government spending cuts have been identified as an issue for the next 12 months, as has the availability of equity finance. Employment and employment confidence were also highlighted as key issues. New planning regulations are also very much on the minds of our respondents.

Raising finance

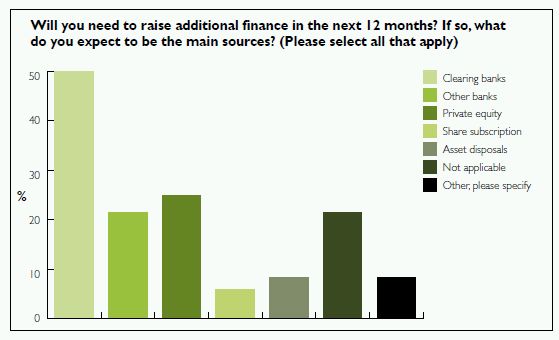

Fewer than 40% of respondents to our survey reported that they would need to raise finance in the next 12 months. Slightly alarmingly, over 70% of those that did expected banks to be a main source of finance. Interestingly, one-quarter of respondents expected the main source of their funding needs to be met by private equity.

Specific reference was made to bond finance, which makes sense if the banks are unable to provide the debt funding required. More than one-third of respondents were of the view that a lack of finance will constrain their businesses during the next 12 months. Another quarter were unsure.

Due to the refinancing spike in 2012, liquidity is likely to be restricted and pricing is likely to increase. Those able to do so may want to refinance sooner rather than later in order to avoid being squeezed in the crowd.

Sector preference

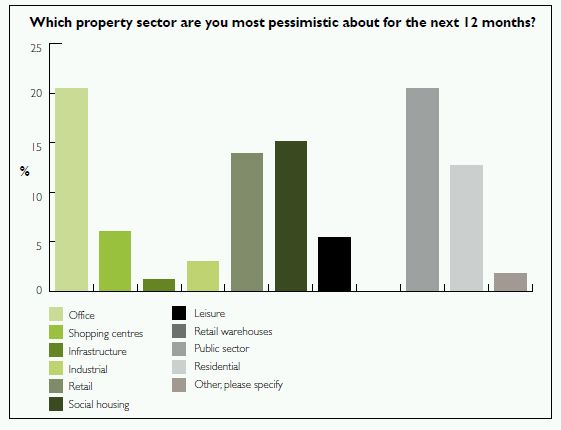

Respondents were pessimistic about all secondary and tertiary assets regardless of which sector they were in. In particular, offices outside of London received special mention as 'at risk' assets. Overall, office, public sector, social housing and retail are giving people most cause for concern at the moment, with only retail warehouses maintaining an unblemished reputation.

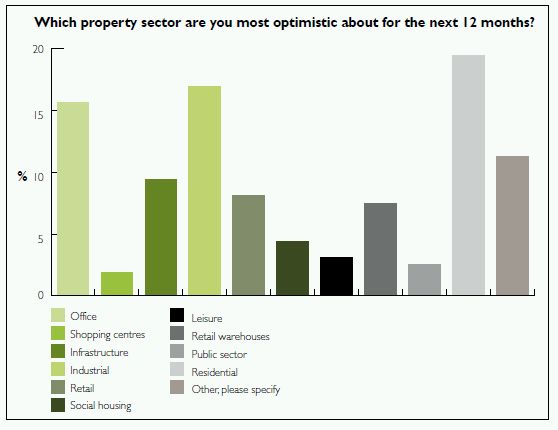

By way of contrast, when asked about sectors to be optimistic about, there were some intriguing outcomes. Not least of all the prominence of office, which we think indicates that the prospects for offices are very location and asset specific. Industrial and, to our surprise, residential also appeared as areas of hope for the next 12 months.

Special mention was made of the student accommodation sector in terms of optimism, as were London prime and central London offices. Specific comments make it clear that in the current environment, more so than ever, the merits of each individual asset are paramount rather than the sector. Overall it is fair to say that pessimism for the next 12 months just about carried the day.

Residential property industry

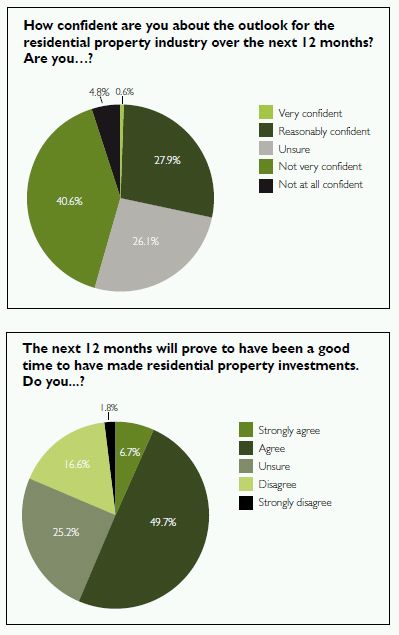

Fewer than 30% of respondents were confident about the prospects for the residential property industry over the next twelve months. Nearly half viewed the outlook for the residential property industry as unfavourable. As you would expect in such uncertain times, over a quarter of respondents were unsure either way of the outlook for the next twelve months. By way of comparison, our respondents held pretty much the same view of the commercial property industry for the next twelve months, only that they are slightly less confident of its prospects.

Many observers agree that not enough new houses are being built and that people cannot raise deposits, so the demand for rental property is ahead of supply, with obvious consequences on rental levels.

Residential property investments

As the chart to the right clearly shows, the majority of respondents are of the view that the next 12 months will prove to have been a good time to have made residential property investments. While they may all have in mind the last quarter rather than the first, there is clearly a belief that the opportunity to buy well will exist in the not too distant future, if not in fact right now.

In conclusion

12 months on from our last survey and yet again the global financial crisis remains the biggest issue for the UK property sector. While property executives clearly hope for a return to normalised bank funding, no one is predicting one and doubts are now arising as to just what the new normal will be. Those with capital and skill are already back in business and report to be intent on generating value rather than riding a wave.

Our own experience is that external investors looking at property ventures are still seeing risk and danger rather than opportunity and reward. This environment creates barriers for those seeking capital and great opportunities for those with expertise and financial backing.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.