Finally, Shippers Have the Upper Hand!

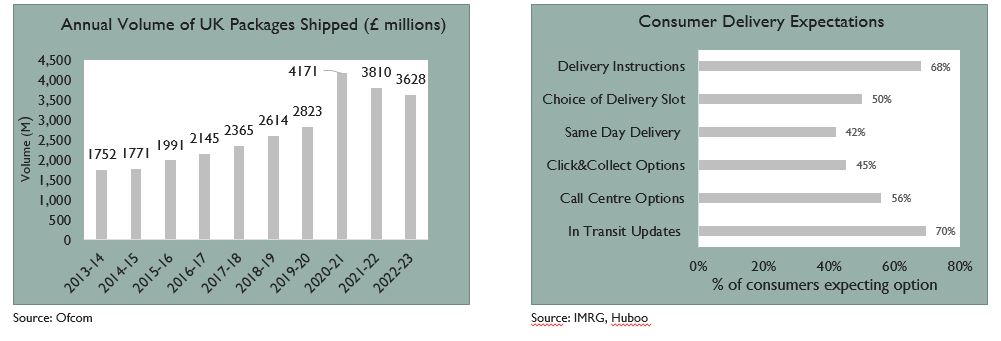

While delivery volume has slowed since the dramatic increases seen during COVID-19, consumers continue to expect high-quality courier services with increased customer contact and control.

Though higher than pre-pandemic levels, volume has slowed since 2021 with a fall in online demand, consumers expect a greater degree of communication and choice over delivery speed.

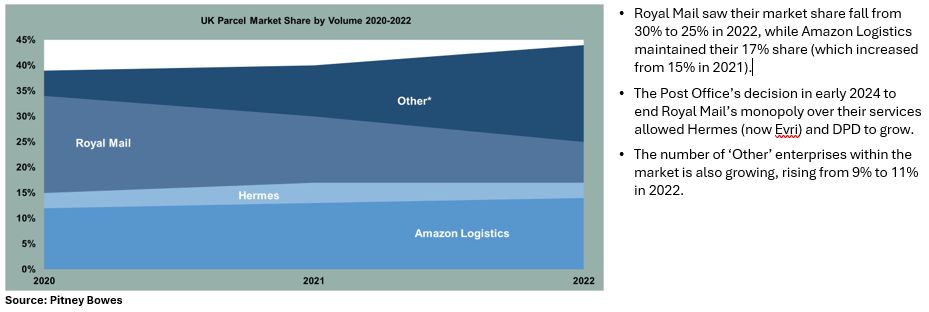

Amazon logistics' expansion, alongside an increased presence from Evri and a sharp rise in small or independent couriers, has seen a reduction in Royal Mail's market share.

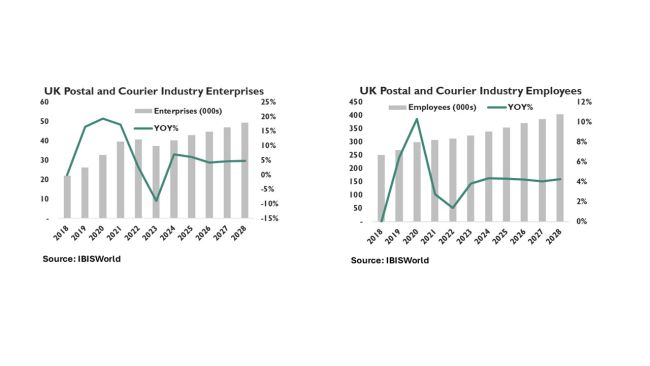

In addition to the market's main players, competition within the industry is steadily increasing. However, a slightly slower employee growth rate indicates that subcontracted and self-employed delivery drivers are also emerging as a viable courier option.

Key Industry Developments:

- Excess capacity caused by a major shift off the peak shipping levels experienced post Pandemic is driving increased competition in the industry

- Increased driver availability: a rise in self-employed and subcontracted drivers is providing companies with more flexible delivery options, but an overreliance on this labour may be causing costs to increase

- Improved automation and AI are driving more efficient shipping through improved mode/freight class selection, making it easier for shippers to optimize with multiple suppliers

- Couriers are facing rising costs amid a recent increase in the minimum wage and trade union disputes

- Increased consumer expectations are placing greater pressure on faster on-time services and improved tracking.

Key Events Driving The Industry Dynamics:

- Royal Mail strike action ended in July 2023 after a vote to accept a 10% pay rise over three years and a one-off payment of £500. Further increases in the National Minimum Wage place additional pressure on the wage bill.

- Excess capacity and increased costs are encouraging companies to cut back through cost-reduction schemes. FedEx will remove 2,000 back-office jobs across Europe, resulting in €175 million in savings per year from FY2027.

- However, Evri has announced 9,000 new jobs, increasing their workforce of self-employed couriers to 28,000. This follows their recent agreement to be sold to Apollo Global Management in a deal worth £2.7bn.

- Larger companies are driving efficiency improvements in last-mile delivery in an attempt to keep up with consumer expectations. UPS invested £138 million in the latest processing technology and AI in its East Midland centre. Royal Mail's 'Super Hubs' which are able to sort 800,000 parcels a day and have helped achieve 76% automation.

- Though consumer demand reduced post-pandemic, a significant increase in online second-hand retail may help the industry recover some parcel volume. A compound annual revenue growth rate of 3.5% is forecast from 2024-25.

Opportunities For Parcel Shippers:

Ankura estimates the window for shippers to capitalize on current market opportunities will close in 6-18 months. Shippers should act soon to:

- Take advantage of the current competitive intensity by re-bidding contracts and potentially introducing alternative vendors to UPS and FedEx for some portion of last-mile deliveries

- Develop a deep understanding of pricing complexity to enter "fact-based" negotiations with full knowledge of how not just rates, but minimum charges and surcharges impact total costs

- Evaluate opportunities to leverage capabilities of alternative last-mile carriers to create additional competitive tension and reduce costs for certain customer segments

- Re-align fulfilment strategy- adjust network shipping nodes, review package sizes, and optimize mode selection to cost-effectively meet consumer expectations

Ankura Performance Improvement Fundamentals:

Ankura's Performance Improvement Team has a proven track record of executing strategic plans to achieve sustainable performance improvement and targeted operating results aimed at maximizing Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), cash flow, and ultimately shareholder value.

Our expertise extends to optimizing distribution and logistics. We work alongside clients to reduce costs and improve efficiency by streamlining inbound and outbound logistics. Our team's hands-on experience ensures cost-effective solutions for transportation modes, shipping rates, and on-time delivery.

Ankura leverages its vast internal resources to assemble the perfect team for each client's unique challenges, guaranteeing optimal outcomes for complex problems.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.