1. Real estate regulation

1.1 MEES changes from April 2023

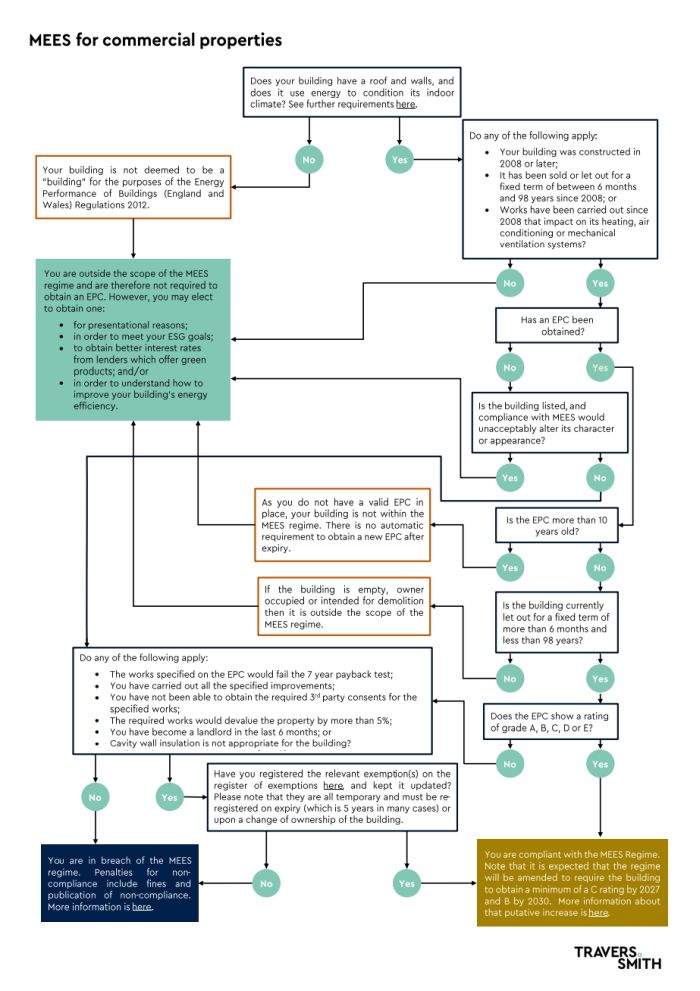

The Minimum Energy Efficiency Standards regime ("MEES") was brought into effect by the Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015. Until 31 March 2023, the MEES rules required landlords granting a new lease of a commercial premises to produce an energy performance certificate ("EPC") for the property, showing a rating of E or above, unless they have registered an exemption. Landlords are prohibited from granting a new lease of commercial properties with an EPC rating of F or G.

From 1 April 2023, it became unlawful for a landlord to continue to let a commercial property with an F or G rating unless (1) they have carried out all the cost-effective energy efficiency improvements prescribed for it in its EPC, and the EPC still shows a rating of F or G, or (2) one of the exemptions applies.

Read the PDF of this publication below. Alternatively you can download to print, to save for later or for a different experience.

What are the exemptions?

- The seven-year payback test – This applies if the cost of the improvement works necessitated by MEES are not covered within seven years by the energy savings brought about as a result of the works.

- Devaluation – This exemption applies where the landlord has obtained a report from a surveyor to the effect that carrying out the recommended energy-efficiency measures would reduce the market value of the premises by 5% or more.

- Third-party consent – Landlords can register this exemption if the recommended energy efficiency improvements require the consent of a third-party (such as a superior landlord or a local planning authority) and they have used reasonable efforts but have been unable to obtain the necessary consents.

- 6 month new owner exemption – On the purchase of a property rated F or G which is subject to existing tenancies, the purchaser can register a six-month exemption in order to carry out the energy-efficiency measures that are needed to bring the EPC rating to an E or above.

Following the Government's 2021 consultation, it is anticipated that the next step in the Government's plan to achieve net zero by 2050 is that all the minimum requirements for landlords letting commercial property will shift to C by 2027 and B by 2030. The real estate sector hoped that the Government would reduce uncertainty for commercial property owners by announcing the details of this trajectory on Green Day in March 2023, but the Powering Up Britain statement did not refer to this issue.

1.2 Overseas Entities regime update

The Register of Overseas Entities ("the Register") launched on 1 August 2022 and the transitional period ended on 31 January 2023. As we described in our previous briefing, pursuant to the Economic Crime (Transparency and Enforcement) Act 2022, overseas entities which own a freehold or grant a lease of more than 7 years in England and Wales are obliged to register on the Register and thereby disclose their registrable beneficial owners. An Overseas Entities ID is issued upon successful registration. If they fail to do so, submit false or misleading information, and/or do not submit annual updates, they could incur criminal liabilities. An overseas entity planning to acquire a qualifying interest in land (i.e. a freehold or a lease of more than 7 years) must register before applying to the Land Registry for registration as proprietor, and although a purchaser/tenant is not committing an offence by entering into a transaction with a non-compliant overseas entity, increasingly UK entities are unwilling to complete without sight of the Overseas Entities ID because they will in most cases, be unable to register their new property interest at HM Land Registry without it.

From 1 April 2023, regulation 30A(1) of the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 was widened to include the Overseas Entities Regime. This means that regulated persons (such as lawyers, accountants and property agents) are required to report to Companies House any discrepancies between the information they hold about the beneficial owners of overseas entities (such as data gathered as part of their KYC processes) and the information recorded by Companies House on the Register. The reporting requirement will be an ongoing duty, although it will only apply to "material discrepancies" defined as something that, by its nature, and having regard to all the circumstances, could be linked to money laundering or terrorist financing, or intended to conceal details of the customer's business.

What sorts of discrepancies should professional advisers watch out for?

The sorts of discrepancies that could be within scope include:

- a difference in name;

- an incorrect entry for nature of control;

- an incorrect entry for date of birth;

- an incorrect entry for nationality;

- an incorrect entry for correspondence address;

- a missing entry for a registrable beneficial owner; and

- an incorrect entry for the date when an individual became a registrable person.

1.3 Charities Act 2022 changes

At present, trustees of charities are subject to a number of restrictions when they sell, let or mortgage their land, including:

- an obligation when selling land, or granting a lease for more than seven years, to obtain a detailed report from a surveyor which must include advice as to marketing the land and the value of the land;

- a duty, when granting a lease for seven years or less, to obtain advice on the proposal from someone whom they reasonably believe has the ability and practical experience to provide them with competent advice;

- a duty to give public notice of the proposed sale or lease (and consider any representations made in response within a specified timeframe) when selling or granting leases of land which is held for stipulated purposes, and the trustees do not intend to acquire replacement land;

- an obligation, when granting a mortgage over land, to obtain advice on whether the loan is necessary to pursue the charity's purposes, whether the terms of the loan are reasonable, and on the charity's ability to repay the loan; and

- the need to obtain the consent of the Charity Commission before they can sell or let land to "connected persons" as defined in section 118 of the Charities Act 2011.

Compliance with these requirements can lead to significant professional costs and can also delay land transactions. In 2017, the Law Commission published its report "Technical Issues in Charity Law" which made a number of recommendations to maximise the efficient use of charitable funds whilst ensuring proper safeguards for the public. The recommendations included giving charities more flexibility to obtain tailored advice when they sell land, and removing unnecessary administrative burdens.

This report culminated in the Charities Act 2022. Sections 17 to 23 of the Charities Act 2022 are expected to come into force this Spring. These will:

- amend the current rules on charities disposing of land, to clarify when the statutory restrictions apply;

- remove the automatic statutory requirement to advertise a proposed disposition; and

- expand the category of advisers who can provide a charity with advice on disposals of charity land to include fellows of the National Association of Estate Agents and fellows of the Central Association of Agricultural Valuers.

Originally published 10 May 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.