Tradition: It's the basis for how investment banks tend to recruit talent and define roles and career progression. While firms have made some changes, the overarching traditional model is fraught with problems – and opportunities for improvement. Consider that investment banks:

- Pay their analysts an enormous amount of money to create pitch books and run basic valuation models

- Are unable to consistently retain or convert analysts and associates

- Struggle to rationalize the cost of directors against actual productivity

- Often lose high-quality executors who cannot sell because of the "up or out" model

Breaking the expensive, single career-path model into pieces is worth considering. It has the potential to save money and retain talent. It also allows firms to focus on the actual skills employees need today rather than the skills of a hypothetical future.

The traditional career progression model

When investment banking was reaching its peak in the early 2000s, the model was easy to explain, if not terribly efficient. Organizations had three different jobs (with associates and directors in between) that required different skills, but organizations called that a single career path:

Analyst: This role creates pitch books and requires data modeling skills. Communication, project management and deal-making are limited.

Vice President: This role focuses on client communication, project management and requires financial/accounting knowledge.

Managing Director: This role focuses on deal-making, negotiation and sales.

Firms took some measure of pride in home-growing their managing directors, believing this reflected positively on their culture, the efficiency of their learning and development efforts and the example their leadership set.

That being said, there were bumps in the road. For example, vice presidents and directors who were solid, useful executors often did not have the personality to generate revenue. This made it difficult to figure out what to do with them in the traditional "up or out" model. A great executing vice president who could never sell needed to find another job.

How the boutique banking era affected career progression

A bevy of banking boutiques sprung up seemingly overnight. Given the small size of these firms, there was limited on-campus recruiting, no analyst programs and no tradition of moving managing directors up the career ladder.

I had the pleasure of working with many of these firms in their early days and, when I asked about growing analysts into managing directors, the most common response was, "Who cares? I can just hire a managing director from another firm. What difference does it make?"

This was a jolt to the system – and it gave boutiques a tremendous economic boost. They didn't have to overpay for entry-level banking talent, and they quickly made peace with hiring for the skill they needed most: deal making.

To be clear, these boutiques did hire analysts and associates and vice presidents, but they cared less about growing managing directors. Some of these firms began creating dual career paths, which allowed powerhouse executing vice presidents and directors to stay even if they couldn't sell.

As private equity and hedge funds began raiding the talent larders of large investment banks, it became harder to rationalize pay rates. More than one large investment bank bemoaned that "we are spending a fortune to train these kids so that a year or two later they are ready to work at a hedge fund!"

Given the expense of this talent and how hard it was to retain them, firms took the simplest approach: They paid them even more.

The shift to a skills-based approach

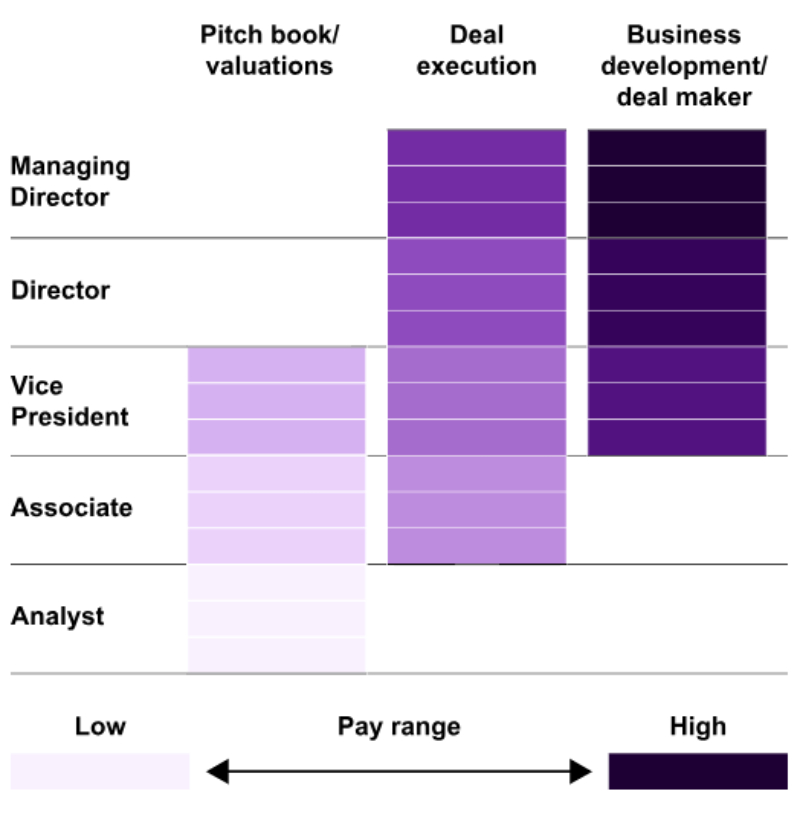

Fast forward to 2024 and we see investment banks' keen interest in skills and how they can be used to unlock business value. Figure 1 shows a high-level approach to optimizing organizational design while conserving costs.

Figure 1. To optimize their organizational design and conserve costs, investment banks can be more discrete in how they pay for different career paths

Figure 1 shows the different entry points for each path as well as the opportunity to switch paths based on current capabilities. Note that executing managing directors are not pushed out of the organization; rather, they don't get paid the same as producing managing directors. Analysts are paid like the entry-level staff they are, and there are no junior dealmakers – those don't exist, for the most part.

By critically examining the skills needed for each career path and then recruiting for those skills, investment banks have an opportunity for higher cost savings and lower turnover. And, by basing career progression more on capability and skills instead of tenure, employees who are slower growing or have plateaued but still contribute to the firm have a long-term home.

Applying 'up or out' to tradition

There is no single path forward for any organization. Figure 1 is intended to fuel conversations within your firm rather than serve as a blanket panacea for current and future talent struggles. However, daily we see the value that skills frameworks are unlocking for our clients across industries and geographies. And there is no indication that investment banks would be an exception to taking a skills-based approach to their career frameworks and paths.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.