Welcome to our second edition of Inform: SQC, our publication which focuses on news, comment and legal updates in the Smaller Quoted Companies (SQCs) sector with a particular focus on the AIM market.

I introduced the last edition of this publication with a gloomy review of the state of the IPO market. Things seem to be getting a bit better: as you will see from the numbers in 'Stato's Corner' below, October was a strong month for AIM admissions, seeing the highest number of IPOs and reverse takeovers in a month this year. These transactions raised total new money of £236m, which is also the highest monthly figure this year. November has continued the positive news with four new admissions to AIM. I appreciate that these "highest" tide marks are measured from a low base but one has to be positive!

Secondary issues also continue to be a feature of the market with almost 500 further issues having been made in October and November and £1.25bn raised. The rate at which companies are leaving AIM is slowing, although in November there were still 17 cancellations of admission, with the total number of companies on AIM standing 207 lower than it did in January of this year.

In the context of secondary placings we have taken a look in this edition at 'cash-box' structures which can provide a route around pre-emption restrictions on the issue of new equity.

With the remuneration of senior bank staff increasingly in the spotlight in respect bonuses, we have also considered the wider moves to control directors' pay and bonuses.

I hope you enjoy the issue.

Directors' pay and bonuses

Directors' pay and bonuses have come in for much criticism recently. Although not usually at the reported stratospheric levels of bankers' bonuses, there are concerns that directors are over-remunerated and can be rewarded for failure by generous option and bonus schemes which pay out even when a company's shareholders are sitting on losses.

There are currently two reviews being undertaken which look at aspects of pay and remuneration. Additionally, interested parties such as The National Association of Pension Funds (NAPF) are making their points of view felt.

The Walker Review on Corporate Governance and The Combined Code

The final Walker Review was published on 26 November. Although primarily focussed on banks and other financial institutions, from the scope of the findings it is clear that many of its recommendations could be imposed on companies outside of that group.

The Combined Code is currently in the process of being reviewed and the Walker Review reports that there has co-operation between David Walker and Sir Christopher Hogg, chairman of the Financial Reporting Council, which is undertaking the Combined Code review. Indeed, the Walker Review consultation paper noted that it "leaves for separate consideration how far Combined Code changes that are proposed in respect of [Banks and Financial Institutions] should be extended to provisions in respect of non-financial institutions".

For smaller quoted companies not in the financial sphere it is therefore possible that the remuneration recommendations contained in the Walker Review will eventually come to affect them.

Those recommendations include:

- Extending the remit of the remuneration committee to cover all aspects of remuneration policy on a firm-wide basis with particular emphasis on risk.

- Minimum shareholdings for senior staff.

- At least 50% of variable remuneration offered should be in the form of a long-term incentive scheme with half of any award vesting after not less than three years and the remainder after five years. Short-term bonus awards should be paid over a three year period with not more than one-third in the first year. Clawback provisions should be used.

The recommendation of putting in place clawback provisions has been criticised for numerous reasons, not least because an award subject to clawback will clearly have its value diminished.

The Combined Code review consultation paper specifically questions whether shareholders should have a greater role in setting remuneration. This is not to say that every single shareholder should be asked to suggest a figure for a CEO's pay (although the results of that survey would be interesting) but it would indicate that institutional shareholders should be consulted as to their opinion. The Walker Review also makes it clear that greater institutional dialogue with companies is desirable.

NAPF

NAPF recently wrote to the Chairman of each FTSE350 company to urge a continued focus on director pay and for a better alignment of remuneration policies with the long-term interests of shareholders. This was a follow up to a similar letter in February and NAPF noted that many companies had shown restraint when reviewing pay and remuneration this year. However, whilst recognising that it is in long-term investors' interests to reward management who perform well, NAPF is still looking for greater dialogue between companies and shareholders when it comes to executive packages.

Particular points made by NAPF are that bonuses should preferably be seen as a form of profit share and so, if profits are down, bonuses should follow that trend and preferably be partly paid in shares. Additionally, if share plan targets are lowered, NAPF expects that the potential awards should also reduced.

Acting now?

Is there anything a smaller quoted company should do now order to continue to attract executive talent, whilst at the same time avoiding institutional shareholder criticism or falling foul of any Combined Code/Walker Review recommendations becoming binding?

There are a number of avenues companies can explore:

- Increasing the scope of the remuneration committee so it takes a look at risk and reward throughout the company, not just at board level.

- Reducing the cash element of bonus packages in favour or shares and/or options.

- Exploring different ways to evaluate bonus targets. For example total shareholder return by reference to a reasonable peer group, which is seen as a "fairer" way of measuring performance as it tends to be more objective in nature.

Meaning of 'acting in concert' clarified for activist shareholders

Under the Takeover Code, if two or more shareholders co-operate as a group to obtain or consolidate control of a company they may be 'acting in concert'. Concern has been raised as to the extent to which this might catch shareholders collaborating in collective shareholder actions so that their combined shareholdings would be aggregated for the purposes of any requirement to make a mandatory offer for the company under Rule 9 of the Takeover Code.

In practice note no. 26, the Takeover Panel has given its view that a mandatory offer will only be triggered by activist shareholders if both of the following tests are satisfied:

- The shareholders requisition a general meeting to consider a board control-seeking resolution or threaten to do so.

- After the activist shareholders agree to propose or threaten a board control-seeking resolution, those shareholders then acquire shares which by reference to their combined holding would trigger a mandatory offer under Rule 9 (i.e. increasing their holding to 30% or more, or, if already between 30% and 50% acquiring any additional shares).

A resolution will not normally be considered to be board control-seeking unless it seeks to replace existing directors with directors who have a significant relationship with the requisitioning shareholders. If the primary purpose is to appoint additional non-executive directors to improve the company's corporate governance, or if the directors to be appointed are independent of the activist shareholders, the resolution will not normally be considered to be board control-seeking.

UK insolvency regime attractive to foreign companies

A recent decision of the High Court has attracted an unusual level of interest from overseas companies, despite the fact that it has simply confirmed the understanding of most insolvency lawyers of existing UK law. However, to the layman or non-UK commercial lawyer, the underlying facts of Re Bluebrook Limited (2009) may seem surprising.

Briefly, the case was brought by junior creditors of a company who objected to being dragged into a re-structuring arrangement by senior creditors which left them unpaid.

The seniority of a creditor is generally dictated by the security that it holds and the application of insolvency law but creditor ranking can also be agreed (or supplemented) by an inter-creditor agreement between a company's creditors. In this instance all of the creditors had entered into an inter-creditor agreement which made it clear that the senior creditors had first claim on the assets of the company in the event of insolvency. When the borrower company defaulted on its repayment obligations the senior creditors proposed a restructuring of the company which would see its business transferred into a new company in which the senior lenders would take the bulk of the equity. The new company would also assume some of the senior debt but all remaining debt would stay in the old company leaving its shareholders and junior creditors with a worthless entity.

The re-structure was carried out under a Scheme of Arrangement under Part 26 of the Companies Act 2006. Three quarters (in value) and a majority (by number) of the company's creditors could, with Court sanction, bind all other creditors into the arrangement. The law states that each "class of creditor" must vote at a separate meeting and that all class meetings must approve the proposals. In Re Bluebrook the junior creditors (who held less than one quarter of the total debt by value) argued that they formed a separate class of creditor and should therefore have a class meeting of their own (at which they could have defeated the proposals). The Court held that, even though a valuation at the date of the proposal made it clear that there was no value remaining for junior creditors, all of creditors nevertheless had a similarity of interest and should therefore be treated as one class. The Court was unimpressed with a second valuation produced by the junior creditors in support of their request for a separate meeting.

It is important to appreciate that Schemes of Arrangement are not new. They date back to the nineteenth century. This case is just a good recent example of how they can be useful to companies and their creditors in implementing a restructure. It has also promoted a debate amongst overseas companies about the merits of locating group holding companies within the UK in order to take advantage of this apparatus for use in future restructures.

Cash boxes and secondary issues - a route around pre-emption for secondary placings

Whilst the IPO market has been effectively closed for the last year, the wave of recapitalisations started in 2008 by UK financial institutions (including RBS and Lloyds TSB) has continued in 2009 (Lloyds Banking Group and HSBC). But with the increasing cost, and potential unavailability, of debt financing, many companies outside the banking sector have also chosen, or been forced, to tap the equity markets by secondary issues of their shares (i.e. an issue of shares of a company whose shares are already listed or traded on a stock exchange).

There has been significant UK activity in the real estate and mining sectors as companies have sought to rebuild balance sheets hit by falling asset values and consequent pressure on financial covenants, with recent secondary issues by companies such as British Land, Land Securities, Xstrata and Rio Tinto, to name but a few. Activity has also extended to other sectors, with capital calls from issuers including DSGi, Premier Foods and Sainsbury's.

There are a number of structures by which a secondary issue can be made and one of the biggest considerations is whether the issue is to be made on a pre-emptive basis. Under the Companies Act 2006, shareholders have the right to be offered new shares which are being offered for cash on a basis that is pro-rata to their existing shareholdings (pre-emptive rights) unless this right is waived in general meeting. However, if the issuer company has existing shareholders or new investors willing to invest immediately, it may wish to allot shares to them without having to make a pre-emptive offer to all its shareholders and waiting weeks to obtain a waiver of the pre-emptive rights at a general meeting (assuming the issuer already has sufficient shareholder authority to allot shares). A non pre-emptive structure can therefore provide access to funds for companies quickly and involve only the parties willing to invest.

The difficulties are that a non pre-emptive issue can only be made to the extent that the statutory pre-emption rights have been waived. Typically the relaxation a company obtains at its AGM each year will allow a non pre-emptive issue of up to 5% of the company's share capital (this threshold is in the guidelines of the Association of British Insurers (ABI), adhered to by the majority of LSE and many AIM companies). Therefore, where a company is limited by pre-emption rules and there is no time or desire to hold a general meeting, new structures have been used, of which the 'cash box' has become increasingly prominent.

'Cash box' structures

The structure of a cash box transaction can be illustrated by considering a scenario in which an issuer, whose shares are listed and traded on the LSE, has agreed to acquire a target company but has insufficient cash reserves and borrowing facilities to fund the acquisition. The issuer wishes to raise the funds through a placing of its ordinary shares with institutional shareholders, but the size of the placing means that the issuer would have to call a general meeting to disapply pre-emption rights. A cash box structure is intended to fall within a statutory exemption from pre-emption, and so the issuer's investment bank recommends that such a structure is used to enable the issuer to obtain funding without seeking shareholder approval.

The exemption relied upon (from the requirement for a pre-emptive offer) is that the subscription for shares in the issuer company is not made for cash.

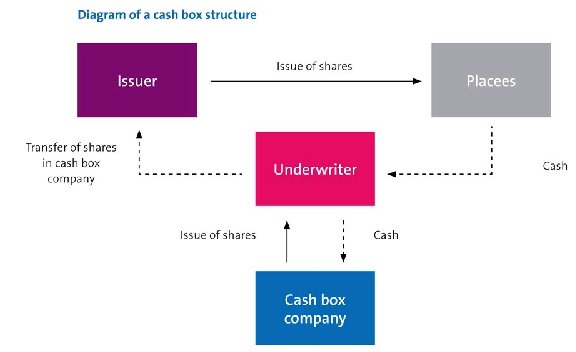

The bank will subscribe for redeemable preference shares in the issuer's newly incorporated subsidiary (the cash box company) and undertake to pay the subscription price for those preference shares. The subscription price will be expressed to be a sum equal to the proceeds of the issuer's placing. The bank may also subscribe for ordinary shares in the cash box company. The bank will then carry out the placing of shares in the issuer and identify those persons who wish to take up the placing shares (the placees), following which the placing shares will be issued to those placees nominated by the bank. The bank will receive the proceeds of the placing and use those proceeds to pay the subscription price for the preference shares and the ordinary shares. Finally, the preference shares and the ordinary shares subscribed by the bank are transferred to the issuer in consideration of the issue of the placing shares to the placees (see diagram below).

If the placing shares are not issued, the bank will require a mechanism to unravel the transaction. In addition, the placing may or may not be fully underwritten by the bank depending on the likelihood of the placing shares being taken up by placees.

Whilst the cash box structure can allow a company to circumvent pre-emption restrictions, in particular where an issuer requires access to funding on short timeframes, it has recently come under increasing criticism by the ABI. The ABI views the structure as a 'device being used in a way that circumvents both the statutory requirements to observe pre-emption rights and the ability of shareholders in general meetings to decide on the extent to which pre-emption rights may be disapplied'. The ABI does not have statutory powers, but does influence the majority of the UK's largest institutional investors. It may take a more restrictive stance on cash boxes for next year's AGM season.

Tier 1 – Migration Advisory Committee (MAC) report

In response to a request by the former Home Secretary, the MAC has published a report on Tier 1 of the Points-Based System (PBS). Tier 1 migrants are highly skilled individuals who are not tied to a specific role or employer and do not require a sponsor.

The MAC has considered evidence from leading experts including

Speechly Bircham and has recommended a number of changes to Tier 1,

some of which may benefit potential applicants although others are

more restrictive.

These include:

- reinstating the ability to claim points for a bachelor's degree (subject to a high level of earnings);

- workers without any degree level qualifications must have earned at least £150,000 in the previous 12 month period;

- making points available for age for those aged 39 and below;

- initial leave to remain entitlement to be reduced to two years, from three years; and

- all applicants must have earned at least £25,000 in the previous 12 month period.

The UK Government is expected to respond to these recommendations

early this year.

Identity cards for Tier 2 migrants

From January 2010 migrants applying to extend their stay in the UK for more than six months under Tier 2 of the Points-Based System will be issued with a biometric identity card.

As part of the application process they will be required to submit

their biometrics (fingerprints and photograph). To speed up

submission of biometric information the UK Border Agency has

expanded the number of centres where the biometric information can

be given.

Biometrics can be enrolled at any Public Enquiry Office, dedicated

biometrics enrolment centres or at a limited number of Crown post

offices. Apart from the post office service which offers a walk-in

service, migrants must pre-book their appointment. The post office

service is only available to those migrants who receive a letter

inviting them to use it.

In London the walk-in service is available at the post office on

Old Street and pre-booked appointments are available at the

biometric enrolment centre in Elephant and Castle and the Public

Enquiry Office in Croydon.

Forthcoming changes to Tier 2

The Government has announced a number of changes to Tier 2 which will come into force in spring 2010. Employers who wish to sponsor non-EEA (or non-Swiss) nationals in the UK after the changes come into force will have to ensure that the individual:

- will earn at least £20,000 rather than the current minimum of £17,000, to gain points for earnings;

- will need to earn at least £32,000 if they cannot claim points for qualifications; and

- has 12 months, rather than 6 months, overseas experience with the employer before transferring to the UK on an intra-company transfer.

Employers should be aware that employees who come to the UK as an intra-company transferee will no longer be entitled to permanent residency after five years.

The UK Border Agency is also considering introducing a separate

intra-company transfer route for graduates who have three months

prior overseas experience with their employer before transferring.

However, these employees may only stay in the UK for 12 months.

Further information about this proposed new route should be

available shortly.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.