WTW recently partnered with Winmark to produce the 2024 edition of the PensionChair Remuneration Report covering topics such as pension trustee remuneration, time spend and perceptions of trusteeship.

The report surveyed 140 Chairs and trustees of UK pension schemes, representing funds with a combined value exceeding £340 billion, making it the largest and most comprehensive study of its kind.

This article highlights some of the key themes and statistics from the report, which offers valuable insights for schemes, sponsors, and industry professionals.

Remuneration

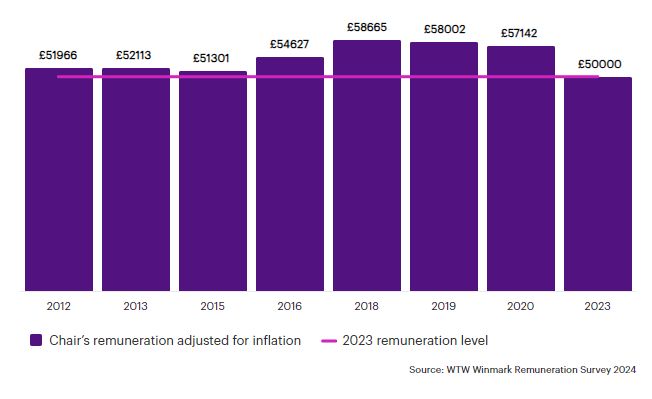

Trustee Chair remuneration has increased nominally since the last survey which covered the calendar year 2020, but has decreased in real terms, as UK inflation peaked at 11% in 2022 and remained above 6% for most of 2023. The median remuneration for 2023 is £50,000 per annum. This represents a substantial decrease when adjusted for inflation (as shown in the chart below). That said, some correction is anticipated in 2024, as nearly half (48%) of respondents expect a remuneration increase, driven mainly by inflationary pressures.

Figure 1: Chair's remuneration adjusted for inflation

The report also explores the factors that influence remuneration levels, including scheme size and sector, trustee role designation and professional background. Some of the notable findings include:

- Perhaps unsurprisingly there is a strong correlation between the size of the scheme and the median pay for the Chair; Chairs of schemes with assets in excess of £5bn earn over three times the amount that a Chair of a sub-£100m scheme earns.

- Professional trustees receive higher remuneration than other trustee roles, with a median of £62,000 per annum for professional trustees from a firm and £50,000 per annum for professional trustees not part of a firm.

- Hybrid schemes pay the highest median remuneration to their Chairs, at £63,600 per annum, followed by Defined Contribution schemes at £45,000 per annum and Defined Benefit schemes at £43,000 per annum.

- Chairs with backgrounds in Law or Accountancy receive the highest median remuneration.

- Female Chairs receive higher median remuneration than male Chairs, at £52,000 per annum and £48,000 per annum respectively. This trend can be partially attributed to the higher proportion of female respondents who are professional trustees (50%) compared to male respondents (37%).

- Chairs with 5 to 9 years of prior experience as a trustee or a Chair receive the highest remuneration.

- Chairs' remuneration increases with the number of working days per month, with a median of £64,000 per annum for those who work 5 or more days per month.

Despite the nominal increase in remuneration, 40% of Chairs feel that their remuneration does not adequately reflect the pressures and complexity of their role, while a third feel that remuneration levels are too low to attract sufficiently skilled Chairs and trustees. The main reasons given for these views are the required time commitment, the increasing complexity and regulation, and the responsibility and liability involved in the role.

Time allocation

The report also examines how Chairs allocate their time across various activities on an annual basis.

The findings show that Chairs spend 42% of their time on board and committee meeting preparation and attendance, and only 11% on strategy and planning. This was a surprising find as schemes are increasingly moving towards end-game scenarios and The Pensions Regulator has placed a greater emphasis on risk management, both areas requiring strategic discussions.

We may see an increase in time spent on strategic discussions in this calendar year and the next, as schemes look to implement the new risk aspects of the General Code and as the new funding regime comes into force for schemes with an effective valuation date on, or after, 22 September 2024.

However, increasing time allocation to these areas may present challenges given the time constraints faced by many Chairs, as highlighted in the report. The proportion of Chairs who agree that they don't have enough time to meet their responsibilities is gradually increasing in each survey wave - from 5% in 2019, 10% in 2020, 16% in 2021 and up to 27% now.

"The role of Trustee Chair of a multi-billion-pound Fund is crucial to its success. It is every bit as difficult and important as running a similar sized company but pay is significantly lower."

There may therefore be value in looking for ways to spread the load. Amongst the options available, Chairs may opt to dedicating more time to 'engagement with other trustees outside of board and committee meetings', which currently occupies 8% of Chair time or to focus time on increasing the sense of inclusivity within the board to encourage more collaboration.

Succession planning and diversity

The report indicates that diversity and inclusion initiatives appear to have been embraced positively, with responses showing those implemented most to date included reviewing recruitment practices and material, and changing trusteeship practices (eg introducing a fixed term or maximum number of terms).

An overwhelming obstacle to increasing diversity on trustee boards, as highlighted in the report, is a lack of diverse candidates applying for the relevant roles, cited by 92% of those who identify a barrier. The perceived lack of diverse candidates suggests that future efforts should focus on broadening the talent pool and making trustee roles more accessible and attractive to applicants. More than half of respondents agree that 'remuneration of member-and employee nominated trustees (MNTs and ENTs) is necessary to get a good pool of talent'.

Although 82% agree that 'trusteeship provides attractive development opportunities' for potential candidates, 34% feel there are 'not enough new trustees entering the profession'. This mirrors the attitudes expressed in 2021 (where the numbers were 71% and 31% respectively) and has been a consistent theme for several years which raises the question of succession planning faced by many schemes.

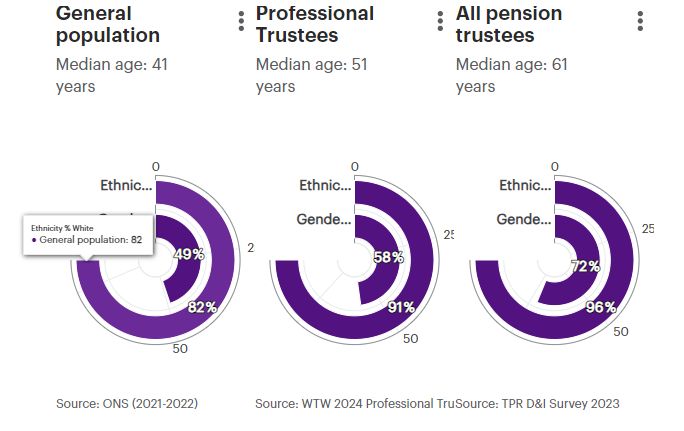

However, the growth of professional trustee firms may help address this. A survey we conducted of the IPT firms earlier this year showed that compared to the wider population of Trustees, professional trustees are typically more diverse from a gender, ethnicity and age perspective. In each case, they are closer to the general population, albeit the position varies between firms.

Figure 2: Could independent trustees increase diversity from a gender, ethnicity and age perspective?

Some professional trustee firms tend to provide opportunities for individuals to pursue trusteeship as a career path, rather than one to start after completion of a main career. This could help to broaden the pool of potential trustees and increase the diversity of skills and backgrounds on trustee boards. However, it also raises questions about the balance between professional and lay trustees, and the representation of scheme members and employers.

Conclusion

In conclusion, the report reveals some interesting trends and challenges in the recruitment and remuneration of pension scheme trustees and Chairs. It shows that remuneration levels may be a factor in attracting and retaining skilled and diverse candidates, especially for MNTs and ENTs. The report provides valuable insights for schemes and regulators to consider how to improve the quality and sustainability of pension governance.

To request the full report, please contact us.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.