- with readers working within the Accounting & Consultancy industries

Background

A series of cases have been working their way through the UK courts in which HMRC has sought to apply the tax charge for "miscellaneous income" to variants of a remuneration planning scheme used by fund managers. In December last year the Court of Appeal, in BlueCrest Capital Management LP and others, upheld HMRC's view in relation to one iteration of the relevant arrangements, and that court has now considered another in HMRC v HFFX LLP and others.

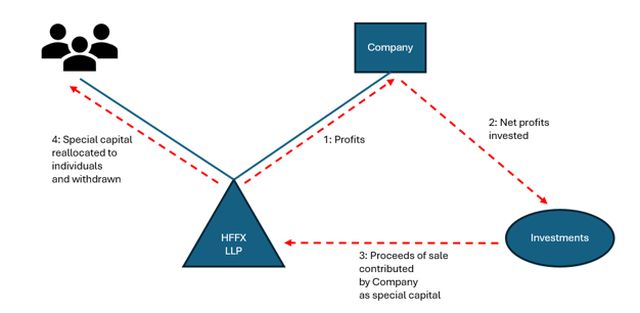

In HFFX, profit share that would otherwise have been allocated to individual members of an LLP was instead allocated to a company member. The company paid corporation tax on those profits and invested the net amounts. These investments were sold in tranches over three years and the proceeds contributed back to the LLP as "special capital". The special capital was then reallocated to the relevant individuals and they were able to withdraw it. HFFX contended that no income tax was payable by the individuals on the reallocation or withdrawal.

Here is a simplified diagram of the arrangements:

Decision

Although a number of conditions must be fulfilled for the miscellaneous income charge to apply, the only one under dispute before the Court was the requirement for the relevant income to have a "source".

The Court found in favour of HMRC, confirming that taxpayers do not need to have a legally enforceable right to a payment for there to be the necessary source. Whilst a pure gift will not meet the source requirement, the individuals had rights to a proper exercise of the company's discretion to reallocate special capital to them (despite wording in the partnership deed saying that that discretion was "sole and absolute"). The company's decisions in favour of the individuals, in combination with their rights under the partnership deed which provided the legal context for those decisions satisfied the source requirement.

Comment

Given HMRC's success in front of previous tribunals and courts in relation to the application of the miscellaneous income rules to "special capital" planning, the Court of Appeal's decision is far from surprising.

That planning was fairly aggressive, but fund managers have been concerned that HMRC may be encouraged by its success to apply the miscellaneous income charge (which has been on the statute book for some time but previously little used) more widely to their remuneration arrangements. Concerns in that regard were not eased in January, when the First-tier Tribunal (in The Boston Consulting Group) applied the charge to an (arguably) less aggressive structure used by a non-asset manager.

Although the Court of Appeal's decision in HFFX is in line with its ruling in BlueCrest, it does throw some helpful further light on the source requirement and indicates that it may be hard to persuade a court that a payment pursuant to a contractual discretionary remuneration arrangement is sufficiently voluntary to mean that that requirement is not met.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.