The European steel industry remains in a prolonged period of difficulty. Demand has returned to crisis levels, following only a slight improvement since the sharp downturn during the 2008 financial crisis. European steel companies face increasing costs and shrinking margins, the result of a continuous price drop over the past three years. Meanwhile, low-cost steel from China and other Asian countries intensifies the pressure on the market, despite the introduction of import customs duties designed to give European companies an advantage.

Steel companies across the continent have announced bold measures in response, including a sharp reduction in production capacity and mass layoffs, in the recent case of ThyssenKrupp. Unsurprisingly, the media is increasingly reporting on these challenges, and questioning the European steel industry's fundamental right to play in the global market. Are further job cuts necessary for the industry's future success and longevity?

In this article, we examine the challenges facing the industry, and recommend strategies for European steel companies to establish a more secure and resilient position.

The steel crunch: A challenging outlook for the industry in Europe

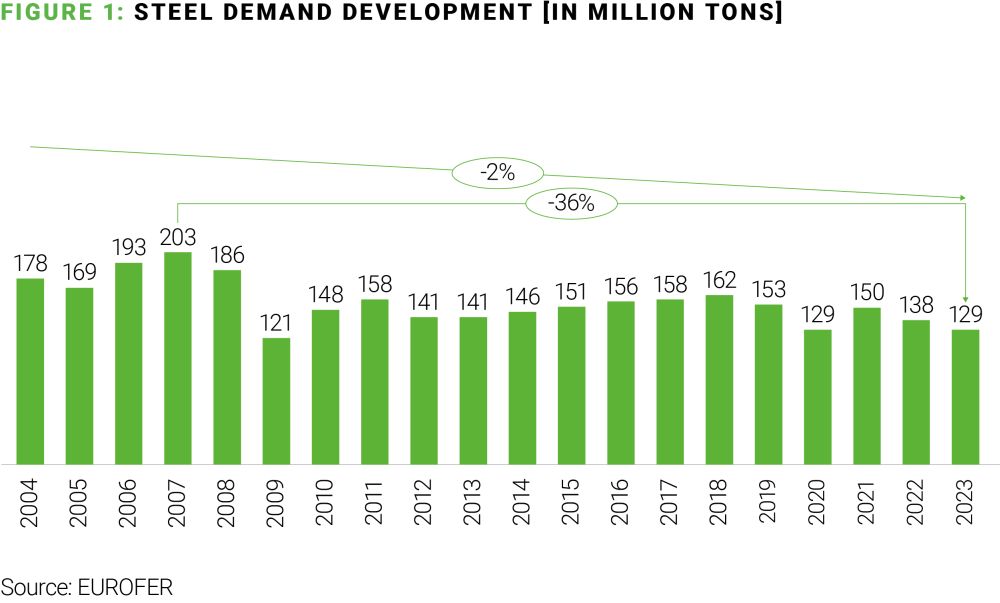

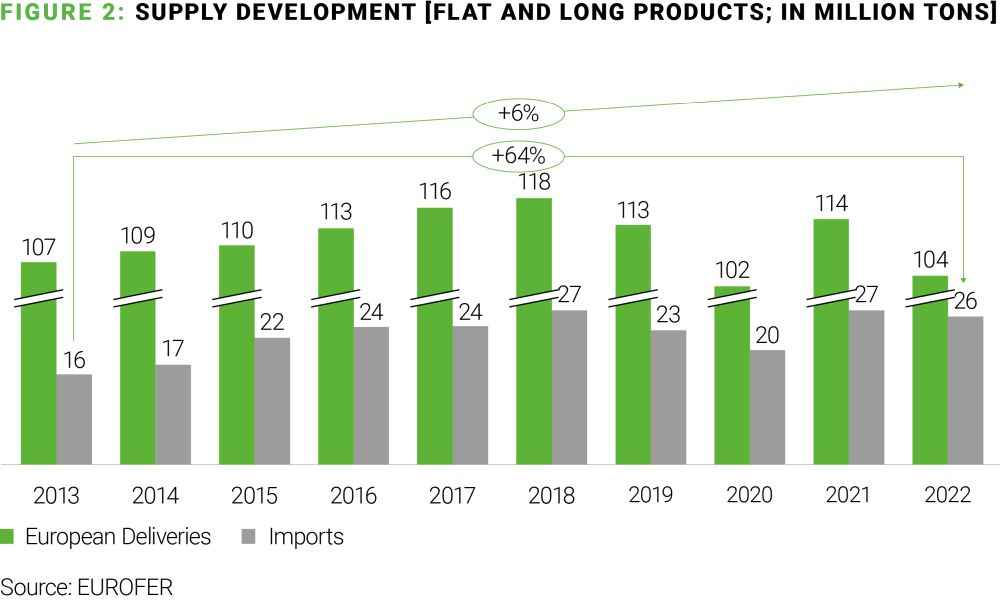

European steel demand has decreased by 36% since 2007, and is almost at its lowest level since the financial crisis in 2009 (figure 1). At the same time, imports from outside Europe have increased and now account for over 20% of supply (figure 2).

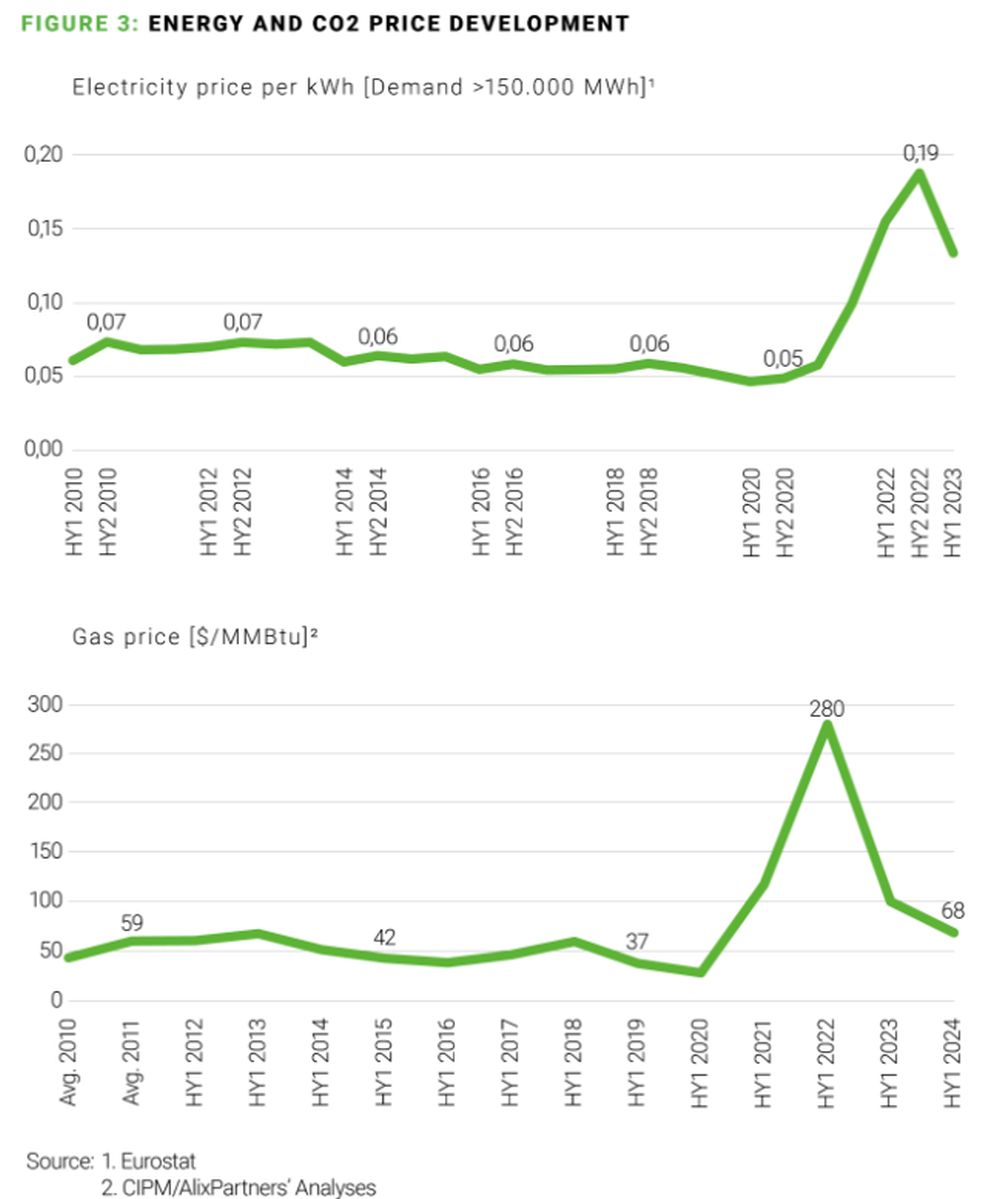

In addition, European steel production is characterized by a worsening combination of energy price uncertainty, inflation, and weak demand in key sectors:

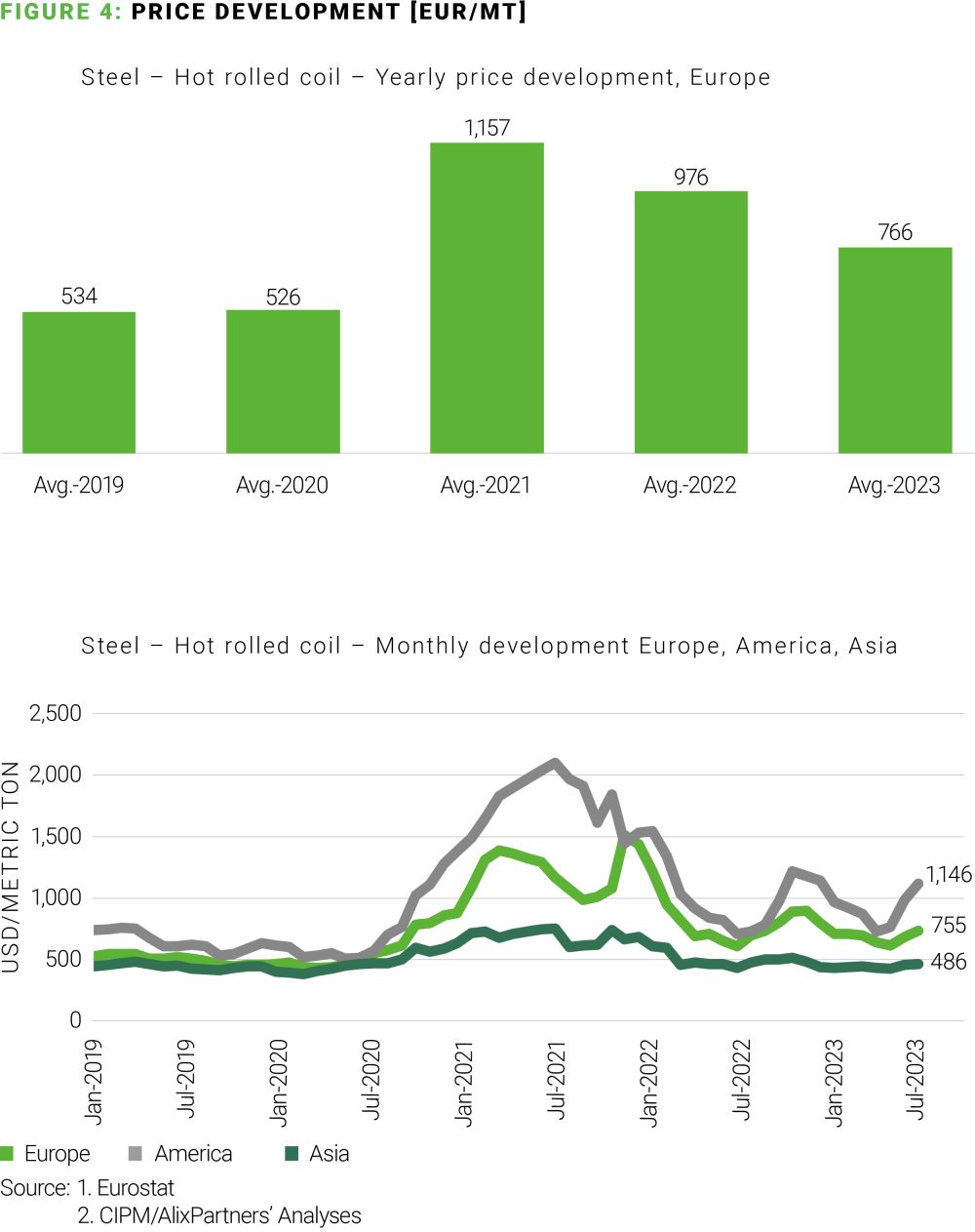

- Energy and raw material costs: Input costs for energy and raw materials continue to increase, impacted by the COVID-19 pandemic and the Ukraine-Russia war (figure 3); hot rolled coil saw a 120% price increase from 2019 to 2021 (46% from 2019 – 2023) (figure 4). Initially, this was not an issue, as a steel shortage led to high prices that could be realized in the market, but this high price could not be maintained, due to dampened demand driven by the current weak European economy. The price of hot rolled coil had to be reduced in 2022 and again in 2023 (figure 4), despite cost increases, leading to margin erosion and the broader industry problems that prevail.

- Weak performance in key sectors: The construction and automotive industries, representing 35% and 18% of steel consumption in Europe respectively, show particularly weak performance and are not expected to improve in the near future.

Companies are adjusting to this new demand reality by reducing production capacities in Europe, with an impact on jobs. The steel industry is an important part of the European economy, representing over 2.5 million jobs (combining induced, indirect, and direct), but direct employment in the industry decreased by 6% from 2015 to 2022 (from 327,000 to 306,000 jobs).

What this means for European steel

The outlook for the European steel industry remains challenging. Demand for steel is expected to remain stagnant or decline slightly in the short term, due to ongoing economic uncertainties and slow recovery in key sectors.

There are, however, some standout opportunities for growth:

- Green steel production: Increasing demand for environmentally friendly materials could open new markets for green steel, produced with reduced carbon emissions.

- Technological advancements: Increasing automation and adoption of new digital technologies create the potential for significant efficiency gains and cost reductions.

Nevertheless, adjustments to the new demand reality are needed. ThyssenKrupp's Duisburg plant recently announced a 17% reduction in annual production capacity, stating that these measures were necessary to ensure a secure and competitive future. But is a reduction in capacity sufficient in addressing the underlying challenges? The reliance on customs duties on imports from China raises the question of what might happen if other countries, such as India or Japan, were to offer similarly low steel prices.

How European steel companies can survive the steel crunch:

Based on our work with leading companies, we recommend a

combination of shorter-term and longer-term strategies.

Short-term, tactical recommendations:

- Cost management and efficiency improvements:

Steel companies must reduce costs and increase efficiency to remain

competitive, through measures such as optimizing production

processes, reducing overcapacity, and lowering administrative costs

– as in the case of ThyssenKrupp's plans to reduce

production capacity at its Duisburg plant.

- Flexibility and adaptability: Given the volatile market conditions, companies need to be flexible and able to adapt quickly to changing demand. This may require developing new products or adapting existing production facilities to respond to changing customer requirements. For example, developing lightweight steel for the automotive industry, or steel for renewable energy applications. So, overall structures of European steel companies need to be more flexible to be able to react to market changes.

Mid-term, strategic recommendations:

- Focus on high-margin products and special

applications: Success lies in manufacturing special

products with high margins, and having the necessary expertise to

produce them in high quality. European steel companies should

prioritize quality over quantity, and move away from low-margin

mass products. ThyssenKrupp generates a significant portion of its

revenue from highly specialized steel for the automotive industry,

sold at high margins thanks to special processing and alloys.

- Healthy downsizing: It is essential for

companies to strategically reduce capacity and focus on high-margin

products, to remain profitable and competitive longer-term.

- Diversification and strategic alliances: To

reduce dependence on the European market and explore new growth

opportunities, companies should pursue a strategy of

diversification and strategic alliances. This could include

entering new markets in emerging industries, or engaging in

strategic partnerships with companies in related sectors –

such as automotive manufacturers or machinery companies – to

jointly develop innovative products and access new markets.

An example of successful diversification is the collaboration between ArcelorMittal and Gestamp, an international group specializing in automotive components. This partnership focuses on developing lightweight steel solutions essential for producing fuel-efficient and electric vehicles. By diversifying their product offerings and entering the burgeoning electric vehicle market, ArcelorMittal has positioned itself to benefit from the growing demand for sustainable automotive solutions.

Voestalpine´s Resilience

Voestalpine stands out as one of the few European steel manufacturers reporting positive results, showcasing resilience despite the adverse market conditions. Key factors contributing to its success include:

- Specialization in high-quality products:

Voestalpine focuses on high-margin products, such as specialty

steel for the automotive, aerospace, and energy industries. Its

investment in advanced technology and quality assurance allows the

company to produce steel with unique properties that are in high

demand.

- Innovative solutions: The company continuously

invests in research and development to create innovative steel

solutions. For example, its lightweight, high-strength steel

products are crucial for the automotive industry, which seeks to

reduce vehicle weight and improve fuel efficiency.

- Sustainability initiatives: Voestalpine is a

leader in green steel production. It is actively working on

reducing its carbon footprint through initiatives like H2FUTURE, a European project that aims to

produce hydrogen-based steel. This positions Voestalpine favorably

in a market increasingly concerned with sustainability.

- Financial performance: Voestalpine reported revenues of €16.7 billion and an EBITDA of €1.7bn for FY 2023/24, showcasing their strong financial health compared to other European steelmakers struggling with losses. Voestalpine is still impacted by the current negative development of the automotive industry – revenue was in FY 22/23 with €18.2 bn and an EBITDA of €2.5 bn quite higher– but remains competitive.

The way forward

The European steel industry faces significant challenges, but there are clear paths to sustainability and growth. The road to recovery and long-term success involves a strategic downsizing to focus on high-margin, high-quality products rather than low-margin mass production. This process will not be quick or easy; it requires substantial adjustments, including reducing overcapacity and making significant investments in technology and innovation.

Adopting a flexible approach to rapidly changing market conditions and forming strategic alliances can help European steel companies diversify and reduce their reliance on the European market. Emphasizing specialized products, innovation, and sustainability can lead to positive financial outcomes, even in challenging times.

Ultimately, the European steel industry must embrace these changes to secure its future. By committing to these strategic measures, the industry can overcome current difficulties and establish a more competitive and resilient position in the global market. From our perspective, this is the only viable path for achieving long-term success and ensuring the industry's right to play in the future.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.