Grocers exploring mergers of their own to better compete with a combined Kroger-Albertsons probably don't need to worry about getting sued by the FTC – but making that assumption would be a high-stakes gamble given how the pursuit of any deal devours management time and stalls progress on other work.

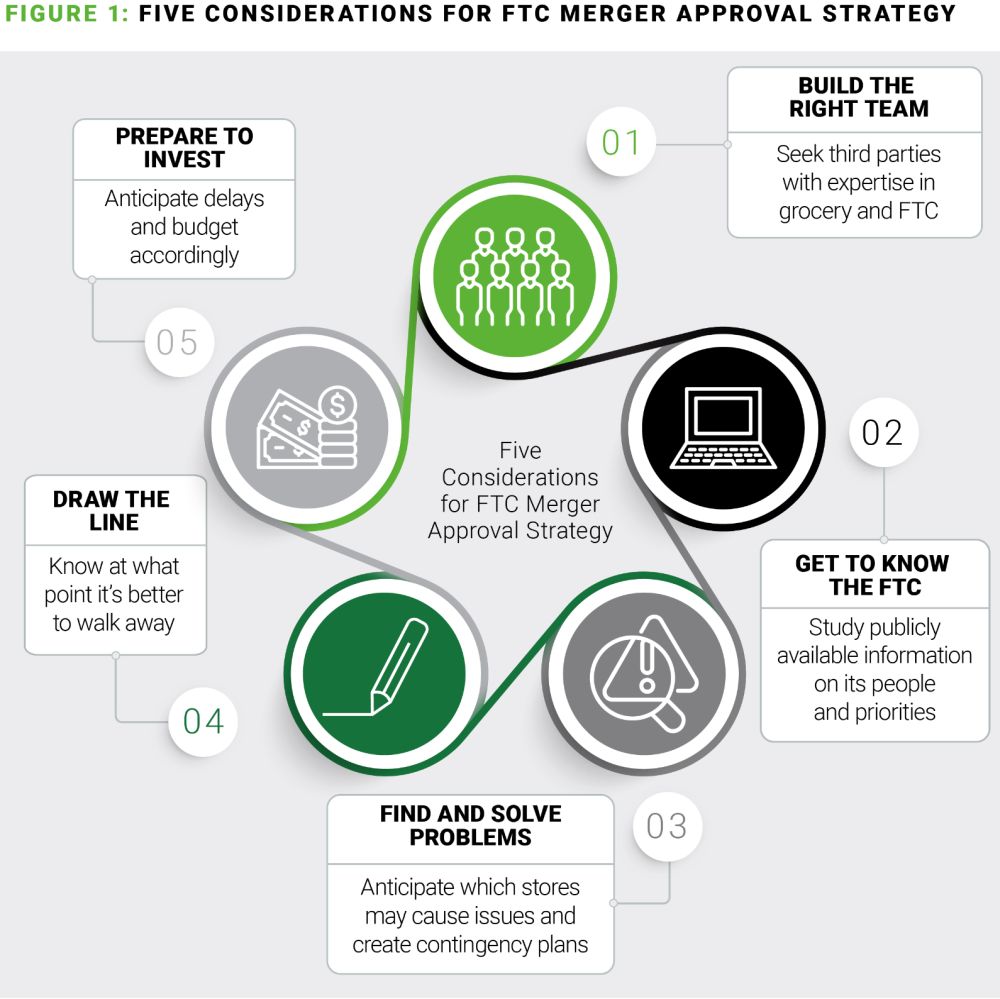

To lower the risk, grocers need to recognize early in the process which aspects of a deal could invite pushback and determine if they can adjust them to the FTC's satisfaction. We recommend five steps.

1. Build the right team.

As grocers seek lawyers, consultants and other partners to help them navigate the merger process, they should look for knowledge and experience in grocery and with the FTC. Ideally, they should find third parties that have taken other grocers through the approval process. Having team members who have recently engaged with the relevant people in the agency can provide invaluable firsthand knowledge.

Grocers should also seek partners that are relatively creative in their thinking and ways of working. While there are certain elements of the FTC approval process that are very structured, resourceful advisors can identify opportunities to present information and perspectives that don't fit into the FTC's standard boxes and thus have a better chance to create a productive dialogue.

2. Get to know the FTC.

A deep dive into publicly available information on the priorities and personalities of the FTC can go a long way in preparing grocers for any opposition they may encounter as they pursue a merger.

The agency's strong response to the Kroger-Albertsons deal certainly didn't surprise anyone who has studied FTC chair Lina Khan, for example. She wrote her doctoral thesis on Amazon being anticompetitive. That document and others provide a window into her thought process, what she values and doesn't value. Reviewing such materials is an easy way to start to understand where the agency is coming from.

Similarly, examining the outcomes of other recent mergers can shed light on which areas the FTC has frequently been calling out as problematic and how those issues were resolved. Often some of the back-and-forth becomes public once a deal is approved, and much can be learned from those exchanges.

For example, one variable of which grocers should be aware is the inconsistency in how the FTC defines competition – what they term the "relevant product market." While most grocers would say their competitors absolutely include not only other supermarkets but many other formats as well – particularly supercenters, club stores, natural and organic stores, discounters and dollar stores – the FTC often takes a different view. Grocers will want to do their homework on the precedent that's been set.

3. Find and solve the problems.

Mergers that involve overlapping store footprints are much more likely to draw close scrutiny and opposition from the FTC. Companies that operate in the same geographic area will want to identify any potential trouble spots and consider ways to mitigate them. They might ask questions like the following – the first two of which, at least, the FTC will certainly examine as well.

- How much market share will the new company have in each of its markets?

- How much more concentrated will each market become as a result of the merger?

- In how many of those markets are there national competitors that create price pressure?

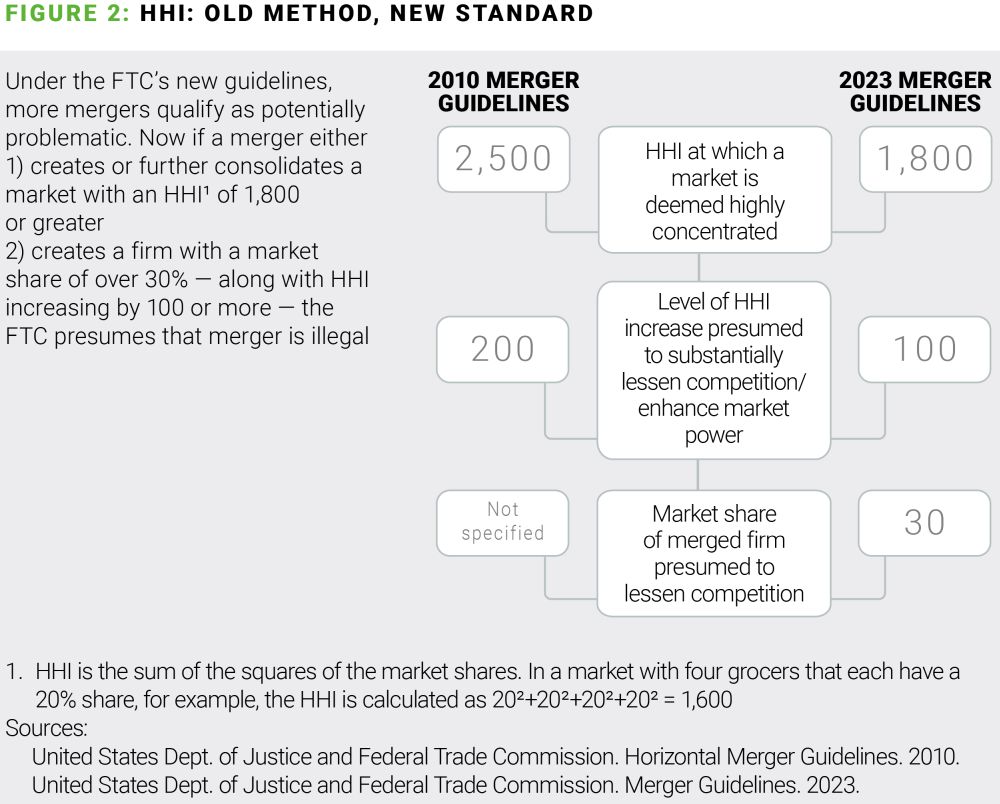

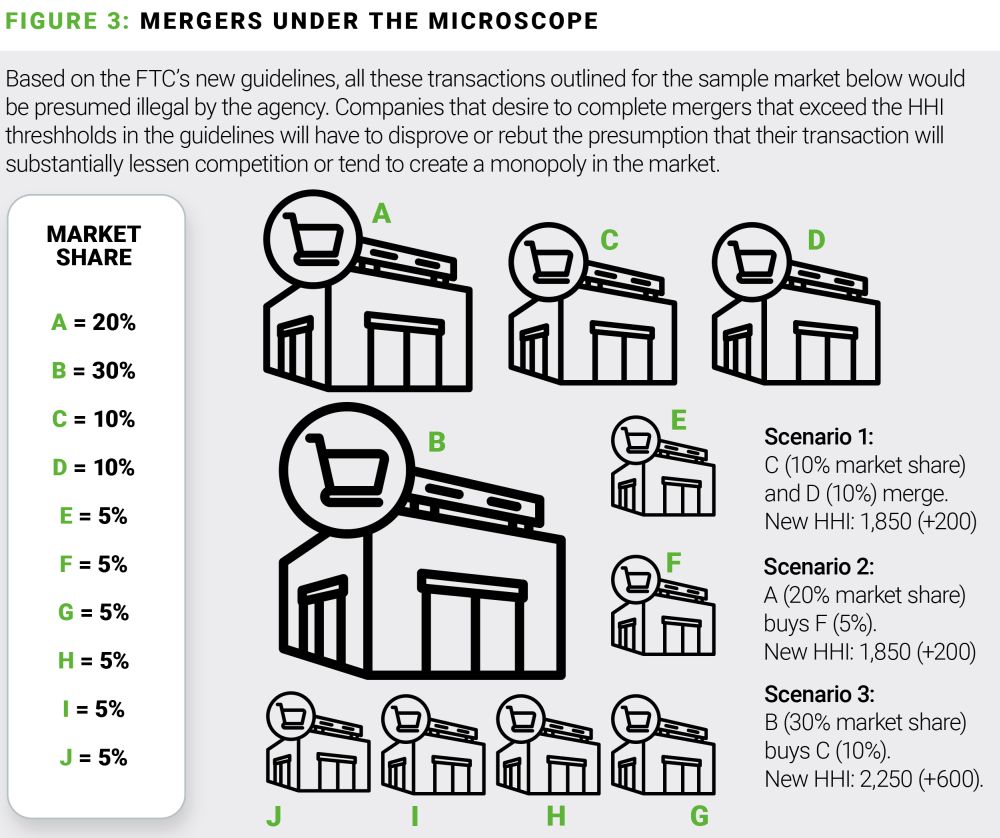

As the companies evaluate their footprints, they need to keep in mind the FTC's point of view and where they're most likely to raise concerns. For example, while FTC has long used the Herfindahl-Hirschman Index (HHI) to measure market concentration, the agency changed in late 2023 the key parameters it uses to evaluate deals (Figure 2).

Due to these changes, transactions that might have merely drawn scrutiny under the old guidelines are now presumed illegal from the start. (Figure 3). By the time the deal is submitted for approval, the companies should be able to present a comprehensive plan to solve any such issues they expect the FTC to identify.

4. Draw the line.

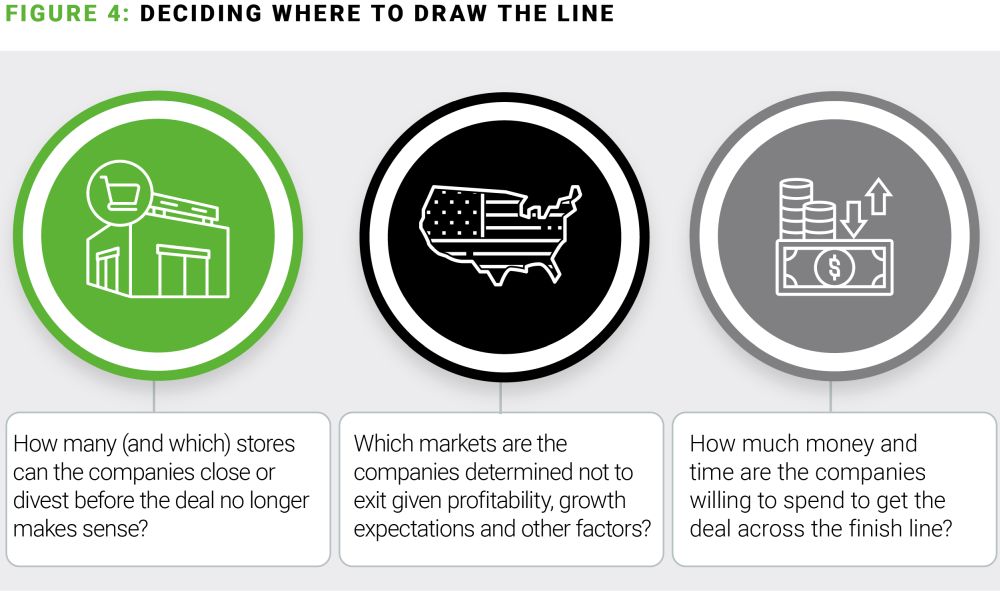

Despite the best efforts of two companies to anticipate what the FTC's problems with a deal will be, there will be surprises. The FTC might suggest divestitures in markets other than the ones the companies identified. It might find insufficient a third grocer to which the companies plan to divest stores. It might require more stores to be divested than the grocers had originally planned. It might take significantly more time than expected for the process, consuming more money and executive focus.

Companies have to be ready to barter, but they also have to be ready to walk away if the FTC declines to accept the minimum parameters that the companies know they need to succeed long-term. It's been nearly two years since Kroger and Albertsons announced their intent to merge, and according to Cincinnati news station WCPO, the companies have invested $864 million to date in their pursuit of the merger, from legal and consulting fees to financing costs to employee-retention expenses and more. No one outside the Kroger-Albertsons process knows what their cut-off number is, but for any merging companies, it's essential to know what that line in the sand is early on and be willing to stick to it.

Grocers need to run the numbers in advance to understand at what point the benefits of the deal are outweighed by the sacrifices required to make it.

5. Prepare to invest.

Grocers should budget generously when they estimate what it will cost them to get a merger across the finish line. The FTC approval process obviously happens before the deal can even close, and lengthy delays can happen. Companies have to understand that the time required of their lawyers, bankers and other third parties as the process unfolds can add up quickly, and they need to plan accordingly.

Grocers don't need to be intimidated by the posture the FTC has taken toward the Kroger-Albertsons merger. While agency opposition is always possible, it doesn't mean a merger isn't worth pursuing. It just means grocers need to do their homework and prepare to be tested.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.