The long-awaited legal regulation on crypto assets, the "Law No. 7518 on the Amendment of the Capital Markets Law" ("Amendment Law"), entered into force with the Official Gazette dated 2 July 2024 and numbered 32590.

Accordingly, the regulations introduced in the Capital Markets Law ("Law") regarding crypto assets are as follows:

|

NEW DEFINITIONS AND CONCEPTS RELATED TO CRYPTO ASSETS AND RELATED TRANSACTIONS |

Under Article 3 titled "Abbreviations and Definitions" of the Amending Law and Law, definitions such as "Crypto Asset", "Wallet", "Crypto Asset Service Provider", "Platform", "Crypto Asset Storage Service" were defined in parallel with international regulations.

| Definition | Description |

|---|---|

| Wallet | Software, hardware, systems or applications that enable the transfer of crypto assets and the online or offline storage of these assets or the private and public keys related to these assets |

| Crypto Asset | Non-material assets that can be created and stored electronically using distributed ledger technology or a similar technology, distributed over digital networks and capable of expressing value or rights |

| Crypto Asset Service Provider | Platforms, crypto asset storage service providers and other entities that specified in the regulations to be made on the basis of this Law to provide services in relation to crypto assets, including the initial sale or distribution of crypto assets |

| Crypto Asset Storage Service | Storage and management of the crypto assets of the platform customers or the private keys that provide the right to transfer from the wallet related to these assets, or other storage services to be determined by the Board. |

| Platform | Entities that engage in one or more of the crypto asset trading, initial sale or distribution, exchange, transfer, storage, and other transactions required by these and any other transactions that may be determined. |

|

CRYPTO ASSET ISSUANCE AS A CAPITAL MARKET INSTRUMENT |

Pursuant to Article 13 of the Law titled "Dematerialisation of capital market instruments", capital market instruments are issued in dematerialised form without secured by a promissory note, and the rights to dematerialised capital market instruments are tracked by the Central Registry Institution ("CRI"). With the Amendment Law, the legislature has authorised the Capital Markets Board ("Board") to ensure the dematerialisation of the crypto assets subject to regulation in the electronic environment offered by the service providers where they are created and stored, without being included in the CRI system. Furthermore, the Board may, through secondary regulations, require the integration between the records in the electronic environment provided by service providers and the CRI system.

|

THE OBLIGATIONS OF CRYPTO ASSET SERVICE PROVIDERS |

According to Articles 3 and 4 of the Amendment Law, Articles 35/B titled "Provisions regarding crypto asset service providers and crypto assets" and 35/C titled "Principles regarding the activities of crypto asset service providers and the transfer and storage of crypto assets" were included to the Law, and the obligations of Crypto Asset Service Providers were regulated as follows:

| No | Basis | Explanation | Article number in the Law |

|---|---|---|---|

| 1 | Obligation to obtain a permit | Permission from the Board is required for the establishment and for the operation of crypto asset service providers. | 35/B - 1 |

| 2 | Compliance of information systems and technological infrastructures with the requirements of TÜBİTAK | To obtain permission from the Board, crypto asset service providers must first comply with information systems and technological infrastructures requirements that published by TÜBİTAK. | 35/B - 2 |

| 3 | Compliance of partners of Crypto Asset Service Providers with legal requirements | As similar to other capital market institutions, some certain conditions have been stipulated for the shareholders and members of the board of directors of crypto asset service providers, such as not being a bankrupt, not having declared concordat, not having an approved restructuring application by way of reconciliation or not having been granted a postponement of bankruptcy, not being prohibited from trading pursuant to subparagraph (a) of the first paragraph of Article 101 of the Law. | 35/B - 3 |

| 4 | Compliance with secondary regulations regarding the trading of crypto assets through platforms and the exchange, transfer and storage of crypto assets | The procedures and principles regarding the purchase and sale of crypto assets through the platforms and the exchange, transfer and storage of crypto assets will be regulated by the Board through secondary regulations to be issued later. | 35/B - 4 |

| 5 | The crypto assets traded by the Crypto Asset Service Provider are crypto assets which (i) provides rights specific to capital market instruments or (ii) are created through the development of distributed ledger technology or a similar technological infrastructures, the value of which cannot be separated from this technology, for which the Capital Markets Board is expected to determine the principles for sale and distribution. | The crypto assets subject to the regulation are limited to (i) crypto assets that provide rights specific to capital market instruments, or (ii) crypto assets approved by the Board subject to the prerequisites stipulated by the Law and created by the development of distributed ledger technology or a similar technological infrastructures, the value of which cannot be separated from this technology, and crypto assets subject to trading on platforms. | 35/B - 8 |

| 6 | Law on the Protection of the Value of Turkish Currency | The provisions of the Law on the Protection of the Value of Turkish Currency and the relevant legislation shall also apply to all transactions made with crypto assets. | 35/B - 9 |

| 7 | Pledge agreements on crypto assets | The Law On Non-Possessory Pledge in Commercial Transactions shall not be applicable to pledge agreements involving crypto assets. | 35/B - 10 |

| 8 | Obligation to execute a contract between the Crypto Asset Service Provider and the Customer | The signing of a contract between customers and Crypto Asset Service Providers is obligatory. Additionally, the opportunity to establish a contractual relationship through remote communication devices, which is granted to other financial institutions such as banks and brokerage houses, is also granted to crypto asset service providers. Any contractual terms that eliminate or limit the liability of crypto asset service providers to customers in the contracts to be concluded will be invalid. | 35/C - 1 |

| 9 | Obligation of identification of the customers | Identification obligations also apply to crypto asset service providers within the framework of the Law No. 5549 on Prevention of Laundering Proceeds of Crime and its sub-regulations. | 35/C - 1 |

| 10 | Requirement for platforms to establish a written listing procedure | Platforms are obliged to establish a written procedure for determining the crypto assets to be traded within their organisation and the termination of such trading. | 35/C - 2 |

| 11 | Establishing a surveillance system for platforms to detect and prevent market-distorting actions and transactions | The Amending Law stipulates that platforms are obliged to ensure that the transactions carried out within their organisation are reliable, transparent, efficient, stable, fair, honest and competitive. Thus, platforms are obliged to establish a surveillance system in order to detect and prevent market-distorting actions and transactions. | 35/C - 3 |

| 12 | To maintain secure, accessible and traceable records regarding the wallets where customers' crypto asset transfers are made and the accounts where fund transfers are made | The purpose of recording all transfer transactions on the platforms is to ensure transparency in accordance with international principles in terms of movements on the platform. Accordingly, crypto asset transfer transactions must comply with the regulations made by the Capital Markets Board and the Financial Crimes Investigation Board. | 35/C - 5 |

| 13 | Storage of Crypto Assets | According to the Law, it is essential for customers to keep their assets in their own wallets. Storage services for crypto assets that customers do not prefer to keep in their own wallets must be provided by banks authorised pursuant to a secondary regulation to be made by the Board and deemed appropriate by the Banking Regulation and Supervision Agency, or by other institutions authorised by the Board to provide crypto asset storage services, and cash belonging to customers must be kept in banks. | 35/C - 6 |

| 14 | The cash and crypto assets belonging to customers are separate from the assets of crypto assets service providers | The cash and crypto assets of customers are considered as separate from the assets of crypto asset service providers. Therefore, the cash and crypto assets of the customers within the crypto asset service providers cannot be seized, pledged, included in the bankruptcy estate or subject to interim injunction due to the debts of the crypto asset service providers, even for public receivables. | 35/C - 7 |

| 15 | Obtaining Crypto Asset Service Provider Authorisation Certificate | A certificate of authorisation will be issued to crypto asset service providers, similar to other financial institutions, indicating the activities that will be performed. | 35/C - 10 |

| 16 | Obligation for Crypto Asset Service Providers to become a member of the Capital Markets Association of Turkiye | Crypto Asset Service Providers are obliged to be a member of the Capital Markets Association of Turkiye. | 74 |

|

OTHER REGULATIONS ON CRYPTO ASSET SERVICE PROVIDERS |

- Crypto asset service providers are not subject to the other provisions of this Law, except for the provisions referred to in the Law. In other words, crypto assets other than crypto assets that grant rights specific to capital market instruments are not included in the regulation of the law. (Law, provision no. 35/B – 5)

- Except for crypto-assets that provide rights specific to capital market instruments, a technical report will be requested from TÜBİTAK, or other public institutions and organisations affiliated, associated or related to ministries or other public institutions when identifying crypto-assets created by developing distributed ledger technology or a similar technological infrastructure, the value of which cannot be separated from such technology. Accordingly, the Board may decide regarding the sale or distribution of crypto assets created through the development of distributed ledger technology or a similar technological infrastructure, the value of which cannot be separated from such technology. (Law, provision no. 35/B – 6)

- Crypto assets that are broadly traded in foreign markets and whose prices are set out abroad are excluded from the scope of the provisions of the Law on market disruptive acts. (Law, provision no. 35/C – 3)

- The procedures and principles regarding investment advisory and portfolio management for crypto assets shall be determined by the Board through secondary regulations. The secondary regulations to be issued pursuant to Articles 35/B and 35/C of the Law shall be put into effect within six months as of the effective date of this Article. (Law, provision no. Provisional Article 11/7)

- If it is determined that unauthorised capital market activities are carried out through the internet, the Board will decide on the removal of the content and/or blocking of access in relation to the publications made through the internet as of the date of regulation, and then it will be delivered to the Association of Access Providers for implementation. (Law, provision no. 99/3)

- Each year, one per cent of all revenues of the platforms, excluding the previous year's interest income, will be paid to the Board and one per cent to the TÜBİTAK budget by the end of May of the relevant year and recorded as revenue. The aforementioned implementation of recording income to the budget of the Board and TUBITAK will start to be implemented in 2025 over 2024 revenues. (Law, provision no. 130/5)

|

THE MEASURES, SUPERVISION AND SANCTIONS TO BE IMPLEMENTED IN THE ACTIVITIES OF CRYPTO ASSET SERVICE PROVIDERS |

- MEASURES TO BE IMPLEMENTED IN THE ACTIVITIES OF CRYPTO ASSET SERVICE PROVIDERS

The newly introduced Article 99/A of the Law regulates the measures to be implemented in the activities of crypto asset service providers. Pursuant to this provision, the Board is authorized to directly limit the scope of the activities of Crypto Asset Service Providers or temporarily suspend their activities, to cancel their authorizations in whole or in respect of certain capital market activities, or to take any other measures it may prescribe in the event of unlawful activities and transactions of Crypto Asset Service Providers.

|

On the other hand, the activities of the crypto asset service providers residing abroad to the residents in Turkiye, or the provision of a prohibited activity related to crypto assets to the residents in Turkiye within the scope of the regulations to be made by the Board shall also be deemed as unauthorized crypto asset service provision. |

- SUPERVISION OF THE CRYPTO ASSET SERVICE PROVIDERS

Paragraphs 1 and 2 of the newly introduced Article 99/B of the Law regulate the supervision of crypto asset service providers. According to this regulation, Articles 88, 89 and 90 of the Law shall apply to the supervision of the compliance of crypto asset service providers with the Law and the relevant legislation. Moreover, according to the regulation,

- In the supervision of crypto-asset service providers, the Board's personnel may be assigned from institutions and organizations that are affiliated, related, associated institutions and organizations of ministries and other public institutions upon the request of the Board, with the approval of these institutions and organizations.

- Financial audit and information systems independent audit of crypto asset service providers shall be performed by independent audit institutions that are determined in the list to be announced by the Board.

- SANCTIONS TO BE IMPLEMENTED ON CRYPTO ASSET SERVICE PROVIDERS

The newly introduced Article 99/B of the Law regulates the sanctions to be implemented on crypto asset service providers. According to the regulation;

- If the damages arising from the illegal activities of the

crypto asset service providers and the failure to fulfil the cash

payment and/or crypto asset delivery obligations can not be

collected from the crypto asset service providers or it is obvious

that they can not be collected from the crypto asset service

providers, the members of the crypto asset service providers shall

be liable to the extent that the damages can be attributed to them

according to their faults and the requirements of the situation,

and the provisions of the Law on personal

liability shall apply.

Crypto asset service providers are jointly and severally liable for crypto asset losses arising from the operation of information systems, all kinds of cyber-attacks, information security breaches or any behaviour of the personnel.

- The administrative fines set forth in Article 103 of the Law

and Article 105 regulating the enforcement of these fines will be

applied to the entities that breach Articles 35/B and 35/C of the

Law or the regulations to be made by the Board, which contain the

obligations that crypto asset service providers must comply

with.

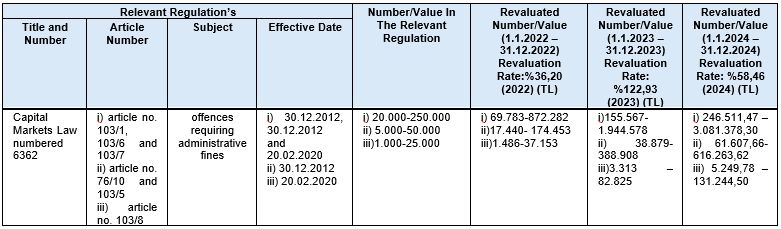

For the year of 2024, these amounts are determined as follows:

- All kinds of administrative and judicial requests such as

injunctions, attachments and similar administrative and judicial

requests regarding cash and crypto assets belonging to customers

are exclusively fulfilled by crypto asset service providers.

- Any real person or legal entity that is found to be operating as a crypto asset service provider without obtaining a permit shall be sentenced to imprisonment from three to five years and a judicial fine from five thousand days to ten thousand days..

- EMBEZZLEMENT IN CRYPTO ASSETS SERVICE PROVIDERS

The newly introduced Article 110/A of the Law regulates the embezzlement offence in crypto asset service providers through a detailed regulation. According to this regulation, the chairman and members of the board of directors and other members of the board of directors of the crypto asset service provider that embezzle money or money substitute documents or securities, other goods or crypto assets that have been entrusted due to their duty as a crypto asset service provider or which are obliged to protect, store and supervise, shall be sentenced to imprisonment from eight to fourteen years and a judicial fine up to five thousand days, and shall be sentenced to compensate the damage of the crypto asset service provider.

Article 110/B of the Law titled "Personal liability for crypto assets" stipulates that the court may decide on the personal bankruptcy of the chairman and members of the board of directors, other members of the board of directors, real person shareholders who are found to have made decisions and transactions deemed as embezzlement within the scope of Article 110/A of the Law in order to ensure that the amount determined to have been embezzled is compensated primarily from the amount determined to have been embezzled, limited to the damage caused to the customers, upon the request of the Board.

Furthermore, Article 115/A of the Law titled "Special investigation procedure for the offence of embezzlement of crypto assets" provides that the offence of embezzlement shall be subject to a special investigation procedure different from the investigation procedures currently in the Law, by considering the characteristics of the offence of embezzlement and the grievances it may cause.

|

OPERATION LICENCE PROCESS FOR CRYPTO ASSET TRADING PLATFORMS |

With the newly introduced Provisional Article 11 of the Law, the applications to be made by crypto asset providers to the Board are regulated as follows;

- The entities that are currently operating as crypto asset service providers on the date of entry into force of the Law are obliged to apply to the Board with the documents to be determined by the Board through secondary regulations within one month following the date of entry into force of the Law and submit a declaration that (i) they will make the necessary applications to obtain an operating licence or (ii) they will make a liquidation decision within three months without damaging customer rights and interests and that they will not accept new customers during the liquidation process.

- The companies that intend to initiate operations after the effective date of the Law shall, before initiating their operations, apply to the Board and declare that they fulfil the conditions stipulated in the secondary regulations and that they will make the necessary applications to obtain an operating licence.

- The applications made to the Board will be announced on the Board's website. Entities to be liquidated are also obliged to announce this situation on their websites and notify their customers via electronic mail, text message, telephone and similar communication tools.

- Any failure to fulfil the transfer requests of customers who have accounts in the entities that have chosen to be liquidated or have not applied to the Board within the specified 1-month period will constitute the offence of unauthorised service provider activity.

- Non-resident crypto asset service providers shall terminate their activities for Turkish residents within three months following the effective date of the Law. According to the regulation of the Law, in the event that a non-resident platform opens a place of business in Turkiye, establishes a website in Turkish, and engages in promotional and marketing activities directly and/or through persons or institutions resident in Turkiye in relation to the crypto asset services offered, the activities will be deemed to be directed to residents in Turkiye.

- The activities of ATMs and similar electronic transaction devices located in Turkiye that allow customers to convert crypto assets into cash or cash into crypto assets and to transfer crypto assets shall be terminated within three months following the effective date of the Law. ATMs that do not terminate their activities will be closed by the competent authorities determined in the legislation on workplace opening and operation licences upon notification of the highest local administrative authority. The provisions of Articles 99/A and 109/A of the Law shall also be applied to those who continue to operate and to those who enable such activities.

CONCLUSION

These long-awaited regulations bring along many important changes. Especially, the number of secondary regulations to be issued by the Board under the Law is quite high. This indicates that new regulations in terms of secondary legislation are at the door. With the publication of the secondary legislation, we expect the developments in the "crypto asset" world to accelerate and the question marks that may arise in practice to decrease.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.