- News about Sonoda & Kobayashi -

1. Sonoda & Kobayashi holds webinar on Trademarks in the Metaverse on June 20 in collaboration with EU-Japan Centre for Industrial Cooperation and EUIPO

On Thursday June 20th at 5 pm JST/10 am CET, in

collaboration with the EU-Japan Centre for Industrial Cooperation

and the EUIPO, Sonoda & Kobayashi held a webinar on Trademarks

in the Metaverse. The webinar focused on bringing both a Japanese

and EU-perspective to the table, describing what classes and goods

are appropriate for goods and services in the metaverse, and

advising on when applying for a trademark in these classes would

make sense in the first place. Yoko Sasaki, Japanese patent attorney,

presented from the Japanese perspective. We would like to thank

those who attended this online event.

2. Sonoda & Kobayashi holds webinar on Divisional Applications in Japan on July 23

On Tuesday the 23rd of July at 3 pm PDT/5 pm CST/6 pm EST, Sonoda & Kobayashi held a webinar on "Using Divisional Applications Effectively in Japan." Yasuhide Nishimura, Yoko Sasaki, and Sukanya Hummel walked attendees through divisional applications, and the methods and points to be aware of in obtaining patents that are starting to attract attention in Japan today. We extend our thanks to attendees of this online event.

- JPO and CNIPA News -

1. JPO updates data on trends in design registration applications

In July 2024, the JPO updated its data on the trends in design registration applications since the amendment of the Design law on April 1st, 2020.

These changes in law provided for the protection of designs for images, buildings, and interiors, and also allowed related design applications to be filed after the publication of the design gazette of the principal design.

Following these revisions, the JPO published design registration application trends. As of July 4th, 2023, there were 5921 design registration applications filed for images, 1656 for buildings, and 1074 for interiors. Of these, 4186, 1207 and 781 were registered, respectively.

Further information can be found here. (Japanese)

2. JPO participates in high-level meeting of trial and appeal divisions of the 5 major patent offices

In June 2024, representatives of the JPO travelled to Seoul, South-Korea, to take part in a high-level meeting of the trial and appeals divisions of the five major patent offices. Hosted by the Korean Patent office (KIPO), the meeting was also attended by the American (USPTO), Chinese (CNIPA) and European (EPO) patent offices.

During the meeting, representatives from each office presented the latest trends in the trial and appeal divisions. They also exchanged opinions on the use of artificial intelligence in operations and on digitization. The JPO introduced its plans for digitization of trial and appeal procedures and its plans for the use of AI.

Further information can be found here. (Japanese)

3. CNIPA and China's Intellectual Property Court: Fortifying Global Innovation Rights

Recently, the Supreme People's Court convened a symposium titled "Enhancing Judicial Safeguards for Intellectual Property Rights in Scientific and Technological Innovation." The Intellectual Property Court of the Supreme People's Court was inaugurated on January 1, 2019.

Since its inception in 2019 through June 26, 2024, the Intellectual Property Court has handled 20,338 cases, successfully concluding 17,638 of them. Over the past five years, approximately 10% of new cases involved foreign entities, marking a notable annual growth rate of 28.6%. Of particular significance, one-third of these foreign-related cases pertained to disputes over invention patent grants and confirmations.

For instance, in an administrative dispute concerning the validity of a university's invention patent in California, the court upheld the validity of the patent holder's drug patent. The case involved a disagreement between the board of trustees of a California university, the CNIPA (China National Intellectual Property Administration), and a pharmaceutical technology firm in Shanghai. The patent in question pertained to the enzalutamide compound, primarily used in treating refractory prostate cancer. The university's board of trustees held the patent and faced a challenge when the pharmaceutical company filed for invalidation, arguing lack of inventive step—a stance supported by the CNIPA.

Disputing this decision, the university filed an administrative lawsuit with the Beijing Intellectual Property Court, submitting additional experimental data to substantiate the patent's inventiveness. Initially, the lower court ruled against the university's challenge. Subsequently, both parties appealed the decision. In the appellate phase, the Intellectual Property Court of the Supreme People's Court accepted the university's supplementary experimental data and affirmed the initial judgment in favor of the university's patent validity.

Further information can be found here. (Chinese)

4. CNIPA Reports: China Leads Global Generative AI Patents Surge

According to a report published by the World Intellectual Property Organization (WIPO) on July 3rd, China has emerged as the global leader in generative AI patent applications, surpassing 38,000 filings from 2014 to 2023. This figure stands six times higher than that of the United States, which holds second position.

The WIPO Patent Landscaping Report on Generative AI reveals a total of 54,000 global patent applications over the decade, with more than 25% of them published in the last year alone. Since the introduction of deep neural network architectures in 2017, pivotal to large language models, generative AI patents have grown seven-fold. These innovations span diverse sectors including life sciences, document management, publishing, business solutions, industrial manufacturing, transportation, security, and telecommunications.

Patents related to generative AI are predominantly classified under image and video data categories, followed by text and speech/music domains. Leading the charge in patent filings are Tencent, Ping An, Baidu, the Chinese Academy of Sciences, IBM, Alibaba Group, Samsung Electronics, Alphabet, ByteDance, and Microsoft. Besides China, top countries contributing to generative AI patents include the United States, South Korea, Japan, and India.

Interestingly, OpenAI, highly regarded for its advancements, notably does not feature in the list of patent applicants. Until early 2023, OpenAI had not submitted any patents, possibly due to its initial nonprofit roots evolving into a "capped" monetization model. Alternatively, OpenAI might be safeguarding its intellectual property through trade secrets.

Further information can be found here. (Chinese)

- Latest IP News in Japan -

1. IBM Settles Patent Lawsuit Against Rakuten Over

E-commerce Technology

Reuters Japan, June 18, 2024

On the 18th of June, Reuters Japan reported on IBM settling a patent lawsuit against Rakuten over e-commerce technology.

IBM initiated legal action against Rakuten in 2021, claiming that Rakuten had violated its patents concerning technology crucial for offering cashback services on its e-commerce platform and mobile application. The lawsuit was filed after six months of unsuccessful negotiations between the two companies. IBM accused Rakuten of using its patented technology without authorization.

The legal dispute between IBM and Rakuten progressed to the U.S. District Court for the District of Delaware. Recently, court records revealed that both parties reached a settlement agreement to resolve the lawsuit. The judge overseeing the case commented positively on the parties' decision to settle.

Despite the confirmation of the settlement through court documents, neither IBM nor Rakuten provided additional statements or comments regarding the terms or implications of the agreement. Both companies remained silent beyond acknowledging the resolution of the lawsuit.

The outcome marks the end of a legal battle where IBM sought to protect its intellectual property rights against Rakuten's operations in the e-commerce sector. Settlements in such cases typically involve terms that resolve the legal dispute while potentially involving financial compensation or licensing agreements. However, specific details of the settlement between IBM and Rakuten were not disclosed in the article.

Further information can be found here. (Japanese)

2. Automotive Industry Groups Challenge Avanci Over 5G

Patent Licensing Terms

Nikkei, July 19, 2024

On the 19th of July, Nikkei reported on several automotive industry groups challenging Avanci, a US-based patent pool, and its approach to licensing essential patents for 5G technology used in connected vehicles.

In a coordinated effort, six leading automotive industry associations have publicly challenged Avanci's methods in negotiating licensing agreements for 5G technology patents. The core of the dispute lies in Avanci's proposed licensing fees, set at $32 per vehicle, which the industry groups find exorbitant and poorly justified. They have demanded clarity on several key aspects of Avanci's operations, including the specific patents covered, criteria for determining essentiality (Standard Essential Patents or SEPs), and the methodology used to calculate the licensing fees.

Avanci, in response to the industry groups' queries, expressed surprise and defended its practices, citing prior engagements with many automakers who have already made decisions regarding patent usage. The organization emphasized its commitment to transparency but did not provide detailed answers to the specific concerns raised in the letter.

This controversy underscores broader tensions within the automotive industry regarding the fair and equitable access to essential technologies, particularly as vehicles become increasingly connected and reliant on high-speed data transmission capabilities. The Japan Automobile Manufacturers Association (JAMA) underscored the importance of clarity and fair conditions in Avanci's licensing program, expressing hope for a resolution that ensures transparency and supports innovation in the automotive sector.

The standoff between automotive industry groups and Avanci highlights ongoing challenges in managing essential patents for critical technologies like 5G within the global automotive ecosystem. As negotiations continue, stakeholders seek clearer guidelines and fair terms that accommodate both innovation and market competitiveness in the rapidly evolving automotive landscape.

Further information can be found here. (Japanese)

- Latest IP News in China -

1. China leading generative AI patent applications, UN

reports

The Japan News, July 4, 2024

On the 4th of July, The Japan News reported that China leads the world in generative AI patent filings, with over 38,200 patents from 2014 to 2023, significantly outpacing the United States, which has nearly 6,300, according to the UN's intellectual property agency. Generative AI, used in tools like ChatGPT and Google Gemini, accounted for about 54,000 inventions in the past decade, with more than a quarter emerging in 2023 alone, reflecting the technology's rapid growth.

While China dominates patent filings, the U.S. excels in developing cutting-edge AI systems and AI foundation models, leading in private AI investments and new AI startups. Critics express concerns about generative AI's impact on jobs and intellectual property rights. Despite the high number of patents, the quality and future value of these patents remain uncertain. The report underscores the rivalry between the U.S. and China in AI development, with the U.S. producing more notable machine-learning models and leading in AI vibrancy metrics.

Further information can be found here. (English)

2. Qualcomm and Philips sue Chinese smartphone maker

Transsion

The Financial Times, July 13, 2024

On 13th of July, The Financial Times reported that Shenzhen-listed Transsion, the world's fourth-largest smartphone maker, is being sued by Qualcomm and Philips for alleged intellectual property violations. Transsion, which holds a 48% market share in Africa, faces growing legal and commercial pressure from major US and European tech companies.

Qualcomm filed a lawsuit against Transsion in India and has also filed claims in Europe and China over alleged patent infringement. Philips has similarly sued Transsion in India. Additionally, Nokia is pressuring Transsion to make payments for patented technologies.

Qualcomm's general counsel, Ann Chaplin, stated that Transsion has declined a license from Qualcomm for most of its products, prompting the litigation to enforce patent rights and maintain a level playing field for all licensees. Smartphone makers must pay royalties for patented technologies, and failure to do so can lead to legal action.

Transsion's low-cost business model has helped it gain market share, with average smartphone prices ranging from $110-120. The company expressed respect for third-party intellectual property rights and willingness to negotiate licenses. Despite signing a 5G patent license with Qualcomm, Transsion is facing lawsuits from multiple entities, including a 2019 case by Huawei in China.

As Transsion expands into more affluent markets with stronger patent enforcement, including parts of Europe and the Middle East, it continues to experience significant growth.

Further information can be found here. (English)

- IP Law Updates in Japan: Insights from Sonoda & Kobayashi -

1. Trademarks in the Metaverse: Navigating New

Challenges in Japan

Yoko Sasaki (Patent Attorney), Debora Cheng (New Zealand

Lawyer)

As the digital landscape rapidly evolves, the metaverse has emerged as a vast, virtual space where individuals and businesses can interact, trade, and provide services. This development has introduced unique challenges and opportunities for trademarks. Here, we explore the essential aspects of trademarks in the metaverse, drawing insights from the latest discussions and examples from the perspective of Japanese trademark prosecution.

What is a Trademark in the Metaverse?

According to the Cambridge Dictionary, the metaverse is "the internet considered as an imaginary area without limits where you can meet people in virtual reality." In this context, trademarks in the metaverse can be categorized into three primary types:

- Trademarks for Digital Goods: These trademarks are used for virtual items that are traded within the metaverse.

- Trademarks for Virtual Services: These trademarks are utilized for services provided entirely within the virtual reality environment.

- Trademarks for NFT-Related Services: These involve trademarks associated with services related to Non-Fungible Tokens (NFTs).

It's important to note that the concept of a "trademark

in the metaverse" does not have a strict definition and can

encompass various other types.

When to File a Trademark in the Metaverse

Companies should consider filing trademarks in the metaverse under several scenarios:

Case 1: Digital Goods

ABC Co., a company that sells bags in Japan, has a popular trademarked bag with the 'ABC' mark. When XYZ Co., an online event organizer, offers ABC Co. the opportunity to sell virtual bags used by characters in virtual games, ABC Co. decides to file a trademark for 'ABC' in the metaverse for downloadable virtual bags. This scenario illustrates when a company files a trademark in the metaverse for digital goods traded in virtual reality.

In terms of whether the trademark holder can take legal action against others who use the mark in virtual reality, it is still a new concept, so there are currently no infringement cases or examples of court precedent in Japan. However, the report on virtual IP rights published by the Japan Patent Office states that the trademark right for real goods does not cover the digital goods in virtual reality, and this is probably why trademark holders of real goods and services are now filing trademarks for digital goods and services in the metaverse.

Case 2: Virtual Services

XYZ Co., an organizer of sports events, plans to host a chess tournament in a virtual environment. To indicate their organization of the tournament, they file a trademark for providing online virtual entertainment in the form of chess tournaments.

In this example, XYZ Co. wants to use their logo in the virtual environment to indicate that the tournament is organized by them. They file a trademark in the metaverse for services provided in virtual reality.

Case 3: NFT-Related Services

J-Bank, an online bank without physical stores, considers offering cryptocurrency management services. To avoid confusion between their virtual currency services and traditional banking services, J-Bank files a different trademark for the management of cryptocurrency authenticated by NFTs. This situation shows when a company files a trademark for services related to NFTs.

How to File Trademark Applications

When filing trademarks in the metaverse, companies need to designate the appropriate goods and services. Here are examples for the hypothetical scenarios:

ABC Co.:

- Class 9: Downloadable virtual bags (Similar Group Code 11C01)

For ABC Co., which already has their trademark registered for actual bags, they can designate 'downloadable virtual bags' in class 9. In Japan, during prosecution, relative grounds are examined, meaning the marks are compared to prior filed or registered marks for similarity. All goods and services are associated with one or more similar group codes in Japan. Any goods or services associated with the same similar group code are automatically considered as similar to each other during the prosecution.

For example, the similar group code for 'downloadable virtual bags' in class 9 is 11C01, which is in the same group with 'computer software; and virtual reality headsets.' Actual 'bags' in class 18 have a different similar group code, so 'downloadable virtual bags' will not be rejected based on prior marks for actual 'bags.'

XYZ Co.:

- Class 41: Providing online virtual entertainment in the form of chess tournaments (Similar Group Code 41F06)

For XYZ Co., which wants to organize a chess tournament in a virtual environment, they can designate 'providing online virtual entertainment in the form of chess tournaments' in class 41. The service is considered similar to 'conducting guided tours and party planning [entertainment].'

J-Bank:

- Class 36: Management of cryptocurrency authenticated by NFTs (Similar Group Code 36A01)

For J-Bank, which wants to start cryptocurrency management

services, they can designate 'management of cryptocurrency

authenticated by NFTs' in class 36. The service is considered

similar to 'banking and exchanging money' services.

In summary, the general classes relevant for trademarks in the

metaverse include:

- Class 9: Downloadable digital goods

- Class 35: Selling downloadable digital goods

- Class 36: Activities for cryptocurrency

- Class 41: Providing videos in virtual environments

- Class 42: Providing virtual environments

Examples of Registrations

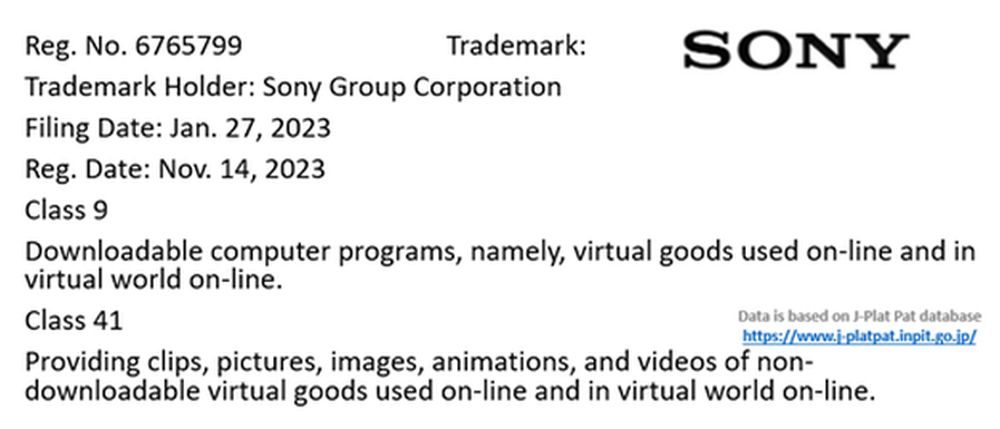

Sony Group Corporation:

An example of designating virtual goods in class 9 and virtual services in class 41 is Sony Group Corporation, a major Japanese electronics manufacturer. Filed on January 27, 2023, the mark is a company name logo already registered for various goods and services. This registration is a refiling of the same mark specifically for virtual activities.

In class 9, 'downloadable computer programs, namely virtual goods used online and in virtual worlds' is designated. In class 41, 'providing clips, pictures, images, animations, and videos of non-downloadable virtual goods used online and in virtual worlds' is designated.

If the software is downloadable, it should be designated in class 9. If the software is non-downloadable (e.g., subscription services), it should be designated as a service in class 41.

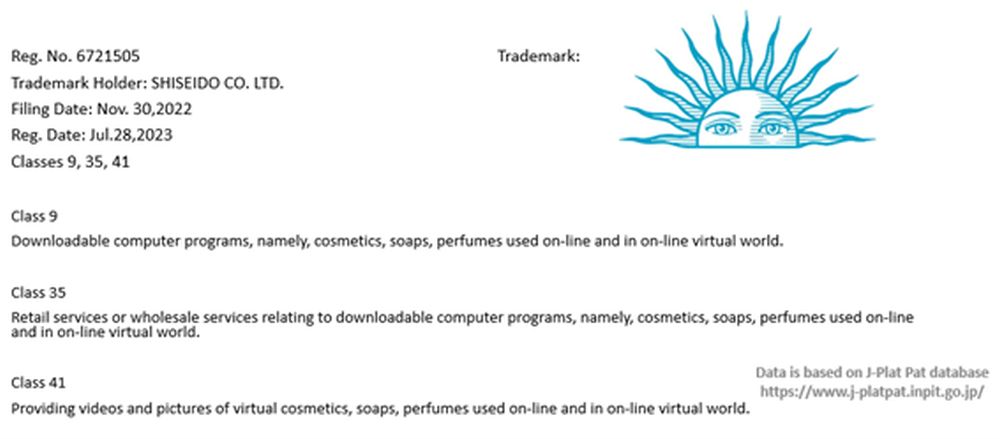

SHISEIDO Co., Ltd.:

Another example is a logo mark resembling the top half of the sun with a face, filed on November 30, 2022, by SHISEIDO Corporation, a major Japanese cosmetics company.

The designated goods in class 9 are 'downloadable computer programs, namely cosmetics, soaps, perfumes used online and in online virtual worlds.' In class 35, 'retail services or wholesale services relating to downloadable computer programs, namely cosmetics, soaps, perfumes used online and in online virtual worlds' are designated. In class 41, 'providing videos and pictures of virtual cosmetics, soaps, perfumes used online and in online virtual worlds' are designated.

Cosmetic companies have started virtual service businesses to provide information on makeup and cosmetics use, covered by designated services in class 41.

The same logo mark was registered in December 2019 for cosmetics, soaps, and perfumes in class 3 (Reg. No. 6203955). This registration is a refiling of the same mark specifically for virtual activities.

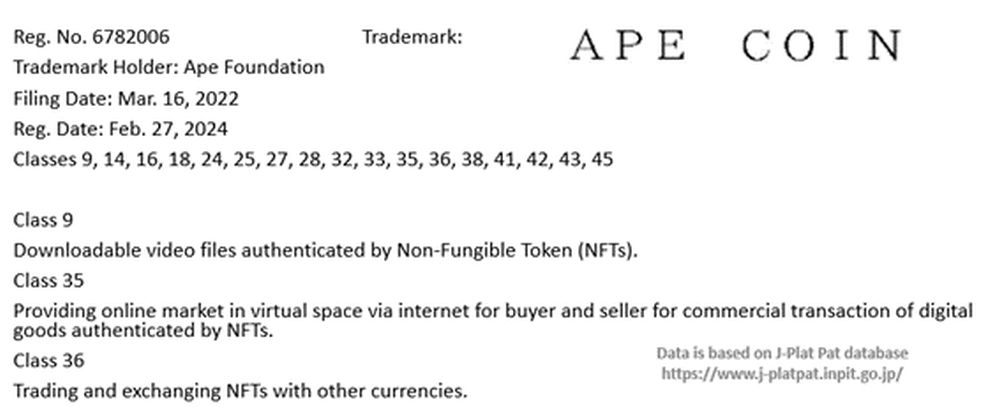

Ape Foundation:

The last example is the 'APE COIN' trademark, filed in March 2022 by Ape Foundation, based in the Cayman Islands. 'APE COIN' is a virtual currency managed by Coincheck since September 2023.

They filed for many classes, but typically trademarks in the metaverse are filed in classes 9, 35, 36, 41, and 42.

In class 9, 'downloadable video files authenticated by NFTs' is designated. In class 35, 'providing an online market in virtual space for buyer and seller transactions of digital goods authenticated by NFTs' is designated. In class 36, 'trading and exchanging NFTs with other currencies' is designated.

Conclusion

As businesses continue to explore opportunities in the metaverse, understanding and navigating the complexities of trademark applications in this virtual space is crucial. The cases and examples provided offer a practical guide for companies looking to protect their brands in this new and dynamic environment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.