The acquisition of an inheritance is taxable in Poland. The obligation to pay it is imposed each time on the acquirer of property and property rights. In particular, on lineal heirs, legatees, persons entitled to a reserved share, recipients of gifts and other relatives or entities specified in detail in the Act on Inheritance and Gift Tax.

Inheritance tax applies when the heir has received it under a will, as well as when he or she has received it under statutory succession.

When is it not obligatory to pay inheritance tax?

Inheritance tax is not payable on the acquisition of inherited property with a pure value not exceeding the free amount, which is:

1. PLN 36,120 - if the acquirer is a person included in tax group I,

2. PLN 27,090 - if the acquirer is a person classified in tax group II,

3. PLN 18,060 - if the acquirer is a person classified in tax group III.

When do you not have to report an inheritance to the tax office?

You do not have to report inheritance tax if:

- the value of the total sum of donations received from the same person or inheritances from the same person in the five years preceding the year in which the last acquisition took place, added to the value of property and property rights previously acquired in the last time, does not exceed the amount of PLN 36,120 or,

- the inheritance or donation was acquired on the basis of an agreement concluded in the form of a notarial deed, or one of the parties made its declaration of intent in this form.

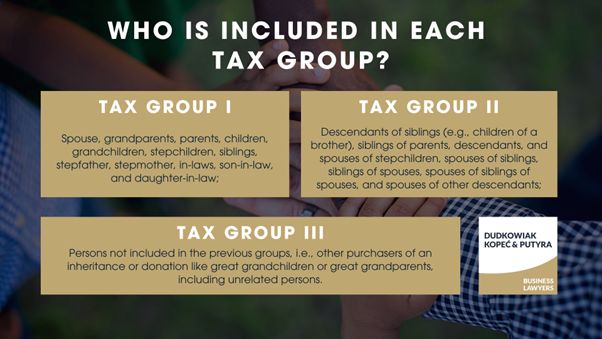

Who is included in each tax group?

According to the Act on Inheritance and Gift Tax, persons liable to pay tax are divided into three tax groups. Belonging to each of them is determined by the relationship that links the testator and the heir. It also determines the inheritance tax rates.

1. tax group I includes:

spouse, grandparents, parents, children, grandchildren, stepchildren, siblings, stepfather, stepmother, in-laws, son-in-law, and daughter-in-law;

2. tax group II includes:

descendants of siblings (e.g., children of a brother), siblings of parents, descendants, and spouses of stepchildren, spouses of siblings, siblings of spouses, spouses of siblings of spouses, and spouses of other descendants;

3. tax group III includes:

persons not included in the previous groups, i.e., other purchasers of an inheritance or donation like great grandchildren or great grandparents, including unrelated persons.

Importantly, there is also a "zero tax group", which includes selected individuals in tax group I.

Is it possible to avoid inheritance tax?

Polish tax law provides exempt from inheritance tax for testator's family member - descendants, siblings, parents, spouse - provided they make the appropriate declaration to the tax office. For this purpose, an SD-Z2 form must be filled in within 6 months of the inheritance becoming legally valid. Each of the heirs has to make a separate declaration.

Failure to declare the acquisition of an inheritance within 6 months, will entail the payment of tax under the rules set out for tax group I.

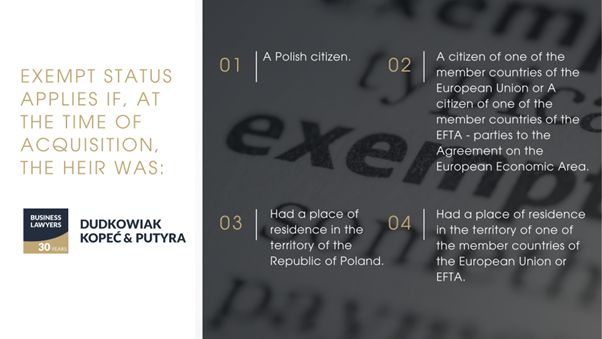

Importantly, the exempt status applies if, at the time of acquisition, the heir was a Polish citizen or a citizen of one of the member countries of the European Union or member countries of the European Free Trade Agreement (EFTA) - parties to the Agreement on the European Economic Area, or had a place of residence in the territory of the Republic of Poland or in the territory of such a country.

How much is the inheritance tax?

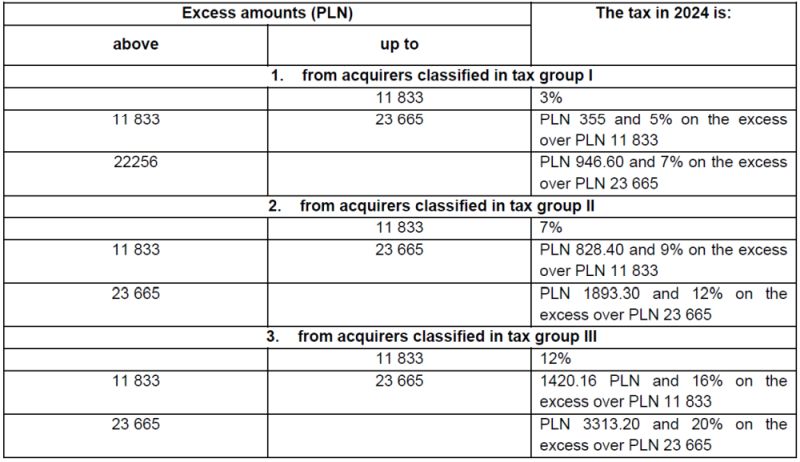

Taxes are calculated on amounts that exceed the free amounts for each tax group, according to a scale:

When does tax liability arise?

Taxes liability arises, as a rule, when the court order confirming the acquisition of an inheritance becomes final, when the deed of certification of inheritance is registered by a notary public or when a European certificate of inheritance is issued.

From this moment, a period of 1 or 6 months should be counted for reporting the acquisition of an inheritance to the tax office.

How to report the inheritance acquisition to the tax office?

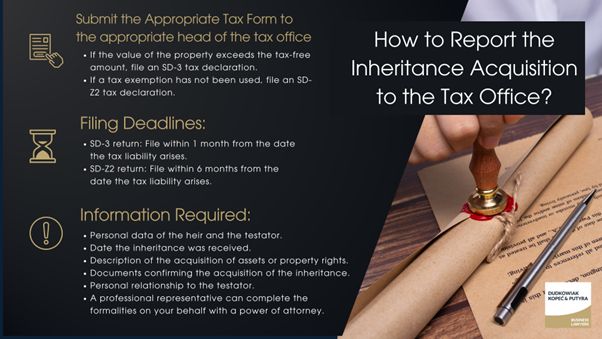

To report the acquisition of an inheritance is to submit a tax form to the appropriate head of the tax office. If the value of the property received exceeds the tax-free amount, an SD-3 tax declaration must be filed. If a tax exemption has not been used, an SD-Z2 tax declaration has to be chosen.

The SD-3 return must be filed to the tax office within 1 month from the date the tax liability arises, while the SD-Z2 return must be filed within 6 months from the date the tax liability arises.

In the forms submitted to the tax office, it is necessary to provide your personal data, the personal data of the testator and the date on which the inheritance was received. Next, it is necessary to describe the title of the acquisition of assets or property rights.

It is also necessary to indicate in the application the type of documents confirming the acquisition of the inheritance and attach them to the form as attachments. Finally, you must specify the personal relationship to the testator.

Significantly, all inheritance tax formalities can be completed on our behalf by a professional representative. To do so, you will need to grant a power of attorney on a special form.

How and when to pay tax to an inheritance?

Once you report the acquisition of an inheritance to the relevant tax office, you will receive a return decision with a fixed tax amount. The tax office will calculate it on the basis of the information you provided in your tax return and the data collected in the course of the tax investigation, if the property or property rights you acquired are goods with a value exceeding the tax-free amount.

You must pay taxes within 14 days of receiving the decision. Paying taxes is possible either at the cash register of the relevant tax office or directly to its bank account.

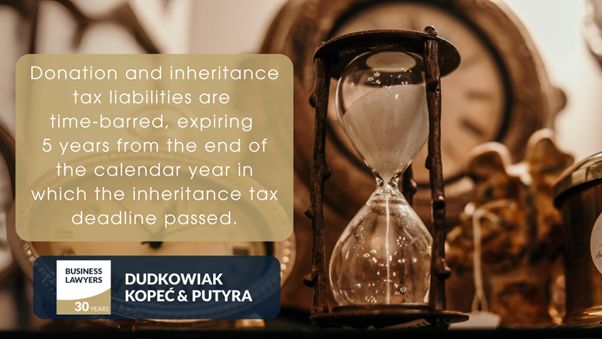

Is inheritance tax time-barred?

The answer is yes if we mean donation and inheritance tax liability. For this, like all other tax liabilities, it is time-barred, specifically with the expiration of 5 years from the end of the calendar year in which the inheritance tax deadline passed.

In other words, we can talk about the statute of limitations on January 1, the calendar year following that date.

On the other hand, the mere "right" to tax the acquisition of property and rights by inheritance does not become time-barred, if the tax liability has not arisen because the taxpayer has not reported the acquisition to the tax authorities, and this is due to the fact that the legislator has provided for the inheritance tax liability to renew in certain situations.

Special attention should be paid to Article 6(4) of the Law on Inheritance and Gift Tax, which may indicate that regardless of the time after which the taxpayer invokes the fact of acquisition, the inheritance tax liability is renewed.

The question of the statute of limitations on gift and inheritance tax liability is an issue that raises many doubts and is sometimes treated differently by tax authorities. It is a good idea to be very careful in this regard and take care to complete the formalities. This will avoid unpleasantness in the event that the existence of the statute of limitations is questioned.

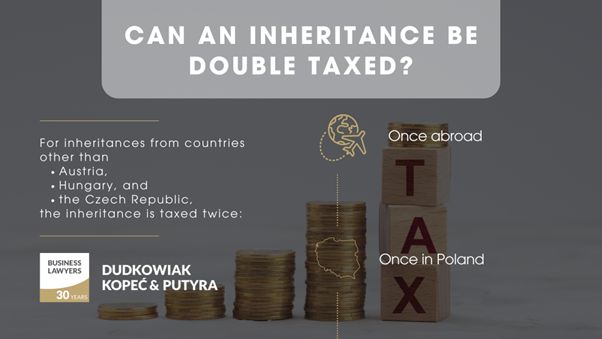

Can an inheritance be double taxed?

In most cases, an inheritance received by a Polish person living in Poland from abroad impose inheritance taxes twice - once abroad and a second time in Poland. Double inheritance tax also applies to inheritances received from Poland by Polish emigrants living abroad.

The problem comes from the fact that standard double taxation agreements do not apply to inheritances. The avoidance of double taxation in the case of inheritances can be regulated in separate international agreements.

Currently, Poland has only three such agreements: with Austria, Hungary and the Czech Republic. Therefore, in the vast majority of cases (for inheritances received from countries other than Austria, Hungary and the Czech Republic), the receipt of an inheritance is taxed twice, in the country of the testator and in Poland.

In spite of the awareness of the existence of the problem of double taxation of cross-border inheritances, also at the level of the European Union, practically no remedies have been implemented so far, neither in international law nor in national law.

Contact us if you need legal advice

All information regarding inheritance tax issues can be explained by our lawyers specializing in inheritance law, who will advise on the best way to obtain the legal title to the inheritance in the shortest possible time and to secure the interests of the heirs.

FAQ on Inheritance Tax in Poland

What is the current estate tax rate for inherited assets in Poland?

The estate tax rate in Poland varies depending on the value of the assets inherited and the beneficiary's relationship to the deceased. For tax group I, the tax rates range from 3% to 7%, for group II from 7% to 12%, and for group III from 12% to 20%.

The exact tax rate is calculated based on the value of the inheritance that exceeds the tax-free amount.

Are immediate family members subject to paying inheritance tax in Poland?

Immediate family members, including spouses, children, grandchildren, parents, and siblings, fall under tax group I. They can be exempt from paying inheritance taxes if they submit the SD-Z2 form within 6 months of acquiring the inheritance.

Failure to do so will result in the imposition of inheritance taxes as per the inheritance tax group I rates.

How can one avoid inheritance taxes on inherited assets in Poland?

To avoid inheritance taxes on inherited assets in Poland, close family members must submit the SD-Z2 form within the required 6-month period after the inheritance is legally valid.

This exemption is applicable to immediate family members, such as a surviving spouse, children, and parents, provided they meet the residency and citizenship requirements specified by Polish tax laws.

What are the inheritance tax reporting requirements in Poland?

In Poland, reporting the acquisition of an inheritance requires submitting an SD-3 or SD-Z2 tax form to the relevant inheritance tax office. The SD-3 form is used when the inheritance is taxable, while the SD-Z2 form is for those claiming an exemption.

The form must include personal data, the relationship to the deceased person, and detailed information about the inherited assets. The SD-3 form must be filed within 1 month, and the SD-Z2 form within 6 months of the tax liability arising.

What is the impact of international inheritance tax on Polish estate taxes?

Inheritances received by Polish citizens from abroad are subject to double taxation unless covered by specific international agreements. Currently, Poland has agreements only with Austria, Hungary, and the Czech Republic to avoid double taxation on inheritances.

Inheritances from other countries will be taxed both in the country of the deceased and in Poland. It's advisable to seek qualified advice from inheritance tax experts or financial advisors to navigate the complexities of international inheritance tax laws.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.