Finland – A Hub For Fenno-Baltic Funds?

Introduction

Although some may regard Finland as being slightly remote from continental Europe, it has had an active private equity industry for a long time. Finland’s venture capital association, the FVCA, was established in 1990 and currently has 42 full members and 69 associate members.

Although the number of investors operating in Finland has increased, and although some of the players have grown and made some progress towards becoming international players, the Finnish private equity industry and the framework in which it operates has not experienced many changes.

However, at present two significant changes may be seen. First of all, the fundraising problems that result from the fact that investing in a Finnish limited partnership creates a permanent establishment for a foreign investor should soon no longer be an issue. Secondly, the growing interest in the private equity and property markets in the Baltic region and Russia has resulted in new funds coming to the market – a trend that is expected to continue.

Property Fund Boom

A few years ago there really was not much of an indirect property investment market in Finland. Despite the fact that Finland has had a special Act on Property Funds since 1997, no funds have been formed under the Act, primarily due to tax considerations (such investments leading to double taxation – i.e. taxation both on fund and investor level – whereas mutual funds available to the public are not separately taxable). Basically, the only form of indirect property investment that was made was investment in a few listed property investment companies that are also subject to double taxation.

Recently things have begun to evolve quite rapidly, and some lawyers have found themselves busy looking at different plans to set up or invest in property funds. The most obvious developments may be characterized as follows:

- Although the legal framework has not been changed, a working group within the Ministry of Finance is considering alternatives, with a view to implementing changes to relevant legislation. The working group has considered, among other things, limited partnership structures, revising the Act on Property Funds and revising mutual funds legislation to enable property investments. A report by the group was scheduled to be published by the end of November 2005 but the actual governmental bill proposing legislative changes will not be issued before spring 2006.

- Finnish institutional investors have clearly taken a new approach to property investments and have during a relatively short period diversified their portfolios by selling Finnish assets and making a number of investments in European property funds. This also includes funds of property funds.

- Foreign property investors have started following the Finnish property market and have made acquisitions in Finland at an increasing rate. Some Finnish players believe that the competition brought in by highly leveraged foreign funds has affected the pricing of the property market. On the other hand, the lack of thin capitalization rules also allows Finnish players to structure highly leveraged funds.

- Finnish sponsors have during a short period formed a number of property funds targeting investments in Finland, the Baltic region (Estonia, Lithuania and Latvia), and Russia.

The Finnish property funds focusing on domestic investments have been structured as Finnish limited partnerships (kommandiittiyhtiö, abbreviated ‘Ky’). Finnish limited partnerships are tax-transparent and closely resemble most ‘market standard’ limited partnership fund vehicles. Finnish partnerships have legal personality, and the limited liability of the limited partner will not be jeopardized if the limited partner participates in the management of the partnership.

In contrast to the funds making investments in Finland, the two Finnish funds established to make investments in the Baltic Region have, once again largely due to tax considerations, been structured as Finnish limited companies.

One of the property funds merits separate note. The largest of the Finnish property funds so far is CapMan Real Estate I Ky, the first property fund for CapMan, a Finnish private equity house managing or advising funds totalling roughly €1.4 billion. The fund raised a total of €500 million in capital in limited partner commitments and leverage. The fund, a Finnish limited partnership, is leveraged through bank finance and a subordinated loan channelled to the fund through a Finnish special purpose vehicle. The SPV issued €100 million worth of bonds listed on the Helsinki Stock Exchange. The structure resembled that used for a geared mezzanine fund formed earlier.

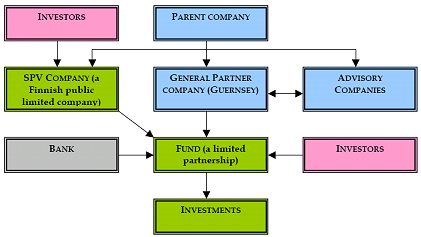

The structure of a leveraged mezzanine fund

Notes:

- The structure of the Fund itself is not out of the ordinary. It is managed by a limited company as its general partner and the investment activities are supported by advisory companies belonging to the same group of companies.

- Investors had two options for making investments (or a combination of these): as limited partners of the leveraged fund and/or by subscribing for bonds issued by the SPV vehicle.

- The fund is leveraged by an overdraft facility provided by a bank and, more importantly, by the loans provided by the SPV vehicle.

- The SPV obtained subscription undertakings from certain investors and issues bonds to the investors in several tranches. The proceeds of the bonds are further lent to the fund. The institutions investing in the bonds were invited to become shareholders in the SPV.

The signs are that we have only seen the beginning of indirect investments in Finland and the Baltic States – several players seem to be considering a move to managing property funds, and there may still be some Finnish investors waiting for an appropriate offer on a disposal of a part of their portfolio.

Farewell to problems with creating a permanent establishment?

According to a previous decision of the Finnish Supreme Administrative Court, a foreign investor who is a limited partner in a Finnish limited partnership is deemed to have a permanent establishment in Finland. Therefore, Finland has a taxing right on the foreign investor in respect of its share of the income of the limited partnership. This ruling was regarded as a major impediment for foreign investors contemplating participation in Finnish private equity or venture capital funds.

In order to make Finnish private equity funds more attractive for foreign investors the Finnish Parliament enacted an amendment to the tax law relating to taxation of non-resident partners. According to the new rules, effective as of 1 January 2006, a non-resident partner’s share of profits received through a Finnish partnership is taxed in the same way as it would be if such investor had invested directly in the Finnish target company. That is to say, a foreign partner shall be taxed as if it were a shareholder in the Finnish target company.

If the non-resident partner’s share of the profits of a Finnish partnership includes capital gains or interest, the non-resident partner shall not be taxed on capital gains or interest in Finland. Dividends paid from Finnish sources included in a nonresident partner’s share of profit of a Finnish partnership are subject to final withholding tax as prescribed in the tax treaty between Finland and the country of residence of the investor. Finland has a wide net (63 countries) of double tax treaties. In Finnish tax treaties the withholding tax rate on dividends is usually 0-15%.

One requirement for the applicability of the new relief provision to a non-resident partner is that the Finnish fund practises venture capital business in the manner prescribed in the Finnish Business Income Tax Act. According to Finnish tax law, the following features are characteristic of venture capital business:

- Investments are targeted to companies not quoted on the stock market.

- Investors aim to develop the business of the target companies.

- Investors aim to sell the shares acquired in target companies within a limited time frame.

Tax aspects of structuring investments in Russia or Baltic region

Recently, there has been growing interest in investing in businesses and real estate in Russia and the Baltic region. From a tax point of view, the manner in which foreign investments may most feasibly be structured is always dependent on the nature of the investments (real estate or shares in operative business companies) and on the anticipated type of income derived from the investments (rental income, dividends, interest income, capital gains).

In general, a Finnish limited partnership fund is a tax-feasible solution for international private equity investments. There is no taxation at the level of a fund, but the investment income is taxed in the hands of the investors. No Finnish tax implications will affect the foreign investor, provided the investor is resident in a country with which Finland has concluded a tax treaty.

The only exception to this concerns dividends from Finnish target companies, which are subject to withholding tax as prescribed in the tax treaty between Finland and the country of residence of the investor. Accordingly, foreign investors (resident in a tax treaty country) in Finnish funds, which invest in foreign (e.g. Russian or Baltic) target companies, are never subject to taxation in Finland on their share of income from target companies.

A Finnish limited liability company (osakeyhtiö or ‘Oy’), as a fund, may be a taxfeasible structure in certain cases. One example might be where the investment income can be repatriated to the Finnish fund as tax exempt dividends, and further distributed as tax-exempt dividends or capital gains to the shareholders of the fund. For instance, in Baltic countries the corporate income tax rate is fairly low (Latvia 15%, Lithuania 15%, Estonia 0% / distribution tax 24%).

To take advantage of low corporate income tax rates, for example in relation to investment in real estate, it may be advantageous to structure the investment in such a way that the Finnish company invests in Baltic real estate through holding companies in the Baltic countries.

Choosing the right structure and the right advisers

Choosing the right structure for a fund may be an overly discussed topic but is still naturally something that every fund manager needs to think about each time it is time to start fundraising. Without discounting the advantages of, for example, UK, Channel Islands and Luxembourg vehicles often used as fund structures, for many players (especially smaller management companies) it may still be worthwhile to consider more local structures.

First of all, depending on the targeted investor group, an offshore structure may not come with any actual tax advantages, but may instead bring along additional establishment expenses and operating costs. For example, if a Finnish management company took the view that the vast majority of commitments to its new fund would in the end come from domestic sources and from foreign investors that have no problem in investing in a Finnish vehicle (and/or possibly a parallel or feeder vehicle in another Nordic country), the benefits of raising additional commitments would not necessarily outweigh the additional administrative burden of forming and operating an offshore structure.

Compared to local structures, the formation and operating expenses of an offshore structure may sometimes prove to be too high in relation to the assets under management. For the time being at least, Finnish funds may also operate with lesser regulatory burdens than funds in most other jurisdictions.

Nonetheless, often at some point a management company wishes to take the next step and reach for a more international investor base, which in most cases calls for a more well-known and commonly used fund structure. In such cases, the choice of advisers is often a key question. The most common choice would be to engage a London law firm, though it may be difficult to select an appropriate one if the local player does not have significant experience in dealing with London firms.

From a Nordic perspective, the fee rates may also distinguish the process from previous fund-raising projects. In fact, in many cases, Nordic players have found it to be most cost-efficient to liaise primarily with, and to have the transaction led by, local counsel, with offshore legal support provided, to the extent appropriate, for example by a Channel Islands law firm. Such a choice may also facilitate discussions with Nordic investors.

For some Baltic players coming into the fund management business, choosing a legal adviser from the Nordic countries rather than from their home country or from London has also to some extent been of assistance. It helps the party in question to approach Nordic investors with the right mindset. In addition, the legal costs involved are likely to be reasonable.

The second point is that due consideration must be given, when selecting advisers, to setting up the appropriate local structures (or feeder or parallel vehicles) and completing actual transactions in the target region of a fund. In the Baltic region, for example, not every adviser will have both sufficiently deep understanding of fund vehicles and be able to provide quality advice in a compact form across all of the Baltic States.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.