In Nigeria's dynamic financial landscape, the recapitalisation of the banking sector has opened new opportunities for growth. This article delves into the critical role financial advisors play in this evolving environment, guiding institutions and investors through strategic planning, risk management, and capital allocation.

The Nigerian banking sector is undergoing metamorphosis. Banks are now mandated to strengthen their financial reserves through a new policy, which necessitates increasing their capital. This new policy is not only a matter of meeting regulatory requirements but also a chance for expansion. But how do banks navigate this new landscape? This analysis explores the world of capital raising, and it reveals how financial advisors can be a catalyst for Nigerian banks to not only meet the requirements but also emerge as more vital institutions ready to unlock a brighter future.

Why Recapitalisation?

Recapitalisation refers to the process of increasing financial strength by raising additional capital. The need to recapitalise Nigerian banks arose from a combination of factors, such as changing economic circumstances, societal expectations, and the inherent weaknesses of the banking industry.

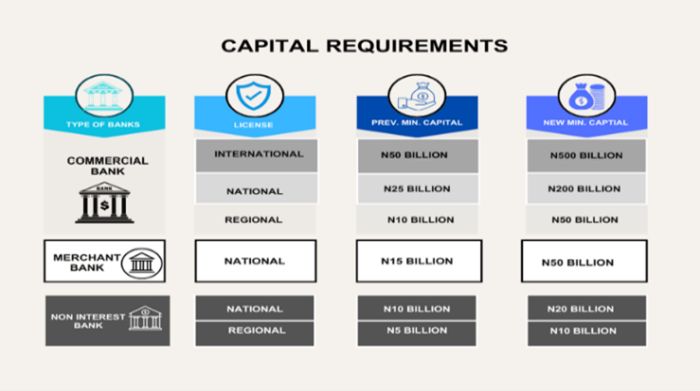

The Banking Sector Recapitalisation Programme is a regulatory initiative of the Central Bank of Nigeria (CBN) introduced on March 28, 2024, effective April 1, 2026, which requires banks to increase their minimum paid-in ordinary share capital to a specified amount according to their license category and authorisation within a specified period of 24 months (April 1, 2024, to March 31, 2026). The primary goal of the recapitalisation is to allow Nigerian banks to take on more significant risks while remaining solvent during difficult times. It aims to provide support to various sectors of the economy and enhance trust in the banking system.

The minimum capital refers to the money a bank needs to function safely and absorb potential losses. This new requirement specifies that only a bank's paid-up capital (the portion of its shares that investors have paid for) and share premium (the additional amount shareholders pay above a share's face value) will help fulfill these minimum requirements. The CBN clarified that a bank cannot use its shareholders' funds, comprising total share capital and retained earnings, as well as additional Tier 1 capital (AT1), to meet the new minimum requirement.

Capital: The Fuel for Growth

Raising capital involves securing external funds to finance strategic initiatives. These initiatives include business expansion, acquisitions, mergers, joint ventures, and strategic partnerships.

It is the lifeblood of a bank's growth. Increased capital allows banks to lend more, invest further, and ultimately expand their reach. Several capital raising options exist, each with its advantages and considerations:

Rights Issue: A rights issue is a method of raising capital where a bank offers its existing shareholders the opportunity to purchase additional shares at a discounted price. This offer is typically proportionate to the shareholder's existing shareholding.

Public Offering: A public offer is a method of raising capital where a bank issues new shares and offers them for sale. This process involves registering with the relevant securities regulator and adhering to strict disclosure requirements. Banks can access a significant amount of capital by selling shares to a wide range of investors to bolster their financial position.

Private Placement: Banks can raise capital by selling shares to a specific group of pre-selected investors, such as institutional investors or affluent individuals.

Merger and acquisitions: Mergers and acquisitions can be a strategic way for a bank to raise capital. By combining with another financial institution, the merged entity can:

- Increase market share: Expanding the bank's customer base and geographic reach.

- Achieve synergies: By creating significant cost synergies and revenue growth opportunities.

- Access new products and services: Expanding the bank's product offerings.

Mergers and acquisitions for banks seeking to raise capital involve careful consideration of strategic fit, financial valuation, regulatory approval, integration planning, and potential dilution of existing shareholders. A thorough assessment of synergies, cost reductions, and revenue enhancements is crucial, along with a robust risk management framework to address challenges such as operational disruptions, and market volatility.

Debt Financing: By selling bonds to investors, promising to repay the principal amount with interest at a specified date. This method can provide large capital but increases the bank's debt burden and interest expense. In line with IAS 32 Financial Instruments on presentation para 11 - 16, the banks should classify the capital proceeds received from investors as either equity or financial liability.

Capital proceeds from the issue of shares through private placement, right issue, and fresh issues will be classified and presented as equity instruments (i.e. equity) while capital proceeds from the issue of bonds will be classified and presented as financial liability (i.e. debt instruments). The net proceeds from the issue of shares will increase the equity of the banks while the net proceeds from the issue of bonds if any will increase the financial liabilities of the banks.

Financial Advisors: Navigating the Recapitalisation Landscape

Imagine this: Nigeria's banking sector is undergoing a massive transformation. It's like a hidden treasure chest has been found, but there's a catch – you need the right key to unlock it. That key? Financial advisors.

Think of it like this: by raising more capital, banks can lend more, invest further, and ultimately become the financial superheroes Nigeria needs. But where do financial advisors come in? They're the strategic masterminds working behind the scenes to develop a successful approach to unleashing this untapped potential. With their extensive knowledge of the financial services sector and proficiency in strategies for raising capital, their contribution could play a crucial role in assisting banks to not only adhere to the Recapitalisation policy but also leverage it as a springboard for growth through the following:

- Strategic Capital Raising: Financial advisors have the expertise to assess a bank's risk tolerance and capital needs. They can recommend the best approach to raising capital to achieve optimal results and ensure that the bank meets Capital Adequacy Ratio (CAR) requirements cost-effectively and strategically.

- Expertise in Valuation and Negotiation: Financial advisors offer fair market valuations during M&A transactions to guarantee that shareholders receive adequate compensation and safeguard their interests during the entire process.

- Regulatory Compliance: Financial advisors ensure the capital raising process adheres to all CBN regulations and best practices, mitigating compliance risks and ensuring a smooth regulatory approval process.

- Beyond Capital Raising: Financial advisors offer additional valuable services such as risk management assessments and post-merger integration planning, smoothing the path to a successful outcome and long-term stability.

Reinforcing Banking Resilience

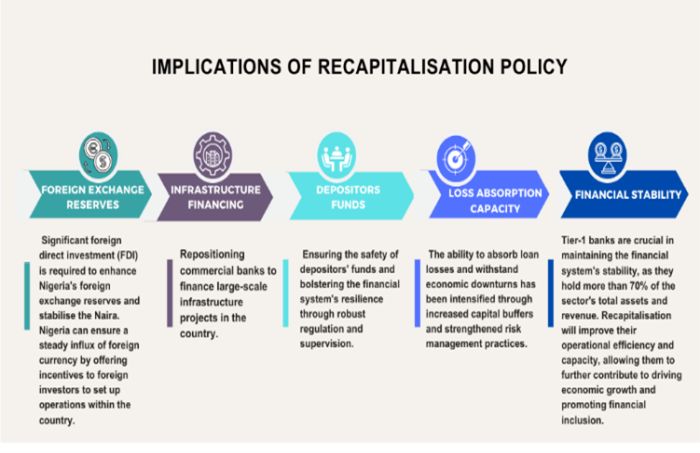

Implementing the Recapitalisation policy by the Central Bank of Nigeria (CBN) is an essential step in bolstering the resilience of the Nigerian banking industry. By imposing higher capital requirements, the CBN aims to strengthen banks' capacity to endure economic upheavals, enhance their role in fostering economic expansion, and safeguard depositors' funds, ultimately resulting in numerous advantages for the sector in the following ways:

- Improved Risk Management: Increased capital allows banks to absorb potential losses and mitigate financial risks, leading to a more robust financial system.

- Engaging Investors and Stakeholders: The recapitalization drive will likely boost investor and stakeholder interest in Nigeria's banking sector. Institutional investors are crucial for providing the necessary capital to reshape banks' strategies and growth. The potential inclusion of retained earnings in regulatory capital could significantly impact investor sentiment, market dynamics, and investment decisions across the sector.

- Strategic Partnerships: M&A activities in the banking industry have the potential to create synergies, boost competitiveness, and ultimately benefit both banks and the overall economy.

- Regulatory Compliance: Through prudent capital management, risk mitigation, and stakeholder involvement, banks can bolster their financial resilience and drive sustainable economic growth in Nigeria. The recapitalization effort is a pivotal opportunity to strengthen the banking sector's foundation for long-term stability in a dynamic market.

Accounting Implications

The CBN's recapitalization policy has far-reaching accounting implications for Nigerian banks. Beyond the requirement for increased capital, banks must navigate a complex landscape of accounting challenges. This includes recalibrating capital adequacy ratios, adjusting equity structures, managing deferredtax implications,reassessing loan portfolios for potential impairments, and accurately disclosing contingent liabilities. These accounting complexities underscore the need for robust financial management and advisory services to ensure compliance and optimize financial performance.

Implications of Recapitalisation Policy

The banking landscape in Nigeria has been reshaped due to the recent requirement for higher minimum Capital Adequacy Ratios (CAR). Despite the challenges posed by this regulatory change, it also brings opportunities for growth and stability.

The banking sector's recapitalisation in Nigeria is crucial for growth and transformation. To fully seize this opportunity, banks must collaborate with seasoned financial advisors who can navigate the complexities of raising capital and complying with regulations.

Banks can emerge as more robust, resilient, and better positioned to drive Nigeria's economic development by strategically using their expertise. Nigeria's bank recapitalisation policy creates both obstacles and opportunities. Through strategic capital raising and collaboration with experienced financial advisors, banks can meet the new requirements and become stronger, more competitive, and ready for substantial growth. A successful Recapitalisation, guided by the expertise of financial advisors, can pave the way for a more resilient and dynamic banking sector, ultimately benefiting the entire economy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.