Enhancements to the Irish regime governing the investment limited partnership (the "ILP") have led to increased interest in this structure as an option when considering the establishment of a new investment fund. The first part of our advisory series provided answers to the key questions on the features of the ILP while the second part covered the asset classes for which a partnership structure is typically considered and the recent guidance for certain closed ended funds from the Central Bank of Ireland (the "Central Bank"). This part considers the service providers that can be appointed to act for an ILP.

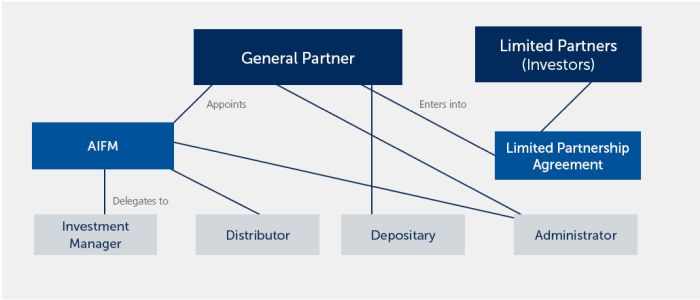

In order to establish an ILP, there must be one or more general partners and one or more limited partners. The investors are admitted as limited partners and generally a new entity will be established that will act as the general partner. The general partner is responsible for conducting the business of the ILP and is liable for the debts and obligations of the ILP.

In November 2020, the Central Bank updated its AIFMD Q&As to clarify that entities acting as general partners are no longer required to be approved as AIF management companies. While the entity appointed to act as a general partner to an ILP does not need to be authorised by the Central Bank, the Central Bank has confirmed that such entities will be considered regulated financial services providers for the purposes of the Central Bank's fitness and probity regime. This means that directors of the general partner will be required to: (i) seek pre-approval from the Central Bank in order to act in such capacity; and (ii) comply with the requirements of the fitness and probity regime on an ongoing basis.

An alternative investment fund manager (an "AIFM") must be appointed to act in respect of the ILP. While the entity acting as general partner may seek authorisation as an AIFM, generally a separate AIFM will be appointed. In cases where the AIFM delegates portfolio management to a separate investment manager, Central Bank approval in respect of this entity will need to be obtained in advance of filing for authorisation of the ILP if this entity has not previously been approved to act for Irish domiciled funds. The approval process for a discretionary investment manager or sub-investment manager depends on whether the entity is based within or outside the EU and the timeframe involved in seeking approval of an investment manager or sub-investment manager should be factored in to the authorisation timeline.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.