- within Environment and Transport topic(s)

- in European Union

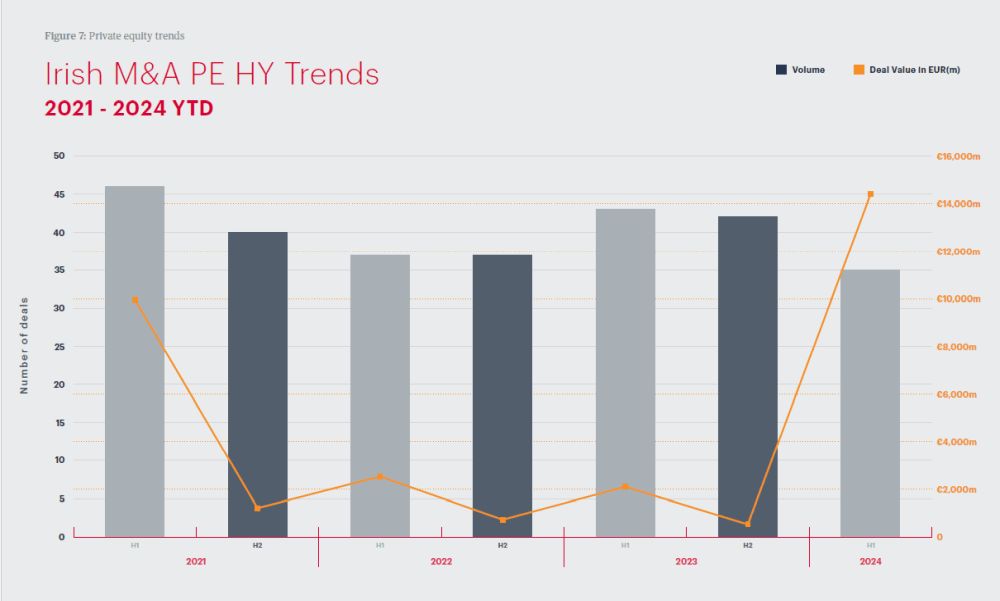

Ireland continues to be an attractive draw for private equity with a number of material transactions taking place so far in 2024, but firms are more deliberate in their dealmaking. In line with the global trend, buyouts are down on previous years, particularly by volume.

There were 35 private equity-driven deals during the first half of 2024, down 19% on the same period last year. That decline was similar to the decrease in trade buyer deal volume.

In part, this reflects the economic backdrop, with higher interest rates increasing the cost of finance and dampening private equity investors' appetite for dealmaking. An ongoing mismatch between sellers' expectations on valuation and buyers' value estimations continues. Higher financing costs contribute to private equity investors not being willing to pay the kind of prices offered in the immediate aftermath of the pandemic, with sellers taking time to adjust to reducing valuations.

Despite drop-off in volume terms, the private equity sector remains an outsized presence in the Irish market, particularly in investment value. Half of the 20 largest deals during the first half of the year involved a private equity acquirer – including the two largest deals so far in 2024. As a result, the total value of private equity deals during the first half was €14.4bn – 585% up on the first half of last year.

As with previous years, Financial Services and Lifesciences remain material sectors in the Irish M&A market in 2024. However, TMT continues to lead performance here in 2024 helped in large part by Apollo's investment in Intel's Irish manufacturing facility Fab 34 for €10.1bn.

Looking ahead, there are several positive indicators that private equity firms will return to the fray in greater numbers. Notably, the industry is sitting on record amounts of capital – on a global basis, funds had US$2.59tn of cash to deploy at the beginning of 2024, according to data from S&P Global Market Intelligence.

Additionally, an improving interest rate outlook in the UK, US and Europe suggests pressure on financing costs may ease, prompting more private equity investors to hunt for deal opportunities. All of this bodes well for the remainder of 2024 and beyond.

Click the image below to download the report

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]