Ireland remains an attractive proposition for international acquirers – both corporates and private equity investors – with the country providing a stable political and economic climate, attractive businesses in high-demand sectors and a gateway to the European Union.

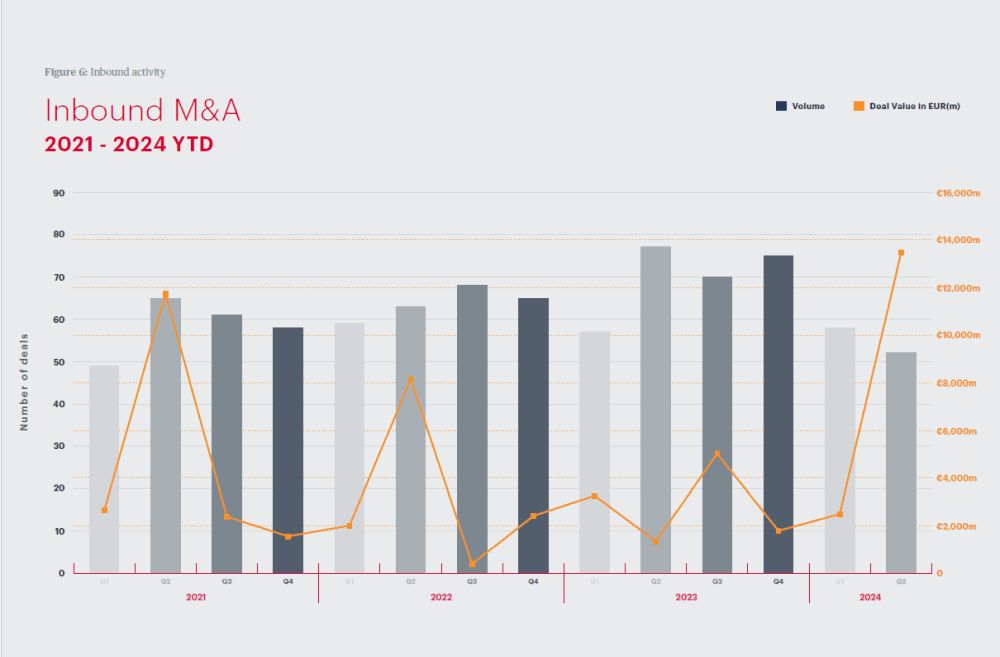

So far this year, there have been 110 inbound transactions into Ireland worth a total of €16bn. That represents a drop of 18% in volume terms compared to the same period last year – broadly in line with the overall fall in Irish M&A activity during the first half – but by value, inbound activity has increased 245% compared to the same period last year, although much of that is as a result of the Apollo/Intel megadeal.

Indeed, 15 of the 20 largest deals of the year so far were inbound cross-border transactions, including four of the top five.

As is often the case, the UK and the US accounted for the largest numbers of overseas bidders for Irish companies this year. While political and economic anxieties in both countries provide pause for thought, bidders remain active. UK acquirers have accounted for 41 deals so far this year, with US bidders involved in a further 22 transactions. That means UK and US acquirers were behind more than half of all in-bound activity in the first half of 2024.

By deal value, the US was the largest investor, although much of the total was down to the Apollo/Intel joint venture. It's worth noting that Sweden was the second biggest source of acquisition capital into Irish companies during H1, with bidders from the Scandinavian country accounting for €2.7bn-worth of deals. While much of that total came from the EQT deal, Kollect on Demand's purchase of Mashup was also a notable top 20 deal. The Swedish waste management company is pursuing a significant expansion strategy in Ireland and is now proposing to change its name to Mashup Ireland. It will be interesting to observe Nordic interest in Ireland over the second half of the year and beyond.

Meanwhile, on the domestic front, activity is down this year. There were 75 transactions involving only Irish parties during the first half of 2024, down from 97 such deals in the same period a year ago. The largest domestic transaction was the AIB Group's €999m purchase of its own shares from the Irish government.

Click the image below to download the report

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.