By two laws of 17 March 2024, new rules on deadlines and penalties for possible coverage disputes and payment of insurance benefits were introduced into the Belgian Insurance Act of 4 April 2014 and the Belgian Act of 21 November 1989 on compulsory motor vehicle liability insurance.

These new rules will come into force on October 1st, 2024 and will apply to claims made on or after that date (the changes for motor liability insurance came into force on April 12, 2024).

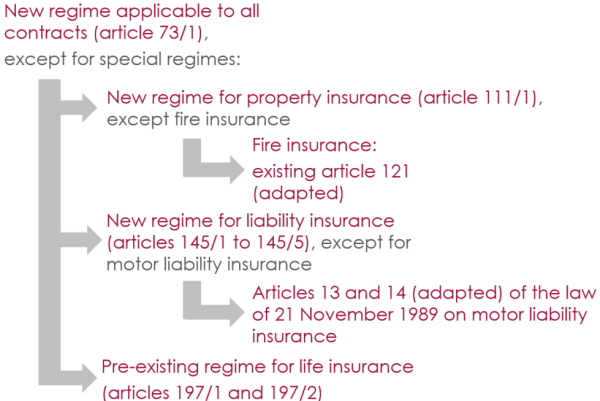

While rules in this area already existed for fire (simple risks), life, supplementary pensions and motor third-party liability insurances, nothing was provided for the other branches. The aim is to provide a harmonised regime applicable to all insurance contracts, by introducing a new general regime (applicable to insurances for which no special regime exists) and bringing the special regimes into line with the new general regime.

The various specific regimes provide for rules adapted to the characteristics of the insurances concerned, but in general terms the new harmonised regime can be described as follows:

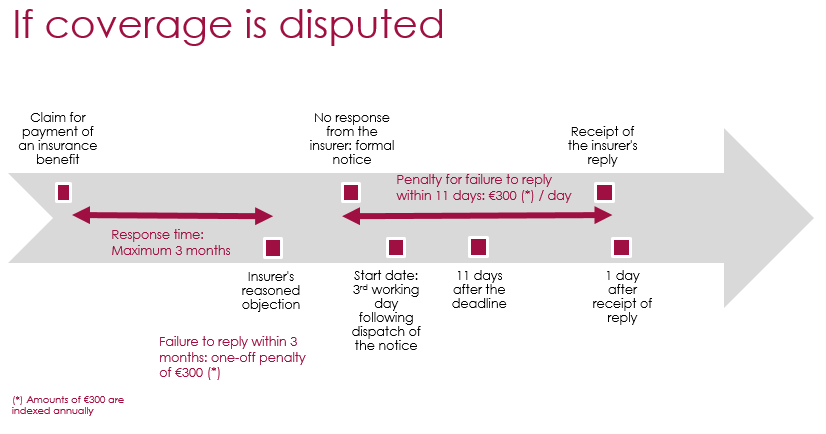

- If the insurer disputes the cover, it must provide a reasoned response within three months of the date on which the claim was submitted.

In the absence of a reasoned response within this deadline, the law provides for a twofold penalty:

- The insurer will owe a lump sum of €300 to the beneficiary of the benefit.

- The beneficiary may also serve formal notice on the insurer (by registered letter or by any other equivalent means determined by royal decree). The insurer then has an additional period of 11 days (starting on the 3rd working day following the dispatch of the formal notice) to provide a reasoned response. If it fails to do so, it will be liable to pay a penalty of €300 per day of delay from the day the formal notice was sent (i.e. retroactively). This daily penalty ceases on the day following receipt by the beneficiary of the benefit of a reasoned response (or an offer of payment) from the insurer.

The €300 amounts are indexed to the consumer price index on January 1st each year.

The deadlines may be suspended by the insurer by informing the beneficiary of the insurance benefit in writing of the reasons beyond its control which make it impossible for the insurer to fulfil its obligations. The deadlines shall begin to run again once these external reasons have ceased. [See the diagram relating to payment deadlines in the section below.]

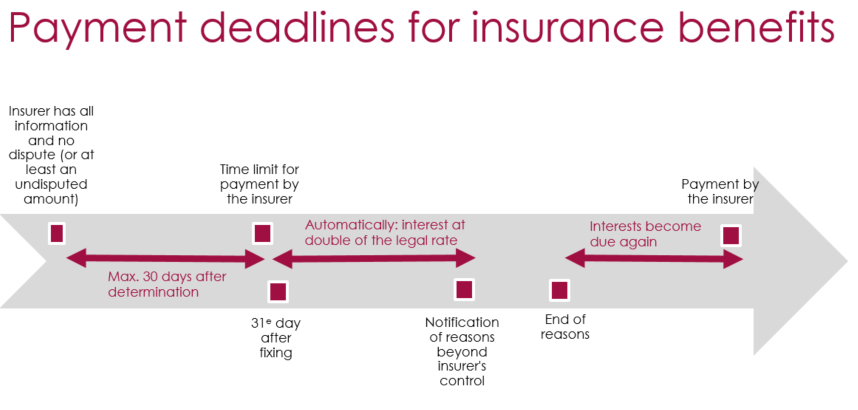

- If there is no (or no longer any) dispute about the cover and the insurer has all the information it needs to assess the benefit, payment must be made within 30 days of the amount being determined.

In the event of late payment, the unpaid amounts shall automatically bear interest at the double of the legal rate from the day following the expiry of the payment deadline.

If the overall final amount remains in dispute, the insurer must at least, within 30 days, pay the undisputed amount due, as agreed by the parties.

As in the case of deadlines for disputes, payment deadlines may be suspended for reasons beyond the insurer's control that prevent payment.

These new rules only apply to payments made directly to the beneficiary of the insurance benefit. They do not apply to subrogated third parties (e.g. mutuals, other insurers, etc.), nor if the insurance benefit is paid to a third-party service provider (repairer, rental company, etc.).

Finally, the new regime introduces two other provisions designed to protect beneficiaries of insurance benefits:

- Offers for advance payments may never contain clauses waiving rights for the future with regard to amounts not yet paid.

- The documents and information requested by the insurer to assess the claim must be "reasonable and relevant".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.