- within Employment and HR and Accounting and Audit topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

Notification Updates

Notification 12/2024–Central Tax dated 10 July 2024

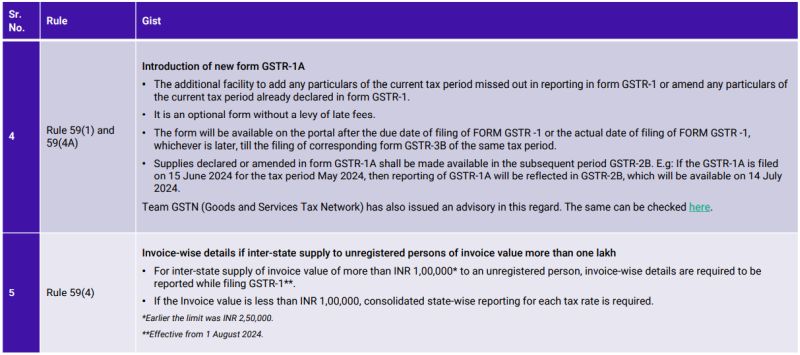

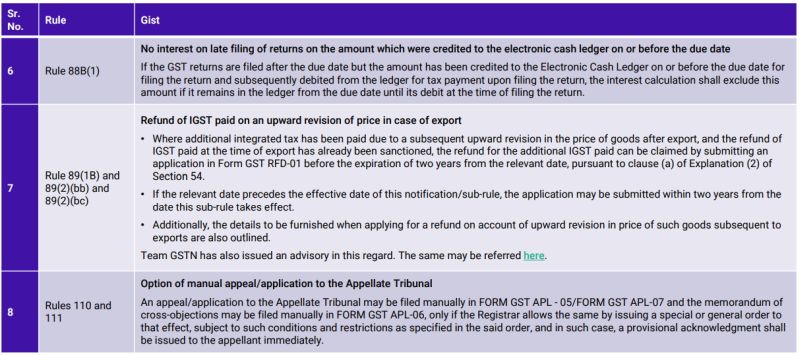

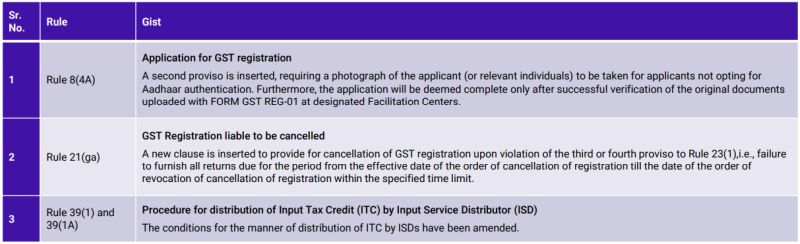

The Central Board of Indirect Taxes and Customs (CBIC) has issued a notification to notify Central Goods and Services Tax (Amendment) Rules, 2024, as per the recommendations of the GST Council. The changes include the insertion of new Form GSTR-1A, amendment to Rule 88B to provide no-interest liability on the amount deposited up to the due date of filing GSTR-3B and debited from Cash Ledger while filing a return, etc. The key updates are summarized below:

Notification 13/2024–Central Tax dated 10 July 2024

The CBIC has rescinded Notification 27/2022–Central Tax dated 26 December 2022 which specified that Rule 8(4A) of CGST Rules shall not apply in all the States and Union territories except Gujarat.

Notification 14/2024–Central Tax dated 10 July 2024

The CBIC has exempted registered persons whose aggregate turnover in the FY 2023-24 is up to INR 2,00,00,000 from filing annual returns for said FY.

The CBIC has amended Notification 52/2018–Central Tax dated 20 September 2018; Notification 02/2018– Integrated Tax dated 20 September 2018 and Notification 12/2018–Union Territory Tax dated 28 September 2018 to reduce the rate at which electronic commerce operators are required to collect Tax at Source (TCS) under said notifications. The CGST and SGST rates have been reduced from 0.5% to 0.25%, whereas the IGST rate has been reduced from 1% to 0.5%.

The CBIC has amended the CGST, SGST, UTGST and IGST rates for various items such as cartons, boxes and cases of corrugated or non-corrugated paper or paper board; milk cans made of Iron, Steel, or Aluminium; solar cookers, etc.

The CBIC has amended Notification 02/2017–Central Tax (Rate); Notification 02/2017–Integrated Tax (Rate) and Notification 02/2017–Union Territory Tax (Rate) dated 28 June 2017 to provide that the supply of agricultural farm produce in package(s) of commodities containing a quantity of more than 25 kilogram or 25 liter shall not be considered as a supply made within the scope of expression "pre-packaged and labeled" for the purpose of exemption from GST.

The CBIC has amended Notification 12/2017–Central Tax (Rate); Notification 09/2017–Integrated Tax (Rate) and Notification 12/2017–Union Territory Tax (Rate) dated 28 June 2017 to exempt the following services from GST:

- Services provided by the Ministry of Railways (Indian Railways)

to individuals by way of

- Sale of platform tickets;

- Facility of retiring rooms/waiting rooms;

- Cloakroom services;

- Battery-operated car services.

- Services provided by one zone/division under the Ministry of Railways (Indian Railways) to another zone(s)/division(s) thereunder.

- Specified services provided by Special Purpose Vehicles (SPVs) to the Ministry of Railways (Indian Railways).

Furthermore, CBIC has also exempted the supply of accommodation services having a value of supply less than or equal to INR 20,000 per person per month, provided that the accommodation service is supplied for a minimum continuous period of 90 days.

Notification 01/2024–Compensation Cess (Rate) dated 12 July 2024

The CBIC has exempted the supply of goods falling under the heading 2202 by a Unit Run Canteen (URC) to authorized customers from GST Compensation Cess.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]