MCA IMPOSES RS. 9 LAKH PENALTY ON MYND FINTECH PRIVATE LIMITED PURSUANT TO SECTION 89 OF COMPANIES ACT, 2013

- INTRODUCTION:

A recent order by the Ministry of Corporate Affairs ('MCA') suggests that MCA has imposed a penalty of Rs. 9,00,000/- (Rupees Nine Lakhs) on Mynd Fintech Private Limited (hereinafter referred to as 'the Company') and its officers in default, in exercise of powers conferred by Section 454(1) and 454(3) of the Companies Act, 2013 (hereinafter referred to as the '2013 Act') read with Companies (Adjudication of penalties) Rules, 2014 due to a substantial delay in filing declaration under Form MGT-6 under Section 89 of the 2013 Act.

- BACKGROUND:

The Company was incorporated on 14 January 2021 having its registered office located at New Delhi. The paid-up capital of the Company was Rs. 3,01,00,000/- (Rupees Three Crore One Lakh Only) as on 31 March 2023.

The Company is a wholly owned subsidiary of Mynd Solutions Private Limited (hereinafter referred to as 'MSPL') since incorporation. In order to comply with the statutory requirement of having minimum 2 members as per the provisions of the 2013 Act, MSPL holds 99.99% shares through its authorized representative and 1 (one) share is held by Mr. Vivek Mishra, in the capacity of a nominee of MSPL.

In terms of Section 89(1) of the 2013 Act, the registered holder is required to declare the status of his interest in the shares, in Form MGT-4 within a period of 30 (thirty) days from the date on which his name is entered into the register of members of such company.

Section 89(2) of the 2013 Act also requires the beneficial holder to declare the status of his interest in the shares in Form MGT-5 within a period of 30 (thirty) days after acquiring such beneficial interest in the shares of the Company.

Further, Section 89(6) of the 2013 Act mandates every Company to make a note of the aforesaid declarations received in the register of members and file a return in Form MGT-6 with the Registrar of Companies (hereinafter referred to as 'ROC' / 'Registrar') within a period of 30 (thirty) days from the date of receipt of the aforementioned declarations.

In this case, the Company had received the copy of Form MGT-4 dated 27 January 2021 signed by Mr. Vivek Mishra and Form MGT-5 dated 27 January 2021 submitted by MSPL, signed by Mr. Sandeep Mohindru. However, the Company failed to file MGT-6 within the stipulated time thereby violating the provisions of Section 89(6) of the 2013 Act.

In the Annual Return for the FY 2022-23, the Company stated that MSPL held 100% shares. In view of the above facts, the Registrar of Companies, NCT of Delhi & Haryana ('ROC' / 'Registrar') was appointed as the adjudicating officer to adjudicate penalties under the provisions of Section 454(1) of the 2013 Act. Accordingly, a show cause notice was issued to the Company under section 89 of the 2013 Act on 5 October 2023.

As a response to the said show cause notice, the Company submitted a reply on 29 October 2023 where it stated that Mr. Vivek Mishra held 1 (one) share of the Company in the capacity of a nominee of MSPL and hence, the Company believed that filing of MGT-6 was not applicable. However, the Company filed MGT-6 on 28 October 2023, with a delay of 975 (Nine Hundred and Seventy-Five) days, and the stated that the said delay was inadvertent, and no person of public at large were affected by this non-compliance. It further submitted that no undue benefit was being taken by way of the said non-filing of Form MGT-6.

- ANALYSIS:

While the Company was of the opinion that no MGT-6 filing was required, it had through its own submissions stated that the registered owner and the beneficial owner of shares had submitted Forms MGT-4 and MGT-5 respectively. Hence, the Company was obligated to declare its submission in Form MGT-6 within 30 (thirty) days of receipt of such declarations i.e., latest by 25 February 2021.

Thereafter, the Company filed Form MGT-6 on 28 October 2023 with a significant delay of 975 days, clearly violating the provisions of Section 89(6) of the 2013 Act. Accordingly, the Company and every officer of the Company who is in default shall be liable to a penalty of Rs. 1000/- (Rupees One Thousand) for each day during which the failure continues, subject to a maximum of Rs. 5,00,000/- (Rupees Five Lakhs) in case of the Company and Rs. 2,00,000/- (Rupees Two Lakhs) in case of the officer in default pursuant to Section 89(7) of the 2013 Act.

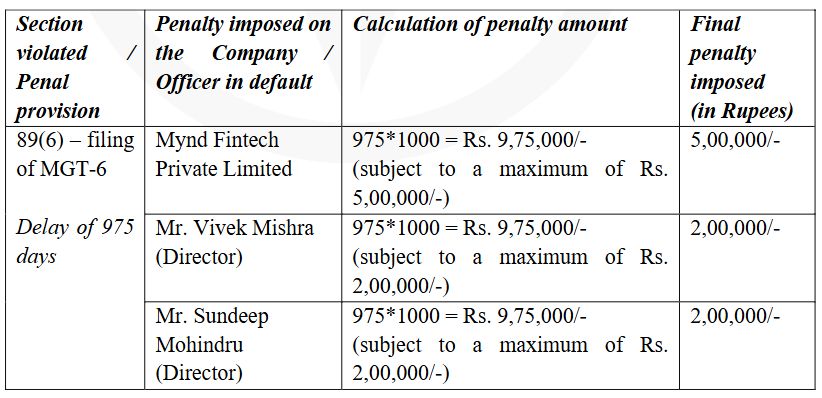

The adjudicating officer imposed the following penalties on the Company and the officers in default vide its order dated 10 January 2024:

The parties to the default are required to pay the penalty within 90 (ninety) days from the date of receipt of the said order and intimate the Registrar with a proof of penalty paid. The Company was also given a right to appeal against the said order within 90 (ninety) days of receipt of order.

- CONCLUSION:

Instances like these are a reminder that MCA holds of high importance, the need to maintain governance standards by the companies, thereby highlighting the standing of timely reporting of disclosures and declarations under the 2013 Act.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.