Integration of AI within M&A – A Game Changer

In an era marked by unprecedented technological advancements and rapidly evolving business landscapes, the world of M&A is undergoing a profound transformation. Navigating the complexities of a globalized marketplace requires innovative solutions to enhance efficiency and expedite transactions, making the strategic integration of AI a game-changer for M&A professionals.

The transformative potential of AI has been well-known within industries like healthcare, e-commerce, legal, and entertainment that have swiftly adopted and leveraged AI to enhance operations and decision-making processes. From predictive maintenance in manufacturing to personalized customer experiences in retail, AI's cross-industry disruption underscores its transformative impact on the way organizations operate and compete. The integration of AI within the M&A landscape is not very far.

As businesses grapple with the ever-growing complexity of transactions, the adoption of AI technologies promises to revolutionize various aspects of the M&A lifecycle. From target identification and due diligence to post-merger integration, AI holds the potential to enhance decision-making, optimize resource allocation, and significantly reduce transaction timelines. The traditional M&A process, characterized by exhaustive due diligence and lengthy timelines, is undergoing a paradigm shift. Recognizing the need to stay competitive, companies are harnessing AI to streamline operations, mitigate risks, and capitalize on opportunities swiftly.

Traditionally, M&A activities relied heavily on human effort for data collection and analysis. However, today, almost every M&A activity involves some level of AI technology. Unlike humans, technology can process vast amounts of data within hours or minutes, eliminating simple errors, saving time, and reducing costs associated with hiring subject matter specialist. As we navigate this digital frontier, the integration of AI is not just a choice but a strategic imperative for organizations seeking to thrive in the fast-paced and competitive landscape of M&A.

In this whitepaper, we delve into how AI is going to transform M&A and explore the various avenues through which technology is reshaping the landscape while propelling organizations towards a future characterized by agility, efficiency, and strategic growth.

Why M&As Fall Apart and How Technology can Solve this Issue

M&As are inherently complex undertakings, with a multiple factors contributing to the high failure rates observed in the industry. Understanding the reasons behind these failures is crucial for organizations looking to successfully navigate the M&A landscape. Several challenges contribute to the pitfalls ranging from slow and cumbersome processes to the overwhelming demands of managing post-M&A projects and Key Performance Indicators (KPIs).

Amplifying Efficiency through Technological Interventions

Recognizing these challenges, the integration of AI and advanced technologies can be a robust solution. Below are some of the aspects which could become more efficient with technology interventions:

No Speed, No Deal

The traditional M&A marathon, characterized by timeconsuming processes, creates deal fatigue and uncertainty. Automation powered by AI accelerates M&A stages, allowing organizations to swiftly capitalize on opportunities and maintain transaction momentum.

Informed Decision-making rather than 'Analysis Paralysis'

Data analysis poses an acute hurdle in the form of being slow and error-prone. The ability of AI to process vast datasets swiftly and accurately significantly enhances due diligence efficiency. This empowers organizations to make informed decisions early in the M&A process, mitigating risks and uncovering opportunities rather than getting into a situation of 'analysis paralysis'.

Increased Bandwidth for Strategic Initiatives

Another important aspect in effective decision-making in M&A is the seamless information flow among stakeholders. AI facilitates real-time communication and collaboration, addressing gaps that lead to misunderstandings and delays. This ensures that all parties involved have access to real-time data and insights, fostering a collaborative environment essential for successful M&A outcomes.

Seamless Management of Multiple Projects/KPIs

Post-M&A integration involves managing multiple projects and KPIs. AI-driven project management tools streamline these tasks and ensures that all projectrelated aspects are systematically planned and organized. This warrants that critical details are not overlooked and organizations can meet their integration objectives efficiently.

By leveraging AI, organizations can transform traditional M&A processes, accelerate timelines, optimize data analysis, foster seamless communication, and ensure effective project and KPI management.

Evolution of AI Tools in M&A: From Reactive Machines to Self-aware Systems

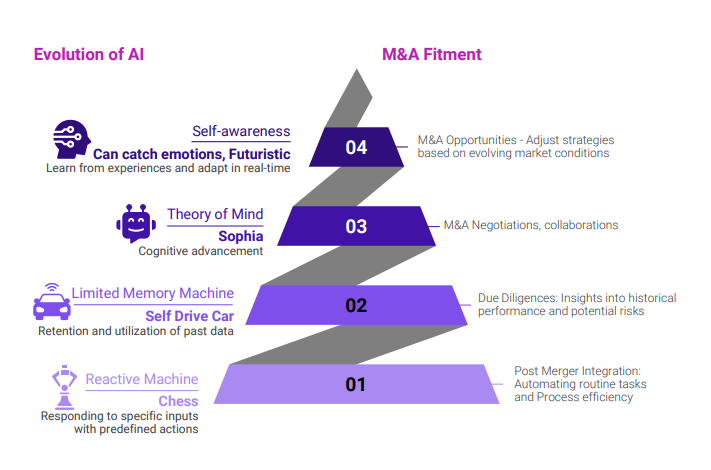

As technology progresses, so does the evolution of AI, transforming its capabilities and applications in the M&A landscape. The journey of AI can be categorized into several stages, each marked by distinct advancements in functionality and cognitive abilities.

Fitment with M&A

The evolution of AI aligns seamlessly with the intricate nature of M&A transactions. Reactive machines expedite routine tasks, limited memory machines enhance data analysis, and the incorporation of a 'Theory of Mind' facilitates nuanced communication. As AI progresses towards self-aware systems, adaptability and real-time learning capabilities become paramount to address the dynamic challenges inherent in the M&A environment.

In the subsequent sections, we will delve into specific applications of these evolving AI capabilities in M&A, showcasing how each stage contributes to the processes optimization, decision-making, and overall success in the M&A landscape.

Evolution of AI Tools in M&A

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.