INTRODUCTION

On March 06, 2024, the Ministry of Corporate Affairs ("MCA") issued two separate notifications in relation to the following:

- notification to enhance the threshold for an acquisition to qualify as combination under the Competition Act, 2002 ("Act"); and

- notification to revise the value of assets and turnover to avail 'De-Minimis / Small Target Exemptions'.

We have discussed both these notifications in detail below

ENHANCEMENT OF THRESHOLD FOR COMBINATIONS

Section 5 of the Act lays down the thresholds for an acquisition, merger or amalgamation of one or more enterprises, to qualify as a combination. In case a transaction qualifies as a combination and breaches the thresholds laid down in Section 5, then a prior approval of the Competition Commission of India ("CCI") is required.

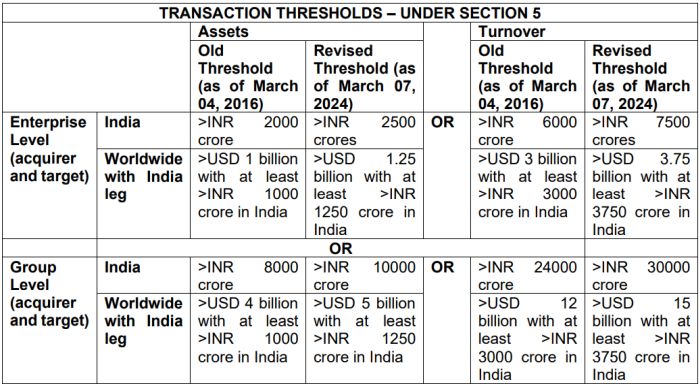

The MCA had increased the thresholds for a transaction qualifying as a combination by 100% (of the original threshold), in the year 2016. Subsequently, these thresholds were further increased by an additional 50% (of the original threshold) by way of the notification issued by the MCA on March 07, 2024. For the purposes of calculating these thresholds, the asset value or turnover of both the acquirer and target are taken into account.

We have laid down below the old and the new thresholds for an easy analysis:

ENHANCEMENT OF DE-MINIMIS / SMALL TARGET EXEMPTION

The De-Minimis Threshold was introduced by the MCA in the year 2017, through which certain transactions falling within the prescribed thresholds were exempted from obtaining prior approval of the CCI. This exemption was made available for a period of 5 years, with effect from March 27, 2017. Subsequently, by way of notification dated March 16, 2022, the time period for availing the small target exemption was extended for another period of 5 years.

By way of a notification dated March 07, 2024, MCA revised the De-Minimis Threshold (to increase the threshold) to state that any enterprise which is being acquired, taken control of, merged, or amalgamated, has:

- an asset value of not more that INR 450 crores in India (the earlier limit was INR 350 crores); or

- turnover of not more than INR 1250 crores in India (the earlier limit was INR 1000 crores),

will not be classified as a 'combination' as laid down under Section 5(a), 5(b) and 5(c) of the Act and accordingly, such transactions will not require prior approval of the CCI.

Unlike Section 5 of the Act where the value of both the acquirer and target is taken into account, to avail the benefit of De-Minimis Threshold, the value of asset or turnover of only the target is taken into account.

This exemption is valid for a period of 2 years, with effect from March 07, 2024.

In cases wherein only a portion of an enterprise is being acquired, taken control of, merged or amalgamated with another enterprise, then the value of assets of the identified portion which is being acquired, will be taken into account for the purpose of calculating the above-mentioned thresholds.

ANALYSIS

Combination Threshold. Section 20(3) of the Act states that the Central Government in consultation with the CCI has the power to enhance or reduce the combination thresholds every two years, basis the changes in the wholesale price index or fluctuations in exchange rate of rupee or foreign currencies. Accordingly, given the fluctuations in the exchange rate of the rupee, the increase in the combination threshold is a welcome step and falls in-line with the current economic conditions of the country.

De-Minimis Threshold validity. It is interesting to note that the 2017 notification had a validity period of 5 years. Thereafter, with the issuance of the 2022 notification, the validity of the De-Minimis Threshold was extended for a further period of 5 years i.e., up to March 16, 2027. The 2022 notification gave reference to the erstwhile 2017 notification and had amended the validity period of the said notification.

On March 07, 2024, another notification was issued by the MCA in relation to the De-Minimis Threshold, which gave no reference to the erstwhile notifications, but increased the De-Minimis Threshold for a period of 2 years. This 2024 notification gives the impression that post the expiration of the 2 year period, the De-Minimis Threshold will go back to the amounts prescribed under the 2017 and 2022 notifications and that the 2024 notification appears to be an interim measure to increase the De-Minimis Threshold.

ABOUT KOCHHAR & CO

Kochhar & Co is a leading full service commercial law firm with a national presence in India. The firm mostly represents international companies doing business in India and offers a high quality, businessoriented service to its clients. The firm takes great pride in its client servicing approach, which is focused on clarity, accessibility and providing business solutions. The firm has a large national presence in India with offices at Delhi, Gurgaon, Mumbai, Bangalore, Chennai, Hyderabad, and Chandigarh as well as overseas offices in Dubai, Singapore, and Chicago.

CORPORATE LAW PRACTICE

The Firm has a robust corporate and transactions' advisory practice and advises client across the broad spectrum of corporate work including private equity and venture capital investments, public takeovers, private M&A, complex joint ventures, buyouts & disposals and corporate restructurings, as well as general commercial, regulatory, anti-trust and corporate governance issues.

The Firm has built a formidable Corporate Transactions' practice that is supported by pan-India teams of market leading experts in real estate, tax, employment, anti-trust/ competition, intellectual property, regulatory and litigation as well as teams offering the full range of finance support including all aspects of banking and finance and restructuring transactions.

The Firm advises on a broad spectrum of issues and procedures involved in funding transactions and the firm's solution-oriented approach combined with its expertise in managing multi-disciplinary teams of lawyers, accountants, financial advisers often minimizes roadblocks and transactional time and maximizes efficiency.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.