Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up of new manufacturing units in the state. Such incentives are in the form of capital subsidies, interest subsidies, subsidized electricity tariffs, and more. The purpose of such incentive schemes is to attract investment thereby enabling infrastructure development, generating employment, developing focus sectors, and largely facilitating the overall economic development of the state.

To enable the availability of a quick summary of such general incentives offered by various Indian states, Nexdigm is releasing a series of documents focusing on providing a brief overview of such incentives offered by respective State Governments in India. This document covers information about incentives offered by Tamil Nadu under the 'Tamil Nadu Industrial Policy, 2021'.

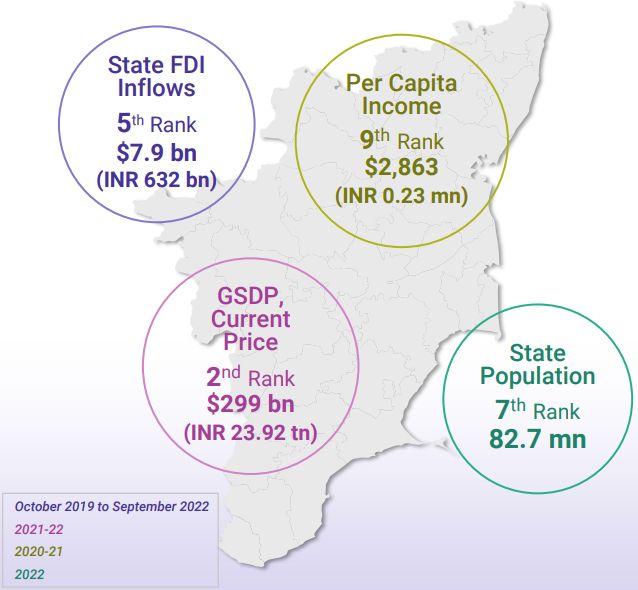

Key Statistics | TAMIL NADU

Policy Overview

The Tamil Nadu State Government released 'Tamil Nadu Industrial Policy 2021', which is valid from 1 January 2021 to 31 March 2025. The policy aims to attract investment of USD 135 billion (~INR 10.8 trillion) and achieve an annual growth rate of 15% in the manufacturing sector during the policy period.

The policy has placed special attention to the manufacturing sector with an objective to increase the contribution of the manufacturing sector to 30% of Gross State Value Added (GSVA) by 2030.

Nexdigm Ratings and Observations

|

Note: The information/data used for the ratings is subjective based on our assessment of the policy, the experience of Nexdigm professionals in dealing with State Authorities, digitization of select statutory requirements, etc. |

|

Policy Highlights

Industry Classification

Manufacturing enterprises, for the purpose of the scheme, are classified under different categories based on the quantum of investment in Eligible Fixed Assets (EFA) which has been briefly tabulated below:

In addition, the above enterprises should create employment for

at least 50 persons to be eligible for incentives under this

policy.

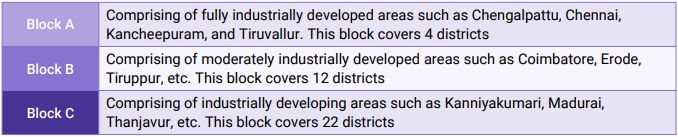

Region Classification

Regions in Tamil Nadu, for the purpose of the scheme, are classified under different categories based on the development stage of such regions, thereby promoting investments with relatively higher incentives in developing or underdeveloped regions for the balanced growth of the entire state. The classification is tabulated briefly below:

Thrust Sectors

Every state encourages select sectors based on their competitive strength and advantage such as geographical location, available resources, raw material availability, existing manufacturing practices, and growth potential. Such sectors are known as thrust sectors and are accorded additional benefits in the incentive scheme.

11 thrust sectors have been identified under this policy:

- Aerospace & Defence Applications

- Agro & Food Processing except for the Edible Oil industries

- Renewable Energy Components Manufacturing

- Electronics System Design & Manufacturing

- Medical Electronics, Devices, & Equipment

- Electric Vehicles, EV Cell & Battery Manufacturing

- Biotechnology

- Pharmaceuticals, Bulk Drugs, & Nutraceuticals

- Petrochemicals & Speciality Chemicals

- Footwear, Finished Leather Goods, & Polyurethane Fabric

- Technical Textiles including Medical Textiles

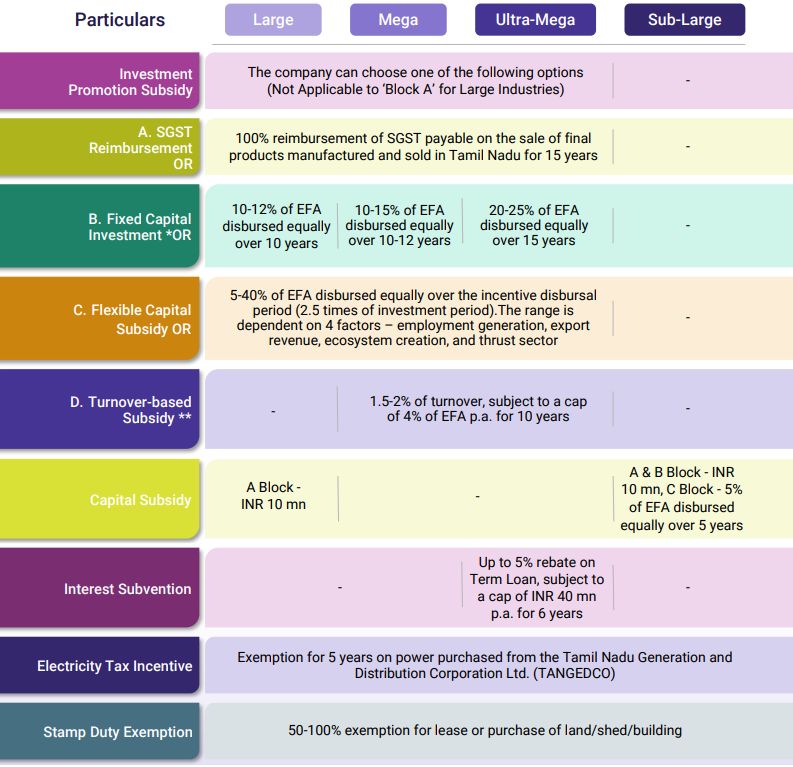

Major Incentives

Several incentives are provided to industries based on their investment thresholds and region of set-up in Tamil Nadu. The below table covers a range of incentives depending on the set-up region provided to enterprises basis the classification of industries:

To avail Fixed Capital Investment Subsidy, companies must provide minimum employment as follows – Large (150), Mega (400), and Ultra-Mega (2000)

** To avail Turnover-based Subsidy, Mega and Ultra-Mega Industries must provide minimum employment to 2000/4000 employees

Important Notes

- Eligible Fixed Assets (EFA): EFA includes investments made in

land, building, plant & machinery, equipment, project-related

infrastructure, other constructions, etc., and excludes intangible

assets

- Industries that form part of thrust sectors and R&D

projects shall be eligible for enhanced subsidies on top of the

above package (higher incentive percentage or limits on Investment

Promotion Subsidy, stamp duty exemption, interest subvention,

etc.)

- Service sectors including warehousing and logistics are also eligible for some incentives such as electricity tariff subsidy, affordable loans, land rate concession, etc.

Additional Key Incentives

- Training Subsidy: Up to INR 4,000 per worker per month for six months

- Land Cost Incentive: 10-50% land rate

concession

- Additional incentives for recycling waste, energy, and water conversation (25% subsidy), quality certification, intellectual property creation (up to 50% subsidy), and SGST refund on capital goods are also available for the above industries.

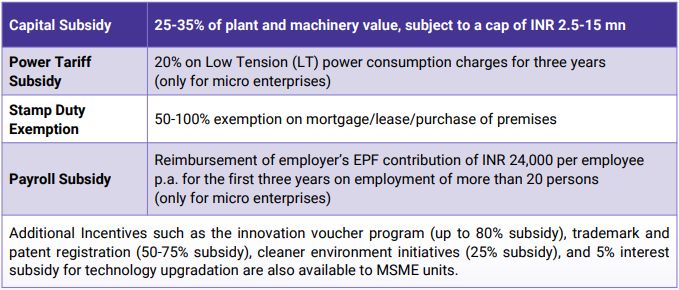

Incentives for MSMEs under MSME Policy, 2021 of Tamil Nadu

A separate policy has been launched by the State Government for covering incentives for MSME.

Eligibility criteria: Minimum investment in plant & machinery up to INR 500 million and turnover up to INR 2,500 million.

Below are the high-level major incentives available to MSMEs as per this policy:

Other Key Policies

Tamil Nadu Electric Vehicles Policy 2023

This policy covers units engaged in the manufacturing of Electric Vehicles (EV), EV components, Electric Vehicle Supply Equipment (EVSE) and EV charging infrastructure, charging stations/charging point operators, and customers purchasing EVs in Tamil Nadu. The policy offers investment promotion subsidies such as 100% reimbursement of the Gross SGST, turnover-based subsidy, capital subsidy of up to 15% of the investment, electricity tax exemption, 100% stamp duty exemption, etc.

Tamil Nadu Footwear & Leather Products Policy 2022

The Tamil Nadu Leather and Footwear Products Policy 2022 offers special incentives for two key categories – A special package for Footwear and Leather Products (FLP) manufacturing and FLP design studios.

Tamil Nadu Start-up & Innovation Policy 2018

The Tamil Nadu Start-up and Innovation Policy 2018-2023 aims to provide an enabling, innovative ecosystem in the state. Implementation of the policy will enable Tamil Nadu to emerge as the 'Knowledge Capital' and 'Innovation Hub' of the country.

Tamil Nadu New Integrated Textile Policy 2019

With a vision to achieve higher and sustainable growth in the textile value chain, multiple incentives are provided to textile units, majorly in the form of credit-linked Capital Investment Subsidy (CIS).

Tamil Nadu Fintech Policy 2021

The Government of Tamil Nadu shall support FinTech start-ups and large firms venturing into the FinTech sector. The State Government shall also support angel funds, private equity, venture capital funds, and incubators. Major incentives include up to 75% of reimbursement of operating expenses and SGST reimbursement.

Sources

https://www.investindia.gov.in/state/tamil-nadu

https://dpiit.gov.in/publications/fdi-statistics

https://investingintamilnadu.com/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.