The Securities and Exchange Board of India (SEBI) via their circulars dated April 28, 2022 (Public InvIT Circular) and June 24, 2022 (Private InvIT Circular), have trimmed down the timelines for listing the units of an infrastructure investment trust (InvIT) pursuant to a public and private offering, respectively, to 6 working days.

Prior to these circulars and pursuant to the SEBI InvIT Regulations, 2014, an InvIT was required to list its publicly and privately offered units within 12 working days and 30 working days, respectively, from the date of the offer closure. Thereafter, SEBI through the two circulars has endeavoured to provide a streamlined shortened mechanism for ensuring that the investors (amongst others) see the light at the end of the tunnel, i.e. the listing of an InvIT's units, much sooner.

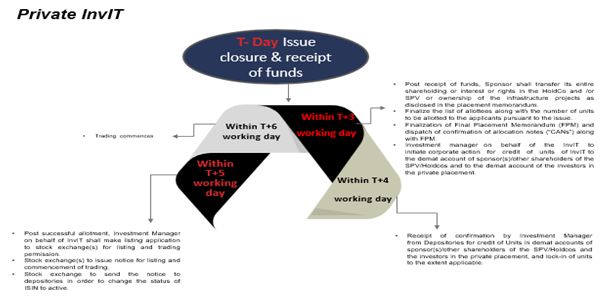

Contours of a Public & Private InvIT listing timeline

These developments will indeed require some coordination amongst the stock exchanges and various intermediaries in order to ensure that public as well as private InvITs are listed within 6 working days from date of the offer closure. Consequently, we believe, that SEBI had mandated this framework for public and private listed InvITs, opening on or after June 1, 2022 and August 1, 2022, respectively.

This can also be seen as a smart move by the Indian regulator in order to sync the timelines for listing a public or a private InvIT with the listing of equity shares offered via a public offering, both of which are monitored in SEBI by their distinct departments.

Moreover, from a commercial perspective, this is indeed a positive direction from SEBI to bolster its efforts in further making InvITs an attractive fund-raising avenue in India for select set of investors, especially during continuous volatility and uncertainty stemming from domestic and global factors. It may be worthwhile to recall that in case of equity public offerings in India (IPOs), SEBI has been shrinking down on the timelines for IPO listings from 22 working days to 12 working days and currently at 6 working days.

We anticipate that sometime in the future, the Indian securities markets regulator will also inch towards reducing these timelines to 3 working days to increase efficiency and maximize seamless listing of a public and a private InvIT in India.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.