In today's business landscape, establishing a business entails inherent risks and demands significant effort along with financial investment. Entrepreneurs must diligently identify an optimal location to mitigate potential challenges and ensure the success of their ventures. One destination that has gained prominence is Labuan, a Federal Territory in Malaysia. This article explores the process, unique advantages and work permit opportunities that make Labuan an ideal choice for establishing a business.

Regulatory Framework

Labuan Financial Services Authority ("Labuan FSA") was established in accordance with the Labuan Financial Services Authority Act 1996, operating under the Ministry of Finance, Malaysia.1 It serves as the regulatory body for the development and administration of the Labuan International Business and Financial Centre ("Labuan IBFC"). Labuan FSA issues licenses and oversees entities within Labuan IBFC, ensuring compliance with local laws, regulations, and international standards. Additionally, Labuan FSA develops regulator policies to ensure the orderly conduct of business and financial services in the Labuan IBFC.

Requirements for the Incorporation of Company in Labuan

A Labuan Company is a company incorporated or registered under the Labuan Companies (Amendment) Act 2022. Both Malaysian residents and non-residents are permitted to establish Labuan Companies. When establishing a Labuan company, the share structure can be categorised as a company limited by shares, company limited by guarantee, or an unlimited company. The share capital may be in any currency and entails a minimum of one share without a specified share par value.

Furthermore, the three types of companies that may be set up in Labuan include a Labuan Company, a Labuan Foreign Company and a Labuan Protected Cell Company. To establish a company, individuals or entities must engage the services of a licensed Labuan trust company, which acts as the agent for incorporating or registering companies under the Labuan Companies Act 1990.2

The newly established company is mandated to have a minimum of one director, who may serve as a resident director. Moreover, there must be a minimum of one secretary in the company. The principal office of the Labuan Trust company shall be the company's registered office.

To fulfil accounting requirements, the company must submit audited accounts as part of tax filing requirements. Furthermore, these companies are obligated to maintain a specified minimum number of employees and annual operating expenditure in Labuan, the values of which depend on the specific activities conducted by the respective Labuan Companies.

Process of Establishing a Labuan Company

The individual or company must firstly, reserve a company name subject to the discretion of the Labuan FSA. The chosen name must include any word or its abbreviation thereof in the national language of any country with an accurate and certified rendition of the name in the English language. An application fee of RM50.00 is applicable for the reservation of the name. The approval is typically granted within twenty-four hours, and the reserved name is valid for a period of three months.

There are a few documents needed for incorporation, and these include:

- Memorandum and Articles of Association of the proposed company.

- Statutory Declaration of Compliance by the trust company.

- Consent to act as director(s).

- Individual forms completed by each director.

- For activities requiring licensing, prior approval for conducting such business must be obtained before incorporation.

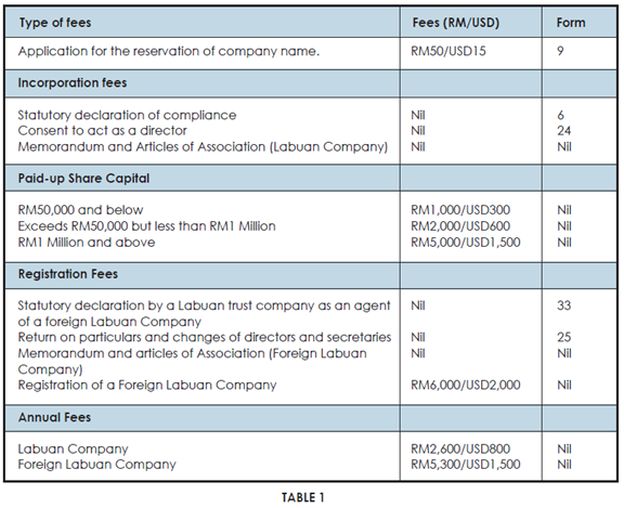

Upon submission of complete documentation and payment of fees as well as clearance from the due diligence process conducted by Labuan FSA a Labuan company can be approved for incorporation or registration within twenty-four hours. The fees payable for incorporation and registration are summarised into Table 1.

Advantages of Incorporating a Labuan Company

Labuan offers numerous advantages that makes it an attractive destination for entrepreneurs. One significant perk is the favourable tax environment. Labuan companies enjoy access to more than 70 Double Taxation Agreements that Malaysia has signed.3

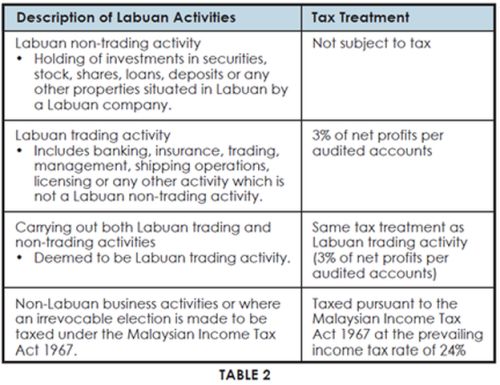

The Labuan Business activities, as defined in the Labuan Business Activity Tax Act 1990, are provided in Table 2.4

Labuan offers several other benefits, notably standing out for its competitive operating costs, rendering it an economically viable choice for businesses. More importantly, Labuan imposes no indirect taxes, including sales and services tax, import duties, and excise duties. The absence of foreign exchange controls further enhances the flexibility of conducting business in Labuan. Labuan companies, including those licensed under the laws related to financial services in Labuan IBFC, enjoy the privilege of setting up marketing offices anywhere in Malaysia. These combined advantages create a conducive environment for business growth, making Labuan an attractive and lucrative destination for entrepreneurs seeking a thriving business ecosystem.

Getting a Work Permit in Labuan

The Labuan Work Permit is a renewable two-year work visa, allowing the holder to reside in Labuan and any location in Peninsular Malaysia. The requirements to apply for a work permit are as follows:

- Application for Work Permit's

("Applicant") minimum monthly income

shall be at least RM 10,000.00 or its equivalent in any foreign

currency and may include:

- Basic Salary;

- Cash allowances. e.g. transportation, housing, perquisites etc.;

- Benefits-in-kin;

- Value of living accommodation; and

- Other fees and commissions.

- The application for Work Permit should be in respect of the

following positions in the company:

- Top management, e.g. Members of the Board. Executive Director, Managing Director, Principal Officer, Chief Executive Officer, Chief Financial Officer and Chief Operating Officer, Professionals, e.g. Accountant,

- Lawyer, Consultant, Underwriter, Economist, Advisor, Engineer, Actuary and Trader (for those who are employed under Labuan Commodity Trading Company).

- Technical experts. e.g. IT specialist or other specialists related to Labuan trading activities.

- Applicant should be a fit and proper person in accordance with

the guidelines issued by the Labuan Financial Services Authority,

as follows:

- Integrity

- Competency

- Soundness of Judgement

- Financial standing of the person

Once the requirements for the work permit application are met, the individual can proceed with the application procedures. The application for work permit shall be submitted to Labuan Financial Services Authority in accordance with the latest checklist provided by Immigration Department of Malaysia. The checklist is as follows:5

- Employment Pass/Dependent Pass

- Typed DP 10 Form

- Typed DP 11 Form

- Cover letter from the employer

- Authorisation letter from the company to the Immigration Department for liaising on the application process. The authorisation letter shall include the name, Identity Card number and designation of the liaison person

- Original copy of approval letter from relevant authority(ies)

- Stamped original employment contract

- Stamped personal bond for visit pass (for temporary employment)

- Duly certified personal resume and academic certificate

- Duly certified copy of passport for pages with entry stamps

- Copy of sponsor's Identification Card

- 4 passport-sized photographs with white background and name written at the back of the photographs

- Copy of Certificate R.O.C. (LOFSA-Form 7), beneficial owner, copy of Business License Certificate to carry on business as financial institution/ insurance & insurance related Form 14, 20. 22. 23 and 24 (applicable to Labuan Financial Services Authority ("Labuan FSA")).

- Form CP22 or proof of Registration with Inland Revenue Board (upon approval)

- If the company is licensed, the Work Permit can be submitted to Labuan FSA through various channels, including Labuan licensed entities, trust companies, insurance managers, underwriting managers, takaful managers, or takaful underwriting managers.

Alongside the application, a statutory declaration and a copy of due diligence documents, such as World-Check results, must be provided. The applicant must furnish the company's address in Malaysia, as required by the Immigration Department. This address should correspond to the operational, co-located, or marketing office in Labuan or Malaysia. Work permit renewals are required at least three (3) months before expiration, with each application incurring a non-refundable processing fee of RM 1,000.00.

Conclusion

With competitive operating costs, no indirect taxes, efficient work permit and the flexibility for Labuan companies to establish marketing offices across Malaysia. Labuan provides an ideal setting for business growth. In essence, Labuan's business-friendly environment, coupled with its unique perks, positions it as a prime choice for entrepreneurs seeking a dynamic and thriving business ecosystem.

Footnotes

1. Labuan FSA, The Regulator, https://www.labuanfsa.gov.my/about-labuan-fsa/the-regulator.

2. Association of Labuan Trust Company (ALTC), Trust Company Definition, http://www.altc.org.my/about_us.htm#:~:text=The%20trust%20company%20acts%20as,documents%20required%20under%20the%20LCA.

3. Labuan IBFC, Appendix 1, A Guide to Labuan Companies, https://www.labuanibfc.com/clients/asset_52E835CC-1342-4701-B6FA-E2CD03AD74B4/contentms/img/publications/brochures/Labuan-IBFC_Labuan-Companies-Brochure_220418_RGB.pdf.

4. Deloitte, The Labuan Tax Framework, https://www.labuanibfc.com/clients/asset_52E835CC-1342-4701-B6FA-E2CD03AD74B4/contentms/img/publications/research-papers/ENG.DELOITTE.pdf.

5. https://www.labuanfsa.gov.my/clients/asset_120A5FB8-61B6-45E8-93F0-3F79F86455C8/contentms/img/documents/Legislation_and_Guidelines/Guidelines/Guidelines-on-Work-Permit-Application-in-Labuan.pdf.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.