1. Introduction

On January 12, 2021, the Financial Services Agency of Japan ("JFSA") and the Local Finance Bureau established the "Financial Market Entry Office" ("FMEO") to provide a one-stop, fullyEnglish services for pre-application consultation, registration procedures, and post-registration supervision for foreign financial business operators, such as asset management firms newly entering the Japanese market. Since the establishment of the FMEO, approximately 40 business operators have been registered as Financial Instruments Business Operators ("FIBOs") through the FMEO.

This newsletter provides an outline of the procedures that prospective FIBO applicants have to undergo through the FEMO, based on our experience in assisting clients with the registration procedures through the FMEO as well as through the lens of Mr. Komaki (co-author of this newsletter), who served at the FMEO for approximately two years as a fixed-term government officer until March 2024.

2. Governmental support program – Availability of financial support

2.1. JFSA support program

Under the auspices of the Japanese government, the FMEO was established to provide free, one-stop English-language support to foreign financial business operators wishing to establish a business base in Japan. The FMEO provides foreign financial business operators with support on incorporation of Japanese subsidiaries, and preparation of application documents for registration as a FIBO, amongst other matters.

Moreover, foreign financial business operators who meet certain conditions may be eligible to receive rebates of up to a pre-determined amount of the costs required to establish a business base in Japan (i.e., 70% of actual costs incurred, subject to the limit of 20 million yen in actual costs) including legal fees payable to law firms as part of the application process for registration as a FIBO.

2.2. Tokyo Metropolitan Government's support program

To encourage of the growth of asset management or FinTech firms in Tokyo, the Tokyo Metropolitan Government has launched a support program under which firms that are intending to establish a business base in Tokyo will receive subsidies for a portion of their expenses (including initial costs for renting an office, professional fees (including legal fees), and fees for hiring personnel) in establishing such business base.

Foreign financial business operators are entitled to apply for both such subsidies as well as the rebates available under the aforementioned JFSA support program.

3. Conditions for registration in English through FMEO

Applicants may apply for registration in English through the FMEO if they meet both the conditions relating to: (i) applicant qualifications and (ii) business requirements, which are discussed in more detail in the Appendix.

4. Registration Procedure through FMEO

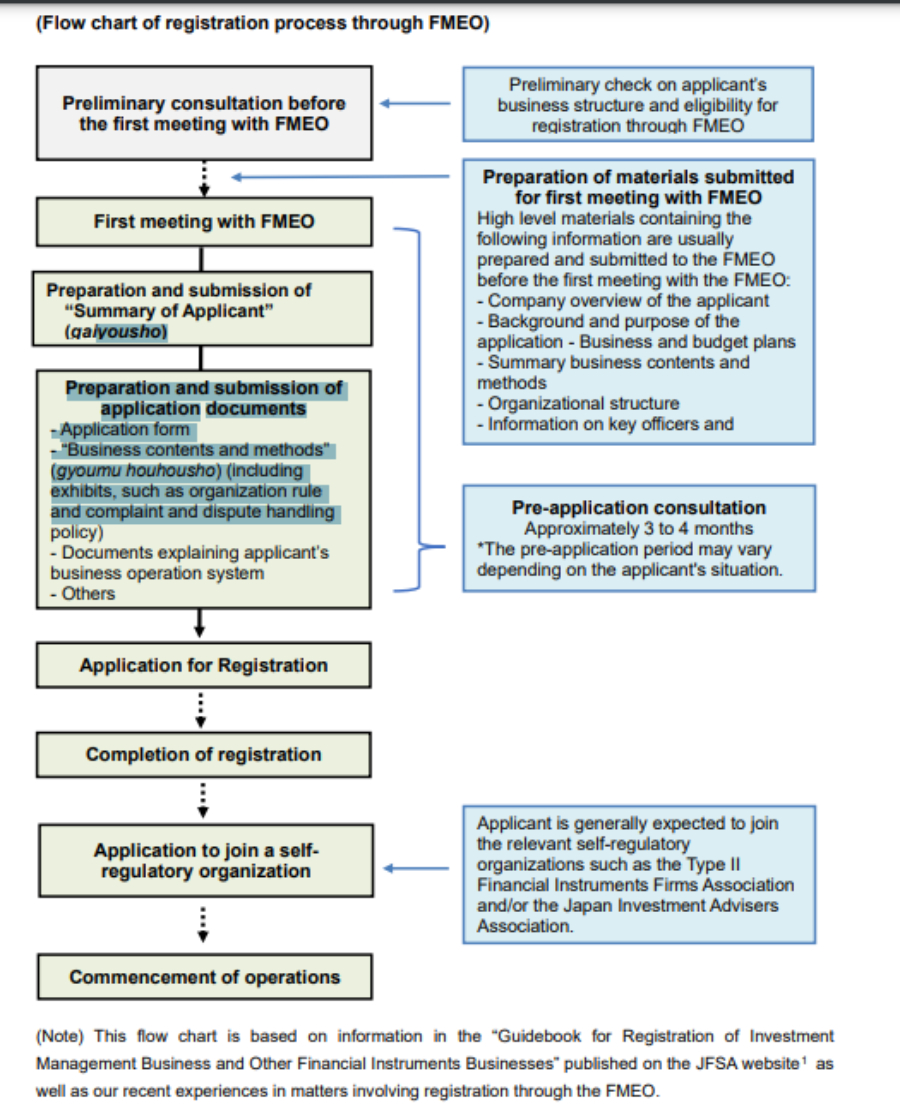

The registration process through the FMEO would vary depending on types of registrations to be applied for and factors specific to each applicant, but can be generally divided into the preapplication consultation stage and the post-application registration stage, as illustrated in the following flow chart:

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.