FMCG Market Watch: Ghana's Cosmetic Import Market

Ghana's cosmetics market is vibrant and rapidly expanding. Like its neighboring and international markets, Ghana's cosmetics sector is experiencing increasing demand, presenting excellent opportunities for various market players. In recent years, the sector has seen significant investment from both local and international investors seeking to tap into this market growth. Currently, there is a rising demand for both local and international cosmetics brands. Local brands are gaining prominence by leveraging the country's abundant supply of cosmetic raw materials such as shea butter, cocoa butter, coconut oil, and other traditional African ingredients to create unique products that cater to the beauty needs of the Ghanaian population and beyond. However, international brands still hold the largest market share. New and existing players are continually entering the market and expanding their product lines to meet the evolving consumer demand. In this article, we delve deep into Ghana's cosmetics import market, examining import trends, the supply chain, a SWOT analysis, as well as the regulatory requirements.

Historical Import Trends and Cosmetic Market Segmentation

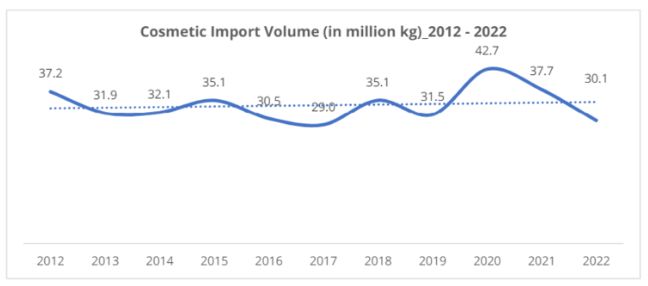

Import data for cosmetic products in Ghana depicts a dynamic market influenced by various economic and market factors. The market's adaptability is evident with new brands being introduced each year in response to the customers' exploratory nature as they search for cosmetic products that cater to their specific needs. Analyzing historical import data from the last decade shows a market that is characterized by changing trends. These trends can be attributed to both domestic and international factors, including unstable currency conditions, growing local competition; especially, in the skin and hair care sectors, evolving consumer preferences, and shifts in global beauty trends. Over the past 10 years, the cosmetic import market has averaged an estimated import volume of 33 million kg. In 2020, the import market experienced a substantial increase, with volumes exceeding 40 million kg; the highest recorded in the past ten years. This surge was primarily due to a substantial import of personal care products, specifically deodorants, by a major player in the market. Conversely, 2022 recorded a significant decline in imports of about 20% compared to volumes in 2021. This decrease can largely be attributed to high inflation rates, which led to increased prices for Fast Moving Consumer Goods, thereby reducing demand for both domestically produced and imported goods, including cosmetics. The chart below illustrates the import volumes for cosmetic products in the Ghanaian market over the past decade.

Figure 1: Historical Import Volume for Cosmetic Import

Source: Ministry of Trade, MOTI

The import market significantly supplements domestic production by providing a wide variety of cosmetic products from international brands to cater to different customer preferences. The imported cosmetic market can be broadly classified into five main segments. The table below represents these segments and their respective shares of the import market.

Figure 2: Market Segmentation Share of Cosmetic Import, 2022

Source: Ministry of Trade, MOTI

The skincare import market is highly competitive, with several players importing various brands of skincare products into the country each year. As with domestic production, skincare products dominate the cosmetic import market, holding the largest share at 38% highlighting a substantial focus on skin health and beauty among consumers. In 2022, over 11 million kg of skincare products were imported, mainly from Côte d'Ivoire, Togo, and Nigeria. These West African countries are primary sources of cosmetic imports due to their relatively large production capacity, favorable economic terms, and lower tax rates compared to imports from Western countries. For the skincare segments, Body lotions and creams lead the skincare import market. Key players in the skincare import market include Uniparco Limited, Paradise Cosmetics, DIMD Ghana, Novelle Perfumiere Gandour Ghana, and Magic Dodo Ghana. These companies distribute popular brands such as Pure White, Light Up, Day by Day, Cocoderm, Bebe and Maman, Clinic Clear, Cocoderm, and Clair Liss, collectively accounting for over 40% of the total skincare import market in 2022.

Haircare products constitute a significant portion of cosmetic imports, recording the second largest cosmetic import segment with over 6 million kg imported in 2022. Major players in the haircare import market include Nouvelle Limited, Weave Ghana, Dennick Trading Enterprise, and others, who import popular haircare brands including; Mega Growth, Laurel Collection, ABC, ORS, etc. each year. Most haircare products are sourced mainly from Côte d'Ivoire, China, and the USA, with Côte d'Ivoire being a primary source for products like hair food, dye, and relaxers.

Personal care products, specifically deodorants, antiperspirants, shave cream, and bath cream, accounted for 20% of total cosmetic import volumes in 2022. This significant proportion reflects the essential nature of these products in daily hygiene and personal care routines. The United Kingdom, France, and the United Arab Emirates are the top three sources for these imports. There are over a hundred players in this segment, importing various brands to meet the dynamic consumer demand. Notable players include Daddy Ash, Beiersdorf Ghana Limited, Abayie Ventures, Angfo Enterprise, and Adore Beauty, who collectively control about 30% of the import market for personal care products.

Fragrances account for 17% of the import market share, primarily dominated by perfumes imported from Côte d'Ivoire, China, and the United Arab Emirates while in the make-up segment, powders are the most imported products, specifically talcum and face powders, with significant proportion sourced from Côte d'Ivoire.

Supply Chain for Imported Cosmetic Products

Supply and distribution of cosmetic products in the Ghanaian market are clear-cut. The main participants within the supply chain are the exporters (the main sources of imported cosmetic products), importers, wholesalers, distributors, retailers, and end-users.

Cosmetic products are sourced from various global players, with Cote d'Ivoire, China, Nigeria, Togo, and Great Britain being the top countries of origin. The players in these countries are either manufacturers, logistics companies, or trading companies. In West African countries like Cote d'Ivoire, Nigeria, and Togo, several trading or logistic companies are involved in the trade of cosmetics through imports and re-exports. Most of these companies import from other foreign brands or source domestically for reselling. This is made possible because of the favorable trade terms in those countries.

Currently, there are over 300 cosmetic importers in Ghana. These importers are predominantly subsidiary companies of parent manufacturers, such as Beiersdorf Ghana Limited, Dodo Cosmetics, Magic Dodo Ghana, etc. Other importers act as franchise dealers and sole distributors of specific international brands, while some are trading companies specializing in the importation of a variety of cosmetic products, such as Paradise Cosmetic, Daday Ash Limited, and Dennirk Trading Enterprise. These importers usually have warehouses across the country where they stock and distribute to major wholesalers at large volumes. Beyond these major importers, there are also small importers, most of whom double as wholesalers. These small importers are usually located in central markets of big cities where they contact both wholesaling and retailing activities. They stock and resell their imports as well as products from other major importers and domestic manufacturers.

Retailers in the cosmetic market often purchase their cosmetic products directly from wholesalers and sell them in single units to final consumers. The retail market includes supermarkets, open markets, corner shops, pharmacies, beauty supply stores, and online shops. The supply chain ends with consumers who purchase products from retailers for personal use.

To view the article in full click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.