Curious about how we can protect our financial system from illicit activities? The European Union has stepped up to the challenge with a robust and comprehensive anti-money laundering (AML) framework. This article explores the complex web of regulations, directives, and authorities that are the backbone of the EU's defense against money laundering and terrorist financing.

Businesses and financial institutions within the EU are gearing up to navigate this intricate landscape more effectively. Embracing these AML regulations isn't just about compliance – it's about establishing a culture of integrity and responsibility. By staying ahead of these stringent measures, companies not only protect themselves from financial crime but also build stronger trust and credibility in the global market. This framework is not just a requirement; it's a strategic advantage that ensures sustainable growth and resilience in today's interconnected world.

The Pillars of EU's AML Framework

The EU's AML framework is built on three crucial pillars: the Anti-Money Laundering Regulation (AMLR), the Anti-Money Laundering Authority (AMLA), and the Anti-Money Laundering Directive (AMLD). Each pillar plays a vital role in preventing the misuse of the financial system for money laundering by corporate entities and through financial transactions. We have discussed this in previous articles which can be found on Mondaq here and here.

Anti-Money Laundering Regulation (AMLR)

The AMLR stands as a testament to the EU's commitment to standardising anti-money laundering measures across its member states. What are the key provisions that make this regulation so pivotal?

- Risk-Based Approach: Financial institutions must adopt a risk-based approach to identify, assess, and mitigate risks related to money laundering and terrorist financing. This ensures that resources are allocated efficiently, focusing on areas with higher risks.

- Customer Due Diligence (CDD): Enhanced CDD measures require verifying customer identities, understanding business relationships, and continuously monitoring transactions. Special attention is given to politically exposed persons (PEPs) and high-risk third countries.

- Beneficial Ownership Transparency: Central registers for beneficial ownership information are mandated, accessible to competent authorities and financial intelligence units (FIUs). This transparency aims to prevent the misuse of corporate structures for illicit purposes.

- Reporting Obligations: Obliged entities must promptly report any suspicious transactions to FIUs, including transactions that appear unusual or inconsistent with a customer's known profile or business activities.

- Sanctions and Penalties: Stringent sanctions and penalties for non-compliance underscore the importance of adherence to AML regulations, including administrative fines and potential license withdrawals for severe breaches.

Anti-Money Laundering Authority (AMLA)

Is it enough to have regulations without effective oversight? The establishment of the AMLA represents a significant leap forward in ensuring the consistent and effective application of AML rules across the EU.

- Supervisory Role: The AMLA oversees national supervisory authorities, conducting assessments, providing guidance, and coordinating joint supervisory actions.

- Direct Supervision: For certain high-risk financial institutions, the AMLA has direct supervision and on-site inspection authority, mitigating risks associated with cross-border operations and complex financial structures.

- Technical Standards and Guidelines: Developing technical standards, guidelines, and recommendations, the AMLA facilitates uniform implementation of AML measures covering CDD, risk assessment, and reporting obligations.

- Coordination and Cooperation: Enhancing cooperation among national FIUs and relevant authorities, the AMLA promotes information sharing and joint investigations to improve the overall effectiveness of the EU's AML framework.

- Advisory Role: Advising the European Commission on legislative and policy initiatives, the AMLA ensures that the AML framework remains dynamic and responsive to emerging threats and challenges.

Anti-Money Laundering Directive (AMLD)

The AMLD complements the AMLR by setting out detailed requirements for member states to implement in their national legislation. How do these directives adapt to the diverse and dynamic nature of financial crimes?

- Scope of Application: The AMLD applies to a wide range of entities, including financial institutions, legal professionals, real estate agents, and virtual asset service providers (VASPs), ensuring comprehensive coverage of sectors vulnerable to money laundering and terrorist financing.

- Enhanced Due Diligence (EDD): Mandating EDD measures for high-risk situations, such as transactions involving PEPs or countries with weak AML controls, the directive includes obtaining additional information about customers and the source of funds.

- Third-Party Reliance: Allowing obliged entities to rely on third parties for CDD measures under certain conditions, the AMLD aims to reduce duplication of efforts and streamline compliance processes.

- Training and Awareness: Member states must ensure that obliged entities provide regular training on AML obligations and emerging trends, maintaining a high level of vigilance and expertise within the industry.

- Whistleblower Protection: Provisions to protect individuals who report suspicions of money laundering or terrorist financing encourage whistleblowing and support the detection of illicit activities.

- Record Keeping: Obliged entities must maintain records of CDD information, transaction data, and internal reports for a specified period, crucial for audits, investigations, and compliance reviews.

- Cooperation with Third Countries: Emphasising cooperation with non-EU countries to combat money laundering and terrorist financing globally, the AMLD includes sharing information, conducting joint investigations, and providing technical assistance.

Beneficial Ownership and the 25% Threshold

How do we identify the true owners behind complex corporate structures? Beneficial ownership transparency is a critical component of AML regulations, aimed at preventing the misuse of corporate entities for illicit activities.

Key Aspects of the 25% Ownership Threshold:

- Direct and Indirect Ownership: The 25% threshold applies to both direct and indirect ownership, including shares held through intermediaries or complex ownership structures.

- Transparency and Disclosure: Legal entities must maintain accurate and up-to-date information on their beneficial owners, recorded in central registers accessible to competent authorities and FIUs.

- Reporting Obligations: Obliged entities must conduct due diligence to identify beneficial owners when establishing business relationships or conducting transactions.

- Enhanced Due Diligence (EDD): For beneficial owners who are PEPs or from high-risk countries, enhanced due diligence measures must be applied.

- Legal and Regulatory Implications: Non-compliance with beneficial ownership disclosure requirements can result in significant legal and regulatory consequences, including administrative fines, sanctions, and potential criminal liability.

AML in the World of Football

What about the world of sports, where enormous financial transactions occur frequently? The AML framework has specific implications for football, where vast sums of money flow through transfers, sponsorships, and other financial activities.

- Transfer Market Scrutiny: Football clubs are required to conduct thorough due diligence during player transfers to ensure compliance with AML regulations.

- Sponsorship and Endorsements: Clubs must verify the legitimacy of sponsors and endorsees to prevent money laundering through these channels.

- Financial Fair Play: The AML regulations support UEFA's Financial Fair Play regulations, ensuring that clubs operate within their financial means and maintain transparency in their financial dealings.

A recent article by our firm's Tax Consultant & Manager – Compliance Officer, Michael Loizou, analyses this topic in more depth. You can read it on Mondaq here.

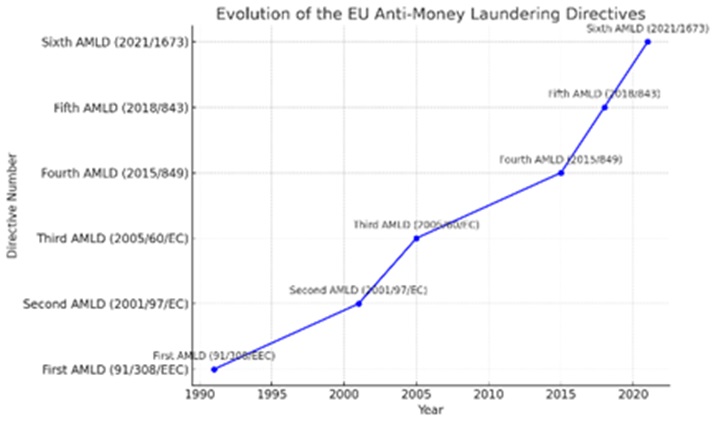

Although Cyprus has not still officially adopted 6th AMLD, here is a graphic representation of the evolution of the EU Anti-Money Laundering Directives. It illustrates the timeline and progression from the First AMLD in 1991 to the Sixth AMLD in 2021.

How do we continue to evolve in the face of new threats?

As obliged entities, service providers within the European Union play a crucial role in upholding the robust anti-money laundering (AML) framework set forth by EU regulations. To maintain compliance and better serve their clients, these entities must implement rigorous due diligence procedures, including thorough customer identification, risk assessment, and ongoing monitoring of transactions. By staying informed about the latest directives and regulatory updates, service providers can adapt swiftly to evolving threats and regulatory expectations. This proactive approach not only safeguards against financial crime but also strengthens client relationships by demonstrating a commitment to transparency and security. Moreover, maintaining a high standard of professionalism and ethical conduct not only enhances trust but also positions service providers as reliable partners in the global marketplace.

What more can be done to fortify our financial systems? The answer lies in continued innovation, cooperation, and a relentless pursuit of transparency and accountability.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.