The semiconductor industry is truly a global ecosystem. Each company within the industry specializes in one or more stages of the chip production process, forming a supply chain that spans worldwide and results in more resilience and efficiency.

As one of the world's most important, sophisticated and complex industries, semiconductors form the backbone of the digital economy and power a vast array of electronic devices. Understanding the trends and risks shaping the industry is crucial for every company that relies on technology. The past few years have given us insight into the substantial disruption that can be caused by chip shortages; for example, due to such events as COVID-19, freeze events, fires and lately the instability of a world facing unclear geopolitical conflicts, business leaders are waking up to pathways that go beyond the balance sheet of any one institution. As public, political and academic awareness on chip shortages grows, policymakers, the semiconductor value chain and end customers are exploring all options to secure production.

Strategic Semiconductor Management Porsche Consulting

In 1978, a Porsche 911 G-Series had approximately eight semiconductors; by 2022, electric vehicles had an estimated 5,000 to 7,0001. Semiconductors are used in communications, power generation, artificial intelligence, electric and autonomous vehicles, robotics, healthcare, military technology, and quantum and cloud computing.

Geopolitics of supply chains

The semiconductor industry is increasingly classified as a critical national infrastructure industry by governments around the world due to the reliance on chips. To secure supply chains, policy initiatives made up of multibillion-dollar investment packages have been announced to support onshoring chip production. Examples include the U.S. CHIPS and Science Act and the European Union Chips Act, encouraging semiconductor businesses to establish new production bases, as well as China's Integrated Circuit Industry Investment Fund, seeking to increase China's economic self-sufficiency.

While these global efforts have not yet taken effect, they are the first steps toward strengthening regional and national resilience against future crises. In some cases, companies have responded with statements of intent to accept these offers. The potential changes may reshape future centers of semiconductor excellence and manufacturing and may disrupt the industry's delicate collaboration process that it relies on; this is a complex goal given the industry has grown through a business model of sharing the load (Figure 1).

Sources: Adapted from Congressional Research Services Report2, Center for Security and Emerging Technology3, and Semiconductor Industry Association4

What are the big complexities you need to know about?

At the heart of it, the semiconductor industry is a global ecosystem

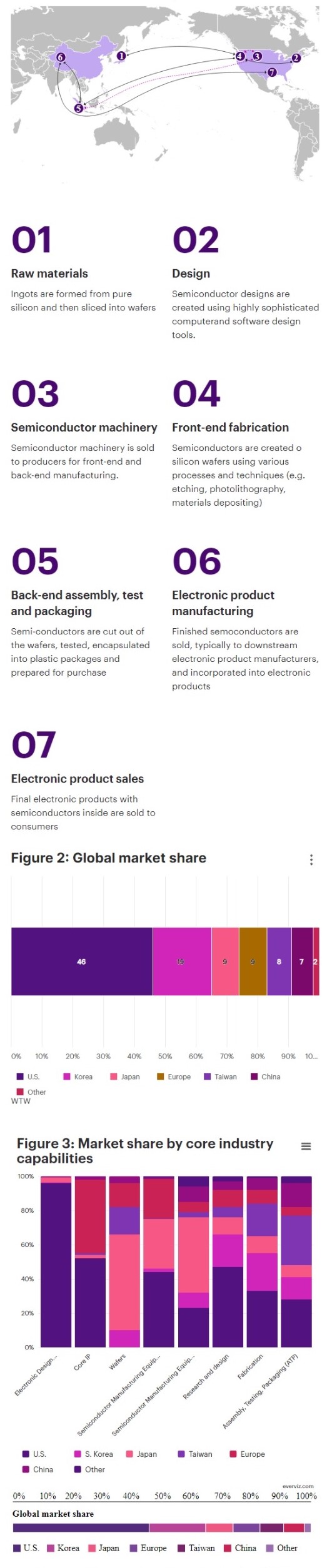

Chip production happens through multiple companies across the world, each specializing in one or more steps of the process, making up the supply chain. This has created resilience and efficiency, allowing companies to focus on their specialization. Specialization has led to industry sales totaling $526.8 billion in 20235 within the estimated $2.2 trillion electronics sector.6

Technology and market growth has concentrated cutting-edge semiconductor manufacturing capabilities among a handful of companies located in global hotspots, including China, the U.S., South Korea and — most importantly — Taiwan.

What's important to remember, however, is that no country is independent enough to sustain the whole semiconductor supply chain on its own. Semiconductor firms, prompted by political and regulatory requirements, are increasingly looking for their suppliers (and their suppliers' suppliers) to manufacture components on their own shores to reduce their supply chain exposure.

Geographic centers of excellence are key

The U.S. currently enjoys a clear advantage in manufacturing capacity compared with China and particularly so in areas such as intellectual property, chip design, manufacturing and non-wafer materials. China, on the other hand, is the key supplier of raw materials, such as silicon needed for manufacturing. In other key areas, such as contract manufacturing, both the U.S. and China depend heavily on Taiwan, South Korea and Japan. Contract manufacturers, in turn, need capital equipment, with one of the most prominent companies located in the Netherlands.

Geopolitical tensions and national security concerns are also pushing countries to explore ways of enticing semiconductor companies to onshore more parts of the value chain and to establish bases to help protect intellectual property. This is a significant commitment of resources.

Industry estimates suggest each chip factory takes a minimum of $10 billion and five years to build,7 from breaking ground to production of chips.

Intellectual capital and labor are essential

While investment in new manufacturing fabrication plants will be welcomed by the industry, its impact will be limited if steps are not taken to address labor shortages as well. Estimates in the U.S. suggest that companies across industries will face a shortfall of 67,000 unfilled jobs by 2030. This includes 26,400 technicians, 27,300 engineers and 13,400 computer scientists.8

Amid intense competition, semiconductor companies are finding it harder than ever to attract and retain personnel. As semiconductors become ever more critical to product differentiation, some electronics companies, automotive manufacturers and other fast-growth companies are beginning to move chip design in-house.

These moves are making competition for already scarce semiconductor talent even tougher than usual and have the potential to undermine semiconductor companies' expansion plans.

Simultaneously, as chip design is becoming more and more complex, this will require a different type of talent and more labor — especially for some of the latest and smaller generations of chips where the manufacturing process is complicated.

Changes in supply and demand require new ways to manage future risk.

Semiconductor companies we spoke to told us that they are not only considering the challenges of meeting demand right now but also facing a significant future risk.

To plan for this, several manufacturers have been looking at new ways to manage product supply, such as additional storage of components and raw material and staged supply. Several semiconductor businesses we spoke to are also planning for better re-tooling (recycling up or down) of older technology/equipment, potentially giving manufacturers a quicker response.

George Haitsch, Technology, Media and Telecom Industry Leader, WTW

In our discussions with industry leaders, we've learned that their concerns extend beyond current demand to potential future risks. A key question they face is, If they invest in capacity to meet shortages today, will they be selling into a glut tomorrow? While the latter is a long-standing risk for a cyclical industry, today's supply shortfall, and the high costs needed to address it, make it imperative to chart a careful course.

How can we prepare against geopolitical complexities and their impacts?

Governments and businesses need to think beyond single risks and solutions and instead be ready for multiple scenarios, which enables them to be reactive when the exact situation doesn't unfold as scripted. There are actions organizations can take now to embolden their stance and boost their preparedness for geopolitical risks:

- Review risk registers and use longer time horizons to challenge assumptions around likelihood and impacts.

- Consider scenario planning with executive teams, so they have ready answers to the question, If either scenario happened tomorrow: what would you do?

- Ensure a global perspective when considering supply chains and business resilience. Working more closely with suppliers as partners can help companies understand their supply chains better and address these risks. Diagnostic mapping and monitoring tools and analytics can help to visualize, quantify and assess risks across the chain and in specific locations.

- Review insurance provisions to understand exactly what is and isn't covered and where the gaps may need addressing ahead of potential losses.

- Understand how your peers and other industries are approaching supply chain risks through WTW's industry insights, research and data-driven risk approaches. Addressing the complexities of onshoring chip production requires a comprehensive approach. By implementing proactive measures and leveraging insights from diverse industries, stakeholders can navigate uncertainties and ensure the resilience of the semiconductor ecosystem.

Footnotes

1. Strategic Semiconductor Management

2. Semiconductors: U.S. Industry, Global Competition, and Federal Policy

3. Semiconductor Supply Chain - Issue Brief

4. SIA State of Industry Report Nov-2022

5. Global Semiconductor Sales Decrease 8.2% in 2023; Market Rebounds Late in Year

6. 2024 semiconductor industry outlook

7. What does it take for chip manufacturers to get a new plant up and running?

8. SIA State of Industry Report 2023 Final

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.